While the Global Trading Dispatch focuses on investment over a one week to six-month time frame, Mad Options Trader, provided by Matt Buckley, will focus primarily on the weekly US equity options expirations, with the goal of making profits at all times. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

May 7, 2018

Fiat Lux

Featured Trade:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or WHERE?S THE RECOVERY?)

(AAPL), (BAC), (AXP), (XLP), (CAT), (X),

(POPULATION BOMB ECHOES),

(DBA), (CORN), (SOYB), (WEAT), (MOS),

(TESTIMONIAL)

Where did that global synchronous economic recovery go? You know, the one strategists were gushing about as the foundation for the bull market in stocks?

Last week we saw ISM, Pending Home Sales, Capital Goods Orders, Chicago PMI, and Prices Paid all disappoint. And Europe just posted a dismal Q1 GDP of only +0.4%.

What is becoming painfully obvious is that the enormous tax breaks given the corporations to expand capital investment and create jobs is having the opposite effect.

Instead companies are accelerating the adoption of tax subsidized robots to replace workers, destroying jobs in the process, but boosting profits.

That was clear as day with the April Nonfarm Payroll Report, which came in at a weak 164,000. With all the hyper stimulus the economy is now getting, it should be over 400,000 a month.

The boost has yet to show up in Average Hourly Earnings which were up a miniscule 0.1%, or a 2.6% YOY rate. No wage hikes here.

The headline Unemployment Rate fell to 3.9%, which will be close to a cycle low. The boarder U-6 "discouraged worker" unemployment rate fell to 7.8%, a 17-year low.

Professional and Business Services gained 54,000 jobs, Manufacturing 24,000, and Health Care 24,000.

Peak earnings? Really?

Maybe for old line industrial companies like US Steel (X) and Caterpillar (CAT) which got a big, one time only shot in the arms in January from the tax bill, and then no more.

Technology companies are still powering on, full speed ahead damn the torpedoes on both earnings and announced share buy backs.

With the Trump team in Beijing this week trying to cut a deal with an incredibly weak hand, we have another big dark cloud hanging over the market.

Gee, do you think the Chinese read the New York Times too and are also aware of the president's weak poll numbers, a Mueller investigation that is closing in for the kill, and desperation to get anything done on the international front?

With corporate stock buy backs expected to leap from $500 billion to a record $800 billion this year, companies have become the sole net buyers supporting the stock market.

It's all starting to sound like a Ponzi scheme.

The great irony here is that consumer staples (XLP), long considered "safety stocks" because of their high dividend yields, have been the worst performers of 2018. When your aggressive stocks do poorly but your safe stocks do worse, you have to worry.

I have never been one to argue with Oracle of Omaha Warren Buffet. The founding subscriber to the Diary of a Mad Hedge Fund Trader has been a follower of many of my Trade Alerts, including for Bank of America (BAC), Burlington Northern (he bought the whole company), and American Express (AXP). But I could never get him into technology stocks.

Now, at last, you can add Apple (AAPL) to that list.

You know all of those panicky investors unloading Apple stock just over $150 a few months ago, apparently believing that the company's product cycle and innovation were at an end? That was Warren doing the buying.

Too bad I couldn't get him interested in the stock when Steve Jobs was still alive. Since then, the share price has risen by 400%. Knowing Steve as I did, maybe that was the reason he stayed away.

Still, I tried.

Looking at Apple's earnings this week, it's better late than never.

Buffet now owns a staggering 240 million shares of Apple worth $44 billion. It is his largest position, and Buffet is also now the largest shareholder in Apple. Remember, when you sell the shares of Apple, you now have both Buffet and Apple itself competing to buy the shares from you.

It's not a trade I would recommend.

I spent a rare week on the sidelines with the Mad Hedge Trade Alert Service, preferring to preserve my performance at an all-time high.

I decided to let the next false breakdown of the 200-day moving average take place without me. To mix a few metaphors, when the sun, moon, and stars line up once again I'll go pedal to the metal once again.

Remember, it's "Sell in May, and go away," except that this year May happened in January.

Now that the financial and technology Q1 earnings reports are out, the rest from here are going to be pretty boring.

On Monday, May 7 at 3:00 PM we get April Consumer Credit.

On Tuesday, May 8 at 9:45 AM EST, we receive the April NFIB Small Business Optimism Index, which has been red hot as of late. Disney (DIS) and China's JD.com (JD) reports.

On Wednesday, May 9, at 8:30 AM, the April Producer Price Index, and important read on inflation.

Thursday, May 10, leads with the Weekly Jobless Claims at 8:30 AM EST, which saw an of 2,000 last week from the 43-year low. At the same time, the all-important Consumer Price Index is released, the most crucial indication of price inflation. NVIDIA (NVDA) and Dropbox (DBX) report earnings.

On Friday, May 11 at 10:00 AM EST we get April Consumer Sentiment.

We wrap up with the Baker-Hughes Rig Count at 1:00 PM EST. Alibaba (BABA) reports.

As for me, I'll be playing around with my new Samsung 75-inch curved QLED quantum TV. I just bought it half price on Amazon (AMZN) half price with free delivery.

And you know what? Just to mess with me, Amazon offered me the set $500 cheaper after I bought. Jeff, you're so cruel.

Good Luck and Good Trading.

?

?

I Think I See Disney?s Earnings Coming

Mad Hedge Technology Letter

May 7, 2018

Fiat Lux

Featured Trade:

(WARREN BUFFET BOARDS THE APPLE TRAIN),

(AAPL), (AMZN), (BABA), (JD), (TSM)

I have never been one to argue with the Oracle of Omaha Warren Buffet. The founding subscriber to the Diary of a Mad Hedge Fund Trader has been a follower of many of my Trade Alerts, including Bank of America (BAC), Burlington Northern (he bought the whole company), and American Express (AXP). But I could never get him into technology stocks.

Now, at last, you can add Apple (AAPL) to that list.

You know all of those panicky investors unloading Apple stock just over $150 apparently believing that the company's product cycle and innovation were at an end? That was Warren doing the buying.

Too bad I couldn't get him interested in the stock when Steve Jobs was still alive. Knowing Steve, maybe that was the reason he stayed away.

Still, I tried.

Still, looking at Apple's earnings this week, better late than never.

The analysts covering tech stocks are making a mockery of their work.

They are continually left to lick their wounds after a slew of inaccurate claims that will empty investors pockets faster than the speed of light.

Granted, Apple had the weakest position of the vaunted FANG group going into earnings because of a lack of a direct cloud play and the stale iPhone narrative.

However, Apple is still a force to be reckoned with and they proved the bears horribly wrong delivering an extraordinary performance in Q1 2018.

Katy L. Huberty, a tech analyst from Morgan Stanley, downgraded Apple citing weak demand in China. This was after Taiwan Semiconductor (TSM) released tepid future guidance, stoking fear into investors causing a short-term dip in shares for chip related stocks and Apple.

The first two months of the year saw a barrage of downgrades from KeyBanc, Bernstein, and BMO capital. It is the same story over and over again.

Analysts do their best to character assassinate Apple on the run up to earnings every time. This ritual has embarrassed the analyst community. I don't think I'll ever believe another analyst again.

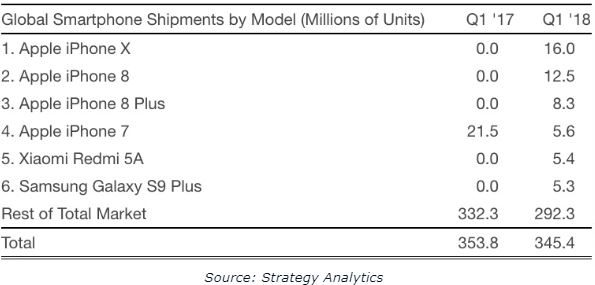

The iPhone X was the World's best-selling smartphone the last two quarters according to big data firm Strategy Analytics because it is the best smartphone in the World.

This logic might be too difficult for Wall Street analysts to comprehend with their hodgepodge of random data points that lead them to the wrong conclusions.

Apple has delivered earning beats on 20 of the last 21 quarters. The guidance was even on the high side of the range and the report was demonstrably better than expectations.

Services is now a material part of the company, blowing past estimates of $8.39 billion posting $9.19 billion in sales. This makes up 15% of the total revenue, and Apple will seek to solidify this segment going forward.

Apple will make a lot of headway if services become 25% of revenue. The optimal method to boost earnings is to develop a revolutionary product or extract additional incremental revenue from existing subscribers. Apple is going with the latter as the low hanging fruit is always easiest to pick.

The timing couldn't be more perfect for Apple. The World is on the cusp of new tech regulation that could lower margins and veering into a reoccurring subscription model is the perfect way to insulate themselves while growing the business.

The potential to increase the incremental revenue from China is strong because most of the iPhone earners in China originate from Tier 1 cities like Beijing and Shanghai and have the disposable income to pay for Apple's cocktail of services.

To dismiss the Chinese consumer is dangerous. Just look at the growth targets being smashed by Alibaba (BABA) and JD.com (JD) each quarter.

Japan and China contributed 20% growth to Apple's top line mainly due to the adoption of Apple Pay at many train and bus stations.

iPhone unit sales missed estimates by 340,000, but the analysts' bearish sentiment led many investors to believe the shortfall would be an unmitigated disaster.

The Average Selling Price (ASP) of $728 remained healthy as Apple has largely avoided the deterioration in margins that analysts routinely use as a pinata.

Apple continues to be the preeminent profit creator in the tech industry. They pocketed almost $50 billion in net profit in 2017. Public companies are in the business of making profits and returning capital to shareholders, and Apple does that better than anyone.

Apple's stock has been unfairly sabotaged by analysts and it almost seems they want the stock to capitulate and buy it for their own personal accounts.

Compare that to Amazon (AMZN) whose annual sales amounted to almost $180 billion but only $3 billion in net profit.

The market is penalizing Apple for a lack of a cash burn, land grab business. It is not Amazon and does not want to be Amazon. That is what the market pays for now.

It is ironic that Apple are penalized for making so much cash. They even hit an all-time high at $183 in a hazardous macro environment.

Saving the best for last, CEO Tim Cook pulled out his "trump" card. Apple announced an altruistic capital allocation program of $100 billion, the largest of any company in history. The dividend was hiked a further 16%.

Apple has given back $275 billion to shareholders since 2012 and this number should surpass $300 billion by 2019.

The unbridled expectations that Apple need to revolutionize the world with something better than an iPhone has reached the tipping point. Investors alike need to understand this is one company. And this company is doing very well.

Steve Jobs made an indelible impact on Silicon Valley, America, and the World. Tim Cook is not Steve Jobs. He will never be Steve Jobs.

Tim Cook is a safe pair of hands that knows how to captain this large ship.

Apple is turning into a service business and is still in the good graces of the Chinese communist government. If you consider that business attached to the iOS operating system has provided employment to a staggering five million local Chinese people. Creating problems for Apple as part of any widened trade war would create a huge loss to the Chinese economy.

I suspect that moving forward, Apple will increase operational margins due to a bigger contribution from the services segment which will dislodge the reliance on iPhone unit sales.

Buy Apple after the next atrocious analyst call and mini selloff.

John, you make me laugh. Following you has been awesome. If it weren't for you, I'd have been a mega bear for the last three years

Cheers

Justin

Western Australia

"The profits at Apple are unprecedented in American history. They are double the next largest competitor. All their products would fit on a small table. We've never seen anything like that," said Oracle of Omaha Warren Buffet.

"It has become appallingly obvious that our technology has exceeded our humanity." Said Albert Einstein.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.