When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Mad Hedge Technology Letter

June 3, 2019

Fiat Lux

Featured Trade:

(WHY THE UBER IPO FAILED)

(UBER), (LYFT)

Do you want to invest in a company that loses $1 billion per quarter?

If you do, then Uber, the digital ride-sharing company, is the perfect match for you.

Uber couldn’t have chosen a worse time to go public, smack dab in the middle of a trade war almost as if an algorithm squeezed them into tariff headlines that are currently rocking the equity markets.

The tepid price action to Uber’s first period of being a public company has been nothing short of disastrous with the company tripping right out of the gate at $42.

The company that Travis Kalanick built would have been better served if they decided to go public in the middle of their growth sweet spot a few years ago.

Hindsight is 20/20.

Uber took in $2.58B last year during the same quarter and they followed that up with 20% growth to $3.1B, hardly suggesting they are delivering on hyper-growth an investor desire.

It will probably become the case of Uber hoping to manage growth deceleration as best as it can.

Infamously, the company has been busy putting out fires because of past poor leadership that threatened to blow up their business model.

The fall out was broad-based and current CEO of Uber Dara Khosrowshahi was brought in to subdue the chaos.

That worked out great in 2017 and damage control nullified further erosion in the company, but since then, management has not carved out an attractive narrative.

Just as bad, investors have no hope on the horizon that Uber can mutate into a profitable company.

It seems that costs could spiral out of control and even though the company is growing, the company is not a growth company anymore.

Investors must look themselves in the mirror and really question why they should invest in this company now.

In the short-term, positive catalysts are scarce.

The reaction to their first earnings report was slightly positive as management indicated that competition is easing up, spinning a negative issue into a positive light.

Remember that Uber bled market share after their management issues that I mentioned and Lyft (LYFT) has caught up significantly.

Lyft has also grappled with poor price action to their stock after they went public.

The result from both companies going private to public around the same time means that they will not be able to undercut each other on price because public investors will not give the same type of leash that private investors did.

This will cause losses to cauterize because subsidizing drivers will decelerate, and the pool of drivers will shrink.

In addition, passenger fares could rise because Uber will have no choice but to consider profitability when pricing rides meaning higher costs to the user.

What I am saying rings true for many tech companies and raising prices to satisfy shareholders is not a groundbreaking phenomenon.

As I see it, offering rides on the cheap could be coming to a screeching halt and nurturing margins could be the new order of the day.

The subsidizing effect can be found in the higher than normal gross bookings for the quarter of $14.65 billion, up 34% from the same period in 2018.

Cheaper fares will drive demand, and if Uber stopped helping out with the cost of rides, the 34% would fall to single digits in a heartbeat.

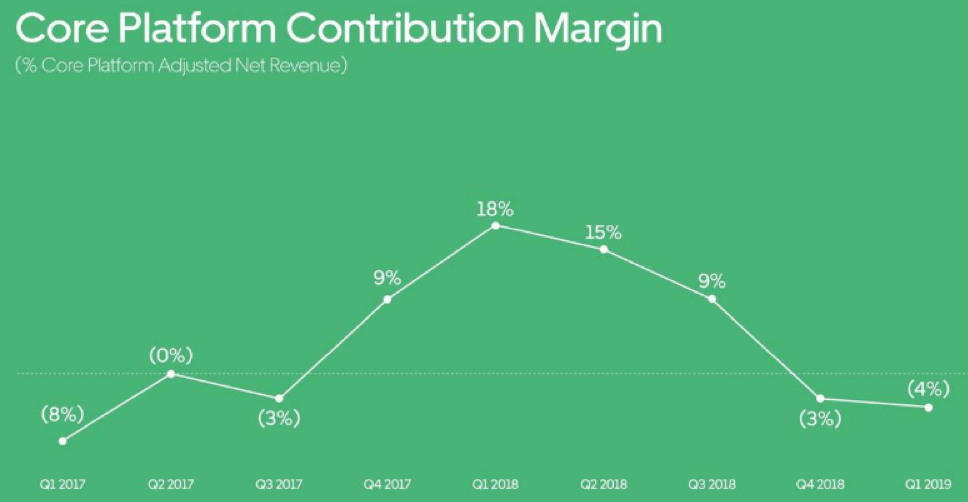

Even more worrying is the negative core platform contribution margin falling 4.5%, meaning the amount of profit it makes from its core platform business divided by adjusted net revenue is on the down.

Uber was able to post a positive 17.9% growth rate during the same period last year.

When the core business is reacting negatively, it’s time to go back to the drawing board.

I believe that the underlying problem with Uber is that they aren’t making any big moves to their business model that would put them in the position to foster hyper-growth.

Incremental changes like removing drivers who fail to collect a 4.6 or above rating and creating a subscription model for its higher growth Uber Eats division are just a drop in the bucket of what they could be doing with its brand and clout.

If investors were waiting for a big step forward with shiny announcements during the first earnings call as a public company, then they were left thirsting for more.

Uber gave us a mini baby step when they need leaps in 2019.

The bigger success might be that Uber had no monumental blow ups which is a telling sign that Uber has at least stabilized operations.

The downside with its food delivery business is that private businesses such as Postmates and DoorDash are private and can still tolerate even bigger losses which will put pressure on Uber Eats to endure the same type of losses.

As it stands, net revenue for its Uber Eats segment rose 31% to $239 million, but then investors must understand this business is scarily exposed and could be attacked by the venture capitalists boding ill for the stock.

Then considering that Uber’s fastest growing geographical segment is Latin America, last quarter was nothing short of abysmal with revenue cratering by 13% to $450 million.

Regulatory risks will cause American companies to take big write-downs the further away they operate from America, and Indian regulation is rearing its ugly head with e-commerce companies bearing the brunt of it.

Looking down the road, Uber has a faulty business model because of a lack of autonomous driving technology, and they will need to partner with a Waymo or Tesla which will destroy margins even more.

Uber has no chance of profitability in the near term, and the data suggests they have lost their growth charm.

Do not buy Uber here, it will become cheaper, and at some point, around $30, this name will be a good trade.

Management needs to up the ante in order to show investors why they are better than Lyft.

“Based on my experience, I would say that rather than taking lessons in how to become an entrepreneur, you should jump into the pool and start swimming.” – Said Co-Founder and Former CEO of Uber Travis Kalanick

Global Market Comments

June 3, 2019

Fiat Lux

Featured Trade:

(MONDAY, JUNE 24 MELBOURNE, AUSTRALIA STRATEGY LUNCHEON)

(MARKET OUTLOOK FOR THE WEEK AHEAD, OR WHAT A WASTE OF TIME!),

(SPY), ($INDU), (JPM), (MSFT), (AMZN), (TSLA)

Come join me for lunch at the Mad Hedge Fund Trader’s Global Strategy Update which I will be conducting in Melbourne, Australia on Monday, June 24, 2019 at 1:15 PM.

An excellent meal will be followed by a wide-ranging discussion and an extended question-and-answer period.

I’ll be giving you my up to date view on stocks, bonds, currencies commodities, precious metals, energy, and real estate.

I also hope to provide some insight into America’s opaque and confusing political system. And to keep you in suspense, I’ll be throwing a few surprises out there too.

Tickets are available for $232.

I’ll be arriving at 1:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a downtown five-star hotel, the details of which will be emailed with your purchase confirmation.

I look forward to meeting you and thank you for supporting my research.

To purchase tickets for this luncheon, please click here.

“Sell in May and go away” has long suffered from the slings and arrows of non-believers, naysayers, and debunkers.

Not this time.

Looking at the trading since April 30, we have barely seen an up day. Since then, the Dow Average has plunged 1,900 points from a 26,700 high, a loss of 7.1%. We are now sitting right at my initial downside target of the 200-day moving average.

The Dow has now given up virtually all its 2019 gains, picking up only 2.0%. In fact, the market is dead unchanged since the end of 2017. If you have been an index investor for the past 17 months, your return has been about zero. In other words, it has been a complete waste of time.

There are a lot of things I would have preferred to do rather than invest in index funds for the past year and a half. I could have hiked the Pacific Crest Trail….twice. I might have taken six Cunard round-the-world cruises and met several rich widows along the way. I might even have become fluent in Italian and Latin. Such is the value of 20-20 hindsight.

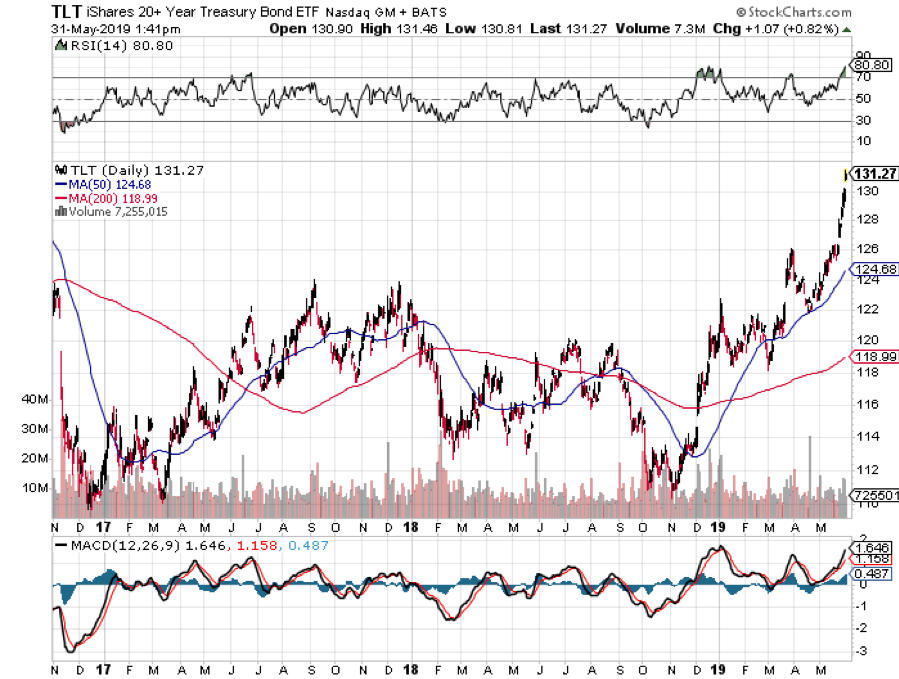

You would have done much better investing in the bond market, which has exploded to a new two-year high, taking the ten-year US Treasury yield down to a once unimaginable 2.16%. During the same period, the (TLT) has gained 11 points, or 9.0% plus another 3.0% worth of interest. You did even better if you invested in lower grade credits.

Which leads us to the big question: Will stocks bottom out here, or are we in for a full-on retrace to the December lows?

Unfortunately, recent events have conspired to point to the latter.

The United States has now declared trade wars against all neighbors and allies around the world: China, Mexico, Europe, and Canada. On Friday, it announced 25% punitive tariffs against Mexico before NAFTA 2.0 was even ratified before Congress, thus rendering it meaningless. Businesses are dropping like flies.

As a result, GDP forecasts have been falling off a cliff, down from 3.2% in Q1 to under 1% for Q2. The administration’s economic policy seems to be a pain now, and more pain later. It is absolutely not what stock investors want to hear.

If you are a business owner now, what do you do with the global supply chain being put through a ringer? Sit as firmly on your hands as possible and do nothing, waiting for either the policy or the administration to change. Stock investors don’t want to hear this either. The fact that stock markets entered this cluster historically expensively is the fat on the fire.

Having hummed the bear national anthem, I would like to point out that stocks could rally from here. We enter a new month on Monday. There will be plenty of opportunities to make amends and the G-20 meeting which starts on June 20. This should provide a backdrop for a rally of at least one-third of the recent losses, or about 600 points.

But quite honestly, if that happens, I’ll be a seller. The economy is doing the best impression of going down the toilet that I can recall, and that includes 2008. Only this time, all the injuries are self-inflicted.

As the trade war ramped up, China moved to ban FedEx (FDX) and restrict rare earth exports (REMX) to the US essential for all electronics manufacture. Most modern weapons systems can’t be built without rare earths. The big question in investors' minds becomes “Is Apple next?”

The OECD cut its global growth forecast from 3.9% to 3.1% for 2019 because of you know what. Stock markets are now down for their sixth week as the 200-day moving average comes within striking distance.

There was more bad news for real estate with April Pending Home Sales down 1.5%. If rates this low can’t help it, nothing will. Where are those SALT deductions?

The bear market in home prices continued in March with the Case Shiller CoreLogic National Home Price Index showing a 3.7% annual price gain, down 0.2%. Home price in San Francisco is posting negative numbers. When will those low-interest rates kick in?

The bond market says the recession is already here with ten-year interest rates at 2.16%, a new 2019 low. German bunds hit negative -0.21%. JP Morgan (JPM) CEO Jamie Diamond says the trade war could cause real damage to the US economy.

US Capital Goods fell out of bed in April, down 0.9%, in another important pre-recession indicator. No company with sentient management wants to expand capacity ahead of an economic slowdown.

Despite all the violence and negativity, the Mad Hedge Fund Trader managed to crawl to new all-time highs last week, thanks to some very conservative positioning on the long side in the right names.

Those would include Microsoft (MSFT), Amazon (AMZN), and Tesla (TSLA). All of these names were down on the week, but the vertical bull call spreads were up. You see, there is a method to my madness!

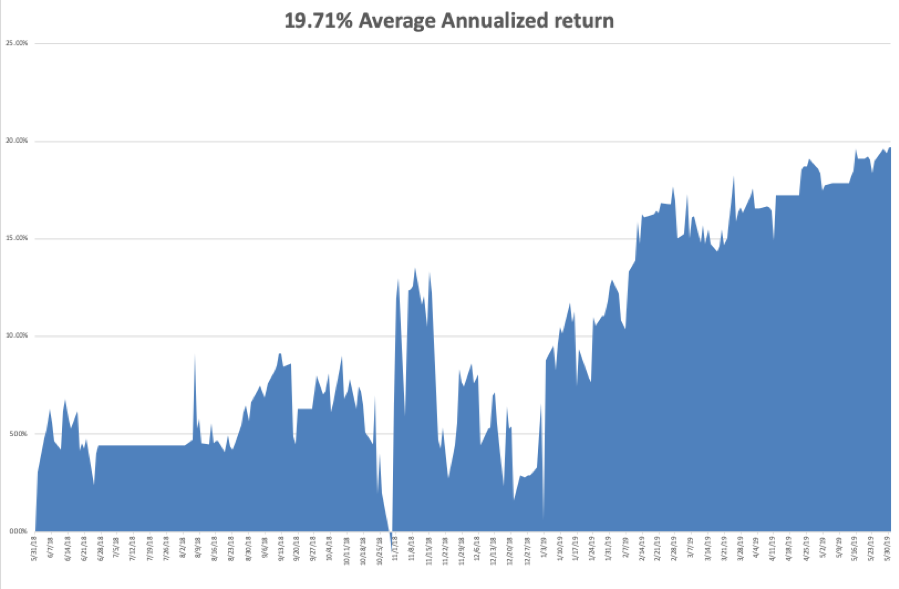

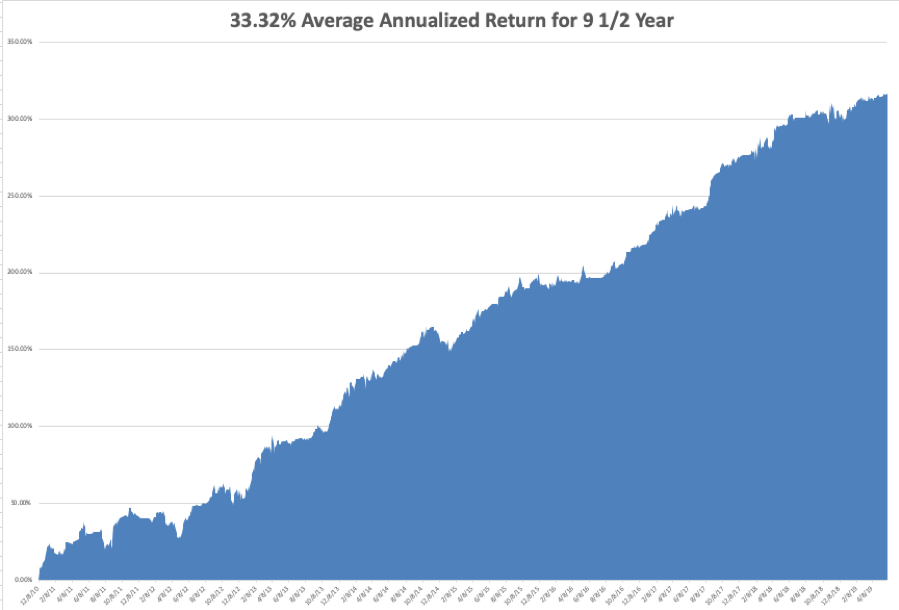

Global Trading Dispatch closed the week up 16.30% year-to-date and is up 0.51% so far in May. My trailing one-year declined to +19.71%.

The Mad Hedge Technology Letter did fine, making money on longs in Microsoft (MSFT) and Amazon (AMZN). Some 10 out of 13 Mad Hedge Technology Letter round trips have been profitable this year.

My nine and a half year profit jumped to +316.55%. The average annualized return popped to +33.32%. With the trade war with China raging, I am now 70% in cash with Global Trading Dispatch and 80% cash in the Mad Hedge Tech Letter.

I’ll wait until the markets enjoy a brief short-covering rally before adding any short positions to hedge my longs.

The coming week will be a big one with the trifecta of big jobs reports.

On Monday, June 3 at 7:00 AM, the May US Manufacturing PMI is out.

On Tuesday, June 4, 9:00 AM EST, the April US Factory Orders are published.

On Wednesday, June 5 at 5:15 AM, the May US ADP Employment Report of private hiring trends is released.

On Thursday, June 6 at 5:30 AM, the April US Balance of Trade is printed. At 8:30 Weekly Jobless Claims are published.

On Friday, June 7 at 8:30 AM, we learn the May Nonfarm Payroll Report is announced which lately has been incredibly volatile.

As for me, I am going to be leading the local Boy Scout troop on a 20-mile hike with a 2,500-foot vertical climb in the Oakland Hills. Hey, you never know when Uncle Sam is going to come calling again. I need to stay boot camp-ready at all times.

At least I can still outpace the eleven-year-olds. I’ll be leaving my 60-pound pack in the garage so it should be a piece of cake.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.