While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

November 30, 2017

Fiat Lux

Featured Trade:

(THE SILICON MELTDOWN FINALLY HITS),

(NVDA), (LRCX), (TSLA), (AMZN), (GS),

(THE GOVERNMENT'S WAR ON MONEY),

(TESTIMONIAL)

I remember 1900 like it was yesterday.

Work on the New York subway began. Women wore huge bustles under their skirts and cinched their waists to 18 inches to make themselves appear more attractive at social events.

The hot new consumer product of the day was the Edison wax cylinder player, the first device that allowed people to play music in their own homes.

The Dow Average brought in a pretty mediocre year, rising a scant 3.4% to close at $70.44.

There was one other thing I recall. The year 1900 was the last time stocks were priced as highly as they are today.

So says Goldman Sachs (GS) in a research report released today.

It was enough to set the cat among the pigeons with technology stocks, 2017's runaway market leaders, which in many cases saw whopping one day declines of 10%-15%.

Much beloved stocks I have been recommending to followers for years like NVIDIA (NVDA), Lam Research (LRCX), Amazon (AMZN), and Tesla (TSLA), running up 200%, 300%, and even 400% gains, we suddenly taken out to the woodshed for a beating.

Is it game over? Has the top been ticked? Should I panic and dump all my technology stocks?

We all knew this day would come.

The theory I have been proposing is coming true.

Technology would not roll over due to deteriorating earnings or a weakening business outlook. The sheer weight of high prices would do the trick, much like they did in Tokyo on the first trading day of 1990.

The Goldman report merely provided the match.

There are an unusual number of risks suddenly piling up for stocks as we rush pell-mell into yearend.

1) Passage of the tax bill could set off one of the greatest "buy the rumor, sell the news" dump of all time. Once the bill becomes law, what will be the next surprise to drive prices ever upward? Nothing.

2) The tax bill doesn't pass. That means we have to back out all the market gains of the fall, or a couple thousands Dow points.

3) An enormous amount of tax selling has been deferred to January to take advantage of perceived lower tax rates. When a ton of selling is about to hit the market in January, what do you do in December? Not much.

4) If you sell your technology stocks now you get paid your annual performance bonus in January. If you lose all your profits before then, you won't.

5) The bitcoin fever is becoming so overheated that it is starting to suck money out of other asset classes. Since Thanksgiving, 100,000 new bitcoin accounts have been opened, mostly by Millennials.

The global cash glut is becoming so severe that we are having to invent new assets out of thin air just to soak up the surplus. Welcome to bitcoin, where 2018 yearend forecasts are now exceeding $50,000.

6) Did I mention that the government is shutting down on December 8?

The tech wreck prompted a vicious sector rotation out of the FANG's and into financials and retail. The move into banks will be sustainable through all of 2018. The switch into retail won't.

Is this REALLY the end of tech?

I don't think so. While the sector periodically suffers serious draw downs, with lead stocks like Apple backing off 40%, they always come back.

That's because the actual technology produced by these companies is hyper accelerating, thanks to artificial intelligence.

Tech isn't dead. It is just resting.

And by the way, will readers please quit asking me if they should buy retailers because they have gone down so much? It is a sector that's NOT coming back. It's a lot like buying buggy whip manufacturers....in 1900.

No, It's NOT Dead

When I lived as a student in West Berlin during the 1960s, I had a nice little side business.

I organized weekend walking tours through the Berlin Wall at Checkpoint Charlie to visit East Berlin for American students too afraid to go alone.

To pay for it, I smuggled US dollars my customers paid me in my boots which I used to buy Ostmarks in the East at a 75% discount to the official price. I then covered lunch and all my other bills, booking a nice profit on the day.

That would be much more difficult to pull off today, as governments around the world have launched a war on cash that will not end until its ultimate demise.

The truth is governments hate cash.

This became clearly apparent when the government of India withdrew circulation of its two largest banknotes. Some 50% of Indian GDP is thought to take place in the underground economy in cash only.

The move caused a financial panic, as consumers sold gold (GLD) and other hard assets to meet bills because they were unable to settle accounts with the large denomination notes they had hoarded.

As we move towards an all-electronic economy, the few remaining purposes where cash is essential are largely illegal.

When I lived as a student in West Berlin during the 1960's, I had a nice little side business.

I organized weekend walking tours through the Berlin Wall at Checkpoint Charlie to visit East Berlin for American students too afraid to go alone.

To pay for it, I smuggled US dollars my customers paid me in my boots, which I used to buy Ostmarks in the East at a 75% discount to the official price. I then covered lunch and all my other bills, booking a nice profit on the day.

That would be much more difficult to pull off today, as governments around the world have launched a war on cash that will not end until its ultimate demise.

The truth is, governments hate cash.

This became clearly apparent when the government of India withdrew circulation of its two largest banknotes. Some 50% of Indian GDP is thought to take place in the underground economy in cash only.

The move caused a financial panic, as consumers sold gold (GLD) and other hard assets to meet bills because they were unable to settle accounts with the large denomination notes they had hoarded.

As we move towards an all-electronic economy, the few remaining purposes where cash is essential are largely illegal.

Waitresses, babysitters, and bookies don't report income to the IRS. Nor do drug dealers.

This is a big deal because eight states legalized marijuana in the last election.

Since banks are still banned from handling pot proceeds, this booming business has to take place entirely in cash. Tales about of dealers making their runs with shopping bags full of $100 bills are rampant.

The IRS estimates that $460 billion in tax revenue is lost every year through unreported income, which is largely earned in cash.

Some half of the entire US paper money supply is held by foreigners, where it is used to evade taxes, bribe foreign officials, and finance terrorism.

The US government's war on cash is not a new thing. In 1929, it cut the size of US banknotes by one third to save money on the cost of high-grade paper.

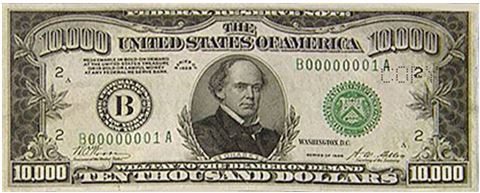

In 1970 the US Treasury banned the circulation of the $10,000, $5,000, $1,000, and $500 bills to halt mafia money laundering. Since then, the IRS has been the biggest beneficiary of the move.

Large denominations US bills are now solely the domain of collectors.

The US government would love to get out of the cash business, as it is so expensive to run. It spends about $737.4 million a year just to print American $1, $2, $5, $10, $20, $50, and $100 notes.

Paper dollar bills, which are actually made of 75% cotton and 25% linen, are completely worn out and have to be returned in only 18 months.

Coins are even a bigger loser. It costs more than two cents to make a penny.

Since the advent of color printers, counterfeiting has exploded. North Korea runs almost its entire economy on fake $100 bills, which are said to be the best in the world.

Today, some 80% of the entire $1.34 trillion M1 notes and coins in circulation in America are in the form of $100 dollar bills. That works out to $4,200 per person. Where has all that money gone?

The US is now considering eliminating even this convenient denomination. While $1 million in $100's can fit into a tote bag, that quantity of $10 bills would weigh 220 pounds, a quantity much more difficult to sneak around.

An all-electronic economy would certainly pose some privacy problems, as it would leave a massive paper trail on everything you do.

When you get audited by the IRS, the first thing they do it obtain your past three years of bank and credit card records detailing your every transaction.

State authorities will pursue phone records to establish your physical presence to verify residency. So how long did you really spend in tax-free Florida last year?

It would also pare back illegal immigration, as this is another industry that runs entirely on cash. Once here, undocumented workers are often paid in cash in restaurants and on construction sites.

There is truly no place to hide.

Other countries are already well ahead in the war of cash. In Belgium, some 93% of all financial transactions take place electronically.

Sweden has also been pushing hard on this front, taking the M1 money supply there down by 27% over the past two years.

Many small businesses there now post signs saying they don't accept cash. The goal is to move to an all-electronic economy.

The preferences of Millennials are also moving us towards the cashless economy.

Have you every been in line at Starbucks and noticed that the kid in front of you just paid $2 for a cup of coffee with his credit card? Or maybe he swiped his Apple Pay account on his iPhone?

Whatever the means, it is clear that hard cash is about to become a dinosaur.

No Longer in Circulation

The confidence you have given me to enter the USD:JPY spot positions have returned me in excess of $1,500,000 in the last few months.

I'll be in California next year.

Can't wait to catch up. Dinner is on me, both times!

I know you said you aren't retiring until you're well into your seventies. Why so soon?

You're welcome to use this as a testimonial.

Cheers

Peter,

Australia

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.