When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Hot Tips

November 6, 2018

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) The Number of Job Opening Exceeded Workers by 1 Million in August, with 7.01 million openings versus 5.96 million unemployed. It’s the first time since the Dotcom Bubble top. Are we headed for a 3% Headline Unemployment Rate? Click here.

2) Warren Buffet Thinks Berkshire Stock is a Bargain (BRK/B) at $324,145 a Share, as he just picked up another $1 billion worth in August. When does paying a premium for your own stock make sense? When everything else is too expensive as they certainly were three months ago. Click here.

3) Amazon Plans to Announce Two New Headquarter Cities, which to me means they plan to spill the retailing giant into three companies in five years. Click here.

4) Iran Says it is Selling All the Oil it Wants, despite US sanctions. It's why Texas Tea is $63 a barrel, instead of $100. Buy oil stocks. Click here.

5) Square Soars on Citibank Upgrade, to $90 a share. We love this stock for good reasons. Click here.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(HOW TO EXECUTE A VERTICAL BULL CALL SPREAD),

(AAPL)

(THANK GOODNESS, I DON’T LIVE IN SWEDEN),

(EWD),

(PLEASE USE MY FREE DATA BASE SEARCH)

(THE GREAT TECH COMPANY YOU’VE NEVER HEARD OF)

(TWLO), (ROKU), (MSFT), (SQ), (AMD), (CRM), (SEND)

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

November 6, 2018

Fiat Lux

Featured Trade:

(HOW TO EXECUTE A VERTICAL BULL CALL SPREAD),

(AAPL)

(THANK GOODNESS, I DON’T LIVE IN SWEDEN), (EWD),

(PLEASE USE MY FREE DATA BASE SEARCH)

Mad Hedge Technology Letter

November 6, 2018

Fiat Lux

Featured Trade:

(THE GREAT TECH COMPANY YOU’VE NEVER HEARD OF)

(TWLO), (ROKU), (MSFT), (SQ), (AMD), (CRM), (SEND)

As volatility rears its hideous head, it’s not necessarily the best time to catch a falling knife as tech companies have been scrutinized harshly lately.

But the market is always right, and waiting for them to drop into your lap will serve you in good stead, even more so for the higher beta tech names that can behave more petulant than a little child.

Roku (ROKU), AMD (AMD), and Square (SQ) are a few of these smaller names with prodigious growth stories backed by secular tailwinds.

These up-and-comers regularly experience 5-7% setbacks, while sturdier names such as Microsoft (MSFT) pull back 1-2% allowing you to sleep soundly at night.

Another influential company taking the liberty to infiltrate the backend of every global and local company is no other than communications software company Twilio (TWLO).

Many of you might not have heard of them, and it doesn’t sound like such a sexy company right off the bat but I am sure you have heard of companies such as Uber, Lyft, and Airbnb.

Why do I mention these three private tech companies that are on the verge of going public next year?

Because this trio of unicorns are all powered by Twilio’s communication technology that is best of breed in their genre of cloud software.

More specifically, Twilio is a platform as a service (PaaS) firm offering programmatic phone call functions, can automate sending and receiving text messages, and performs other communication functions using its web service APIs.

When your Uber driver calls asking you to reveal yourself out of a concrete apartment block or your lavish gated community, this is all facilitated by Twilio’s technology.

At the recent Twilio Signal Conference in San Francisco, Twilio indicated that its latest “call center in a box” product called Flex was up and running after announcing it this past March.

Prior to Twilio’s roll-out, this type of call center functionality was only reserved for the Fortune 500 companies that could afford expensive software to serve its minions of customers.

The small guy was left out in the cold as usual.

Twilio has reshaped the call center and, at $1 per hour or $150 per month, has made itself a gamechanger for SMEs who don’t have the manpower or capital to fund exorbitant back-end operations.

Twilio is really going after anyone with a light or bulky-shaped wallet as you see from their all-star lineup of customers. U-Haul, real estate website Trulia, and data analytic firms Scorpion and Centerfield are just a few of their customers proving the incredible flexibility of the software.

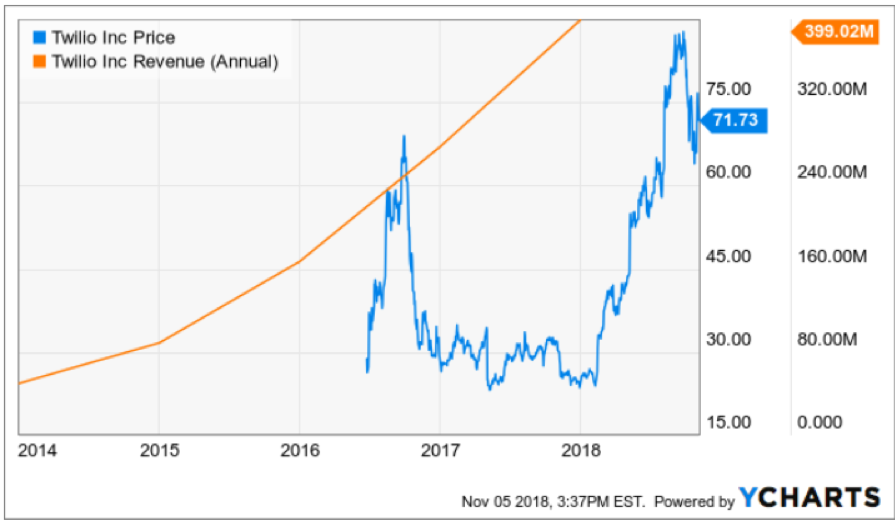

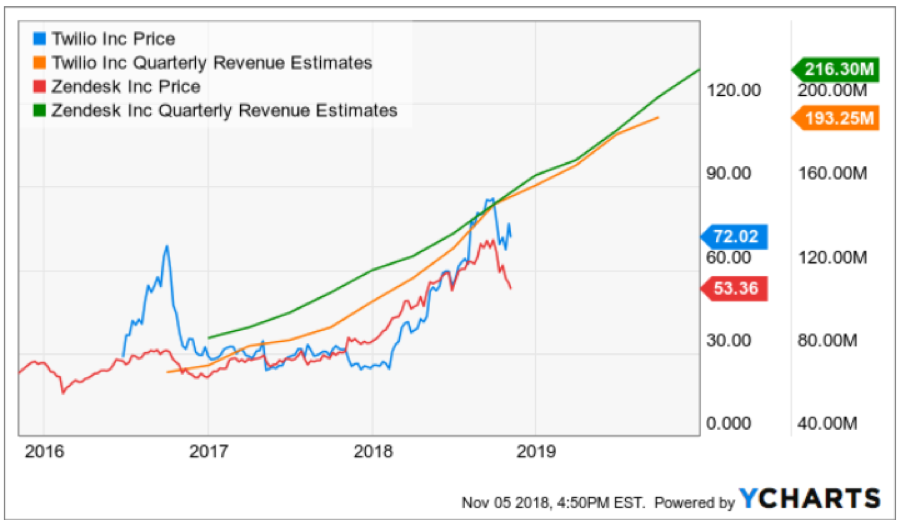

It’s not a shock that this stock has gone ballistic in 2018 surging over 200% and I must admit, investors need to wait for this molten hot stock to cool down.

But how can you blame a company that habitually tears apart any expectation of them devouring expectations because of its super growth model and rapid broad-based adoption?

From the fourth quarter of last year, revenue accelerated to 48% YOY and Twilio followed that up with a blistering 54% YOY quarter.

Then they pulled a shocker guiding down only expecting 35% to 37% growth but dismantled any whiff of jangling investors' nerves by posting another quarterly growth rate of 54%.

If you average out the three-year sales growth rate, few can topple the 57% Twilio has registered.

Performance has been fantastic, to say the least, and Flex could be the product that cements their industry lead and widens the moat around them.

Airbnb, Uber, and Lyft will avoid tinkering with the back end of their operations before their 2019 IPOs boding well for Twilio who are on a hot streak scoring a series of big contracts.

Twilio has been embroiled in further recent stock weakness as they gobbled up SendGrid (SEND), a mass-email marketing software service, for $2 billion.

SendGrid is growing sales at a lower rate in the mid-30%, and this move will add to top line growth.

Synergies from this acquisition are numerous and Twilio will be able to cross-sell to SendGrid’s customers who can apply other communication tools to use.

Telecommunication product in the past was truly unaffordable for the bulk of companies and now that Twilio can bring in all the smaller companies, the SME landscape is poised to change.

Software is becoming powerful to the point where one person living in a basement will have the access to a software that could convince customers a 100-man team is putting this product altogether.

Flex allows customers to personalize this contact-center-in-a-box software for each specification.

It can even quickly integrate into CRM platforms like Salesforce (CRM) which is a wildly popular interface for companies around the world.

Twilio Autopilot, Twilio’s oral conversational AI tool, offers machine learning bots who deliver automated voice-activated functions to customers.

Companies can easily type what they want bots to orate to customers and simply paste it into the code with ease and minimal hassle.

Twilio’s updated payment capabilities offer a new API for building payment experiences by contacting center agents who can now securely accept credit card payments from customers over the phone without the agents ever getting a whiff of the actual numbers.

Effectively, this allows any business in the world to professionalize their communications and backend department to a point they could have never imagined a few years ago.

The saying rings true when industry experts note that it’s the best time to become a billionaire and worst time to become a millionaire because the power of leveraging these robust software programs could potentially fuel the rapid rise of anyone in the world who will eat everybody else’s lunch.

If you break down the numbers, most companies are still holding on to their legacy systems of yore.

Being saddled with outdated hardware and software will doom companies going forward as the explosion of brilliant software modernizes companies in a few clicks of the mouse.

Twilio has added another 15,000 developers to the 35,000 already on the books and the purchase of SendGrid can no doubt be attributed partially to a talent grab of developers who have deep experience building communication-based products.

These types of developers don’t grow on trees.

Last year saw Twilio bring in about $400 million in sales and I am modeling for around $1 billion in sales by 2021.

This $7 billion market cap tech darling has a long runway ahead of itself and investors looking for high-volatility, high-reward stocks can tuck this one away in their sheath.

With earnings coming up and an already 200% plus pop this year, there will be better entry points into this ebullient company if investors are patient.

Wait for a dip to get in on the best communication-based cloud company on the market.

The original purpose of this letter was to build a database of ideas to draw on in the management of my hedge fund.

When a certain trade comes into play, I merely type in the symbol, name, currency, or commodity into the search box, and the entire fundamental argument in favor of that position pops up.

You can do the same.

Just type anything into the search box with the little magnifying glass found on the Home Page in the upper right-hand side, and a cornucopia of data, charts, and opinions will appear.

Even the price of camels in India should show up.

The database goes back to February 2008, totaling 10 million words, or 12 times the length of Tolstoy’s War and Peace. Watching the traffic over time, I can tell you how the database is being used:

1) Small hedge funds want to see what the large hedge funds are doing.

2) Large hedge funds look to see what they have missed, which is usually nothing.

3) Midwestern advisors to find out what is happening in New York and Chicago.

4) American investors to find out if there are any opportunities overseas (there always are).

5) Foreign investors to find out what the hell is happening in the US (about 1,000 inquiries a day come in through Google’s translation software).

6) Specialist traders in stocks, bonds, currencies, commodities, and precious metals looking for cross-market insights which will give them a trading advantage with their own book.

7) High net worth individuals managing their own portfolios so they don’t get screwed on management fees.

8) Low net worth individuals, students, and the military looking to expand their knowledge of financial markets (lots of free online time in the Navy).

9) People at the Treasury and the Fed trying to find out what the private sector is doing.

10) Staff at the SEC and the CFTC to see if there is anything new they should be regulating.

11) More staff at the Congress and the Senate looking for new hot-button issues to distort and obfuscate.

12) Yet, even more staff in the White House gauging the president’s popularity and the reception of his policies.

13) As far as I know, no justices at the Supreme Court read my letter. They’re all closet indexers.

14) Potential investors/subscribers attempting to ascertain if I have the slightest idea of what I am talking about.

15) Me trying to remember trades which I recommended long ago but have forgotten.

16) Me looking for trades that worked so I can say ‘I told you so.’

It’s there, it’s free, so please use it. You can find the search box on my home page at the bottom of the column on the right.

“Your brand is what other people say about you when you’re not in the room.” – Said Founder and CEO of Amazon Jeff Bezos

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.