As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

September 15, 2016

Fiat Lux

Featured Trade:

(OCTOBER 7TH INCLINE VILLAGE, NV GLOBAL STRATEGY LUNCHEON),

(DON?T TOUCH THE COAL BUBBLE),

(KOL), (BHP), (TCK),

(TEN TIPS FOR SURVIVING A DAY OFF WITH ME)

VanEck Vectors Coal ETF (KOL)

BHP Billiton Limited (BHP)

Teck Resources Limited (TCK)

What has been the top performing asset class so far in 2016?

Is it gold (GLD), oil (USO), or collectable French postage stamps?

If you said ?coal,? you win the kewpie doll. In fact, the 19th century energy source is the best performing commodity of the year by a large margin.

Indeed, the Van Eck Coal ETF (KOL) has picked up an eye popping 130% since it printed its $5 low in the first week of? January.

As a result, I have recently been deluged by readers asking if it is time to buy this prehistoric energy source.

My answer is no, not ever, and not even with Donald Trump?s money.

However, my answer relies more on basic market dynamics, rather than any environmental sympathies I might have.

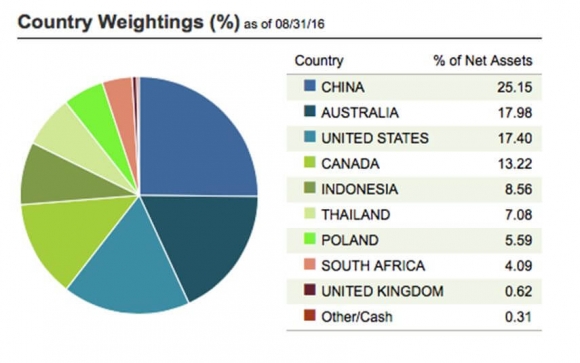

It all has to do with China.

The Beijing government is manipulating its domestic coal industry to prevent it from defaulting on hundreds of billions of dollars worth of loans to local banks.

So it has cut back the number of days the industry can operate from 330 to 276 days a year.

Then the Chinese economy started to improve.

What happens when you restrict supply and increase demand? Prices go through the roof, as they have done smartly.

It gets better.

In August, the Middle Kingdom was hit with rainstorms of biblical proportions, flooding many mines and forcing them to close. The sushi hit the fan.

That forced major consumers, the big steel producers and electric power plants, to resort to the international spot market, or the ?seaborne market? to cover shortages to avoid shutting down themselves.

Who is the world?s largest supplier to the seaborne market?

That would be BHP Billiton (BHP), the largest capitalized company in Australia, which has seen its shares appreciate by 65% since January.

I have been following coal for 45 years, ever since I was the coal correspondent for the Australian Financial Review (AFR) during the 1970s.

I had to write a mind-numbing five pieces a week on coal (the AFR was a daily). So it?s safe to say that I know which end of a lump of coal to hold upward.

For a start, you never want to invest in an asset that is dependent on government fiat for rising prices. They can change their minds at any time. The loans in question could get paid off.

And you can count on the world market to suddenly find new supplies whenever of commodity price doubles.

Remember the Rare Earths' bubble, where we were active players? After a hyperbolic bubble, prices fell by 90%. Rare earths turned out to be not so rare. Only the cheap labor to extract them was exempt from environmental regulation.

So you can count on the current coal bubble to deflate fairly quickly. The perfect storm is about to run in reverse.

That leaves us with the long term fundamentals of coal which are bleak, to say the least.

China is far and away the world?s largest coal consumer at 49%, followed by the US at 11%.

China is making every effort to reduce reliance on this cheapest form of energy, thanks to the blinding, choking smog alerts besetting its largest cities.

It is only still using coal because with an economy growing at 6% a year plus, it has to rely on every energy form just to keep the lights only. Power brownouts can lead to political instability.

Coal consumption in the US has been in a death spiral for years, falling from 50% to 33% of electric power generation over the past decade. That led to the bankruptcy of several of its largest players such as Arch Coal (ACI) and Peabody Energy (BTU).

The collapse of natural gas prices to $2/btu made a cleaner burning alternative cost competitive. And gas lacks the nitrous and sulfur oxides and particulate pollution prevalent in coal.

Read the prospectus of any electric power company and you will find them besieged by lawsuits from consumers claiming that the coal they burned caused their cancers. Utility companies would love to be rid of it.

Any reluctance by US companies to dispense with coal were blown away last year when the Environmental Protection Agency classified carbon dioxide as toxic waste. That put a big fat bulls eye on the remaining coal companies.

If Hillary Clinton wins the presidency, you can expect restrictions to worsen. She hates coal and makes no bones about it. She has told me so personally.

And then there?s solar energy. This week, California Governor Jerry Brown signed the nation?s toughest climate legislation mandating a cut in the state's greenhouse gas emissions to 40% below 1990 levels by 2030.

While ambitious, the target is viewed as doable. Solar energy, which now accounts for 5% of the state?s power output, will do the heavy lifting.

Many other states are expected to follow suit. No coal here.

The United Kingdom has already taken this path. It says a lot that a country that ran a coal-based economy for 300 years announced the closing of its last mine which it did a few months ago. It will replace the power output with alternatives.

Having lived in England during the violent miner?s strikes during the early 1980?s, it was quite a revelation.

So the writing is on the wall. Another major producer, Anglo American (NGLB.BE), is now in contract to sell two major mines in Australia.

Coal is an energy source whose time has clearly come and gone. So will the price of coal.

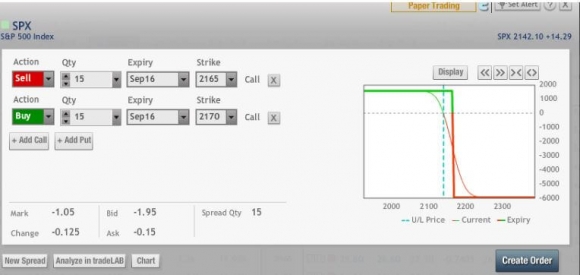

Looks Like a Short To Me

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

September 14, 2016

Fiat Lux

Featured Trade:

(LAST CHANCE TO ATTEND THE SEPTEMBER 16TH PORTLAND, OR GLOBAL STRATEGY LUNCHEON),

(10 REASONS WHY JANET YELLEN WON?T RAISE RATES),

(UUP),

(LAUNCHING ?TRADING OPTIONS FOR BEGINNERS?)

PowerShares DB US Dollar Bullish ETF (UUP)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Portland, OR at 12:00 PM on Friday, September 16, 2016.

A three-course lunch will be followed by an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too.

Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $208.

I?ll be arriving early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets. I expect a small group, so there will be plenty of opportunities to exchange ideas.

The lunch will be held at five star downtown Portland hotel, the exact location of which will be emailed to you with your confirmation.?

I look forward to meeting you, and thank you for supporting my research.

To purchase tickets for the luncheon, please click here.

No way, Jose.

That is my read on the likelihood of the Federal Reserve raising interest rates at next week?s Open Market Committee meeting.

The evidence against it is overwhelming. Here are ten reasons why:

1) Chairwoman Janet Yellen has told me on many occasions that she will not raise interest rates until she sees ?the whites of inflation?s eyes? to paraphrase a Battle of Bunker Hill metaphor (we lost that one).

There is no inflation of any kind anywhere in the world. Deflation is still rampant. A US CPI of 0.8% YOY is not what rate hikes are made of.

2) The US economic data has recently slowed. Central banks are supposed to raise rates to prevent economies from getting overheated.

Overheated?

August Nonfarm Payroll came in at a lowly 151,000. The August ISM Manufacturing Index plunged from 52.6 to 49.9, a six year low. To a data dependent Fed, these numbers are shouting ?STOP?.

Need I say more?

3) Remember that election? The Fed is loathe to take any action before November 8. If the economy were in free fall, as in 2008, or going to the moon, like we saw in 1999 that would be a different story. But it?s not.

4) Even the hint, the rumor, or even a scintilla of a rate rise is keeping the US dollar at its high for the year. That is wreaking havoc with US multinationals which are seeing their products priced out of the international markets. This alone is a significant drag on the economy.

5) Watch the Fed fund futures. It is showing a 20% probability of a rate rise on September 20, or a one in five chance. Always follow the people who are putting their money where their mouths are, not the talking heads or dime newsletters that flood the Internet.

6) By the way, the same Fed funds futures are showing only a 48% chance of a December rate rise, which means there is a better than even chance that there will be NO rate rise in 2016. Did I mention that has been my view all year?

?

7) After watching the Fed for 45 years I can tell you that when in doubt, the fed always does nothing (remember the magisterial Arthur F. Burns?). It NEVER makes 50/50 calls.

8) Remember that black long chain carbon molecule, oil. Its price is in free fall again. That is delivering another deathblow to the oil patch, which accounts for 6% of US GDP (formerly 10%). I?m sure the new Dallas Fed governor has views on this situation.

9) Thanks to a gale force deflationary headwind, the Fed will be limited to only eight quarter point rate rises in this business cycle, and it has already used one. Why waste a rate hike now, when dry powder in the future is more valuable.

10) While the longest economic recovery in history is slow, but steady, it has also been uneven at best.

Growth has primarily been focused on the coasts, while those left behind by globalization in the Midwest and South are still suffering.

For many of these unfortunate people, the 2008 recession never ended. A rate rise just might push them over the edge.

To sum it all up, inertia is always a huge influence at the Fed.

Yes, we are already in a rate raising cycle in the wake of the December, 2015 25 basis point snugging. The Fed will raise again, it?s just a question of when.

And while there has been an abundance of Fed speakers over the past week, in the end, only one view counts.

That would be the one of my former UC Berkeley economics professor, Janet Yellen, possibly the most dovish Fed chairperson in history.

I rest my case.

What?s On Your Mind, Janet?

While the Global Trading Dispatch focuses on investment over a one week to six-month time frame, Mad Options Trader, provided by Matt Buckley, will focus primarily on the weekly US equity options expirations, with the goal of making profits at all times. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.