When I trained for the Japan National Karate Championships, fought in Tokyo's fabled Nippon Budokan 45 years ago, there was one rule my sensei never failed to beat into me.

Ducking the punch is far more important than landing one.

Certainly stock market traders took that rule to heart last week.

Four out of five days, a weak US dollar triggered a stock selloff in Europe that led to triple digit declines at the New York opening.

Yes, humble managers are becoming aware that they are not smart enough to achieve the returns they have made in 2017, therefore they are getting nervous.

In every case shares battled back to recover the losses.

The week ended with a push, and stocks largely unchanged. It was all a lot of work for absolutely nothing.

The Volatility Index (VIX) made a rare visit to the $14 handle, whereupon the entire planet sold into it.

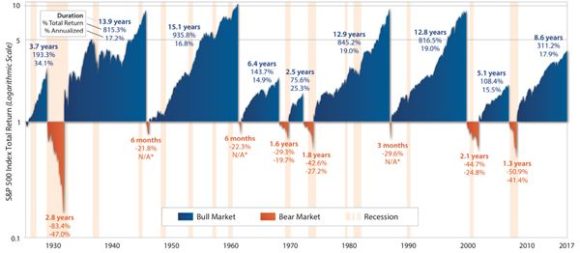

You can blame the advanced age of this bull market, now approaching an eye popping nine years old.

Shares have not seen more than a 2% decline for 62 weeks, the most extended since 1965.

Indeed, we have seen the second longest bull market of the past half century, defined as a pull back from the top of more than 20%.

To beat the record, stocks have to rise for six more years to match the torrid 15 year run that started with the US national railroad strike in 1946 and ended with the Cuban Missile Crisis in 1962.

Looking at the chart below what is truly fascinating is how short bear markets are, usually measures in mere months.

You have to go all the way back to the Great Depression to find a bear that lasted two years and eight months.

Yes, hanging on to your stocks always IS the right thing to do.

The bigger questions is: Why aren't you leveraging 2:1 like a hedge fund does?

Much of the flip flopping this week can be traces to the violent evolution of the tax bill, which seemed to change shape by the hour, and is currently opposed by 59% of the voting population.

As if this weren't hard enough, the Republicans at the last minutes decided to also make it a health care bill, wiping out coverage for 13 million.

Here's your math.

Passing the House was the easy lift, where the Republicans hold a 56-seat majority. Still, it was only able to garner a 10-vote win.

The tax bill next has to pass the Senate, where Republicans hold a paper thin two seat majority, and five have already expressed their opposition.

My bet is that a bill will pass sometime in Q1, 2018 in highly diluted form, without the loss of deductions for mortgage interest, local and state taxes, or an estate tax repeal.

I also think the bill will fail its first vote in the Senate. That will NOT be a good day to be long the market.

Without this funding, the corporate tax rate will be cut to only 25% for the few who pay them.

This will be called a great victory.

This bill could be passed today, but it may take the GOP leadership three months to figure this out.

The net effect on the economy will be nil, and we can all go back to watching corporate earnings as the principal driver of share prices, as they should be.

I expect this will drive the indexes to new highs for at least the next one or two years.

Ironically, it will also move forward the next recession, as stimulating an already hot economy will move forward the next inverted yield curve and interest rate spike.

We could well be solidly in a bear market and recession before the next presidential election.

Certainly the global junk bond markets think so, where we saw the first signs of the smart money sitting down before the music stops playing.

The SPDR Barclays High Yield Bond ETF (JNK) managed a 2.3% swan dive to a three month low.

Certainly, prices had reached insane levels, with the spreads on some issues falling to a scant 200 basis points over US ten year Treasury bonds. In Europe junk yield are BELOW Treasury yields, if you can find any to buy.

However, these days insanity doesn't stop anyone from doing anything.

That's Why I recommended a tactical short position in junk bonds (SJB) a few weeks ago (click here for Take A Ride in the New Short Junk ETF)

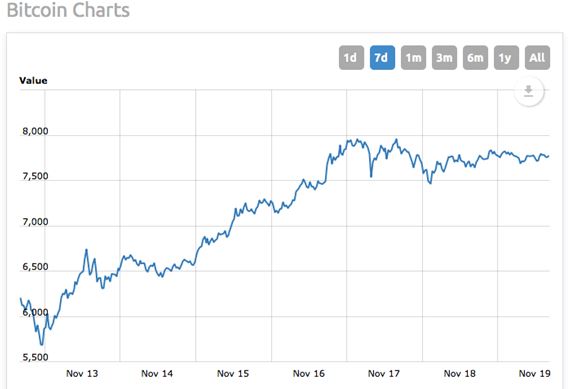

The big revelation for me last week is that I finally understood WHY people were pouring money into bitcoin, which recently touched $8,000.

In one week, it crashed 20%, then soared 30%. It is almost the only place in

the world where you can find this kind of volatility.

I'm sure tulip prices saw the same price action in the early 17th century.

Trading looks to be dull, brutish, and boring in this holiday shortened week. Expect markets to remain flat ahead of the Senate vote on the bill, which I expect to fail.

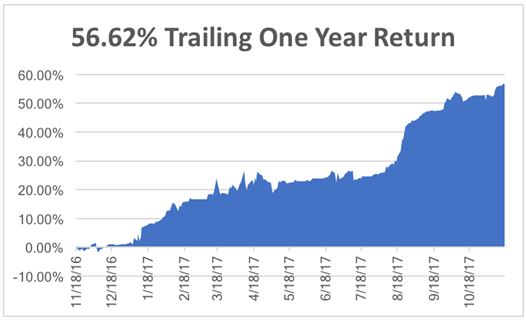

Despite these hair-tearing trading conditions, I managed to push my Trade Alert performance up to new highs, adding 274.15% over the past eight years, generating an average annual return of 34.63%.

I am up 3.54% so far in November, and 56.62% over the past 12 months.

To leave you on a positive note, it's looking like your entire financial future may be determined by the 20% of eligible voters who turn out to vote for a new Senator on December 12.

On Monday, November 20, at 10:00 AM the Index of Leading Economic Indicators is published, a forward-looking basket of ten monthly data points.

On Tuesday, November 21 at 6:00 AM EST we get October Existing Home Sales. Since the data predates the Republican plan to deny mortgage interest and real estate tax deductions, the data should remain hot.

On Wednesday, November 22, most of the week's data bunch up due to the holidays. We obtain October Durable Goods at 8:30 AM. Weekly Jobless claims are out at the same time. October Consumer Sentiment comes out at 10:00 AM.

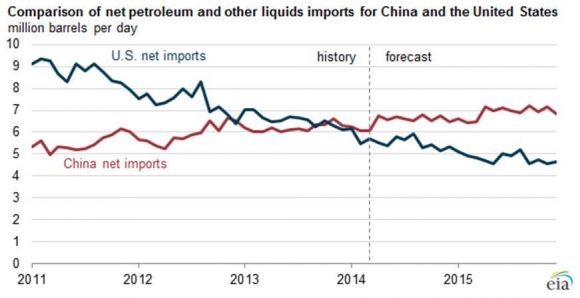

The weekly EIA Petroleum Status Report is out at 10:30 AM.

Thursday, November 23 the markets are closed for the US Thanksgiving holidays.

On Friday, November 24 at 1:00 PM, we receive the Baker-Hughes Rig Count, which lately has started to turn up again.

As for me, I will be foraging through the High Sierras, looking for the ideal Christmas Tree to take home. My USDA permit allows be to take two.

I Meet Some of the Most Interesting People