When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

March 6, 2019

Fiat Lux

Featured Trade:

(BUY SALESFORCE ON THE DIP),

(CRM)

Taking the current temperature of bellwether stocks is just as important as understanding the secular trends imbuing the tech industry.

Salesforce (CRM) released earnings on Monday and the report was solid but not spectacular.

Shares of Salesforce sold off mildly following the report and could be an indicator of trading lethargy engulfing the hot software group.

At the end of 2018, I urged readers to focus on the cloud-based software stocks and they have performed admirably the first three months of the year.

This trade isn’t finished yet, but it needs a breather and that is what the slight consolidation of Salesforce’s stock is telling us.

The weak guidance issued for the following quarter was more than enough reason to take some profits and accumulate more gunpowder for the next big leg up.

I do not believe tempering forecasts is a material negative for the stock and anyone following this great company can wholeheartedly agree that they have resolutely delivered the top line growth promised by audacious founder and Co-CEO of Salesforce Marc Benioff.

Subduing next quarters forecasts could be a management trick to lower the bar that even mediocre performance can surpass.

I fully expect Salesforce to handily beat next quarters' estimates.

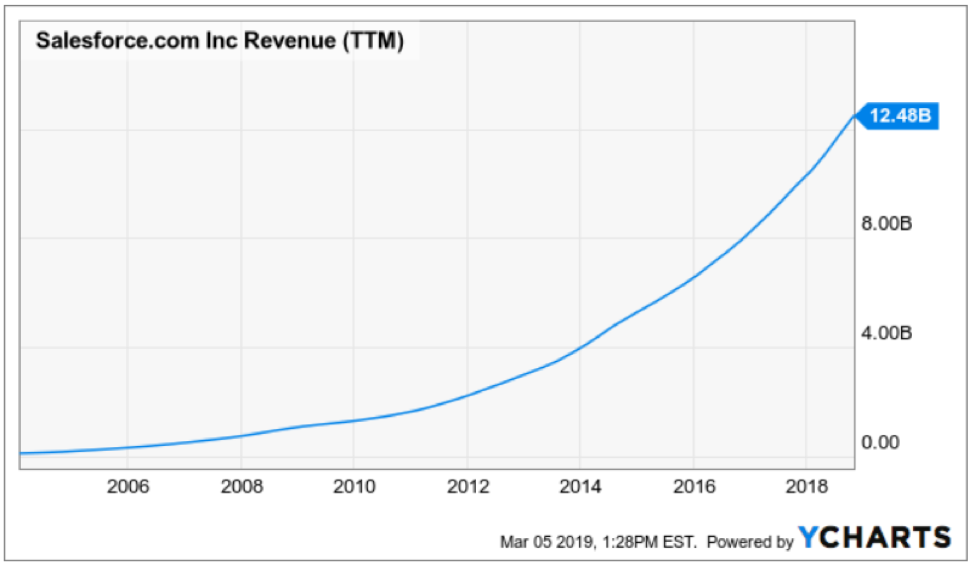

For the full year of 2018, Salesforce racked up more than $13.2 billion in revenue, making Salesforce the fastest enterprise software company ever to eclipse $13 billion.

Salesforce issued a new revenue target for fiscal year 2023 - $26 billion to $28 billion.

The company will need to organically double revenue again in the next 4 years to achieve this feat.

Last quarter experienced a continuation of revenue growth that has made Salesforce one of the leading luminaries of enterprise software industry with revenue in the quarter rising to more than $3.6 billion, up 27% YOY.

They are the 800-pound gorilla in the CRM industry commanding 20% of the overall CRM market according to Edge IDC which adds up to more than the next three competitors combined.

The accolades are impressive for a company that is on the verge of hitting its 20th anniversary and still squarely in uber-growth mode.

The impact of Salesforce is deep, creating a Salesforce economy growing around the firm, and the network effect derived from it is truly breathtaking, one that will deliver at least 3 million additional jobs and more than $850 billion in GDP impact by 2022.

The volume of $20 million and over relationships grew 48% YOY including two 9-figure renewal expansions in the quarter.

Take a look at the finance sector with Barclays as a golden example.

At the World Economic Forum, CEO of Barclays Jes Staley gloated that they had just signed the largest technology agreement in their 300-year history with Salesforce in January.

Salesforce is aiding them in the digital transformation for their 48 million customers, and aim to enhance the digital service offerings to them via the cloud.

I reckon that the volume of $20 million relationships will keep trending higher as Salesforce refine their products for big institutions, as almost every one of them is keen on rapid digital migration that will effectively serve the customer better and put the kibosh on expenses.

Recently raising annual revenue forecasts to around $16.05 billion was inevitable and is not a question of if, but how much earlier than expected can they deliver this overperformance.

It is the first stop on the way to $20 billion in annual sales and if Salesforce can continue to push this narrative of mid-20% top-line growth, shares will climb higher.

The amount of business gravitating towards their CRM interface is demonstrably positive with 96% of media companies from the Fortune 500 Salesforce customers.

This is just the beginning.

The crux of this narrative is that its business model is unrivaled amongst competitors and its strategic position will allow the company to harvest multiyear revenue growth of mid-20% YOY growth as cloud computing is the major recipient of this massive digital transformation.

Salesforce has an enviable position and any weakness in shares is temporary.

The company has forged into a new era of profitability and its scalability allows more and more revenue to drop down to the bottom line.

I believe operating income will accelerate and the company will become even more lucrative with exploding EPS growth just around the corner.

It’s one of the most efficient firms in the world and the 22% spike in new hires will add to the robust growth engine that is known as Salesforce, considering 85% of enterprise customers are in the first innings of full-blown digital transformation.

“You must always be able to predict what's next and then have the flexibility to evolve.” – Said Founder and Co-CEO of Salesforce Marc Benioff

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

March 6, 2018

Fiat Lux

Featured Trade:

(WILL UNICORNS KILL THE BULL MARKET?),

(TSLA), (NFLX), (DB), (DOCU), (EB), (SVMK), (ZUO), (SQ),

(A NOTE ON OPTIONS CALLED AWAY), (TLT)

With stock market volatility greatly elevated and trading volumes through the roof, there is a heightened probability that your short options position gets called away.

I have already gotten calls from holders of the iShares Barclays 20+ Year Treasury Bond Fund (TLT) March 2019 $124-$126 in-the-money vertical BEAR PUT spread who have seen their short March $124 puts called away.

If it does, there is only one thing to do: fall down on your knees and thank your lucky stars. You have just made the maximum possible profit for your position. You just won the lottery, literally.

Most of you have short option positions, although you may not realize it. For when you buy an in-the-money call option spread, it contains two elements: a long call and a short call. The short called can get assigned, or called away at any time.

You have to be careful here because the inexperienced can blow their newfound windfall if they take the wrong action, so here’s how to handle it.

What your broker had done in effect is allow you to get out of your put spread position at the maximum profit point seven days before the March 15 expiration date.

All you have to do was call your broker and instruct him to exercise your long position in your March $126 to close out your short position in the March $124.

Puts are a right to sell shares at a fixed price before a fixed date, and one option contract is exercisable into 100 shares.

Sounds like a good trade to me.

Weird stuff like this happens in the run-up to options expirations.

A call owner may need to sell a long stock position right at the close, and exercising his long March 15 puts is the only way to execute it.

Ordinary shares may not be available in the market, or maybe a limit order didn’t get done by the stock market close.

There are thousands of algorithms out there which may arrive at some twisted logic that the puts need to be exercised.

Many require a rebalancing of hedges at the close every day which can be achieved through option exercises.

And yes, calls even get exercised by accident. There are still a few humans left in this market to blow it.

And here’s another possible outcome in this process.

Your broker will call you to notify you of an option called away, and then give you the wrong advice on what to do about it.

This generates tons of commissions for the broker but is a terrible thing for the trader to do from a risk point of view, such as generating a loss by the time everything is closed and netted out.

Avarice could have been an explanation here but I think stupidity and poor training and low wages are much more likely.

Brokers have so many ways to steal money legally that they don’t need to resort to the illegal kind.

This exercise process is now fully automated at most brokers but it never hurts to follow up with a phone call if you get an exercise notice. Mistakes do happen.

Some may also send you a link to a video of what to do about all this.

If any of you are the slightest bit worried or confused by all of this, come out of your position RIGHT NOW at a small profit! You should never be worried or confused about any position tying up YOUR money.

Professionals do these things all day long and exercises become second nature, just another cost of doing business.

If you do this long enough, eventually you get hit. I bet you don’t.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to the six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Mad Hedge Hot Tips

March 5, 2019

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) China Cuts Growth Forecast, from 6.5% to 6.0% GDP growth for 2019. The trade war with the US and the stimulus haven’t kicked in yet. The last time they did this, the market fell 1,000 points. Buy (FXI) on the dip. Click here.

2) ISM Non-Manufacturing Index Pops in February from 57.2 estimated to 59.7. Another rare positive data point for the economy. Services are still alive while manufacturing is dying. Buy tech, sell industrials. Click here.

3) New Homes Sales Bounce in December, up only 3.7% to an annual 621,000 rate after a horrific November. If you can’t sell a home with rates this low, you never will. Avoid homebuilders. Click here.

4) Trump Starts New Trade War Against India, eliminating $5.7 billion in import exemptions. You’re going to have to start paying more for those cheap clothes. Click here.

5) The US Dollar is Driving All Trades Right Now, and has been rising. Buy tech, avoid commodities for at least a few days. But without rising rates, it’s only a short term play. Click here.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(THE BIPOLAR ECONOMY),

(AAPL), (INTC), (ORCL), (CAT), (IBM),

(TESTIMONIAL)

(MEET THE PREMIER DINOSAUR OF OUR TIME),

(HPQ), (LNVGY), (DVMT), (AAPL)

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.