As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

October 11, 2016

Fiat Lux

Featured Trade:

(DON'T MISS THE OCTOBER 12th LIVE GLOBAL STRATEGY WEBINAR),

(UPGRADE TO MAD OPTIONS TRADER NOW TO BEAT THE PRICE INCREASE),

(WELCOME TO THE EIGHT-WEEK YEAR),

(SPY), (QQQ), (IWM), (TLT), (BAC), (GS)

SPDR S&P 500 ETF (SPY)

PowerShares QQQ ETF (QQQ)

iShares Russell 2000 (IWM)

iShares 20+ Year Treasury Bond (TLT)

Bank of America Corporation (BAC)

The Goldman Sachs Group, Inc. (GS)

The $64,000 answer.

That was the reply I received from Mad Options Trader, Matt Buckley, known to his fellow traders as ?Whiz,? regarding my question about his two-month performance.

That is how much traders have made since the August 1 free trial started for our new Mad Options Trader service for each $100,000 of invested capital.

I knew Whiz had a hot hand. But when I heard those numbers, they blew me away.

I knew something big was happening when unsolicited testimonials started pouring in.

First, there was Frank in Dallas, Texas who said,

?I just wanted to tell you what a great find the Mad Options Trader was for you. I stumbled into two of his trades this week and made enough profit to pay for two years of his service. I know he may eventually cool off, but he is hot now.?

Then, I got another one from Bill in Richmond, Virginia who gushed, ?Trading with Whiz is like having a rich uncle. He cuts me a check once a week for $2,000. I've never been able to do this before.?

The last two weeks have been especially eye opening.

Whiz went into the September 17th Fed decision long volatility through the (VXX) and clocked a $12,000 winner in one week.

Then he flipped to the short side when Janet Yellen took no action on rates, picking up another $4,000.

He took a small hit going into the OPEC surprise Algiers deal with a short oil (USO) deal. He mitigated some of those losses with a long position in the S&P 500 (SPY).

What?s Whiz doing now?

He is scaling into ultra long dated positions in Goldman Sachs (GS) January, 2019 call options.

The bet is that sometime over the next two years, interest rates will rise, and Goldman shares will explode. He then trades against this position with weekly and monthly short positions.

It is all typical big hedge fund type stuff that the small individual retail trader never sees.

At the request of several readers, I have therefore conducted an audit of the long term trading performance of the Mad Options Trader.

The numbers blew my mind.

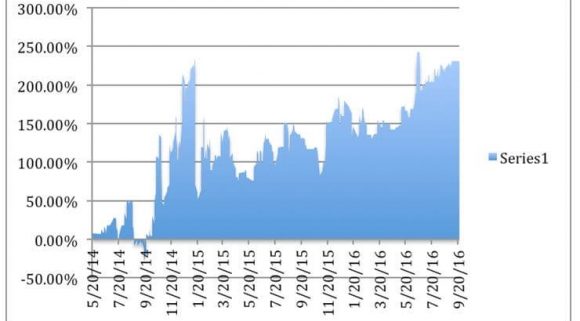

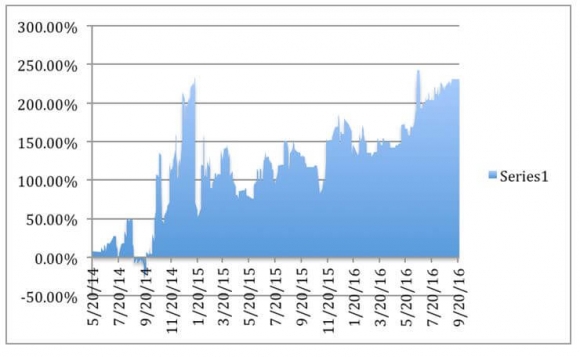

Since May 20, 2014, the Mad Options Trader has delivered A STUNNING 231.45% PROFIT, net of fees (see chart below).

This is during a period when the overall market performance was essentially zero.

As a result of this stellar performance, Whiz is raising his price for an upgrade to your existing Global Trading Dispatch from $1,500 to $2,000 a year.

And quite justifiably so.

It is only because we are fellow combat pilots that he is letting my regular subscribers get in at the old price one final time.

BUT ONLY IF YOU ACT THIS WEEK!

Nancy is taking orders now. You can email her directly with your request at support@madhedgefundtrader.com. Just put ?MOT UPGRADE? into the subject line.

The? Mad Options Trader service focuses primarily on the weekly US equity options expirations, with the goal of making profits at all times.

The trading will place in the S&P 500 (SPY), major industry ETFs like the Financials Select Sector (XLF), and large capitalized single names, such as Facebook (FB), JP Morgan Chase & Co. (JPM), and Apple (AAPL).

Matt?s performance works out to an eye-popping average 7.92% a month, and annualizes out to an incredible 95.11% a year.

Matt, a native of New Jersey, joined the Navy straight out of college, and rose to become an F-18/A fighter pilot. He attended the famous Top Gun school in Coronado, California. During the second Iraq War, Matt flew 44 combat missions.

Matt left the service in 2006, and immediately entered the hedge fund industry. A rapid series of promotions eventually took him to Peak6 Investments, L.P., a prominent Chicago hedge fund.

There, he soaked up the most crucial elements of technical market timing, fundamental name selection, risk control, and options trade execution.

These are the multiple skills that have enabled Matt to post such a blockbuster performance.

Matt, known to his friends by his old pilot handle of ?Whiz?, is an incredibly valuable addition to the Mad Hedge Fund Trader team. I have appointed him Head of Options Trading.

I have known for some time that fortunes were being made in the weekly options expirations, where stories of tenfold returns are not unheard of. It is a strategy that is perfectly suited to these highly volatile, uncertain times, with most options positions expiring within four days.

Matt allows us to fill that gap in our product offerings.

The Mad Options Trader provides essential support for the active trader, and includes:

1) Instant Trade Alerts sent out at key technical levels, an average of one a day. Alerts will be sent out on the opening and closing of every position.

2) Weekly Market Strategy Webinars held every Monday at 1:00 PM EST to give you a head?s up on the week ahead.

3) A weekly Live Trading Room held every Tuesday from 9:00 to 11:00 AM EST to give followers active real time trading experience.

4) Specialized Training Webinars on how to best execute Matt?s trades.

What I love about Matt is that he eats his own cooking.

Many of the Trade Alerts he recommends are executed in his own personal retirement account with real dollars.

I?ve never felt better about recommending a new product.

Good Luck and Good Trading,

John Thomas

Publisher and CEO of the Diary of a Mad Hedge Fund Trader

Both the major stock and bond indexes are up about 6% on the year.

Those who left on January 1st to sail a yacht around the world, engage in a research project in Antarctica, or meditate at an Ashram in India, will return today and discovery that 2016 effectively didn?t happen, at least as far as the financial markets are concerned.

Index funds are still showing barely positive numbers, as they have to atone for management, administration, and other hidden costs. Active managers are down even more.

And who is doing worst of all?

The Masters of the Universe, like hedge fund titan Bill Ackman, who is licking massive double-digit performance wounds this year. Other hedge funds are dying on the vine.

I heard that Citadel?s unfortunate hedge fund manager has moved to Brazil to look for all the money he lost there.

Watch out for those aging Nazis!

So, almost everyone in the financial advisory and portfolio management industry now has two months in which to make their 2016.

The industry effectively shuts down on December 18.

WELCOME TO YOUR EIGHT WEEK YEAR!

Unless, of course, you read the Diary of a Mad Hedge Fund Trader, and are up a blistering 15% this year. I know of many who have doubled their money since January following my timely advice.

Which brings us all to the eternal question of ?NOW WHAT DO WE DO??

There is absolutely no doubt that we have entered the next leg of what could eventually be an 8-10 year bull market. The S&P 500 hit new all time highs only months ago. New peaks are to come shortly.

I looked to other asset classes to add ?RISK ON? positions. That means buy stocks (SPY), QQQ), (IWM) on absolutely every dip from here on and sell short ?RISK OFF? positions like the Treasury bond market (TLT), (TBT) and the Japanese yen (FXY), (YCS).

Almost every Trade Alert in these areas has proven profitable for me in recent months.

As for equities, I am not inclined to chase monster 20%-30% rallies. What I will do is buy them on a nice 5%-10% dip, or after a sideways digestion-type move of several weeks.

Post election November is setting up to be just that kind of month.

Here are ten reasons why I believe the bull market in shares is still alive and well:

1) Stocks are selling at only 19 X 2016 earnings, not exactly a bargain (it?s double the 2009 low). The October rally is telling us that there will be a major rebound in earnings next year, and that GDP growth could ratchet back up to 3%.

Look no further than technology and cyclicals which are all on fire.

2) The $60 plunge in oil prices from the 2014 highs is still with us. So is the windfall tax cut on consumer spending. This could add a full 1% to US GDP growth in 2017, which has essentially come out of nowhere. However, consumers are, at last, spending their money now, not banking it.

3) The Christmas selling seasons is setting up to be a strong one, thanks to a friendly calendar and renewed consumer confidence. Good luck standing in line at Needless Mark Up, I mean Neiman Marcus.

4) The November 8 elections are basically over, but I already know who the winner is: Gridlock. No matter who wins the Senate, they are unlikely to also capture both houses of congress.

Plan for another 5-9 years of gridlock, and no change in economic policies or tax law. By then, I?ll be dead and won?t care what happens.

5) The final blow off top is in for the bond market. There is a 50/50 chance that my friend, Federal Reserve Chairwoman Janet Yellen, will drive the final dagger through the heart of this monster with a 25 basis point rate hike at the next meeting on December 16-17.

What a nice Christmas present that will be! A reversal would be very friendly for financials, Bank of America (BAC) and Goldman Sachs (GS) which should provide new market leadership.

6) Mergers and acquisitions are continuing at a torrid pace and are getting larger and larger. This is happening because companies see each other as cheap, not expensive, and this usually happens at market bottoms.

The quickest way to grow earnings in a hyper competitive world is to buy them, especially if you can obtain them at a zero cost of funds.

7) Those who aren?t merging are buying their own stock back with both hands, like Apple, at a staggering $1 trillion annualized rate. Such purchases will peak this month.

8) Volatility (VIX) spikes like the ones we saw in August and September also signal major market bottoms (see chart below). After briefly tickling 21 in September, we have made it all the way back to an unbelievable 13.38.

9) A strong dollar demolished multinational earnings this year. While rising interest rates assure the bull market for the greenback will continue, it will be at nowhere near the rate that we saw this year. This is stock market positive.

10) Ever heard of ?Sell in May and Go Away?? Well, ?Buy in November and stay put until April? is also true. October is usually the worst month of the year to sell and is not the path to untold riches.

The net net of all of this is that you can look for the S&P 500 to reach 2,300-2,400 by March, up 10%-15% from present levels.

Just thought you?d like to know.

Watch Out! They Bite!

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

October 10, 2016

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE COMING WEEK),

(SPY), (TLT), (TNX), (FXB),

(WHY DOCTORS MAKE TERRIBLE TRADERS)

SPDR S&P 500 ETF (SPY)

iShares 20+ Year Treasury Bond (TLT)

CBOE Interest Rate 10 Year T No (^TNX)

CurrencyShares British Pound Ster ETF (FXB)

On Friday, another nail was driven into the coffin for the December Fed rate rise.

That is the undeniable conclusion derived from the tepid September Non Farm Payroll Report at 156,000. The headline unemployment rate ticked up slightly to 5.0%.

The Fed tells us every day that it is data driven, and this number certainly does NOT scream that the economy is overheating and urgently needs to be reigned back.

What does all of this means for the markets?

It confirms my view that all asset classes will continue to churn sideways in narrow ranges for another month going into the election.

With the media bombarding us nonstop daily with election bombast, nobody wants to stick their neck out and front run the outcome.

Except, that is, me.

I did use the opportunity to double my long position in the US Treasury bond market while it was trading at the bottom of a four-month range.

The strike prices I am using assume that the yield on the ten-year Treasury bond (TLT) won?t rise above 2.03% over the next six weeks, a bet that I am quite happy to make.

In our relentlessly deflationary world, bond markets will continue to shock traders, investors, and financial advisors with ultra low yields.

The long side entry point for bonds was created by a run in the economic data last week that suddenly turned positive.

The final read on Q2 GDP bumped up to 1.4%. Then we saw a leap in the September Services ISM from 51.4 to 57.1. September Non Manufacturing ISM rocketed from 51.4 to 60.3.

After months of uninspiring reports, this batch served as a sudden wakeup call for bond owners.

The August payroll report was revised upward from 151,000 to 167,000.

Professional and business services did the heavy lifting, up +67,000. Health care was up 33,000, while restaurants were up 30,000.

The U-6 long-term structural unemployment rate held steady at 9.7%.

The other big shocker last week was the flash crash in the British pound (FXB), which plunged an eye popping 6% in two minutes.

This was a capitulation move resulting from the UK government?s decision to move forward with a ?hard? Brexit. England is getting so cheap that I can?t afford NOT to return next summer.

Of course, the principal volatility event for the week takes place at 9:00 EST on Sunday night in St. Louis when the second presidential debate takes place.

If Donald Trump has learned how to debate in the past 12 days, stocks will open down triple digits on Monday morning.

I think not. The leopard does not change his spots overnight.

Monday, October 10 see the banks closed for Columbus Day, so most traders will be calling it in that day.

On Tuesday, October 11 at 6:00 AM EST we learn the National Federation of Independent Business Small Business Optimism Index. This is where the bulk of the country?s job creation comes from.

On Wednesday, October 12 at 10:00 AM EST we get the Labor Department?s JOLT Report on job openings.

On Thursday, October 13 at 8:30 AM EST we get the Weekly Jobless Claims which should confirm that employment remains at four-decade highs.

Friday, October 14 delivers us the September Retail Sales at 8:30 AM EST, and August Business Inventories at 10:00 AM EST.

We wind up with the Baker Hughes Rig Count on Friday at 1:00 PM EST. Worryingly, the trend has been up for the past 14 out of the past 15 weeks.

All in all, I expect us to continue trading in narrow ranges in what is essentially a four day week, with profits accruing only to the quick and the nimble.

Good luck and good trading.? Keep your hard hat on.

John Thomas

The Mad Hedge Fund Trader

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.