The electric car industry is about to get turned right side up.

The dozen manufacturers out there have long struggled to achieve ranges that could match the 300 miles that is standard for competing gasoline engines.

All electric cars on the market today max out at 100-mile ranges or less. Except, that is, my Tesla S-1 (TSLA), which can drive 305 miles ? but for $110,000.

That is, unless I am driving back from Lake Tahoe. By descending 6,200 feet the regenerative braking system enables me to add 100 miles to my range, increasing it to 405 miles. All four wheels essentially act as electric turbines.

In a research paper published in the prestigious journal Science, a Cambridge University research team announced a major breakthrough in electrochemistry that would lead to a 500% increase in electric car ranges.

Expressed in terms of the S-1, it would drop the cost of the 1,000 pound lithium ion battery from $30,000 to $6,000, shrinking the overall cost of the vehicle to $86,000. That would enable it to compete with equivalent luxury models from Daimler Benz, BMW, and Lexus.

Alternatively, it could maintain the same battery weight and cost and boost the S-1 range to 1,450 miles.

Yikes!

The research was partially funded by the US Department of Energy. Cambridge University retains the patent, and is already working with several firms to move the technology forward.

The great leap forward is made possible through the use of a lithium-air formula in battery construction. The basic chemistry of lithium-air batteries is simple.

The cell generates electricity by combining lithium with oxygen to form lithium peroxide and is then recharged by applying a current to reverse the reaction. Making these reactions take place reliably, over many cycles, is the challenge.

The attraction here is that lithium air battery energy densities are ten times higher than the lithium ion batteries now in use. The Cambridge team was able to tweak battery performance through adding lithium iodide to the process.

Elon Musk has told me that he is shown dozens of new battery technologies every year. The problem is always the same.

The newfangled batteries can only be recharged once or twice. They develop ?tendrils? on the anodes and cathodes which make future recharges impossible.

The Cambridge professor, Dr. Clare Grey, says her team has been able to recharge their lithium air battery 2,000 times. That?s enough to get to the eight-year battery lifetime guarantee mandated by the state of California.

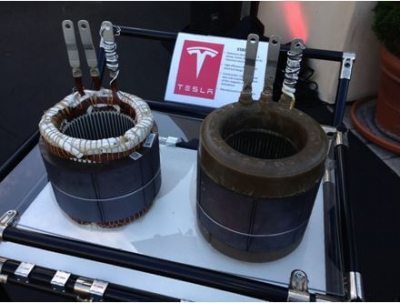

Tesla is no slouch. They have been tinkering with the electrochemistry of their batteries on their own. The recent series of cars has achieved a 5% boost in range to 290 miles through the addition of silicon to the battery cathodes.

Of course, it will take a few years before lithium-air batteries reach full commercial viability. New technology doesn?t exactly leap out of labs on to store shelves.

After all, current electric battery design is not too different from that first introduced in electric street trollies of the 1880s.

But my guess is that further research will bring greater battery ranges, not lesser ones.

The news could be better for Tesla. It has always been a ?faith? type stock, reliant on the development of futures technologies to achieve future profitability.

All of the profits announced so far have really been accounting tricks, reliant on generous government subsidies and the sale of carbon credits.

Shareholders have to believe that Tesla will become the world?s largest car maker in a decade, or they shouldn?t be in the shares. I believe Tesla can do it, but expect the road to be rocky.

Tesla is in effect a high risk venture capital investment that has already gone public.

Now, at last, we have the technology in hand.

For more background about this car from the future, read ?16 Facts and 6 Big Problems I discovered by Tearing Apart my Tesla S-1? by clicking here.? You must be logged into your account to view this article.

Tesla Has a Lot More Than Meets the Eye

Tesla Has a Lot More Than Meets the Eye