When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

January 23, 2018

Fiat Lux

Featured Trade:

(KEEP A CLOSE EYE ON FREEPORT MCMORAN),

(FCX), (COPPER), ($SSEC), (BHP), (RIO), (ECH), (CU),

(WILL BITCOINS REPLACE THE $10,000 BILL), (GLD),

(THE SERVICE JOB IN YOUR FUTURE), (MCD)

It is clear from the improving economic data from China that the hard landing scenario is off the table. It is all part of the synchronized global economic recovery that is powering financial markets everywhere.

This is great news for the producers of everything that the Middle Kingdom buys in bulk, especially copper.

If you like copper, you've got to love Freeport-McMoRan (FCX), one of the world's largest producers for the red metal. These factors explain the sizeable insider buying that has been taking place in the shares over the past months.

The technical picture is looking pretty positive as well. The chart is showing that a strong upside breakout took place in the fall, supported by a sharp turn up in the 50-day moving average. This is universally positive for share prices.

This commodity is known in the investment industry as Dr. Copper, the only metal that has a PhD in economics. That's because of its uncanny ability to predict the future of the global economy.

Copper is now screaming of better things to come, along with the stock market, like a 3.5% GDP growth rate in the US this year, and stronger growth elsewhere.

The recent strength further is confirmed by longer-term charts for the Shanghai index ($SSEC), which is showing that a double bottom may well be in place.

Copper was the first metal used by man in any quantity. The earliest workers in the red metal found that it could be easily hammered into sheets and worked into shapes, like swords, which became more complex and artistic as their skill increased.

The ability to resist corrosion ensured that copper, bronze and brass remained as functional as well as decorative materials during the Middle Ages and through the Industrial Revolution to the present day.

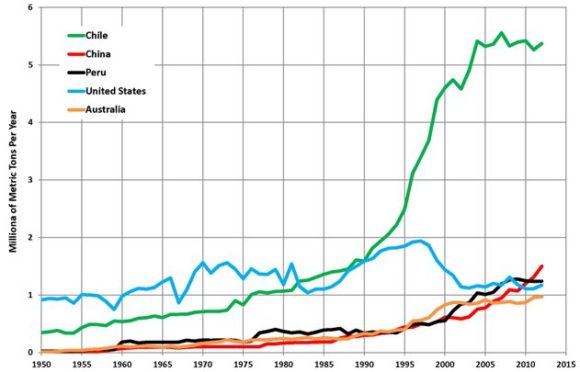

Of the 19.1 million metric tonnes of copper produced in 2015, the latest year for which figures are available, Chile was far and away the leader, with 5.76 million metric tonnes. It was followed by China at 1.71 million tonnes, Peru at 1.7 million tonnes, and the US at 1.38 million tonnes.

This makes the Chile ETF (ECH) another great backdoor play in copper, which is up a ballistic 178% in two years.

As copper is a great electrical conductor, it is primarily used for electrical wiring, followed by the construction industry and shipbuilding, and the auto industry, especially in the rapidly growing electric vehicle space.

It's true that copper is no longer the dominant metal it once was, due to a structural global oversupply in shipping and the ongoing transition of the Chinese economy from a manufacturing to a services economy. Their copper intensive infrastructure is already largely built out.

Because of the lack of a consumer banking system in the Middle Kingdom, individuals have been hoarding 100-pound copper bars and posting them as collateral for loans. Get any weakness of the kind we saw in 2015, and lenders panic, dumping their collateral for cash. That's what made the early 2016 bottom.

The high frequency traders are now also in there in force, whipping around prices and creating unprecedented volatility. You can see this also in gold, silver, oil, coal, platinum, and palladium.

This is why I am spurring readers into the shares of Freeport McMoRan. The gearing in the company is such that a 50% rise in the price of copper triggers a 100% rise in (FCX).

More conservative and less leveraged investors can buy the First Trust ISE Global Copper ETF (CU).

Where to Find Copper

The conspiracy theorists will love this one.

The IRS has long despised the barbaric relic (GLD) as an ideal medium to make invisible large transactions. Did you ever wonder what happened to $500, $1,000, $5,000, and $10,000 bills?

Although the Federal Reserve claims on their website that they were withdrawn because of lack of use, the word at the time was that they disappeared to clamp down on money laundering operations by the mafia.

In fact, the goal was to flush out income from the rest of us.

Currency trivia question of the day: whose picture was engraved on the $10,000 bill? You guessed it, Salmon P. Chase, Abraham Lincoln's Secretary of the Treasury.

Now organized crime, terrorists, and tax cheats have another means with which to sidestep the IRS: Bitcoin.

When India dumped its high denomination banknotes in 2016, to where did everyone flee? To Bitcoins.

When China clamped down on individuals desperate to get their savings out of the country, what means did they use? Bitcoin.

As a result, the price of Bitcoins exploded some 110% to $1,100 over the past six months, and then crashed.

It is an old nostrum that if you block one means to avoid taxes, new ones will spring up to replace them.

This is a classic case.

Out With the Old

In With the New

Anyone wondering about the long term future of the US economy is amazed at how fast it is evolving.

There has been an unrelenting growth of services' share of American GDP, from 25% to 45% over the last sixty years.

Far and away the fastest growth area for the past eight years has been health care, thanks to Obamacare. With that program now headed for the dustbin of history, those job gains are about to be quickly unwound.

It takes one health care professional to take care of 14 Americans. If you eliminate health care for 20 million, that eliminates 1.42 million jobs.

That's what will happen if our national health care is eliminated without a replacement.

This is not necessarily a bad thing. Would you rather be mining coal or designing a website? Do you want to earn $12 an hour, or $150?

These statistics make us the envy of the world, as services are where the future lies. By creating so many key technologies, our country has been the most successful in the world in climbing up the value chain.

China can have all the $3 an hour jobs it wants.

Services largely comprise pure intellectual content, require no raw materials, and the end product can be transmitted over the Internet.

There is a reason why nearly a million foreign students have flocked to the US for an education.

Emerging nations like China and South Korea, which only see services generating 10%-15% of their GDP, are wracking their brains trying to figure out how to play catch up.

While the Global Trading Dispatch focuses on investment over a one week to six-month time frame, Mad Options Trader, provided by Matt Buckley, will focus primarily on the weekly US equity options expirations, with the goal of making profits at all times. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

January 22, 2018

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or CLOSED FOR BUSINESS),

(SPY), (TLT), (TBT), (GLD), (AAPL), (FB),

(BUSINESS IS BOOMING AT THE MONEY PRINTERS)

(TESTIMONIAL)

There is nothing quite like selling short sovereign bonds and then seeing the country in question go into default.

That was a big trade during the 1970's and 1980's, when after two oil shocks the credit worthiness of emerging nations went into a tailspin. I think I made three round trips on Brazil alone.

However, this time the sovereign in question is the United States of America. The government shut down that ensued on Friday triggers a de facto default on all its IOU's.

As a result, US Government bond prices have sold off sharply, taking yields on the ten-year Treasury bond from 2.44% to 2.64%, a four-year high.

The charts on bond prices couldn't look uglier, with many important long-term trend lines shattered. The double top is bleakly staring you in the face.

If you happen to be a coupon cutter not to worry. The Treasury has enough cash in the pipeline to keep up interest payments for at least a month.

And there is a silver lining behind the giant black clouds roiling over Washington. If you are being audited by the IRS this week the meeting is cancelled. Agents won't show if there's no money to pay them.

Such is trading and investing in the modern age, which seems to change by the day. Governments were never really all that reliable anyway; here today, gone tomorrow.

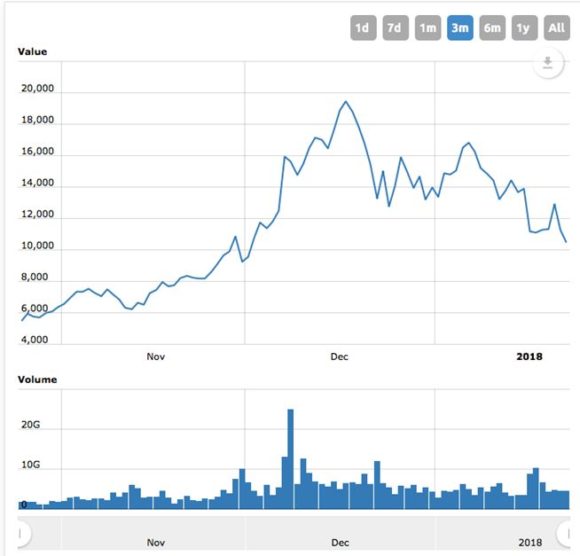

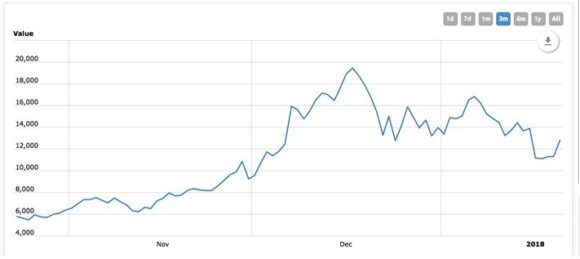

One of my 2018 forecasts has already played out. A Bitcoin crash would lead to a major rally in gold. That is exactly what has happened, with the crypto currency down an amazing 55% from its December high.

The barbarous relic popped smartly, some 8.54%. Is this the beginning of its long-awaited run to the old high at $1,928? We shall see.

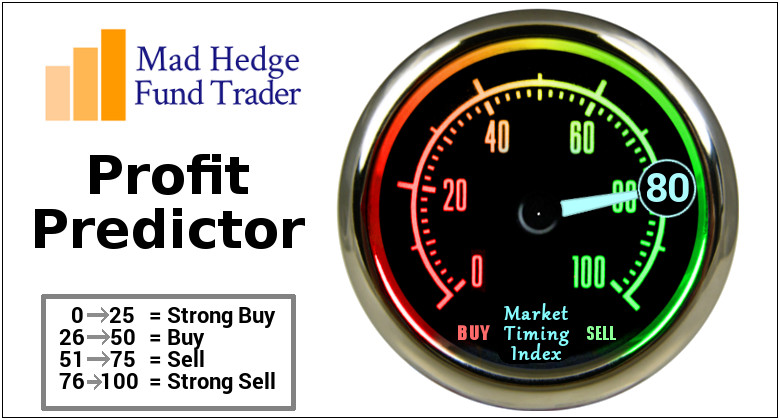

After a slow start, no doubt the after effects of the Chicago winter, it's off to the races again with the Mad Hedge Fund Trader's Trade Alert Service.

At the Friday close we were up 3.1% so far in 2018, and boast a trailing 12 month profit of 58.68%, thanks to longs in Apple (AAPL) and Facebook (FB) and a short in Treasury bonds (TLT).

It hasn't been an easy market to get into. You essentially had to close your eyes and BUY. I sold into a brief short covering rally in bonds because they were so obviously falling apart.

I picked up the first of my long's during the 300 point dump triggered by the Steve Bannon subpoena. So far, I'm batting 100% in 2018.

This week will be all about housing data, which we already know are hotter than hot. Then there's the all-important Q4 GDP data on Friday. You'll have to count on individual company earnings reports as the wellspring of any volatility.

We are now into Q4 earnings season so those should be the dominant data points of the coming weeks.

On Monday, January 22, at 8:30 AM, the week kicks off with the December Chicago Fed National Activity Index, a leading indicator of inflation. Haliburton (HAL) announces Q4 earnings.

On Tuesday, January 23 at 10:00 AM EST the December Richmond Fed Manufacturing Index, a read on southern business activity. Johnson & Johnson (JNJ) announces earnings.

On Wednesday, January 24, at 10:00 AM EST, we obtain December Existing Home Sales. Ford Motors (F) announces earnings.

Thursday, January 25 leads with the 8:30 EST release of the Weekly Jobless Claims. At 10:00 AM December New Homes Sales are announced. The weekly EIA Petroleum Status Report is out at 11:00 AM EST. Celgene (CELG) announces earnings.

On Friday, January 26 at 8:30 AM we learn the first read on Q4 GDP, which should be very positive. Honeywell International (HON) announces earnings.

Then at 1:00 PM, we receive the Baker-Hughes Rig Count, which has started going ballistic.

As for me, I shall be flat on my back trying to recover from the flu. Yes, I am writing this letter in bed with a 103-degree fever watching the WWII movie Fury (my dad was a tanker).

Some 30 years of flu shots didn't do me any good this time, and 74 people in California have already died from this epidemic. However, as poorly as I may feel, the work schedule continues unabated. No rest for the wicked!

How about that (TLT) short!! It turns out that imminent government default on their bond obligations makes bond prices fold like a wet taco.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.