When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

August 12, 2019

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or

(CYB), (FXE), (TLT), (FXY), (COPX), (USO),

(GLD), (VIX), (FXB), (IWM0, (DIS), (CRB), (FB)

(A COW BASED ECONOMICS LESSON)

So, this is what the best trading week looks like.

Investors panicked. The hot money fled in droves. Predictions of escalating trade wars, recessions, and depressions abounded.

The bottom line for followers of the Mad Hedge Fund Trader? We picked up 4.4% on the week, as may make as much next week.

A number of trading nostrums were re-proven once again. That which can’t continue, won’t. When too many people gather on one side of the canoe, it will capsize. If you execute a trade and then throw up on your shoes, you know it will be a good one. I could go on and on.

The week also highlighted another trend. That is the market has become a one-trick pony. The focus of the market is overwhelmingly on technology, the only sector that can promise double digit growth for years to come. And it’s not just technology, but a handful of large cap companies. Investing has become a matter of technology on, or technology off.

This is always how bull markets end, be it the Nifty 50 of the early 1970s, Japanese stocks of the late 1980s, or the Dotcom Bubble of the 1990s.

It was a week that ran off fast forward every day.

China retaliated against the US in the trade war and stocks dove 900 points intraday. The Middle Kingdom imposed a total ban on all US agricultural imports and took the Yuan (CYB) down to a decade low to offset tariffs.

All financial markets and asset classes are now flashing recession and bear market warnings. The Mad Hedge Market Timing Index fell from 70 to 22, the steepest drop in recent memory. The US dollar dropped sharply against the Euro (FXE) and the Japanese yen (FXY). Oil (USO) went into free fall. Copper (COPX) collapsed to a new low for the year.

The New York Fed lowered its Q3 GDP growth to a lowly 1.56%, with the Atlanta Fed pegging 1.9%. Payrolls, orders, import/export prices, and trade are shrinking across the board, all accelerated by the ramp up in the trade war. Manufacturing and retailing are going down the toilet. Sow the wind, reap the whirlwind.

The German economy (EWG) is in free fall, as most analysts expect a negative -0.1% GDP figure for Q2. The fatherland is on the brink of a recession which will certainly spill into the US. That Mercedes Benz AMG S class you’ve been eyeing is about to go on sale. Great Britain (FXB) is already there, with a Brexit-induced negative -0.2% for the quarter.

Some 50% of S&P 500 dividends now yield more than US Treasury bonds. At some point, that makes equities a screaming “BUY” in this yield-starved world, but not quite yet. Is TINA (there is no alternative to stocks) dead, or is she just on vacation?

Ten-year US Treasury bonds (TLT) hit 1.61%, down an incredible 50 basis point in three weeks. Zero rates are within range by next year. The problem is that if the US goes into the next recession at zero interest rates, there is no way to get out. A decades-long Japanese style Great Depression could ensue.

Bond giant PIMCO too says zero interest rates are coming to the US. Too bad they are six months late from my call. It’s all a matter of the US coming into line with the rest of the world. The global cash and profit glut has nowhere else to go but the US. Much of the buying is coming from abroad.

Gold (GLD) hit a six-year high, as a rolling stock market panics drive investors into “RISK OFF” trades and downside hedges. While high interest rates are the enemy of the barbarous relic, low rates are its best friend and negative rates are even better. We are rapidly approaching century lows on a global basis.

Do your Christmas shopping early this year, except do it at the jewelry store and for your portfolio. Above $1,500 an ounce gold is beating stocks this year and the old all-time high of $1,927 is in the cards.

As I expected, August is proving to be the best short selling opportunity of the year. Not only can we make money in falling markets, elevated volatility means we can get into long side plays at spectacularly low levels as well.

With the Volatility Index (VIX) over $20, it is almost impossible to lose money on option spreads. The trick was to get positions off while markets were falling so fast.

The week started out with a rude awakening, my short in the US Treasury Bond Fund rising 1 ½ points at the opening. I covered that for a tear-jerking 3.26% loss, my biggest of the year. But I also knew that making money had suddenly become like falling off a log.

I fortuitously covered all of my short positions in the S&P 500 (SPY) and the Russell 2000 (IWM) right when the Dow average was plumbing depths 2,000-2,200 points lower than the highs of only two weeks ago. Then I went aggressively long technology with very short dated August plays in Walt Disney (DIS), Salesforce (CRM), and Facebook (FB).

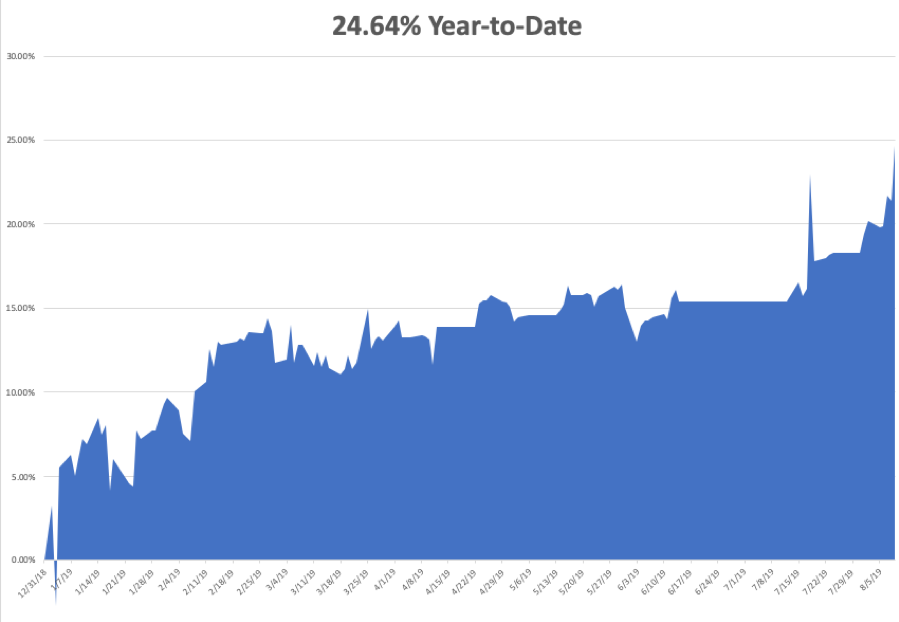

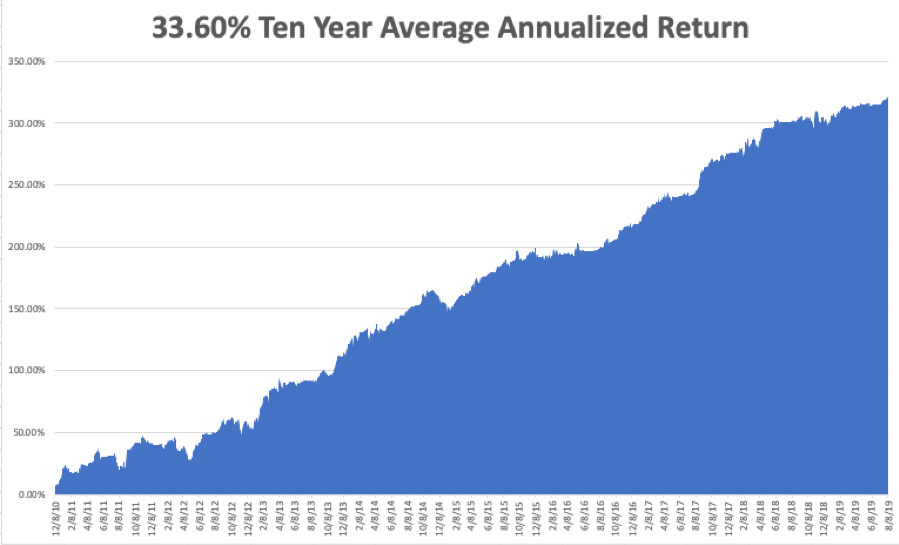

My Global Trading Dispatch has hit a new all-time high of 324.78% and my year-to-date shot up to +24.68%. My ten-year average annualized profit bobbed up to +33.60%.

I coined a blockbuster 6.31% so far in August. In a mere three weeks I shot out 12 Trade Alerts, 11 of which made money, bringing in a 10% profit net of the one-bond loss. All of you people who just subscribed in June and July are looking like geniuses.

The coming week will be a snore on the data front. Believe it or not, it could be quiet.

On Monday, August 12 at 11:00 AM EST, the Consumer Inflation Expectations for July are released.

On Tuesday, August 13 at 8:30 AM US Core Inflation for July is published.

On Wednesday, August 14, at 10:30 the IEA Crude Oil Stocks are announced for the previous week.

On Thursday, August 15 at 8:30 AM EST, the Weekly Jobless Claims are printed. At 9:15 we learn July Industrial Production.

On Friday, August 16 at 8:30 AM, the July Housing Starts are out.

The Baker Hughes Rig Count follows at 2:00 PM.

As for me, I’ll be headed to the Land’s End Music Festival in San Francisco this weekend and listen to many of the local rock groups. Hopefully, I will be able to unwind from the stress and volatility of the week.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

You Need Special Glasses to Understand This Market

Mad Hedge Technology Letter

August 12, 2019

Fiat Lux

Featured Trade:

(UNSTOPPABLE ROKU)

(ROKU)

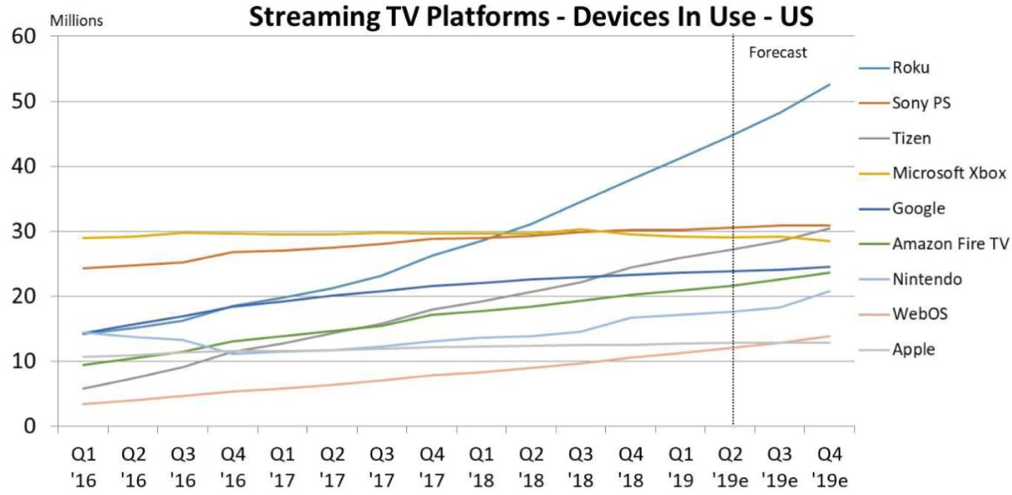

Roku has been unleashed.

To be honest, I was worried when it dipped all the way down to $25 last year because it was a stock that was prime for liftoff.

Liftoff has happened but a little later than I first surmised.

Roku had a blowout quarter crushing estimates with expanding their pie 59% year-over-year to $250 million scorching consensus estimates of $224 million.

The outperformance doesn’t stop there with the company rapidly adding users to 30.5 million active users during the quarter, up 39% year-over-year.

The monetization side showed the same outperformance with average revenue per user (ARPU) up to $21.06, up $2.00 year-over-year.

For all the doubters out there, who dismissed the potential of Roku because they weren’t part of an Amazon, Google, Facebook, or Apple group, then you were wrong.

What we have seen in the past year is the potential transforming in real-time into high octane outperformance.

The x-factor that put the company’s business model over the edge was the “onslaught” of new streaming assets coming online this year and in 2020 from Disney, NBCUniversal, and HBO.

Recent surveys suggest that Amazon’s Fire TVs haven’t been able to keep up with Roku.

And as Disney and NBC roll out gleaming new streaming assets, Roku will be able to do what is does best – sell digital ads.

Roku being independent doesn’t care who streams what because selling ads can be sold on any streaming program.

This makes me believe that Roku is in a better position not being a Fang because of a lack of conflict of interest.

For example, Google and Amazon have skirmished about different crossover partnerships such as YouTube on the Amazon Kindle and so on.

They plainly don’t want to help each other

Part of the DNA of these big tech companies is bringing each other down.

In my mind, Roku has definitely benefited from the first-mover advantage and have perfected selling digital ads over over-the-top (OTT) boxes.

It just so happens that Roku has prepared itself to extract maximum profits from the intersection of integrating online streaming assets and the consumer quitting analog cable.

The timing couldn’t have been better if they tried.

In its infancy, Roku’s revenue was reliant on selling the physical hardware, but that revenue has trailed off at the perfect time because of the explosion of digital ad growth in the industry boosting its other business.

Perhaps even more impressive is the loss of 8 cents last quarter when the company was expected to lose 22 cents.

This signals to investors that profitability is just around the corner for Roku and after years of burning cash, they are finally ready to turn the page and start a new chapter in the history of Roku.

Roku bottomed out at $25 and is now trading over $125, an extraordinary feat and one of the stories of the tech industry in 2019.

I wouldn’t chase the stock here, but I will say the momentum is palpable and Roku will end the year higher than where it is now.

It’s a great stock with an even more compelling story and about to harvest and monetize the new streaming assets that are coming through the pipeline.

“I believe this artificial intelligence is going to be our partner. If we misuse it, it will be a risk. If we use it right, it can be our partner.” – Said CEO of Softbank Masayoshi Son

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.