While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

February 8, 2019

Fiat Lux

Featured Trade:

(FEBRUARY 6 BIWEEKLY STRATEGY WEBINAR Q&A),

(TLT), (FXA), (NVDA), (SPY), (IEUR),

(VIX), (UUP), (FXE), (AMD), (MU), (SOYB)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader February 6 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: Why are you so convinced bonds (TLT) are going to drop in 2019?

A: I think the Fed will regain the confidence to start raising rates again in the second half. Wage inflation is starting to appear, especially at the minimum wage level in several states. That will crater the bond market as well as the stock market, just as we saw in the second half of 2018. We’re in unknown territory in the bond market; we’re issuing astronomical WWII levels of debt and it’s only a matter of time before the Federal government crowds out private sector borrowers. Even if the bond market sidelines during this time, we will still make the maximum profit in the kind of option bear put spreads I have been putting on.

Q: Why did the Aussie (FXA) go down when they suddenly flipped from rising to cutting interest rates?

A: Interest rate differentials are the principal driver of all foreign exchange rates. They always have been and always will be. Rising rates almost always lead to a stronger currency. And with the US Fed on pause for the foreseeable future, we think the Aussie will be stronger going into 2019.

Q: Do you see the 10-year US Treasury yield going back up to 3.25% this year?

A: Yes, it’ll probably happen in the second half of the year—once the Fed gets its mojo back and decides that high employment and inflation are the bigger threats to the economy.

Q: Has NVIDIA (NVDA) bottomed here?

A: Probably, but you don’t want to touch the semiconductor chip companies until the summer. That’s when all the industry insiders expect the industry to turn and start discounting rocketing earnings after the next recession.

Q: Are stocks expensive here (SPY)?

A: On a trailing basis no, on a forward basis definitely yes. The current price/earnings multiple for the market is 17 now against a 14-20 range in 2018. So, we are dead in the middle of that range now. That’s OK when earnings are rapidly rising as they did last year. But they are falling now and at an increasingly increasing pace.

Q: Do you think the administration used the shutdown to bring forth a recession? To kickstart the pro-economic platform for reelection in 2020?

A: The administration’s view is that the economy is the strongest it’s ever been with no chance of future recession and that they will win the election as a slam dunk. If you believe that, buy stocks; if you don’t, sell them.

Q: How bad do you think Europe (IEUR) will get and does that mean the dollar (UUP) could see parity with the Euro (FXE) soon?

A: Europe is bad but they’re not going to raise interest rates anymore. However, they’re not going to cut them either because they’re already at zero. You need rising rates to see a stronger currency and the fact that the U.S. stopped raising rates is an argument for the Euro to go higher.

Q: Are we about to settle into a fading Volatility Index (VIX) environment for the rest of the year?

A: No, we are not; the (VIX) has been fading for 6 weeks. We’re approaching a bottom with the (VIX) here at $15, and the next big move in will probably be to the upside. The market has gotten WAY too complacent.

Q: Which are the most worrisome signals you see in the U.S. economy right now?

A: Weak earnings and sales guidance from all U.S. companies going forward and the immense jump in jobless claims last week as well as the ever-exploding amounts of government debt. Did I mention the trade war with China and the next government shutdown? Traders have a lot on their plate right now.

Q: How far will Lam Research (LRCX) go?

A: We’ve just had a massive 46% move up, so I wouldn’t chase it up here. However, long term there is still an easy double in this stock. They’re tied in with the semiconductor companies; NVIDIA, Advanced Micron Devices (AMD) and Micron Technology (MU) all trade in a group and may take one more run at the lows. Short term it’s overbought, long term it’s a screaming buy.

Q: Will the ag crisis feed into the main economy?

A: It could. All ag storage in the country is full, so farmers are putting the new harvest under tarps where it is rotting away and then claiming on their insurance. If you add another harvest on top of that it will be a disaster of epic proportions. China is America’s largest ag customer. It took decades of investment to develop them a client, and they are never coming back in their previous size. The trust is gone. Bankruptcies are at a ten-year high and that could eventually take down some regional banks which in turn hurt the big banks. However, ag is only 2% of the US economy, so it won’t cause the next recession. It’s really more of a story of local suffering.

Q: If you give out stop and not filled at stop price, when and how do you adjust to exit?

A: I would quickly enter it and if you’re not done quickly move it down five cents. If you don’t get done, do it again. There is no way to know where the real market is in until you put in a real order. There are 11 different option exchanges online and they are changing prices every millisecond. Furthermore, spread trades can get one leg done on one exchange and the second leg done on another, so prices can be all over the place.

Q: What data goes into the Mad Hedge Market Timing Index and how do you use it to time the markets?

A: It uses a basket of 30 different indicators which constantly changes according to what generates the highest return in a 30 year backtest. It includes a lot of conventional data points, like moving averages and RSIs, along with some of our own internal proprietary ones. When we are getting a reading below 20, we are looking to buy. Any reading over 65 and we are looking to sell, and over 80 we will only go short. It works like a charm. It paid for my new Tesla! I hope this helps.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to the six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Mad Hedge Hot Tips

February 7, 2019

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) The Biggest Bank Takeover in a Decade, hits the tape with BB&T (BBT) buying SunTrust (STI) for $28 billion, a 7% premium. This is another chip away at the massive overbanking of the US. The US still has 5,000 banks while Australia gets by with four. Click here.

2) Video Game Stocks Get Destroyed, as privately held Epic Games’ Fortnight sucks all the oxygen out of the room. Yes, $250 million a month in competing sales can wipe out your entire business. Electronic Arts (EA) and Activision Blizzard (ATVI) are banging on the basement door. If you wonder where your kids have disappeared to, they’re all playing Fortnight online. Click here.

3) Another Nail in the Bitcoin Coffin. A major crypto exchange files for bankruptcy protection when the founder died and took all the passwords with him. Quadriga CX is now in liquidation in Canada and investors are likely to get stiffed for $140 million. I know it’s not Bitcoin, but it’s hardly a ringing endorsement for the sector. Click here.

4) Farm Sector Bankruptcies are Soaring, hitting a decade high. Apparently, the trade wars and global warming aren’t working for them. Ironically, ag prices are about to take off to the upside when a Chinese trade deal gets done. Buy the ags for a trade. Click here.

5) Tesla Cuts Prices Again, in a blatant bid for market share and global domination. The low-end Tesla 3 price drops to $42,900. Next stop $35,000. Too bad they laid off my customer support personel to cut costs. I can’t find my AM radio. Click here.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(WHAT TO BUY AT MARKET TOPS?),

(CAT), ($COPPER), (FCX), (BHP), (RIO),

(EUROPEAN STYLE HOMELAND SECURITY),

(TESTIMONIAL)

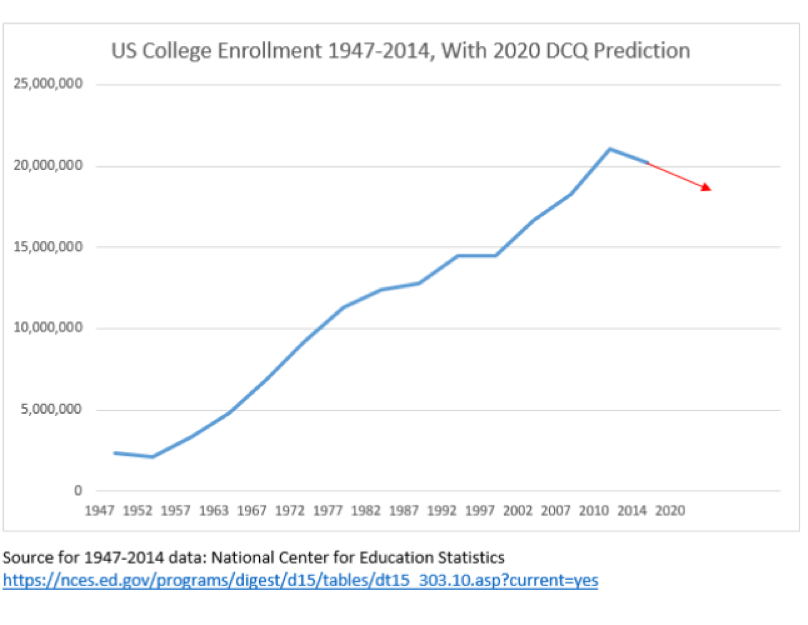

(THE DEATH OF THE COLLEGE DEGREE),

(GOOGL), (IBM), (AAPL), (BABA), (BIDU)

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to the six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Mad Hedge Technology Letter

February 7, 2019

Fiat Lux

Featured Trade:

(THE DEATH OF THE COLLEGE DEGREE),

(GOOGL), (IBM), (AAPL), (BABA), (BIDU)

If you’re an educator not at a top 25 American university, you might want to stop reading right now.

Disruption.

You’re either on the right or wrong side of it.

I’ve detailed numerous subsets of the economy and society that have been transformed by sharp shifts in technological innovation.

But the one industry that has stealthily moved into the heart and center of technological disruption is education.

For centuries, universities and higher learning institutions had a stranglehold on critical information required to successfully perform in the cutting-edge knowledge economy of those times.

Then on September 15, 1997, a mere 21 years ago, Google search launched its free services to the world and grabbed the monopoly of information away from the college system.

This website effectively caused the cost of information to crater to zero and its free website is ranked #1 as of February 2019 with over 4.5 billion monthly active users.

The ensuing 21 years has been a renaissance in the ability to distribute information propelled by this one platform, and the result is that billions have the ability to study and read up on what they want and when they want.

The ability to learn for free combined with a tight labor market is a promising landscape for job seekers, with analysts forecasting more opportunities for professionals without a degree.

Job-search site Glassdoor amassed a list of various employers no longer bound by requiring applicants to possess a 4-year bachelor’s degree.

These firms aren’t your second-rate companies either made up of gold standard workplaces such as Google, Apple, and IBM.

In 2017, IBM's vice president of talent Joanna Daley confided that about 15% of IBM’s new hires don't have a four-year bachelor qualification.

She emphasizes hands-on experience through coding boot camp or industry-related vocational classes as explicit criteria to get hired.

This development bodes poorly for the future of universities and boosts the prospects of alternative education.

Online college offers working adults ample flexibility in furthering their education.

According to the most recent federal statistics from 2016, roughly one out of every three, or 6.3 million college students learned online.

Even though online courses are becoming more widespread, the best and brightest aren’t attending these schools.

However, it did hijack the marginal student that was on the fence for a 4-year university and brought them into the orbit of for-profit online courses and the revenues that came with it.

That was the first stage of online forces imposing financial pressure on the education marketplace.

Now analysts are discovering the second major trend with higher rated students opting out of the university system altogether.

In many cases, a 4-year university degree is a bad value proposition.

Why is that?

Costs.

In a capitalistic economy that lives and dies by the mantra of buy low and sell high – universities seem to be getting sold short lately.

The exorbitant costs to obtain a 4-year degree has led to an outsized student debt bubble and removed the mystique of this once treasured qualification.

A growing chorus of bipartisan voices has pigeonholed student debt as a major problem across the country.

In the previous presidential election, Democratic candidate Bernie Sanders called this situation “outrageous” as national student debt has spiraled out of control to the amount of $1.5 trillion.

This has been a terrible commercial for the younger generations to follow in the footsteps of the indebted Millennial generation.

And with Generation Z tech savvy at building stand-alone firms buttressed by Instagram and YouTube platforms, why go to college anymore?

Or to nail one of those jobs developing iPhones in Cupertino, why not take a few coder boot camps and self-develop a portfolio impressive enough to score an Apple interview?

The bottom line is that there are workarounds for a fraction of the price.

And because tech firms have outpaced analog companies in salaries and hiring for the past two decades, there is an outsized bias on compiling technical skills that will lead a candidate down a path to a salary of over $100,000 quicker than a 4-year degree can.

Not many other industries can claim the same.

The cracks are beginning to reveal themselves in the overall university apparatus.

Universities had years of record revenue that they reinvested into the system to enhance programs, staff, buildings, stadiums, and infrastructure.

The financial catalyst was the rise of the Chinese college student.

The latest statistics nailed the number of Chinese nationals in America studying for 4-year degrees at over half a million.

Many of those were trained up with engineering-related degrees and bolted back home to find jobs at Baidu (BIDU), Tencent, or Alibaba (BABA) powering Chinese Inc.

However, the drop off in demographics from young Chinese and Americans are forcing universities to fight for a shallower pool of candidates with less attractive degrees relative to the value of degrees of past generations.

The second-tier universities are hardest hit with examples galore.

Alcorn State University in Mississippi saw a dramatic 69.45% decrease in applications in 2018 and its rural location didn’t help either.

Alabama State University is feeling the pinch with a 33.06% drop in application in recent years.

If you thought the University of New Orleans was clawing its way back to relevancy after Hurricane Katrina, you are mistaken with its 38.23% drop in applications.

Military schools haven’t been spared either with applications to The United States Air Force Academy crashing 28.12% over the past ten years.

A confluence of deadly trends is about to beset the university system and schools will likely go bust.

Technology is giving a reason for students to bypass the system while also speeding up the financial timebombs many universities are about to confront.

Then we must ask ourselves, will universities even exist in the future?

Probably, but perhaps just the top 25 elite schools that are still worth the high costs.

IS IT STILL WORTH IT?

Global Market Comments

February 7, 2019

Fiat Lux

Featured Trade:

(WHAT TO BUY AT MARKET TOPS?),

(CAT), ($COPPER), (FCX), (BHP), (RIO),

(EUROPEAN STYLE HOMELAND SECURITY),

(TESTIMONIAL)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.