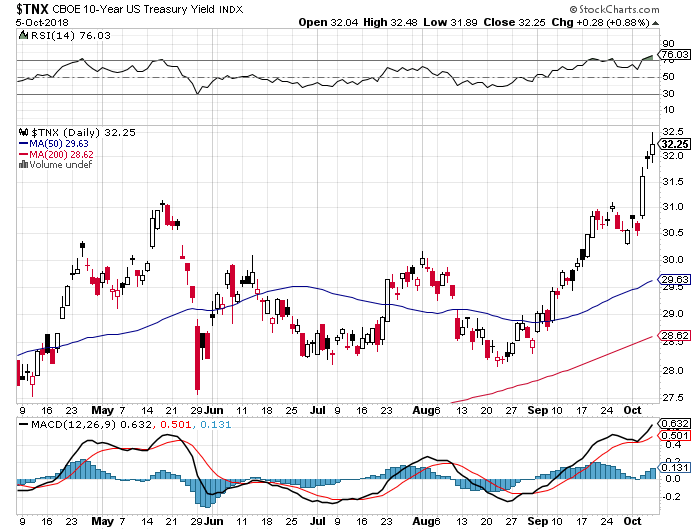

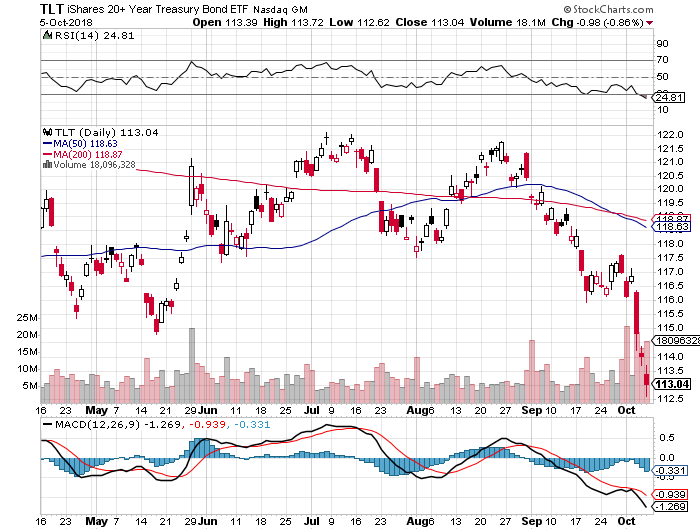

After two years of somnolent complacency, the bond market finally broke out of a two-year range, putting the cat among the pigeons with investors everywhere.

In a mere six weeks, the yield on the ten-year US Treasury bond (TLT) soared by 45 basis points from 2.80% to 3.25%, and 25 basis points during last week alone. It is the kind of move one normally associates with major financial crisis, the bankruptcy of a leading bank, or a major geopolitical event.

Once the 3.11% top was taken out, there was a virtual melt up to 3.25%. Rumors of Chinese dumping of its massive bond holdings were rife. Apparently, trade wars DO have consequences.

The 30-year fixed rate mortgage hit 5%, shutting millions out of the housing market. If you haven’t sold your home by now you’re in for the duration.

Personally, I believe that it was Amazon’s wage hike for 250,000 workers from $12 to $15 an hour that had the bigger impact. The inflation train is obviously leaving the station.

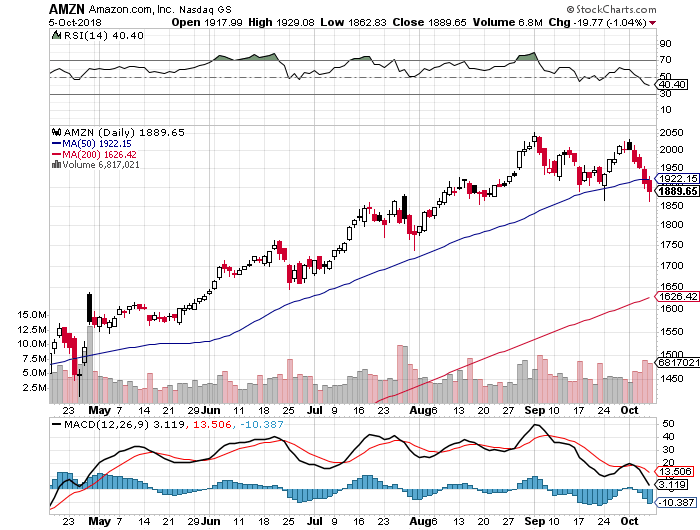

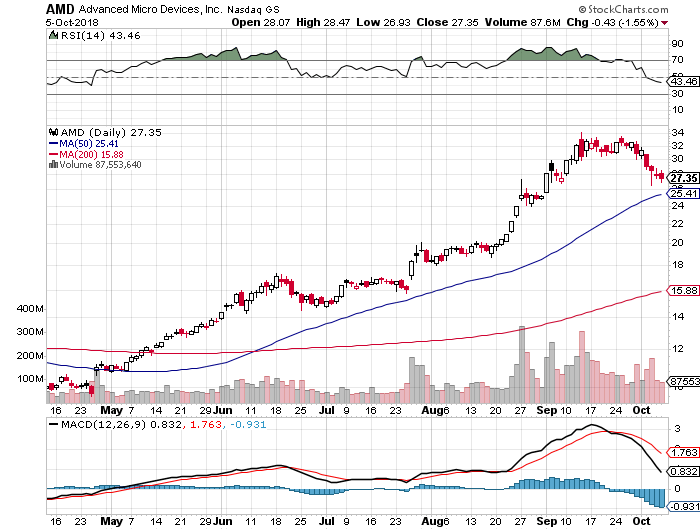

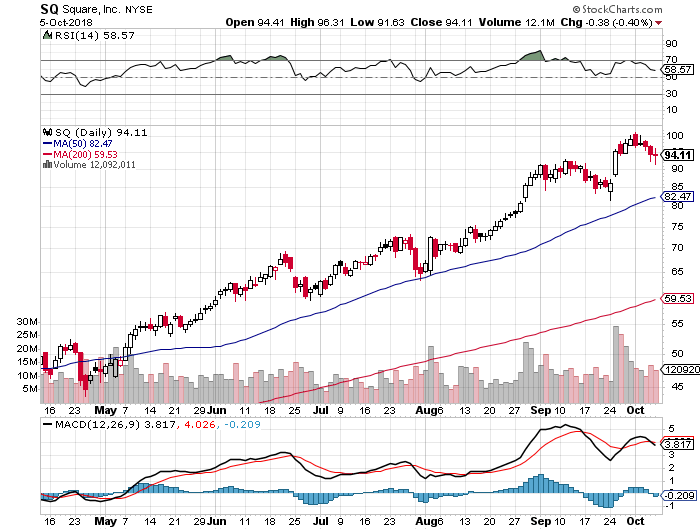

The free ride we have enjoyed in equities since February ended abruptly. The long, long overdue correction is here. This has ignited a rush by managers to lock in gains by selling off their biggest winners, and that would be the large cap tech stocks we have all come to know and love.

It started to be a great week with the settlement of NAFTA 2.0. Suddenly, Canada was no longer deemed a national security threat, and our supply of maple syrup was safe once again. My “trade peace” stocks soared.

The shocker came the next day when Amazon announced that it was raising wages by 25% for its 250,0000 minimum wage US workers. Suddenly, this inflation thing was real. It was the stick that broke the camel’s back.

General Electric (GE) dumped its CEO, after only a year and the stock rocketed 17%. It looks like the hedge fund that makes light bulbs still hasn’t found the “ON” switch.

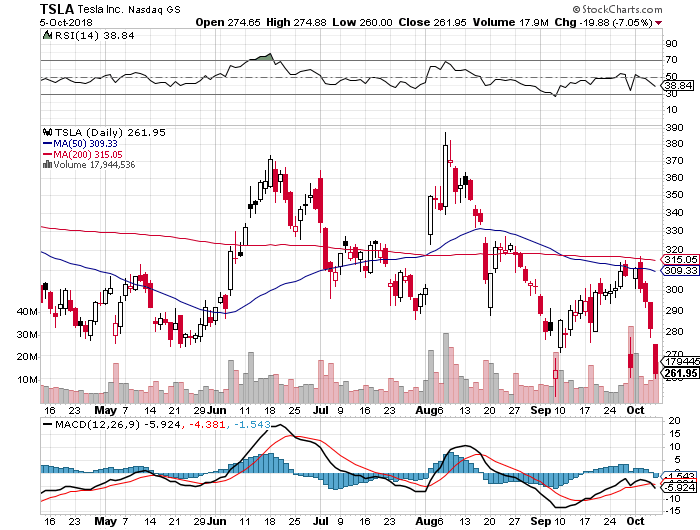

Tesla cut its deal with the SEC for a token amount, and the stock soared 20%. Then Elon tweeted once again, and it fell 20%. With the Defense Department now dependent on Musk to get their spy satellites into orbit there was no way the case against him was ever going anywhere.

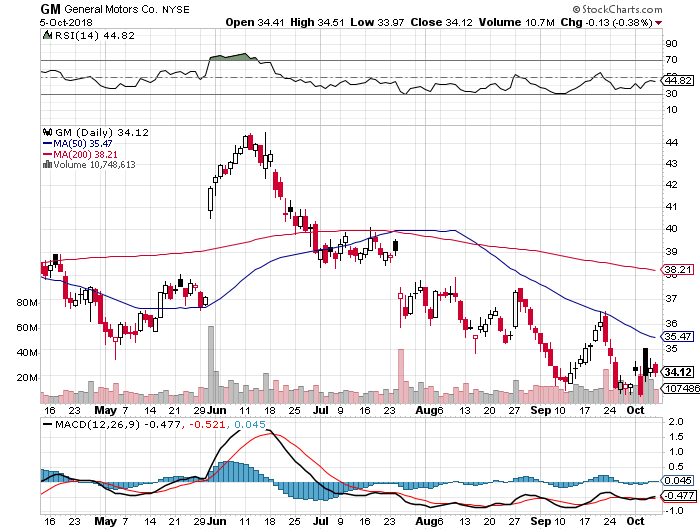

General Motors Q3 sales collapsed by 11.1% YOY as new Tesla 3 sales wiped out the electric Chevy Bolt, down 44%. The two hurricanes didn’t help here either.

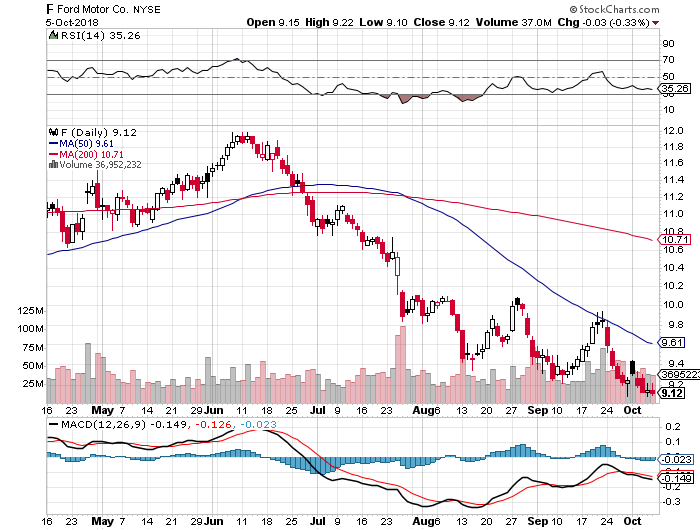

Oil prices soared, driven by our new sanctions against Iran, knocking the wind out of transportation stocks like airlines Delta (DAL) and Southwest (LUV). The short squeeze is on, as Europeans scramble to make up lost Iran supplies. The last time this happened we went into a recession.

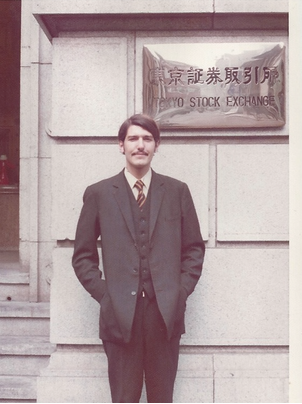

Tying up the week with a nice bow was the September Nonfarm Payroll Report, which took the headline unemployment rate down to 3.7%, the lowest since 1969.

I remember that year well. I was earning a dollar an hour at the May Company snack bar. Kids who dropped out of my high school were sent off to Vietnam and were killed within weeks. Neither the snack bar nor the May Company nor South Vietnam still exists, but I do. I guess I’m too mean to kill.

Average hourly earnings improved by eight cents to $27.24, and are up 2.8% YOY. Although the print was a weak 134,000, the back month upward revisions for July and August were huge.

Leisure and Hospitality lost 17,000 jobs due to the hurricanes, as did Retail, which shed 20,000 jobs.

Professional and Business Services were up 54,000, Health Care was up 26,000, and Manufacturing gained 18,000.

The performance of the Mad Hedge Fund Trader Alert Service is down -1.42% so far in October. Now, it’s all about keeping positions small. I managed to get a nice bond short off before the big collapse. But the real money was made being long the Volatility Index (VIX) which I missed.

Those who took my advice in the Wednesday Strategy Webinar to buy the iPath S&P 500 VIX Short Term Futures ETN (VXX) March 2019 calls for 50 cents make a quickie 500%.

My 2018 year-to-date performance has retreated to 26.97%, and my trailing one-year return stands at 32.11%.

My nine-year return appreciated to 303.44%. The average annualized return stands at 34.30%. I hope you all feel like you’re getting your money’s worth. The goal here is to minimize losses so we can bounce back quickly to a new all-time high once the dust settles.

Yes, I am looking at BUYING the bond market with a bet that ten-year yields won’t rise above 3.35% in the next month.

This coming holiday shorted week will be pretty non-eventful after last week’s fireworks.

Monday, October 8, is Columbus Day. Stocks will be opened but bonds will be mercifully closed.

On Tuesday, October 9 at 6:00 AM, the September NFIB Small Business Optimism Index is announced.

On Wednesday October 10 at 8:30 AM, the September Producer Price Index is published.

Thursday, October 11 at 8:30 we get Weekly Jobless Claims. At the same time, we get the September Consumer Price Index, the most important inflation indicator.

On Friday, October 12, at 10:00 AM, we learn September Consumer Sentiment. The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, it’s fleet week so I’ll be watching the Parade of Ships come in under the Golden Gate Bridge. After that, the Navy’s Blue Angels will be flying overhead using my mountain top home as a key navigation point. I’ll be wishing I was in the air at the stick with them.

Good luck and good trading.