While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

January 17, 2018

Fiat Lux

Featured Trade:

(THE BIG WINNER FROM INTEL'S CHIP DESIGN FLAW),

(INTC), (NVDA), (AMD),

(THE CONTINUING DEATH OF RETAIL),

(AMZN), (WMT), (M), (JWN),

(TESTIMONIAL)

Buy Intel (INTC) on the dip. That is the only conclusion you can reach after watching the company go through the meat grinder after revelations of its chip design flaws were made public.

After following this company for four decades, that is always the correct kneejerk reaction. Certain industries suffer from inherent idiosyncratic risks unique to them, and this is one of them.

Some 25 years ago, I had dinner with the late Intel CEO Andy Grove (we shared the same doctor), and I asked what was his biggest fear. He answered that the company would spend $1 billion on a new fab, then flipped the switch on opening day, and nothing happed.

Intel has a disaster something like that on its hands today.

Samsung knows this lesson too well from 2016, the makers of the Galaxy S7 smartphone, which took a huge blow when their batteries continually burst into flames in 2016. Apparently, their testers didn't find this flaw until after delivering the first large batch of new phones.

The news went viral and Samsung had a PR disaster of mega proportions, a battery design catastrophe, and quality control crisis on their hands all at the same time. You may recall that every airport had signs at the boarding gate reminding passengers to leave behind their flaming Samsung phones.

In the fickle market of premium smartphones, Samsung was taken out to the woodshed and severely beaten by the Chinese consumer, and their market share in the biggest smart phone market dropped from a robust 18.7% in 2013 to pitiful 2.2% in Q4 2017.

They have never recovered.

Intel's (INTC) disclosure of the design flaw exposed in their CPU was a terrible start to 2018.

Predictably, Intel shares were hammered.

Hardware companies cannot afford sacrificing whole product cycles. The wasted R&D and the brand damage is lamentable and it will take time to recover, not to mention the multibillion dollar cost.

You can bet that a comprehensive review has been set in motion for the designs in all lucrative hardware products at all companies. Expect a gradual trickle of bad news to come out from other players too.

Intel noted the problem was known for "a few months" but did not fix it immediately. This is awful. Brian Krzanich, CEO of Intel, also suspiciously sold a good chunk of Intel stock during this period. He is already in the SEC's sites.

Hiding architectural problems for months does not exactly breed shareholder trust.

Intel replied, "There have been no examples of the flaw being exploited by hackers". Unawareness does not exactly equate to safety. It's highly possible the future trickle of bad headlines will detail the criminal element that took advantage of this gaping hole.

Will the tech naivety continue unabashed? Will the contagion be worse next time?

Hardware reliability is truly something consumers and companies must ponder about.

Companies have more room to maneuver in the future when negotiating CPU contracts with Intel because of this debacle. That will hurt profit margins.

Technically, the patches will slow certain processors by up to 30% according to Intel officials.

The Intel CPU flaw brings up deeper questions. Is it safe to store important data on the cloud? Can hackers steal entire sets of cloud data and resell it to the highest bidder?

Another option is returning to the good old days when data was kept on external hard drive storage away from the tentacles of professional hackers. By the way, that's what we do here at Mad Hedge Fund Trader, who have never trusted the cloud.

The vast amount of data in 2018 makes this strategy highly inefficient for the biggest firms.

If storage risks flare up, the industry shifts closer to an inflection point and alternative measures will float around about how and where to store data.

Running apps on any platform requires more processing power each passing day as we expand the functionality and integration of smartphone and computing apps into our daily lives.

This higher opportunity cost of operating a slower CPU will be passed onto the user, much to their chagrin, but the problem will subside as the design architecture in new CPU's will be absent design defects.

Companies will also increase overhead. Additional quality control and design specialists to ensure that components produce products as advertised will be added to payroll. This will add higher costs, more stringent development guidelines, further pressuring margins.

The tech industry was the darling of Wall Street for many years and still is in most quarters. But some cracks are starting to form around its core foundations and ethos.

Fortunately, Wall Street still favors the tech sector and the accelerated earnings growth narrative remains intact albeit with a small chink in their armor.

The net net is tech companies will take on more operational risk.

Vulnerability will be a key theme in 2018 and entwined in this game of cat and mouse are cybersecurity firms and rogue hackers.

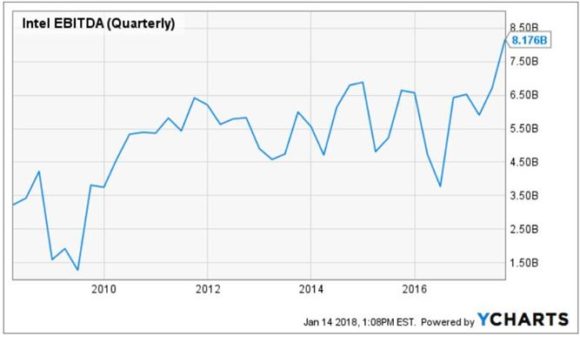

As the total global revenue for semiconductors revs up towards $80 billion, there will be multiple winners as the pie expands. Intel shares look stupidly cheap at 13x forward PE and looks substantially cheaper than AMD which trades at an insane 33x forward PE.

Comparably, the best of breed in this space is NVIDIA (NVDA) which trades at 50x forward earnings and the high multiple is justified as earnings consistently surprises to the upside.

That acrophobic multiple is well deserved, as NVIDIA represents the vanguard of several monster trends in the semiconductor industry and lead in the autonomous driving and AI spaces.

Ultimately, sales of chips could migrate up the industry chain; a natural flight to quality. Intel's slip up highlights Nvidia's top notch quality and the countdown starts again for the next batch of compromised hardware. The losers are the chip companies that are perceived as smaller, lower quality and their sell-offs are dramatic when related names roll over.

As with every other major industry trend, all signs still point to NVIDIA. But I wouldn't mind picking up some (INTC) on this dip either as the CPU market is a duopoly between AMD (AMD) and Intel (INTC).

These days, all problems for equity investors seem to be temporary.

Oops!

While the Global Trading Dispatch focuses on investment over a one week to six-month time frame, Mad Options Trader, provided by Matt Buckley, will focus primarily on the weekly US equity options expirations, with the goal of making profits at all times. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

January 16, 2018

Fiat Lux

Featured Trade:

(JANUARY 17 GLOBAL STRATEGY WEBINAR),

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE DUMB MONEY FINALLY COMES OUT OF THE WOORDWORK),

(SPY), (TLT), (AA), (WMT), (XLE), (XLK), (IBKR),

(C), (BAC), (SLB), (USO), (KSU), (OXY)

My next global strategy webinar will be held on Wednesday, January 17 at 12:00 PM EST, which I will be broadcasting live from Incline Village, Nevada.

I'll be introducing a new co-host this week. Doug Robertson of OptionsEDU.com is an old friend and a battle-scarred veteran of the equity options market. Readers in the past have found his search for value in the market fascinating. We'll look forward to receiving his insights. I'll forgive him for being an Army veteran, and not a Marine. Semper Fi!

We'll be giving you my updated outlook on stocks, bonds, commodities, currencies, precious metals, and real estate.

The goal is to find the cheapest assets in the world to buy, the most expensive to sell short, and the appropriate securities with which to take positions.

I will also be opining on recent political events around the world and the investment implications therein.

I usually include some charts to highlight the most interesting new developments in the capital markets. There will be a live chat window with which you can pose your own questions.

The webinar will last 45 minutes to an hour. International readers who are unable to participate in the webinar live will find it posted on my website within a few hours. I look forward to hearing from you.

We recently have taken in a large number of new subscribers. If you miss it, the webinar will be posted on the website within the hour.

To register for the webinar, please click on the link we emailed you entitled "Next Bi-Weekly Webinar - January 17, 2018" or click here.

Yikes, holy smokes, and sweet mother of Mary!

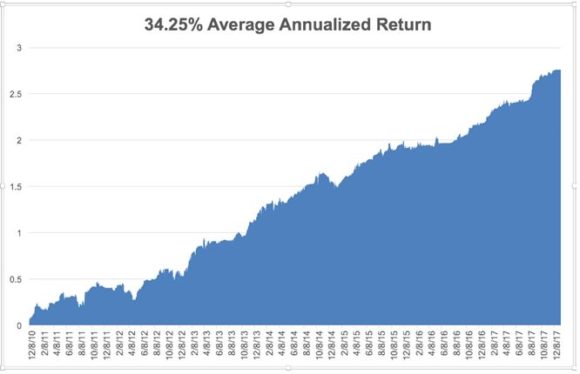

The S&P 500 (SPY) is up an eye-popping, gob smacking 4.2% so far in 2018, making up a third of my original 12% target for the entire year. Even more incredible is that it has gained nearly 10% in 30 days. If we continue to appreciate at this rate we will see 75,000 by yearend!

Which means we won't. But it is fun to run the numbers. Remember that NASDAQ soared 80% in the final eight months of the Dotcom Bubble until April, 2000 before its final downfall. It took 17 years to match that high again.

Action like this can only be explained by one new factor. After being absent for a decade, the "dumb money" is finally coming back into the stock market after a decade long hiatus.

"Dumb money," as all seasoned veterans know, are individual retail investors gun shy of stocks, thanks to the disastrous outcome of the 2008-09 crash. They have a bad habit of only buying at market tops.

Even after a blockbuster 2017, which saw 20% index gains and many 80% individual stock melt ups, that kept a death grip on their cash. Flows into equity mutual funds last year were virtually flat, while bond funds saw $200 billion worth of net inflows.

Ma & Pa appear to be pouring their money into index funds, which has the effect of focusing buying into the largest cap stocks, like the FANG's. Of course, the evidence is only anecdotal so far, gleaned from checks with the big brokers. We won't get the hard numbers that the dumb money has arrived until next month.

Good luck getting through to your broker though. If you call Interactive Brokers (IBKR) all you get is a recoding telling you how to execute a Bitcoin trade.

All the hoopla over the passage of the tax bill seems to have finally melted the ice. They were not alone.

Big tech (XLK) and oil companies (XLE) also seem to be major buyers of their own stock, front running a new round of buybacks financed by $2.6 trillion of repatriation, also enabled by the tax bill.

All asset classes are drinking the Kool-Aid.

Oil (USO) is also fast approaching my yearend target of $65, and seems hell bent on kissing $70. US oil supplies have seen the fastest ten week draw down in history, some 39 million barrels, thanks to extreme cold and accelerating economic growth. And it looks like the weather is about to hit again.

Some analysts are now forecasting $80 if the current OPEC production quotas are honored through yearend, once considered a long shot.

It's a good thing I rushed you out a research piece two weeks ago pounding the table that oil companies like Occidental Petroleum (OXY) would see the fastest earnings growth of 2018.

Even forlorn gold (GLD) has caught a bid, as the stock market wealth effect spills into other asset classes. I'll get around to writing a piece on how that works one of these days.

Those who have been waiting nine years for a crash in the bond market may be finally getting their wish. US Treasury bonds committed some key technical damage to their long term charts.

The 25-year trend lines for the two and ten year bonds entered bear market territory. I shot out a Trade Alert to sell short the (TLT), (or buy the (TBT)), the day it happened.

The most important announcement of the week was misread by almost everyone. Walmart (WMT), with 1.5 million employees the largest private employer in the US, said it was raising its minimum wage from $9 to $11 an hour as a result of the tax bill.

Here's what really happened. A massive fiscal stimulus on top of the lowest unemployment rate in a decade is creating a severe shortage of workers. As the largest employer and lowest payer, (WMT) will be the first to feel this. Some $2 an hour, or 22.22%, is a big jump. It means that real, card carrying inflation is on the way.

Walmart credited the tax bill for the move to score points with an administration that is at war with it on other fronts. The big one is the overwhelming share of imports from China and Mexico the company sells in its stores, which the administration is trying to cut back.

These days, EVERYTHING, is political.

Friday's December CPI Report was still muted at a 2.1% annual rate. But break down the numbers, and they show that the prices of manufactured goods (the past) have been falling for five years, while the prices of services (the future) are roaring at a 3% plus annual rate. And the overall rate may not be so muted when the Walmart figures his in three months.

As my UCLA Math professor used to lecture me, "Statistics are like a bikini. What they reveal are fascinating, but what the conceal is essential."

Conclusion: SELL MORE BONDS!

We are now into Q4 earnings season so those should be the dominant data points of the coming weeks.

On Monday, January 15, the markets are closed for Martin Luther King Jr. Day.

On Tuesday, January 16 at 8:30 AM EST the December Empire State Manufacturing Survey is published. Citigroup (C) reports earnings.

On Wednesday, January 17, at 9:15 AM EST, we obtain December Industrial Production. Bank of America (BAC) and Alcoa (AA) report earnings.

Thursday, January 18 leads with the 8:30 EST release of the Weekly Jobless Claims. At the same time December Housing Starts are Announced. The weekly EIA Petroleum Status Report is out at 11:00 AM EST.

On Friday, January 19 at 10:00 AM we learn December Consumer Sentiment, which should be very positive.

Then at 1:00 PM, we receive the Baker-Hughes Rig Count, which lately has started gone ballistic. Schlumberger (SLB) and Kansas City Southern (KSU) report earnings.

As for me, we finally got some decent snow at Lake Tahoe, so I'll be up there pounding the slopes in the morning when its cold, and diving into my research in the afternoon. I'm still trying to fix leaks in the roof from last winter's crushing 70 feet of snow.

When the kids are glued to their iPhones upstairs, I will be investigating the considerable assets of one Stormy Daniels. Clearly nature was kind, very kind. I understand the rest of the country is doing the same thing.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

January 12, 2018

Fiat Lux

Featured Trade:

(JANUARY 17 GLOBAL STRATEGY WEBINAR),

(SOME HUMBLE ADVICE FROM AN OLD TRADER),

(SIGN UP NOW FOR TEXT MESSAGING OF TRADE ALERTS)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.