“Stone Age. Bronze Age. Iron Age. We define entire epics of humanity by the technology they use.” – Said Founder and CEO of Netflix Reed Hastings

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Mad Hedge Hot Tips

December 17, 2018

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) A Government Shutdown on Friday is Dominating Sentiment. A squabble over $5 billion in spending over a wall may wipe $300 billion off the value of equities. It’s not the risk/reward ratio I am used to. Click here.

2) The Fed is Raising Interest Rates on Wednesday, by 25 basis points to a 2.25%-2.50% overnight range. The big question is: “How many rises next year?” The market has just shifted from three to two. Watch for dovish commentary like a hawk. Click here.

3) Malaysian Government is Seeking Criminal Charges Against Goldman Sachs.

The stock market was rallying 100 points overnight until this little tidbit brought us a down 300-point opening. Watch for (GS) to write a big check to make this go away. I told you to avoid the stock like the plague. Click here.

4) Surprise Obamacare Ruling Demolishing Health Care Stocks. It looks like a Texas judge has just wiped out the industry’s largest customer. Use the meltdown to cherry-pick the best stocks. It’s one of the few industries with a long-term future. Click here.

5) Wild Swings in Stock Market at Seven-Year High. What if the roller coaster continues for all of 2019? What if it continues until the 2020 presidential election? Suddenly, the triggers are all there. It’s hard hat in the bomb shelter time. Click here.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or THERE’S NO SANTA CLAUS IN CHINA)

($INDU), (SPY), (TLT), (AAPL), (AMZN), (NVDA), (PYPL), (NFLX)

(WHY TENCENT WILL REMAIN TRAPPED IN CHINA)

(TME), (SPOT), (IQ), (GOOGL), (FB)

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

December 17, 2018

Fiat Lux

Featured Trade:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or THERE’S NO SANTA CLAUS IN CHINA)

($INDU), (SPY), (TLT), (AAPL), (AMZN), (NVDA), (PYPL), (NFLX)

Mad Hedge Technology Letter

December 17, 2018

Fiat Lux

Featured Trade:

(WHY TENCENT WILL REMAIN TRAPPED IN CHINA)

(TME), (SPOT), (IQ), (GOOGL), (FB)

On Friday, five serious hedge fund managers separately called me out of the blue and all had the same thing to say. They had never seen the market so negative before in the wake of the worst quarter in seven years. Therefore, it had to be a “BUY”.

I, on the other hand, am a little more cautious. I have four 10% positions left that expire on Friday, in four trading days, and on that day I am going 100% into cash. At that point, I will be up 3.5% for the month of December, up 31.34% on the year, and will have generated positive return for one of the worst quarters in market history.

I’m therefore going to call it a win and head for the High Sierras for a well-earned Christmas vacation. After that, I am going to wait for the market to tell me what to do. If it collapses, I’ll buy it. If it rockets, I’ll sell short. And I’ll tell you why.

These are not the trading conditions you would expect when the economy is humming along at a 2.8% annual rate, unemployment is running at a half-century low, and earnings are growing a 26% year on year. You can’t find a parking spot in a shopping mall anywhere.

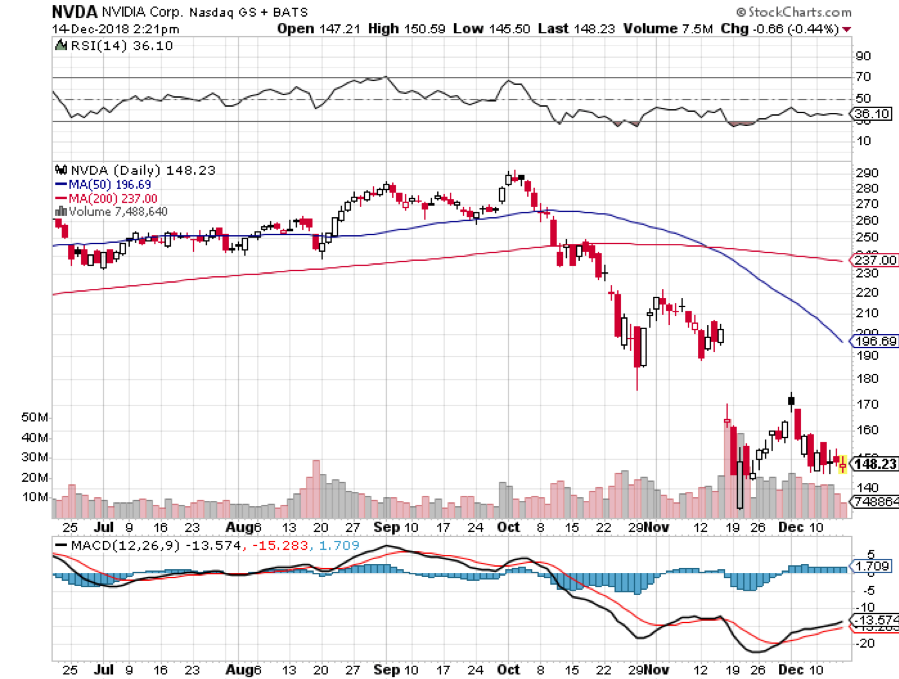

However, the lead stocks like Apple (AAPL), Amazon (AMZN), and Netflix (NFLX) have plunged by 30%-60%. Price earnings multiples dropped by a stunning 27.5% from 20X to 14.5X in a mere ten weeks. Half of the S&P 500 (SPY) is in a bear market, although the index itself isn’t there yet. I would rather be buying markets on their way up than to try and catch a falling knife.

There is only one catalyst for that apparent yawning contradiction: The President of the United States.

Trump has created a global trade war solely on his own authority. Only he can end it. As a result, asset classes of every description are beset with uncertainty, confusion, and doubt about the future. Analysts are shaving 2019 growth forecasts as fast as they can, businesses are postponing capital spending plans, and investors are running for the sidelines in droves. Business confidence is falling like a rock

To paraphrase a saying they used to teach you in Marine Corps flight school, “It’s better to be in cash wishing you were fully invested than to be fully invested wishing you were in cash.”

The Chinese have absolutely no interest in caving into Trump’s wishes. They read the New York Times, see the midterm election result and the opinion polls, and are willing to bet that they can get a much better deal from a future president in two years.

I have been dealing personally with both Trump and the Chinese government for four decades. The Middle Kingdom measures history in Millenia. The president lives from tweet to tweet. The Chinese government can take pain by simply ordering its people to take it. We have elections every two years with immediate consequences.

The best we can hope for is that the president folds, declares victory, and then retreats from his personal war. This can happen at any time, or it may not happen at all. No one has an advantage in predicting what will happen with any certainty. Not even the president knows what he is going to do from minute to minute.

It is the possibility of trade peace at any time that has kept me out of the short side of the stock market in this severe downturn. That robs a real hedge fund manager of half his potential income. Trade peace could be worth an instant rally of 10% in the stock market. Even a lesser move, like the firing of trade advisor Peter Navarro, would accomplish the same.

The market was long overdue for a correction like the one we have just had. Investors were getting overconfident, cocky, and excessively leveraged. In October, we really needed the tide to go out to see who was swimming without a swimsuit. But if the tide goes out too far, we will all appear naked.

Thanks to some very artful trading, my year to date return recovered to +27.54% boosting my trailing one-year return back up to 27.54%. I covered an aggressive short position in the bond market (TLT) for a welcome 14.4% profit. I also took profits with an instant winner in PayPal (PYPL). On the debit side, I stopped out of an Apple call spread for a minimal loss.

December is showing a very modest loss at -0.26%. The market has become virtually untradeable now, with tweets and China rumors roiling markets for 500 points at a pop. And this is against a Dow Average that is down a miserable -2.8% so far in 2018. I should have listened to my mother when she wanted me to become a doctor.

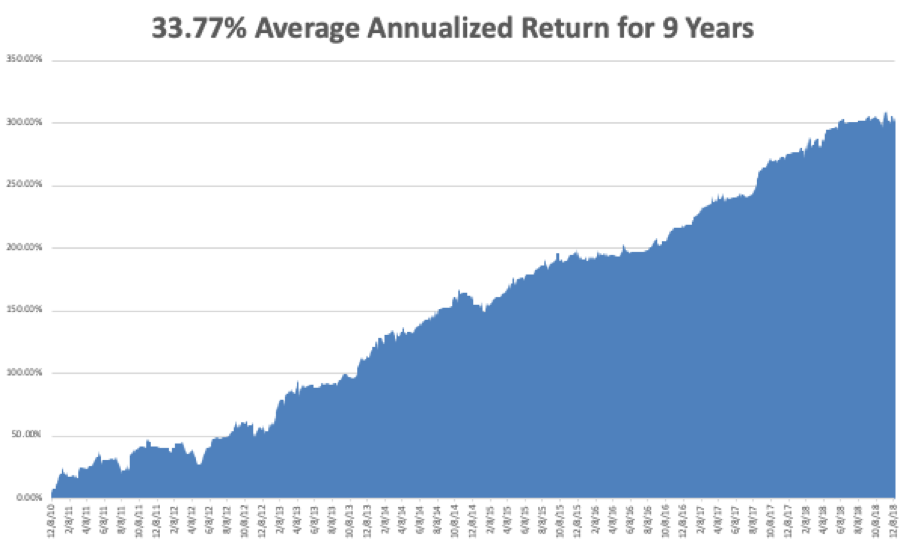

My nine-year return nudged up to +304.01. The average annualized return revived to +33.77.

The upcoming week is all about housing data, with the big focus on the Fed’s interest rate hike on Wednesday.

Monday, December 17 at 10:00 AM EST, the November Homebuilders Index is out.

On Tuesday, December 18 at 8:30 AM, November Housing Starts are published.

On Wednesday, December 19 at 10:00 AM EST, November Existing Home Sales are released.

At 10:30 AM EST the Energy Information Administration announces oil inventory figures with its Petroleum Status Report.

At 2:00 PM the Federal Reserve Open Market Committee announces a 25 basis point rise in interest rates, taking the overnight rate to 2.25% to 2.50%. An important press conference with governor Jay Powell follows.

Thursday, December 20 at 8:30 AM EST, we get Weekly Jobless Claims.

On Friday, December 21, at 8:30 AM EST, we learn the latest revision to Q3 GDP which now stands at 2.8%.

The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, I’ll be battling snow storms driving up to Lake Tahoe where I’ll be camping out for the next two weeks. Mistletoe, eggnog, and endless games of Monopoly and Scrabble await me.

Good luck and good trading!

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

So you thought that Tencent Music Entertainment (TME), the Spotify (SPOT) of China, going public at $13 a share on the New York Stock exchange would mean the music streaming giant would potentially tyrannize the Western music streaming market.

Relax, it will never happen, China’s personal data laws are analogous to Facebook’s (FB) lax data guidelines multiplied by a factor of 10.

There is no possible scenario in which a Chinese content service constructed at the magnitude of Tencent Music Entertainment Group would ever get the thumbs up from American regulators.

The ongoing trade war has effectively barred any Chinese capital’s ability to snap up key American technological firms, as well as stymieing any Chinese tech unicorns dishing out streaming content in participating in a monetary relationship with the American consumer.

In August, the Department of the Treasury which chairs the Committee on Foreign Investment in the United States (CFIUS) rolled out an expansionary pilot program widening CFIUS’ jurisdiction to review foreign non-controlling, non-passive investments in companies that produce, design, test, manufacture, fabricate, or develop “critical technologies” within certain industries deemed paramount to national security.

Even though the amendment does not specify China, it means China.

If you had a hunch that Tencent would take over the music streaming world, then the better question is to ask yourself if Tencent Entertainment is equipped to take over the Chinese streaming world and monetize the product efficiently.

What really is (TME)?

(TME) is the Tsar of Chinese music streaming with apps that allow users to stream music, sing karaoke, and watch musicians perform live. (TME) dominates this sphere of Chinese tech with a combined 800 million monthly active users.

(TME) is a concoction of services including QQ Music, Kugou, Kuwo, and karaoke app WeSing making up over 70% of the music streaming industry in China.

Its daily active users (DAUs) spend over 70 minutes per day on the platform and have inked exclusive deals with elite Western artists.

Tencent Music's revenue nearly doubled YOY to $2 billion during the first nine months of 2018, and its net income more than tripled to $394 million.

The social entertainment services aspect has been a massive revenue driver for them including income from virtual gifts on WeSing, a platform where fans gift virtual items to favorite singers, and sign up for premium memberships giving users access to exclusive concerts.

This collection of clever services mixed with social media has been successful, and the reason why it comprises 70% of total revenue.

Paid membership has grown 24% YOY to 9.9 million while paid users only make up 4.4% in China. This is a huge change in the tech climate from the past when Chinese netizens would never pay for internet content. This has allowed the average revenue per user (ARPU) to creep up to $17.22 per paid user.

The other 30% of revenue can be attributed to its ad-less music service which is not ad-less for free users.

So, in fact, the 30% of the business that mirrors Spotify is its Achilles heels echoing the painstaking task of monetizing pure music content.

No company has ever shown that a pure music streaming internet model can be profitable, the music streaming graveyard is littered with the failed attempts of companies from the past.

The unit registered a mere $1.24 in average revenue per paid user during the third quarter, paltry compared to (TME)’s social media products.

(TME)’s combination of social media and music entertainment weighted towards virtual gifts’ income is a weak business model in the west and would not extrapolate in the western world.

It is a supremely China model only unique to China and other Asian countries.

Therefore, I would point out that even if this arm of Tencent could migrate to America, management knows better than to put square pegs in round holes.

That being said, its potential in China is its long runway and most Chinese content companies haven’t been able to crack the western market.

The only types of Chinese companies that have had any remnant of success in the west are hardware companies and look what happened to telecommunication equipment companies Huawei and ZTE recently – taken out by the western regulatory sledgehammer.

It’s crystal clear that the Chinese understanding of personal data and IP regulation simply don’t marry up with western standards, and that is why I suggested that these two massive tech worlds are in for a hard splintering dividing these two competing models.

There has been some intense jawboning going on behind the scenes as Huawei, who is in the lead to develop 5G technology, still needs Qualcomm’s radio access technology to make 5G a reality.

The scenario of a hard fork between western and Chinese 5G becomes more real each passing day.

Part of Tencent Music’s ability to perform revolves around its swanky position installed in the center of the most popular chat app in China called WeChat.

Using this position as a fulcrum, Tencent Music plans to invest 40% of the capital raised from its IPO on expanding its music library, 30% on product development, 15% on marketing, and the last 15% on M&A.

For right now, there is an elevated emphasis on growing the number of paid users and converting its free users to premium subscriptions.

Ironically enough, Spotify has a 9% stake in Tencent Music and Tencent has a 7.5% holding in Spotify. Just by having stakes in each other is enough reason to avoid migrating into the same competitive markets with each other.

If you read between the lines, the stakes seem more a pledge of trading expertise in developing each other’s business as you see traces of each other in both unicorns.

Would I invest in Tencent Music?

One word – No.

There are almost 1,000 pending lawsuits alleging copyright infringement, not a huge surprise here.

Tencent concedes around 20% of the music content is not licensed.

Pouring fuel on the fire, a Tencent Music executive is also being sued by a seed investor claiming he was bullied into selling his stake ahead of its IPO.

There are question marks surrounding this company and that might have been part of the justification of tapping up the American public markets to prepare for this next stage of uncertainty.

As it is, Spotify cannot make money because of the elevated royalty costs eroding its business model, (TME) probably can if it steals most of its music, but that is a suicide mission waiting to happen.

Fortunately, Tencent is a hybrid mix of not only pure music streaming but of social media fused with music apps through gift giving gimmicks and karaoke-themed services.

These higher margin drivers are the reason why Tencent is profitable and Spotify is not, plus the giant scale of servicing 800 million Chinese users that give credence to the freemium model.

However, it’s entirely feasible that Tencent Music could use a good portion of the $1.1 billion from the IPO to battle the slew of pending lawsuits waiting around the corner.

Would you want to invest in a company that went public just to fund their legal defense?

Definitely not.

Look at its streaming cousin iQIYI (IQ), shares peaked over $40 in June after its IPO and have swan-dived ever since going down in a straight line and is trading around $17 today.

In general, most Chinese tech stocks have been collateral damage of a wider trade war pitting the maestros of crude geopolitical strategies against each other.

This year has not been kind to Chinese tech shares, and considering most of Tencent’s music library has been stolen, investors would be crazy to invest in this company.

I am surprised this company held up as well as it did on IPO day because the timing of the IPO couldn’t have been worse in a segment of tech that is awfully difficult to become profitable in a country whose economy is softening by the day in an insanely volatile stock market.

And to be honest, I would have stopped listening about this company after knowing they face pending lawsuits of up to 1000.

As for Spotify, yes, they are the industry leader in music streaming but investors need concrete proof they can become profitable. I like the direction of increasing operating margins, but that all goes to naught if it’s in a perpetual loss-making enterprise. I would sit out on both these stocks with a much negative bias towards its ticking time bomb Chinese music version.

Regulation and the trade war have taken a huge swath of tech off the gravy trade such as semiconductors, Google, social media, hardware, American tech who possess supply chains in China and I would smush in Chinese tech ADR’s on that list too.

Stay away like the plague.

“Life’s too short to hang out with people who aren’t resourceful.” Said Founder and CEO of Amazon Jeff Bezos

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.