When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Hot Tips

November 9, 2018

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) Disney Earnings Soar, Stock Pops. Things are rocking at the Mouse House, announcing Disney+, the new streaming service. Better late than never. I made my donations at Orlando, Los Angeles, and Paris this year. $20 for a cheeseburger? Even Goofy would choke on that. At least in Paris, you can get it with cheap red wine. Click here.

2) ROKU Beats, Stock Slaughtered. Good thing I took profits on the stock on Monday. Down 28%, you would think the streaming company was having a going out of business sale. Crushing stocks on the earnings announcement, whether they are good or bad, has become a regular feature of the market. Just ask Netflix (NFLX). Time to buy. Click here.

3) A Supervising Adult is Brought in to Tesla, and the stock soars. Robin Denholm, the finance chief at Australian telecom firm Telstra, is the new chairman at Tesla. Now Elon can focus on building electric cars. Maybe he can get some sleep too. Click here.

4) Thai Businessman Buys Fortune Magazine for $150 Million, in another mark of the decline of print journalism. And I thought that I was the last reader of the rag put out by my former employer. Will the last one to leave please turn out the lights? Click here.

5) Producer Price Index Soars in October, up 0.6% versus 0.2% expected. Yikes, and double yikes! Inflation is here. Keep selling short those bonds (TLT)! Click here.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(PLAYING THE SHORT SIDE WITH VERTICAL BEAR PUT SPREADS), (TLT)

(WHY TECHNICAL ANALYSIS DOESN’T WORK)

(FB), (AAPL), (AMZN), (GOOG), (MSFT), (VIX)

Note to readers: I am on call to fly spotter planes for the California fires so I may not be around on Monday. - John Thomas

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

November 9, 2018

Fiat Lux

Featured Trade:

(PLAYING THE SHORT SIDE WITH VERTICAL BEAR PUT SPREADS), (TLT)

(WHY TECHNICAL ANALYSIS DOESN’T WORK)

(FB), (AAPL), (AMZN), (GOOG), (MSFT), (VIX)

Mad Hedge Hot Tips

November 8, 2018

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) Attorney General Sessions Fired and Pot Stocks Soar. The long-term opponent of the marijuana industry heads for his greater reward. Finally, he’ll have time to read his free subscription to High Times. Avoid the sector. Barriers to entry for growing a weed are very low. Click here.

2) November Share Buy Backs to be the Largest in History. Of course, you knew this was going to happen a month ago if you read Mad Hedge Fund Trader. And you wondered why the market was up 545 points yesterday? Gotta love that tax reform! Click here.

3) Mad Hedge Market Timing Index Sees Sharpest Rally in 30 Years, from 4 to 29 in a week. I told you the market was cheap last week! Click here.

4) Wynn Rolls Snake Eyes, with an earnings disaster triggered by weak Macao business. Stock is down 14%. Tell THEM that trade wars are easy to win! Click here.

5) Why Are Oil Prices Telling Us We Are Already in Recession? Prices are in free fall. China certainly is, and they are the largest marginal new buyer, as is Europe. Click here.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(A NOTE ON OPTIONS CALLED AWAY), (SPY), (MSFT)

(TESTIMONIAL)

(IT’S ALL ABOUT SOFTWARE, SOFTWARE, SOFTWARE)

(WDAY), (NOW), (ZEN), (AMZN), (ORCL), (WMT), (TGT), (BAC), (FB)

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

November 7, 2018

Fiat Lux

Featured Trade:

(A NOTE ON OPTIONS CALLED AWAY), (SPY), (MSFT)

(TESTIMONIAL)

If you thought software week at the Mad Hedge Technology Letter was over, you were absolutely wrong.

I have done my best to offer a barrage of cloud-based software stocks with monstrous upside potential that would put any other industry companies six feet under.

Silicon Valley software companies have access to quinine in a mosquito-infested market – digitally savvy talent.

This talent is the best and brightest the world has to offer, and they want to work for a dominant company that gets it.

Much of this involves companies with bright futures, career opportunities galore, solving deep-rooted problems, all applying a treasure trove of data and a mountain of capital your rich uncle would giggle at.

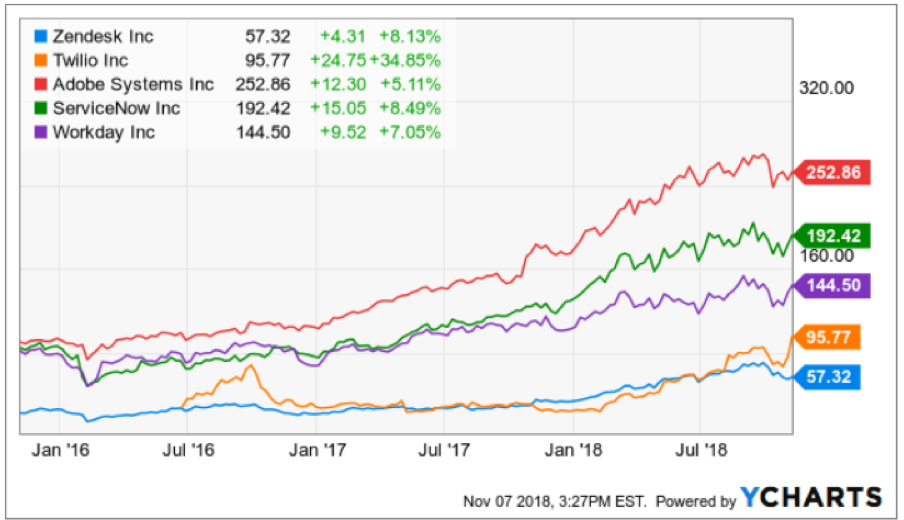

In the short term, I have been succinctly rewarded by my software picks with communication software Twilio (TWLO) rocketing upward 35% intraday at the time of this writing from when I recommended it just a few days ago.

Another Mad Hedge Technology Letter recommendation Zendesk (ZEN), a software company solving customer support tickets across various channels, is up a tame 10% after the election.

All in all, I would desire readers to access due caution as the volatility can bite you badly with crappy entry points, but the upside cannot be denied.

The turbocharged price action means the pivot to software with its new best friend, the software as a service (SaaS) pricing model, encapsulates the outsized profits this industry will rake in going forward.

Without further ado, I’d like to slip in two more companies rounding out a robust quintet of software companies – I bring to you Workday (WDAY) and Service Now (NOW).

Workday is a software company based on a critical component of every successful company – human resources.

Unsurprisingly, human resources are tardy to this wave of software modernization.

Sensibly, companies have chosen short-term software fixes that drive profits with instant success rather than to update its human resource department’s processes.

Big mistake.

I would argue that getting the right people in the doors is paramount and can save substantial time because of the wasted time rooting out toxic employees who weren’t suitable fits.

Ultimately, I have concluded the worst-case scenario entails the enterprise resource planning market stagnating driving minimal growth to the cloud, however, this minimal growth would be substantial enough for Workday to outperform.

The landscape as of now only involves several vendors with a competitive (SaaS) solution auguring well for Workday allowing them to capture a further chunk of market share.

Workday’s growth metrics back up my thesis with its businesses posting a 3-year EPS growth rate of 291% and a 3-year sales growth rate of 36%, painting a picture of a company that will turn profitable in the next few years.

They can even showboat their glittering array of heavy-hitting customers who purchase their software that include Walmart (WMT), Target (TGT), and Bank of America (BAC).

The one headwind tarnishing these types of software companies is the stock-based compensation awarded to employees.

SBC rose 21% YOY and is slightly worrying in an otherwise stellar company. This method of compensation only works when the stock is rising and is a major issue for new Facebook (FB) hires who will prefer cash over its burnt-out share price.

If Workday doesn’t whet your appetite, then how about sampling a main dish of ServiceNow.

This company completes technology service management tasks offering a centralized service catalog for workers to request technology services or information about applications and processes that are being used in the system.

Admirably, this software helps IT workers fix IT system problems which in this day and age is useful considering the bottleneck of chaos many tech and non-tech companies face.

And more often than not, the chaos inundates the in-house IT departments causing the whole business to go offline.

Putting out digital fires is a perpetual business that will never flame out.

As websites and enterprise systems become more complicated, a bombardment of errors are prone to crop up and instant remedies are crucial to carrying out businesses in a time sensitive manner.

Even ask the best tech company in the universe Amazon (AMZN), whose move off Oracle’s (ORCL) database software was the ultimate reason for a serious outage in one of its biggest warehouses on this past Amazon Prime Day, according to Amazon’s internal documents.

The faux paux underscores the hurdles Amazon and other companies could face as they seek to move completely off the Oracle legacy database software whose development has stayed relatively stagnant for a generation.

The slipup was minutes and snowballed into excruciating hours on Amazon Prime Day resulting in over 15,000 delayed packages and roughly $90,000 in wasted labor costs.

Crikey!

These numbers didn’t even consider the wasted man-hours spent by developers troubleshooting and solving the errors or any potential lost sales.

When these mammoth tech giants are running at an incredible scale, a small blip can result in job losses, lost revenue, lost time, a slew of IT engineer sackings, and for some smaller companies, an existential crisis.

The large-scale acts as a powerful multiplier to the lost resources and cost, and as you can see with the Amazon debacle, a few hours can make or break a developer’s career.

Fortunately, IT budgets are higher up the food chain than human resource budgets while more than inching up every year. This is the main reason why I believe ServiceNow will outperform Workday.

The proof is in the pudding and when I scrutinize various metrics, the truth is filtered out.

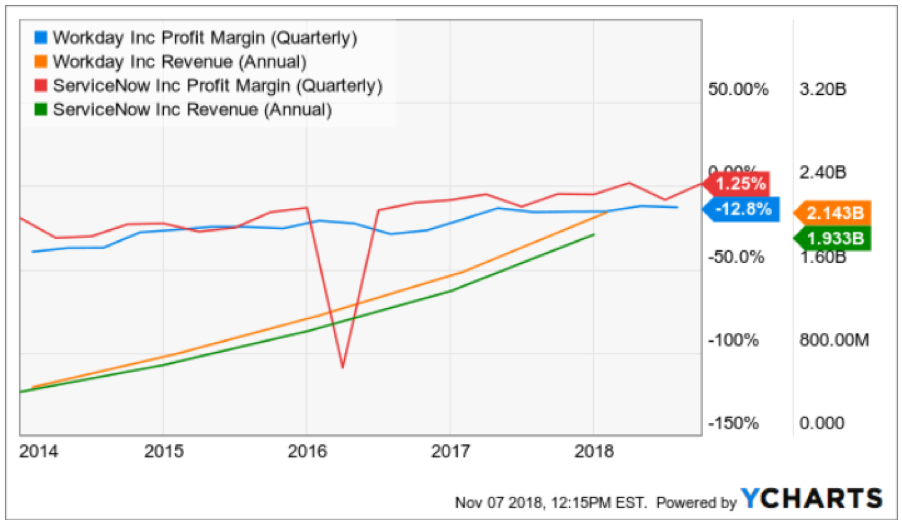

ServiceNow’s quarterly growth rate is 35% which is higher than Workday’s who slipped back to 28% last quarter even though the 3-year growth rate is in the mid-30%.

Put mildly, accelerating sales growth is better than decelerating sales growth.

Both companies have a market cap in the low $30 billion and almost identical annual sales in the $2 billion range.

However, ServiceNow presides over significantly higher quarterly profit margins than Workday and will achieve profitability sooner than Workday.

In short, Workday loses more money than ServiceNow.

I believe in the underlying thesis of HR modernization underpinning Workday’s rapidly growing revenue and this secular trend is here to stay.

But I much rather put my hard-earned money on a company tied to IT modernization which is imminent and harder to put on the backburner because of its strategic position at the forefront of the tech curve.

HR CAN be put on the backburner and kept analog longer, and as the economy inches closer to a recession, this expense will be shifted further away from greener pastures supported by the fact that companies decelerate hiring new talent in poor economic environments.

To wrap it up, I do believe ServiceNow is the Burmese python consuming a cow, but that doesn’t mean I am bearish on Workday.

Workday will flourish, just not as much on a relative basis as ServiceNow.

Effectively, these stocks are well placed to move higher even after the violent moves upward this year. As the economic cycle moves further into the late innings, the importance of cloud-based software companies will become magnified further.

As for the software week at the Mad Hedge Technology letter, these solid five picks will offer deep insight into one of the most compelling parts of the internet sector.

As many observers have found out, not all tech firms are created equal and that is made even trickier with the existence of the vaunted FANGs who are the real Burmese python in the current tech landscape.

Thank you so much for meeting with us in Portland!

I hope I didn't monopolize your time at the expense of everyone else. But how often does one get a chance to pick the brain of the Mad Hedge Fund Trader?

You have such an ability to see the big picture on so many fronts and whittle it down into actionable strategies.

I will confess that at one point I considered dropping your service because I couldn't effectively implement your trades, as we discussed.

But the thought of not getting your daily insights made me realize how often I use what you write when talking with clients, making allocation decisions, and selecting industries in which to invest.

So, you're stuck with me!

Again, thanks for taking the time!

Cheryl

Rogue River, Oregon

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.