While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

October 26, 2018

Fiat Lux

Featured Trade:

(WHY FINANCIAL ADVISORS ARE GOING EXTINCT),

(HOW THE UNDERGROUND ECONOMY IS EXPLODING)

Mad Hedge Hot Tips

October 25, 2018

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

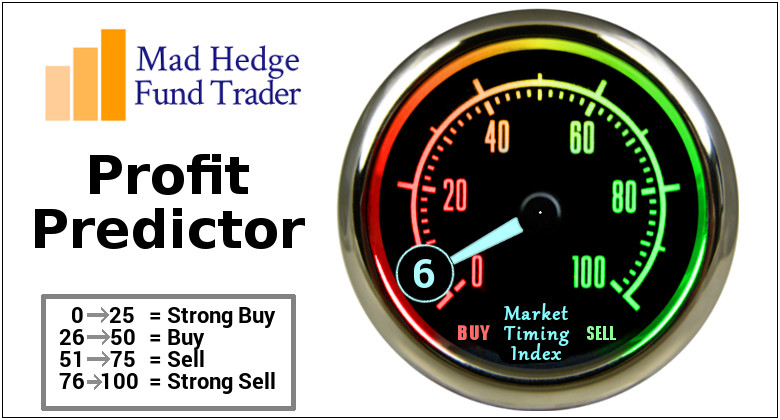

1) Mad Hedge Market Timing Index Hits a Ten-Year Low at 6, indicating that markets are an “EXTREME BUY”. Artificial Intelligence is never wrong. Go for quality tech. You pay your money and you take your chances. See my Global Trading Dispatch for where to load the boat now. Click here.

2) September Durable Goods Up a Hot 0.8%, versus -1.4% expected. When will the stock market start looking at the numbers again? My guess is now. Gotta love those Saudi weapons purchases. It was all defense-led. Click here.

3) Weekly Jobless Claims at 215,000 are Blistering as Always. My local morning breakfast dive could really use a new waitress. Maybe they should offer more than $10 an hour. Click here.

4) Tesla Announces Surprise Profit, except that it was not a surprise here. Stock has rocketed back to Musk pre-meltdown levels in the $320’s. Consumers are paying up to buy fully loaded electric vehicles to beat the expiration of federal subsidies at the end of the year. Click here.

5) American Airlines Gets Slaughtered, with soaring fuel prices eating up most of their profit. Two hurricanes didn’t help either. If you can’t make money now in this peak economy, when will you? No wonder the PE multiple is a bargain basement six times. Click here.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(THE LAZY MAN’S GUIDE TO TRADING),

(ROM), (UXI), (BIB), (UYG),

(THE NEXT THING FOR THE FED TO BUY IS GOLD),

(GLD), (GOLD), (GDX), (ABX), (NEM)

(HOW ENVIRONMENTALISTS MAY KILL OFF BITCOIN),

(BTC), (ETH), (TWTR), (SQ)

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

October 25, 2018

Fiat Lux

Featured Trade:

(THE LAZY MAN’S GUIDE TO TRADING),

(ROM), (UXI), (BIB), (UYG),

(THE NEXT THING FOR THE FED TO BUY IS GOLD),

(GLD), (GOLD), (GDX), (ABX), (NEM)

Mad Hedge Technology Letter

October 25, 2018

Fiat Lux

Featured Trade:

(HOW ENVIRONMENTALISTS MAY KILL OFF BITCOIN),

(BTC), (ETH), (TWTR), (SQ)

If Jack Dorsey's proclamation that bitcoin will be anointed as the global "single currency," it could spawn a crescendo of pollution the world has never seen before.

In a candid interview with The Times of London, Dorsey, the workaholic CEO of Twitter (TWTR) and Square (SQ), offered a 10-year time horizon for his claim to come to fruition.

The originators of cryptocurrency derive from a Robin Hood-type mentality circumnavigating the costly fees and control associated with banks and central governments.

Unfolding before our eyes is a potential catastrophe that knows no limits.

Carbon emissions are on track to cut short 153 million lives as environmental issues start to spin out of control while the world's population explodes to 9.7 billion in 2050, from 8.5 billion people in 2030, up from the 7.3 billion today.

All these people will need to barter in bitcoin, according to Jack Dorsey.

Cryptocurrency is demoralizingly energy-intensive, and the recent institutional participation in crypto server farms will exacerbate the environmental knock-on effects by displacing communities, destroying wildlife, and climate-changing carbon emissions.

This seemingly controversial means to outmaneuver the modern financial system has transformed into a murky arms race among greedy cryptocurrency miners to use the cheapest energy sources and the most efficient equipment in a no-holds-barred money grab.

Bitcoin and Ethereum mining combined with energy consumption would place them as the 38th-largest energy consuming country in the world - if they were a country - one place ahead of Austria.

Mining a bitcoin adjacent to a hydropower dam is not a coincidence. In fact, these locales are ground zero for the mining movement. The common denominator is the access to cheap energy usually five times cheaper than standard prices.

Big institutions that mine cryptocurrency install thousands of machines packed like a can of sardines into cavernous warehouses.

In 2015, a documentary detailed a large-scale foreign mining operation with an electricity outlay of $100,000 per month creating 4,000 bitcoins. These are popping up all over the world.

An additional white paper from a Cambridge University study uncovered that 58% of bitcoin mining comes from China.

Cheap power equals dirty power. Chinese mining outfits have bet the ranch on low-cost coal and hydroelectric generators. The carbon footprint measured at one mine per day emitted carbon dioxide at the same rate as five Boeing 747 planes.

The Chinese mining ban in January set off a domino effect with the Chinese mining operations relocating to mainly Canada, Iceland, and the United States.

Effectively, China has just exported a tidal wave of new pollution and carbon emissions.

Bitcoin is mined every second of every day and currently has a supply of approximately 17 million today, up from 11 million in 2013.

Bitcoin's electricity consumption has been elevated compared to alternative digital payment currencies because the dollar price of bitcoin is directly proportional to the amount of electricity that can profitably be used to mine it.

To add more granularity, miners buy more servers to maintain profitability then upgrade to more powerful servers. However, the new calculating power simply boosted the solution complexity even faster.

Mines are practically outdated upon launch and profitability could only occur by massively scaling up.

Consumer grade personal computers are useless now because the math problems are so advanced and complicated.

Specialized hardware called Application-Specific Integrated Circuit (ASIC) is required. These mining machines are massive, hot, and guzzle electricity.

Bitcoin disciples would counter, describing the finite number of bitcoins - 21 million. This was part of the groundwork laid down by Satoshi Nakamoto (a pseudonym), the anonymous creator of bitcoin when he (or they) constructed the digital form of money.

Nakamoto could not have predicted his digital experiment backfiring in his face.

The bottom line is most people use bitcoins to literally create money out of thin air in digital form, rather than using it as a monetary instrument to purchase a good or service.

That is why people mine cryptocurrency, period.

Now, excuse me while I go into the weeds for a moment.

Enter hard fork.

A finite 21 million coins is a misnomer.

A hard fork is a way for developers to alter bitcoin's software code. Once bitcoin reaches a certain block height, miners switch from bitcoin's core software to the fork's version. Miners begin mining the new currency's blocks after the bifurcation creating a new chain entirely and a brand-spanking new currency.

Theoretically, bitcoin could hard fork into infinite new machinations, and that is exactly what is happening.

Bitcoin Cash was the inaugural hard fork derived from the bitcoin's blockchain, followed by Bitcoin Gold and Bitcoin Diamond.

Recently, the market of hard fork derivations includes Super Bitcoin, Lightning Bitcoin, Bitcoin God, Bitcoin Uranium, Bitcoin Cash Plus, BitcoinSilver, and Bitcoin Atom.

All will be mined.

The hard fork phenomenon could generate millions of upstart cryptocurrency server farms universally planning to infuse market share because new currencies will be forced to build up a fresh supply of coins.

If Peter Thiel's prognostication of a 20% to 50% chance of bitcoin's price rising in the future is true, it could set off a cryptocurrency server farm mania.

By the way, Thiel also believes that there is a 30% chance that Bitcoin could go to zero.

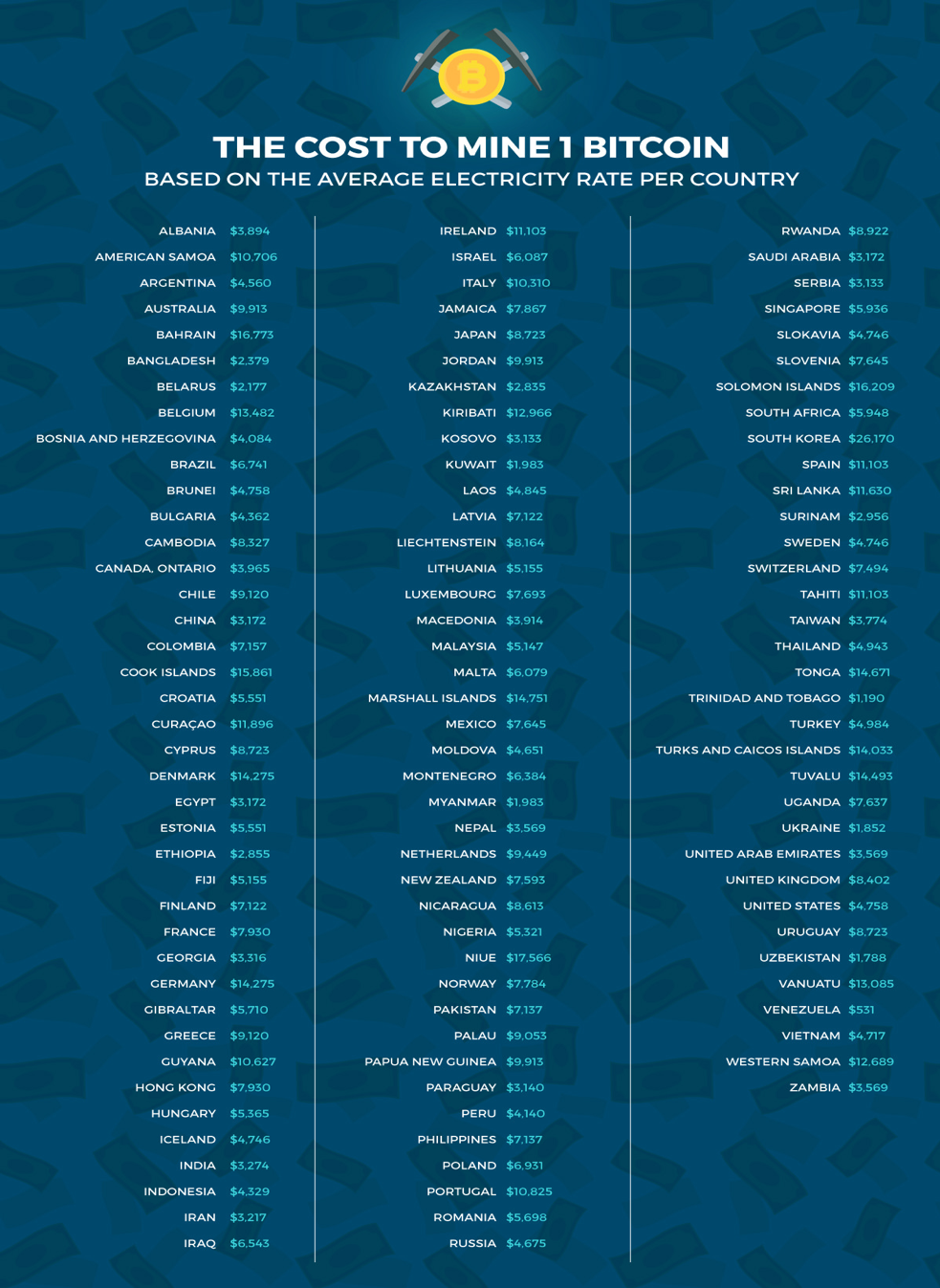

A surge in the price of bitcoin results in mining cryptocurrency operations everywhere by any type of electricity, especially if the surge maintains price stability. Even mining in Denmark, where one finds the world's costliest electricity at $14,275 per bitcoin, would make sense.

Recently, miners' appetite for power is causing local governments to implement surcharges for extra infrastructure and moratoriums on new mines. Even these mines built adjacent to hydro projects are crimping the supply lines, and consumers are forced to buy power from outside suppliers. Miners are often required to pay utility bills months in advance.

By July 2019, mining will possibly need more electricity than the entire United States consumes. And by February 2020, bitcoin mining will need as much electricity as the entire world does today, according to Grist, an environmental news website.

Geographically, most locations around the world were profitable based on May's bitcoin price of $10,000.

However, the sudden slide down to $6,400 reaffirms why the Mad Hedge Technology Letter avoids this asset class like the plague.

The most unrealistic operational locations are distant, tropical islands, such as the Cook Islands at $15,861, to mine one bitcoin.

If you'd like to drop your life and make a fortune mining bitcoin, then Venezuela is the most lucrative at $531 per bitcoin.

As bitcoin's nosedive perpetuates, Venezuela might be the last place on earth with mining farms.

Who doesn't like free money? Set up a few devices, crank up the power, collect the coins, pay off the electricity bill, pocket the difference and hopefully the world - or Venezuela - hasn't keeled over by then.

SHOW ME THE MONEY

"If privacy is outlawed, only outlaws will have privacy," - said Philip R. "Phil" Zimmermann, Jr., creator of the most widely used email encryption software in the world.

Mad Hedge Hot Tips

October 24, 2018

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

2) Tesla Soars 12%, as famed short seller covers and goes long. The company is dominating the entire EV sector and no one can ever catch them. Who knew? You did if you read my letter. Click here.

3) My Bond Short Kicked Ass Yesterday, clocking nearly a 10% profit in one day. Sell high, buy low. Everyone talks about it, but no one ever does anything about it. Click here.

4) Caterpillar Does a Swan Dive, down 10% yesterday. It looks like old-line industrials are going to get hit much harder than tech stocks in the next recession. Click here.

5) Australian Tycoon Plans to Build New Titanic. Ah, but this one will be unsinkable, really! Put me in the owner’s suite but I think I’ll bring my own life raft. With global warming, icebergs will be gone in a few years anyway. Click here.

Published today in the Mad HedgeGlobal Trading Dispatch and Mad Hedge Technology Letter:

(HANGING WITH LEONARDO)

(THE CLOUD FOR DUMMIES)

(AMZN), (MSFT), (GOOGL), (AAPL), (CRM), (ZS)

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.