How would you like to be part of the biggest business development in the history of mankind?

This revolution will increase business functionality up to 10 times while flattening costs by up to 90%.

Still interested?

Enter the Internet of Things (IoT).

The Internet of Things (IoT) can be boiled down to Internet connectivity with things.

Your luxury juice maker, hair removal kit, and multi-colored Post-its will soon be online.

No, you won't be able to have Tinder chats with the new connectivity, but embedded sensors, tracking technology, and data mining software will aggregate a digital dossier on how products are performing.

The data will be fed back to the manufacturing company offering a comprehensive and accurate review without ever asking a human.

The magic glue making IoT ubiquitous and stickier than a hornet's nest is the emergence and application of 5G.

4G is simply not fast enough to facilitate the astronomical surge in data these devices must process.

5G is the lubricant that makes IoT products a reality.

Verizon Communications (VZ) and AT&T (T) have been assiduously rolling out tests to select American cities as they lay the groundwork for the 5G revolution.

The aim is for these companies to deliver customers a velocious 1 Gbps (gigabits per second) wireless connection speed.

Delivering more than 10 times the average speed today will be a game changer.

America isn't the only one with skin in the game and some would say we are not even leading the pack.

China Mobile (CHL) is carrying out a bigger test in select Chinese cities, and Chinese telecom company Huawei can lay claim to 10% of the 5G patents.

Americans should start to notice broad-based adoption of 5G networks around 2020.

Once widespread usage materializes, watch out!

It will go down in history books as a transformational headline.

The IoT revolution will follow right after.

Until the 5G rollout is done and dusted, tech companies are licking their chops and preparing for one of the biggest shifts in the tech ecosphere affecting every product, service, and industry.

The worldwide IoT market is poised to mushroom into a $934 billion market by 2025 on the back of cloud computing, big data, autonomous transport technology, and a host of other rapidly emerging technology.

The arrival of 5G will have an astronomical network effect. Companies will be able to enhance product specs faster than before because of the feedback of data accumulated by the tracking technology and sensors.

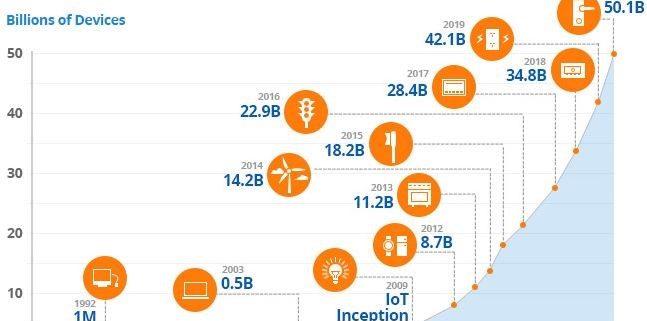

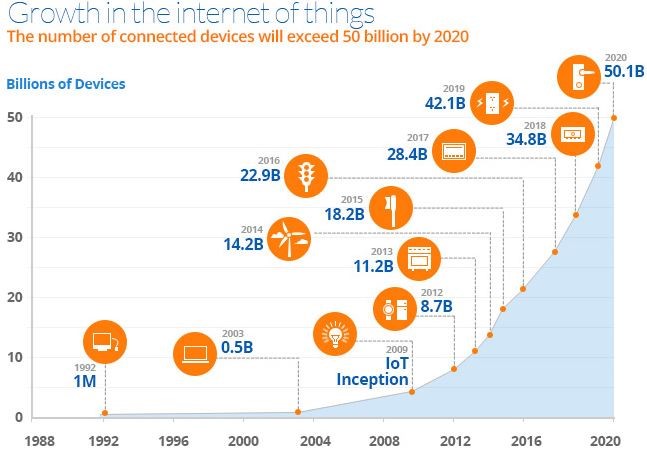

The appearance of this flashy new technology will spawn yet another immeasurable migration to technological devices by 2020.

In just two years, the world will play host to more than 50 billion connected devices all pumping out data as well as consuming data.

What a frightful thought!

IoT's synergies with new 5G technology will have an unassailable influence on the business environment.

For instance, industrial products in the form of robots and equipment will be a huge winner with 5G and IoT technology.

The industrial IoT market is expected to sprout to $233 billion by 2023.

Robots will pervade deeply into economic provenance acting as the mule for brute strength heavy labor plus more advanced tasks as they become more sophisticated.

Total global spending related to IoT products will surpass 1.4 trillion dollars by 2021, according to the International Data Corporation (IDC).

IoT growth will become most robust in the thriving Asian markets fueled by a bonus tailwind of the fastest growing region in the world.

The advanced automation abilities of Germany and the U.K. will also give them a seat at the table.

Micron CEO Sanjay Mehrotra gushed about the future at Micron's investor day celebrating IoT and data as the way forward. Mehrotra explained that the explosion of IoT products will create a new tidal wave of "growing demand for storage and memory."

Chips are a great investment to grab exposure to the 5G, IoT, and big data movement.

Up until today, the last generation of technological innovation brought consumers computers and smartphones.

That world has moved on.

Open up your eyes and you will notice that literally everything will become a "data center on wheels or on feet."

To arrive at this stage, products will need chips.

As many high-grade chips as they can find.

Data centers are one segment in dire need of chips. This market will more than double from $29 billion in 2017 to $62 billion in 2021.

The general-purpose chip market for servers is cornered by Intel.

Industry insiders estimate Intel's market share at 98% to 99% of data center chips. Clientele are heavy hitters such as Amazon Web Services, Google, and Microsoft Azure along with other industry peers.

The only other players with data server chips out there are Qualcomm (QCOM) and Advanced Micro Devices Inc. (AMD).

However, there have been whispers of Qualcomm shutting down the 48-core Centriq 2400 chip for data centers that was launched only last November after head of Qualcomm's data center division, Anand Chandrasekher, was demoted via reassignment.

AMD's new data center chip, Epyc, has already claimed a few scalps with Baidu (BIDU) and Microsoft Azure promising to deploy the new design.

IoT integration is the path the world will take to adopting full-scale digitization.

Microsoft just announced at its own Build 2018 conference its plans to invest $5 billion into IoT in the next four years.

The Redmond, Washington-based company noted operational savings and productivity gains as two positive momentum drivers that will benefit IoT production.

Consulting firm A.T. Kearny identified IoT as the catalyst fueling a $1.9 trillion in productivity increases while shaving $177 billion off of expenses by 2020.

These cloud platforms give tech companies the optimal stage to win over the hearts and dollars of non-tech and tech companies that want to digitize services.

Many of these companies will have IoT products percolating in their portfolio.

Examples are rampant.

Schneider Electric in collaboration with Microsoft's IoT Azure platform brought solar energy to Nigeria by the bucket full.

The company successfully installed solar panels harnessing its performance using IoT technology through the Microsoft cloud.

Kohler rolled out a new lineup of smart kitchen appliances and bathroom fixtures coined "Kohler Konnect" with the help of Microsoft's Azure IoT platform.

Consumers will be able to remotely fill up the bathtub to a personalized temperature.

Real-time data analytics will be available to the consumer by using the bathroom mirror as a visual interface with touch screen functionality giving users the option to adjust settings to optimal levels on the fly.

Kohler's tie-up with Microsoft IoT technology has proved fruitful with product development time slashed in half.

To watch a video of Kohler's new budding relationship with Microsoft's Azure IoT platform, please click here.

It is safe to say operations will cut out the wastefulness using these new tools.

Look no further than legacy American stocks such as oil and gas producer Chevron (CVX), which wants a piece of the IoT pie.

Chevron announced a lengthy seven-year partnership with Microsoft's Azure platform.

The fiber optic cables inside oil production facilities generate more than 1 terabyte of data per day.

In the Houston, Texas, offices, sensors installed six miles below the surface shoot back data to engineers who monitor human safety and system operations on four continents from the Lone Star State.

The newest facility in Kazakhstan, using state-of-the-art technology, will produce more data than all the refineries in North America combined.

Using the aid of artificial intelligence (A.I.), computers will analyze seismic surveys. This pre-emptive technology customizes solutions before problems can germinate.

The new smart-work environment will multiply worker productivity that has been at best stagnant for the past generation.

To get in on the IoT action, buy shares of companies with solid IoT cloud platforms such as Microsoft and Amazon.

Buy best-of-breed chip companies such as Nvidia (NVDA), Intel (INTC), Advanced Micro Devices (AMD) and Micron (MU).

And buy tech companies that produce wafer fab equipment such as Applied Materials (AMAT) and Lam Research (LRCX).

_________________________________________________________________________________________________

Quote of the Day

"Don't be afraid to change the model." - said cofounder and CEO of Netflix Reed Hastings.