As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

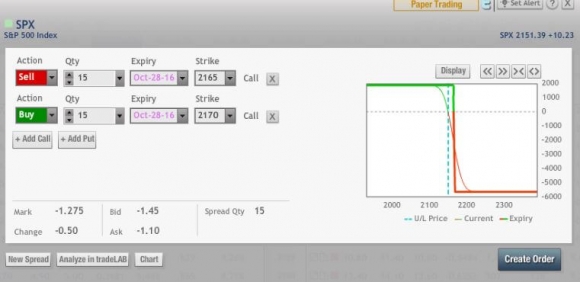

While the Global Trading Dispatch focuses on investment over a one week to six-month time frame, Mad Options Trader, provided by Matt Buckley, will focus primarily on the weekly US equity options expirations, with the goal of making profits at all times. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

October 24, 2016

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE COMING WEEK),

(THE ?INTRODUCTION TO RISK MANAGEMENT? TRAINING VIDEO IS POSTED),

(AMERICA?S DEMOGRAPHIC TIME BOMB),

(EEM)

iShares, Inc. - iShares MSCI Emerging Markets ETF (EEM)

The financial markets are starting to sniff something big out there, even though traders and investors can?t see it yet.

Right now, the assumption is that Hillary Clinton will win the Presidency and the Senate, but will come 10 seats short of seizing the House of Representatives.

Donald Trump utterly failed to engineer a dramatic comeback at the last debate, digging himself into more and deeper holes instead.

That brings us eight more years of gridlocked government in Washington.

But what if that doesn?t happen?

What if, instead, Hillary pulls off a ?Grand Bargain? with House speaker, Paul Ryan, during her first 100 days in office?

Paul Ryan, chastened by a recent thrashing at the polls, might become more amenable and inclined to compromise.

A forewarned Clinton, wary of Barrack Obama?s example of the past eight years, might be ready to deal as well.

At the very least, they should be able to get bills through Congress concerning matters they both agree on.

What would such a grand bargain look like?

Create 30-year tax exempt bonds through which corporations can repatriate their $2.5 trillion in hidden offshore profits.

The money would be earmarked only for a national infrastructure revitalization effort.

Some 1 million blue-collar jobs would be created, largely in the states with the highest unemployment rates.

Since the government would be borrowing at less than the long-term inflation rate, probably at 1.5%-2.0%, it would essentially be getting the infrastructure for free.

However, the new taxes generated by the new incomes and efficiencies would be absolutely mammoth.

What would the stock market do in such a scenario?

It would probably rise 20% by the end of 2017. Bond prices would collapse, and gold, commodities, energy and the US dollar would soar.

The economic recovery continues for another three years, with US GDP growth recovering 3%. Then all of my ?Roaring Twenties? factors kick in.

We can?t know for sure how things will play out until after November 8th. That is when both Clinton and Ryan know what they have to work with.

Sounds like a win-win-win to me.

Who will be the big beneficiaries?

You, me, and risk takers everywhere.

You may want to sit down and smoke a cigarette to digest this one. It is a potential outcome of positively Rooseveltian proportions.

With that said, we have an incredibly boring week in store for us next week.

It will confirm my expectation that markets will continue to trade in narrow ranges for the remaining 12 trading days until the presidential election.

However, it should be noted that we are now well into the Q3 earnings period, and most companies are reporting better than expected, especially technology companies and financials.

That bodes well for the post election stock market.

Monday, October 24th at 9:45 AM EST, we get the PMI Manufacturing Flash Index.

We also get no less than four different Fed speakers that day, so the bond market should be dancing the watusi.

On Tuesday, October 25th at 9:00 AM EST we get a new monthly update on the S&P 500 Case Shiller Home Price Index, which should confirm continued price increases in the residential real estate market. Remember, supplies are short.

On Wednesday, October 26th at 9.45 AM EST, the PMI Services Flash Index is published. Now that we are short the oil market (USO), we should also pay careful attention to the EIA Petroleum Status Report, due out at 10:30 AM EST.

Thursday, October 27th will be a big data day, with Weekly Jobless Claims and Durable Goods Orders at 8:30 AM EST, and September Pending Home Sales at 10:00 AM EST.

Friday, October 28th at 1:00 PM delivers us only the Baker Hughes Rig Count. Worryingly, the trend has been up for 16 out of the past 17 weeks.

This should help cap oil prices for the short term which is what my (USO) trade is all about.

Good luck and good trading.? Keep your hard hat on.

John Thomas

The Mad Hedge Fund Trader

Now that you know how to make money in the options market, thanks to my Trade Alert service, I am going to teach you how to hang on to it.

There is no point in being clever and executing profitable trades only to lose your profits through some simple, careless mistakes.

So I have just posted a new training video on Risk Management.

The first goal of risk control to preserve whatever capital you have. I tell people that I am too old to lose all my money and start over again as a junior trader at Morgan Stanley. So I am pretty careful when it comes to risk control.

The other goal of Risk control is the art of managing your portfolio to make sure it is profitable, no matter what happens in the marketplace. Ideally, you want to be a winner whether the market moves up, down, or sideways.

Remember, we are not trying to beat an index here. Our goal is to make absolute returns, or real dollars, at all times. You can?t eat relative performance, nor can you use it to pay your bills.

So the second goal of every portfolio manager is to make it bomb proof. You never know when a flock of black swans are going to come out of nowhere, or another geopolitical shock occurs, causing the market crash.

I?ll also show you how to use my Trade Alert service to squeeze every dollar out of your trading.

So, let?s get on with it!

To watch the video, please click? Introduction to Risk Management.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.