While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

November 15, 2017

Fiat Lux

Featured Trade:

(NVIDIA REPORTS...STOCK ROCKETS, AGAIN),

(NVDA), (IBM), (HPQ), (TSLA), (DVMT),

(IS USA, INC. A "SELL")

Last year, whenever anyone asked me for a stock most likely to double in 2017, I uniformly responded with the same name: NVIDIA (NVDA).

For me, it was a no-brainer.

The processor manufacturer occupied the nexus of the entire movement towards machine learning and artificial intelligence, and then was still relatively unknown.

I lied.

The stock didn't double, it more than tripled, from $67 to a high of $219.

These days, I am being asked the same question.

But this time, I'm going to be boring. Believe it or not, the name to double again in 2018 is (NVDA).

You would think I am MAD to be chasing the big winner of 2017.

But take a look at their blockbuster earnings announced last week first, which blew away the street's most optimistic expectations.

Q3 revenue leapt 54% to just over $2.64 billion, and net profits of $1.33 a share, up 33% YOY, and 41.5% greater than expected.

Their gross operating margin is an eye popping 59.7%.

It is dominating in the fastest growing sectors of the technology space, including AI, virtual reality, and fast data processing.

Every automobile company is basing its self-driving technology on its XP computer.

And now there is a new game in town.

(NVDA) is a major beneficiary of the exponential growth of cryptocurrencies, whose need for processing power is growing voraciously.

At this point, the company has a huge installed base of users on which to build on.

Look at the spec sheets of anything you buy these days and you will find NVIDIA parts somewhere in the guts.

I bought a Dell Alienware Area 51gaming PC to run the Oculus Rift virtual reality hardware for my kids this Christmas (they don't read this letter on a daily basis). It came with a state of the art NVIDIA GeForce GTX 1080 graphics card.

I also happen to know that NVIDIA chips are lurking somewhere in my Tesla (TSLA) Model S-1 and Model X.

Most companies have only one or two artificial intelligence experts. NVIDIA has over 1,000.

While the stock is priced for perfection, it is continuing to deliver just that. The shares actually fell on the earnings announcement.

But let's face it. The momentum of this stock has been unassailable.

However, the company is so far ahead of its competitors it is actually increasing its lead. Nobody has a chance of catching them.

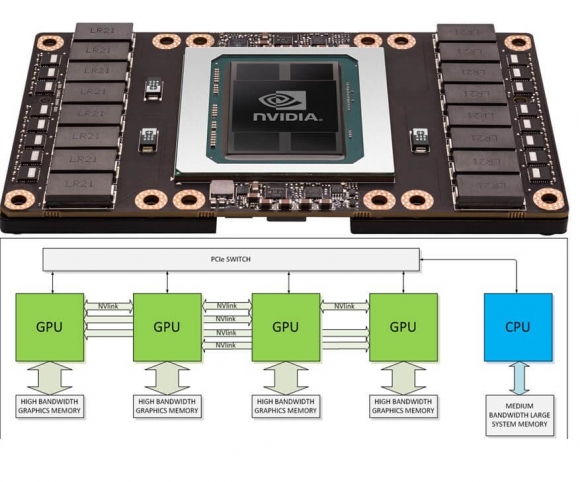

The company is managing an industrywide migration of processing power from the CPU to the GPU. You have to use their architecture, or you will go out of business.

This is why every PC manufacturer, including Dell (DVMT) and Hewlett Packard (HPQ), are partnering with them. IBM (IBM) is using their chips in their high-end machines.

This is because (NVDA) is now first to market with everything important.

Nvidia's dominance of the high-end GPU market is allowing it to soak up all of the spending that would normally have been at least somewhat split between itself and AMD.

Gaming was the big revenue booster for Nvidia, which now accounts for 59% of sales.

Sales of Nvidia's flagship product, the passively cooled 16GB Tesla P100 GPU, is being ravenously consumed by data centers around the country, and should double again in 2018.

And the company has just started to ship its new Volta-based Tesla V100 GPU, which offers a tenfold increase over previous generations.

Hold one of these dense, wicked fast processors in your hand and you possess nothing less than the future of western civilization.

Over the long term, the picture looks even better. It should continue with annual earnings growth of at least 20%-30% a year for the foreseeable future.

At a minimum, the shares have at least another double in them. If I'm wrong, they'll only go up 50%.

Not a bad choice to have.

To learn more about Nvidia, please visit their website by clicking here.

For those of you who did the trade at the beginning, or better yet, bought deep out of the money one year option LEAPS, well done!

I am hearing of 800% returns, or better.

What would happen if I recommended a stock that had no profits, was losing billions of dollars a year, and had a net worth of negative $44 trillion?

Chances are, you would cancel your subscription to the Mad Hedge Fund Trader, demand a refund, unfriend me on Facebook, and unfollow me on Twitter.

Yet, that is precisely what my former colleague at Morgan Stanley, technology guru Mary Meeker, did.

Now a partner at venture capital giant, Kleiner Perkins, Mary has brought her formidable analytical talents to bear on analyzing the United States of America as a stand-alone corporation.

The bottom line: the challenges are so great they would daunt the best turnaround expert. The good news is that our problems are not hopeless or unsolvable.

The US government was a miniscule affair until the Great Depression and WWII, when it exploded in size. Since 1965 when Lyndon Johnson's "Great Society" egan, GDP rose by 2.7 times, while entitlement spending leapt by 11.1 times.

If current trends continue, the Congressional Budget Office says that entitlements and interest payments will exceed all federal revenues by 2025.

Of course, the biggest problem is health care spending which will see no solution until health care costs are somehow capped. Despite spending more than any other nation, we get one of the worst results, with lagging quality of life, life span, and infant mortality.

Some 28% of Medicare spending is devoted to a recipient's final four months of life. Somewhere, there are emergency room cardiologists making a fortune off of this. A night in an American hospital costs 500% more than in any other country.

Social Security is an easier fix. Since it started in 1935, life expectancy has risen by 26% to 78, while the retirement age is up only 3% to 66. Any reforms have to involve raising the retirement age to at least 70 and means testing recipients.

The solutions to our other problems are simple, but require political suicide for those making the case.

For example, you could eliminate all tax deductions, including those for home mortgage interest, charitable contributions, IRA contributions, dependents, and medical expenses. That would raise $1 trillion a year, and more than wipe out the current budget deficit in one fell swoop.

Mary reminds us that government spending on technology laid the foundations of our modern economy. If the old DARPANET had not been funded during the 1960s, Google, Yahoo, EBay, Facebook, Cisco, and Oracle would be missing in action today.

Global Positioning Systems (GPS) were also invented by and are still run by the government. They have been another great wellspring of profits (I got to use it during the 1980s while flying across Greenland when it was still top secret).

There are a few gaping holes in Mary's "thought experiment". I doubt she knows that the Treasury Department carries the value of America's gold reserves, the world's largest at 8,965 tons worth $576 billion, at only $34 an ounce versus an actual current market price of $1,280.

Nor is she aware that our ten aircraft carriers are valued at $1 each, against an actual cost of $5 billion each in today's dollars. And what is Yosemite worth on the open market, or Yellowstone, or the Grand Canyon or the Grand Tetons? These all render her net worth calculations meaningless.

Mary expounds at length on her analysis, which you can buy in a book entitled USA Inc. at Amazon by clicking here.

Worth More Than a Dollar?

"The rule of thumb is to do your homework, do your analysis, don't give up prudent risk management for the sake of certain fads. Look for real valuations, and stay true to your time frames," said Marc Chandler, the global head of currency strategy at Brown Brothers Harriman.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Global Trading Dispatch focuses on investment over a one week to six-month time frame, Mad Options Trader, provided by Matt Buckley, will focus primarily on the weekly US equity options expirations, with the goal of making profits at all times. Read more

While the Global Trading Dispatch focuses on investment over a one week to six-month time frame, Mad Options Trader, provided by Matt Buckley, will focus primarily on the weekly US equity options expirations, with the goal of making profits at all times. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.