Not all tech will survive.

Come hell or high water, chatbots are not going away today but have an ugly fate with the tech graveyard of past technologies in the near future.

The rise of pervasive technology has brought consumers a wave of modern technology – some useful and some that go straight rogue.

Microsoft (MSFT) was on the receiving end of tech gone bad when its Tay bot was duped into spewing anti-Semitic and racist blather.

Bill Gate’s brainchild allowed Tay to behave according to what it learned from fellow users with which it interacted.

The developers forgot that not all Internet speak is nice and bubbly.

In another humiliating episode, cyberhackers wielded a chatbot to masquerade as a woman asking men to hand over credit card information in order to become verified on the raunchy dating app Tinder.

Manipulating an app platform has been a favorite of cyberhackers where users blindly trust these brands with which they have become familiar, and barely question the motives behind these strange developments.

As cybercriminals endlessly hunt for monetization and opportunities ramp up, chatbots represent a critical vehicle to pillage prospective victims.

These examples are just two that were publicly reported.

In reality, flashpoints are widespread, and users are usually completely unaware that they are being victimized.

Some chatbots are even out just for data harvesting among other targeted activity.

The dark web is the perfect marketplace to sell hijacked data.

Many Internet users believe they can feel safe and secure behind the auspices of end-to-end encryption.

However, users seem to forget that this type of foolproof security has its limitations.

The easiest way to become exposed is by the other person on the other end of the message.

They can turn you in.

Paul Manafort found this out the hard way when the FBI seized messages from the people he sent them too.

WhatsApp, owned by Facebook, along with chat app Signal are the best ways to keep chats confidential if you trust the other party. This is where the conversation disappears in about ten seconds.

However, just because WhatsApp is secure now, does not mean it will be secure tomorrow.

WhatsApp co-founder and CEO Jan Koum quit in a vicious row against Facebook’s upper management flipping off the rogue ad-seller as the relationship came to a screeching halt.

He later said he was quitting to collect “rare air-cooled Porsches” and play “ultimate frisbee.”

Facebook plans to weaken WhatsApp’s encryption levels and is intent on harvesting the data to eventually install a digital ad business to this ad-less messenger.

Facebook has shown a blatant disregard to privacy. Plan on everything you have ever sent on WhatsApp being privy to all the workers in the Facebook office at some point in the near future.

In some eerie way, Facebook mimics the hackers that maneuvered around Tinder’s developers, but in a completely legal way showing zero concern for its end user.

That is a scary thing.

Facebook has become borderline criminal in the court of public opinion in Europe. And that sentiment has seeped into the hearts of minds of Americans as well, and rightly so.

In short, the tidal wave of junk tech such as chatbots and Facebook spinning your information to the hills will end badly.

The public has smartened up and cannot be misled by Facebook’s privileged management spouting out that its “values” are different as an excuse for obvious debacles.

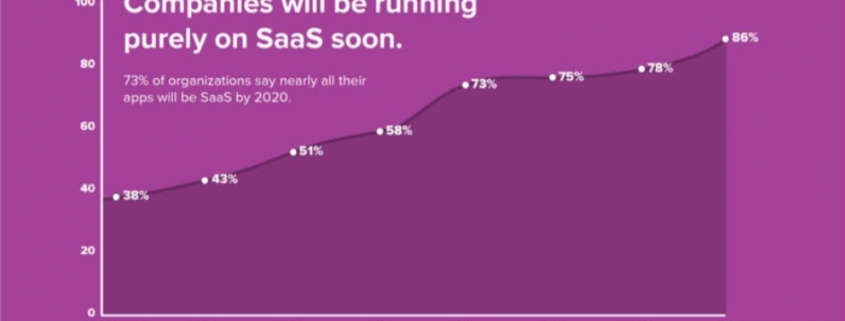

The global chatbot market was $369.79 million in 2017, and by 2024, this industry will balloon to $2.17 billion.

Chatbots will have a ubiquitous presence in work and daily life.

Companies desire to curtail rising costs, and are doubling down on the chatbot revolution.

The current obstacle is that artificial intelligence (A.I.) is just not good enough yet for chatbots to comprehensively serve customers and never will be.

The chatbots rely on the data in their systems to solve problems to difficult questions, but humans need to receive answers on the fly in the case of multi-part complications.

Chatbots spectacularly fail at this endeavor.

Even worse, chatbots cannot empathize with a furious customer and feel out customers’ emotions to properly optimize the perfect solution.

And in some instances, humans do not feel at ease to discuss certain topics with software code.

Then there is the generational difference of age groups preferring to use what they are familiar with.

For older generations, this absolutely means speaking to a real human who lives, breathes, and sleeps at night.

Younger generations who grew up never going outside but instead addicted to a screen have an easier time routing their lives through technology.

Granted, chatbots are effective when answering rudimentary questions to direct the customer to a department where they will soon be talking to a human. But chatbots are not the solution to every customer service problem.

Then there is the question of whether a rogue chatbot is going to disperse your data to a nefarious hacker or even behave like Microsoft’s Tay chatbot.

Facebook is already a legal entity that disperses personal data for money.

As the tech sector advances, the weak technology will crash and burn.

Low-quality social media platforms such as Facebook and inferior technology-like chatbots will succumb to the same fate as the woolly mammoth.

Investors are experiencing this massive migration up in quality as the public and investors are doing everything to insulate themselves from the dark side of technology.

In a further blow to user-generated platforms Facebook and Alphabet’s Google (GOOGL), Brussels voted in favor of a law that would force tech companies to actively filter out copyrighted content uploaded to their platforms.

This will crimp profitability for the two giants, as the data and content received for free is being put under a stronger microscope.

Europe is doing everything it can to disrupt these two companies from their free lunch, and they are fed up with the negligence and arrogance in which they run their platforms.

This was evident when Europe slapped Alphabet on the wrist with a $5 billion antitrust penalty earlier this year.

Chatbots will eventually face the public opinion death squad, as fatigued Internet users will completely avoid chatting with software code and move their businesses to the competitor.

The ultimate problem tying chatbots and Facebook together is the utter lack of attention to the customers’ needs.

These two phenomena exist to make more corporate money in a myopic fashion.

Every shortcut available will be taken and has been taken.

Facebook will never be able to monetize its website like the pre-Cambridge Analytica scandal days. It will take a sweeping reset, most importantly dethroning Mark Zuckerberg from his perch in Menlo Park, California, to reinvigorate this lost firm.

Chatbots will not exist in a few years and technology will move on to more effective solutions.

It is the end of bad tech as we know it, as technology is evolving so fast, yesterday’s conquerors become todays pariah’s in just a few years.

Chatbots – A Flash in The Pan Tech

________________________________________________________________________________________________

Quote of the Day

"Our goal has never been to make the most. It's always been to make the best,” said CEO of Apple Tim Cook.