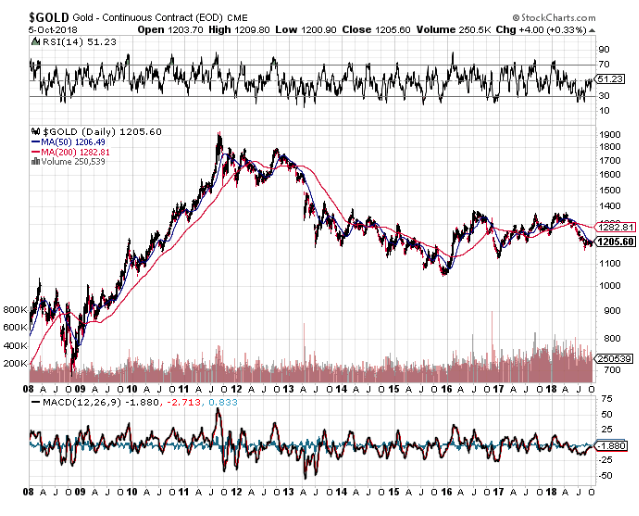

As incredible as it may sound, I’m starting to hear good things about gold. That’s amazing as the barbarous relic has been the red headed step child of the financial markets for the past six years. Not since the yellow metal peaked in 2011 have I heard the talk so bullish.

You can thank central banks which have become the principal buyers of gold in 2018. China is always the largest buyer. It has been joined by Russia, which is avoiding American trade sanction, and Kazakhstan. Now Poland has joined the fray. Central banks have accounted for a stunning 264 metric tonnes of purchases this year, or some 9.3 million ounces.

You can thank the coming return of inflation in the US economy, gold’s best friend. With a 4.2% GDP growth rate in Q2, the return of rapidly rising prices is just a matter of time. We here in Silicon Valley have grown inured to ever rising prices for everything. You in the rest of the country are about to get the bad news.

You can thank Amazon (AMZN) founder Jeff Bezos for pouring gasoline on the fire. By giving 250,000 US workers a 25% pay increase from $12 to $15, he has created a national short squeeze for minimum wage workers. If McDonald’s (MCD), Target (TGT), and Wal-Mart (WMT) join the fray, as they must or lose workers, wage inflation will go national.

Yes, you can remind me that rising interest rates are a terrible backdrop against which to own gold. The Federal Reserve has essentially promised us four more 25 basis point rate hikes by next summer. That would take the overnight rate to 3.25%, a historically "normalized” rate.

But what happens when the rate hikes stop? Gold takes off like a scalded chimp.

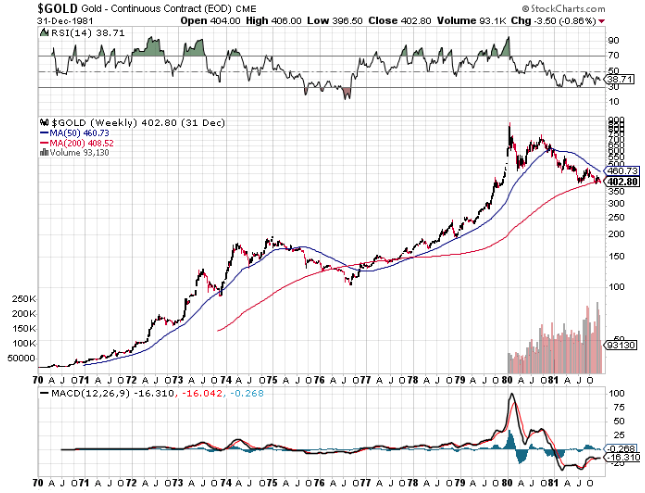

It is in fact a myth that gold can’t perform in a raising rate environment. When you look at gold’s “golden age” during the 1970’s when the barbarous relic rocketed from $34 to $900, a 24-fold increase, interest rates were rising almost as fast.

Over the same time period, the ten-year US Treasury yield soared from 5% to 16%. At the end of the day, investors fear inflation far more than high interest rates.

So when you believe that an oversold asset is about to turn but don’t know when, what is the best course of action?

Long Term Equity Anticipation Securities, or LEAPS, are a great way to play the market when you expect a substantial move up in a security over a long period of time. Get these right and the returns over 18 months can amount to several hundred percent.

At market bottoms these are a dollar a dozen. At all-time highs they are as scarce as hen’s teeth. However, scouring all asset classes there are a few sweet ones to be had.

Today, you can buy the SPDR Gold Shares ETF (GLD) January 2020 $120-$125 call spread for $1.60. For those who are new to the Mad Hedge Fund Trader, that involves buying the January 2020 $120 call and selling short the January 2020 $125 call.

This has the attributes of reducing your cost and minimizing the cost of time decay while giving you highly leveraged upside exposure over a long period of time.

If the price of gold rises by $11.20, from $113.80 to $125, a mere 9.8% by the January 17 option expiration date, the profit on this trade will amount to 212.5%. In order words, a $1,000 investment will become worth $3,125 if gold simply returns back to where it was in April.

If you’re more aggressive than I am (unlikely), you can buy the SPDR Gold Shares ETF (GLD) January 2020 $125-$130 call spread for $1.00, That would give you a maximum potential profit of 400%. In order words, a $1,000 investment will become worth $5,000 if gold simply return back to its February 2018 high.

A number of other fundamental factors are coming into play that will have a long-term positive influence on the price of the barbarous relic.

The only question is not if, but when the next bull market in the yellow metal will accelerate.

All of the positive arguments in favor of gold all boil down to a single issue: they're not making it anymore.

Take a look at the chart below and you'll see that new gold discoveries are in free fall. That's because falling prices from 2011 to 2018 caused exploration budgets to fall off a cliff.

Gold production peaked in the fourth quarter of 2015 and is expected to decline by 20% in the following four years.

The industry average cost is thought to be around $1,400 an ounce, although some legacy mines such as at Barrack Gold (ABX) can produce it for as little as $600.

So why dig out more of the stuff if it means losing more money?

It all sets up a potential turn in the classic commodities cycle. Falling prices demolish production and wipe out investors. This inevitably leads to supply shortages.

When the buyers finally return for the usual cyclical macro-economic reasons, there is none to be had, and price spikes can occur which can continue for years.

In other words, the cure for low prices is low prices.

Worried about new supply quickly coming on-stream and killing the rally?

It can take ten years to get a new mine started from scratch by the time you include capital rising, permits, infrastructure construction, logistics and bribes.

It turns out that the brightest prospects for new gold mines are all in some of the world's most inaccessible, inhospitable, and expensive places.

Good luck recruiting for the Congo!

That's the great thing about commodities. You can't just turn on a printing press and create more, as you can with stocks and bonds.

Take all the gold mined in human history, from the time of the ancient pharaohs to today, and it could comprise a cube 63 feet on a side.

That includes the one-kilo ($38,720) Nazi gold bars with stamped German eagles upon them which I saw in Swiss bank vaults during the 1980's when I was a bank director there.

In short, there is not a lot to spread around.

The long-term argument in favor of gold never really went away.

That involves emerging nation central banks, especially those in China and India, raising gold bullion holdings to western levels. That would require them to purchase several thousand tonnes of the yellow metal!

Venezuela has also been a huge gold seller to head off an economic collapse, thanks to the disastrous domestic policies there.

When this selling abates, it also could well shatter the ceiling for the yellow metal.

Tally ho!