When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

September 4, 2019

Fiat Lux

Featured Trade:

(HOW FREE ENERGY WILL POWER THE COMING ROARING TWENTIES),

(SPWR), (TSLA)

(ARE YOU IN THE 1%?),

(SNE), (HMC), (TLT)

I have been in the much-talked-about and often despised 1% for most of my adult life.

I started my relentless march towards wealth and financial independence when I was 11 years old and landed a job delivering newspapers for the Los Angeles Herald Examiner, an old Hearst rag, earning $30 a month.

I’ll never forget the weight of 30 pounds of newsprint on my shoulders as I delivered them around my neighborhood in the dark on my Schwinn bicycle.

I eventually got fired because I found the stock pages so enthralling that I was always late delivering the papers. The Herald was run out of business by the Los Angeles Times in 1989.

My next step towards success came with a job in the snack bar at the May Company, a Los Angeles department store that also no longer exists, earning the untold sum of $1 an hour, then the minimum wage.

The really smart thing I did there was that whenever a customer paid for a hot dog with a 40% pure Kennedy silver half dollar, which in 1967 was still in widespread circulation, I would switch it for paper money.

Eventually, I accumulated 100 of these half dollars.

At age 15, I was willing to bet that someday the US would go off the gold standard and all precious metals would rise in value.

President Nixon did exactly that in 1971, and the value of my stash rose 100-fold to $5,000.

I still have those silver half dollars. I understand that Texas hedge fund manager Kyle Bass owns the rest.

I finally made it into the 1% when I was 33, after spending two years at Morgan Stanley. By then, my pay there had rocketed from an entry level $45,000 to $300,000 a year.

It helped that I won the betting pool for picking the best performing stock in the world two years running.

Back then, nobody had ever heard of an obscure electronics company in Japan called Sony (SNE) which rose in value 85-fold in dollar terms over the following seven years.

Nor had they heard of Honda Motors (HMC). When the other traders saw their little eggshell shaped cars for the first time, they laughed.

The pitiful vehicles had to make a high-speed run to make it to the top of an American freeway onramp. Its shares rose 45 times in dollar terms.

This was back when $300,000 could buy you a luxury two-bedroom condo on the 34th floor on the upper east side of Manhattan. That is exactly what I did, right next door to corporate raider Carl Icahn, and across the street from Henry Kissinger and Ginger Rogers.

A London mansion followed, located between other homes owned by Jacob Rothschild and Sir Richard Branson.

After a few more years at Morgan Stanley, and then founding the first-ever dedicated international hedge fund, I soon found myself in the much-vaunted 1/10th of the top 1% of American earners.

I stayed there for quite a while.

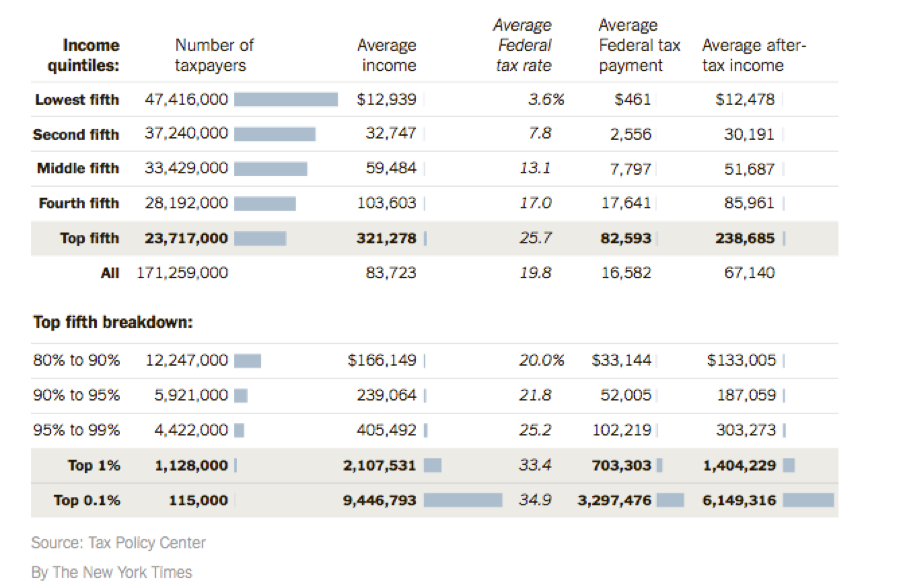

However, I recently got the bad news from the New York Times that I have been kicked out of the top tier.

According to their research, to prove I have grabbed the brass ring, I have to have an average annual income of $9,446,793. Only 115,000 taxpayers can meet this elevated standard.

I am still in the top 1%, where I only need to earn $2,107,531 to qualify and can remain with my 1,128,000 friends.

My Brioni suits, Turnbull & Asser Sea Island Silk shirts, and Bruno Magli shoes will not be found for sale on eBay anytime soon.

Which left me to ponder why I had lost my position at the apex of US earning power.

It turns out that the concentration of wealth at the top has vastly accelerated since the stock market bottomed in March 2009.

Risk takers, like those who owned stocks, bonds, and real estate, were tremendously rewarded by the recovery of asset prices.

Those who don’t own any assets, about 40% of the country, were left behind in the dust.

So, the low tax leveraged longs, like those running big hedge and private equity funds, started to greatly outpace my own earning power.

Concentrating so much wealth at the top is a problem for the United States. As any financial advisor can tell you, the richer people become, the more conservative they get with their investments.

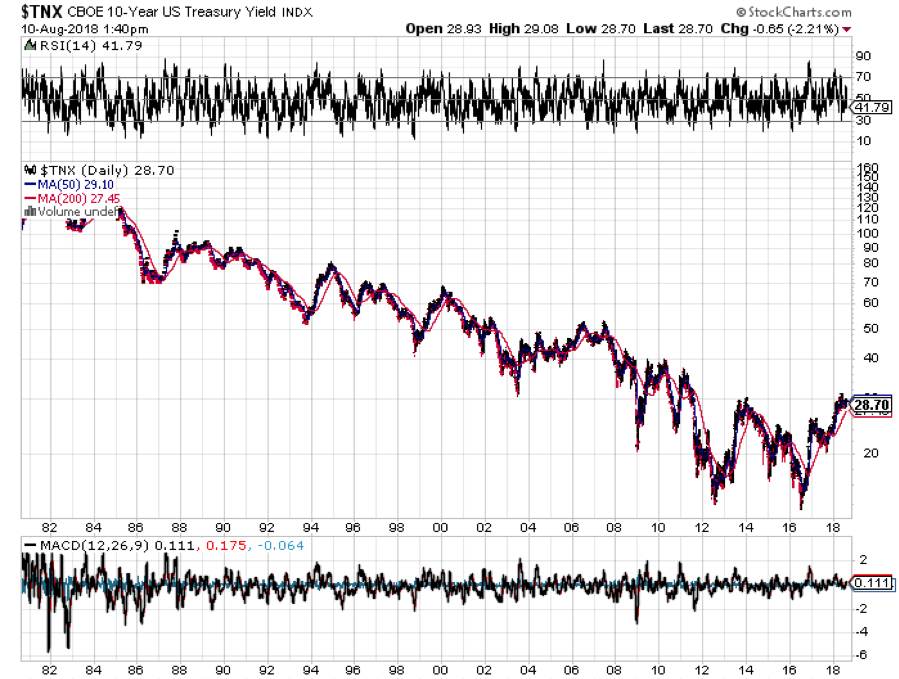

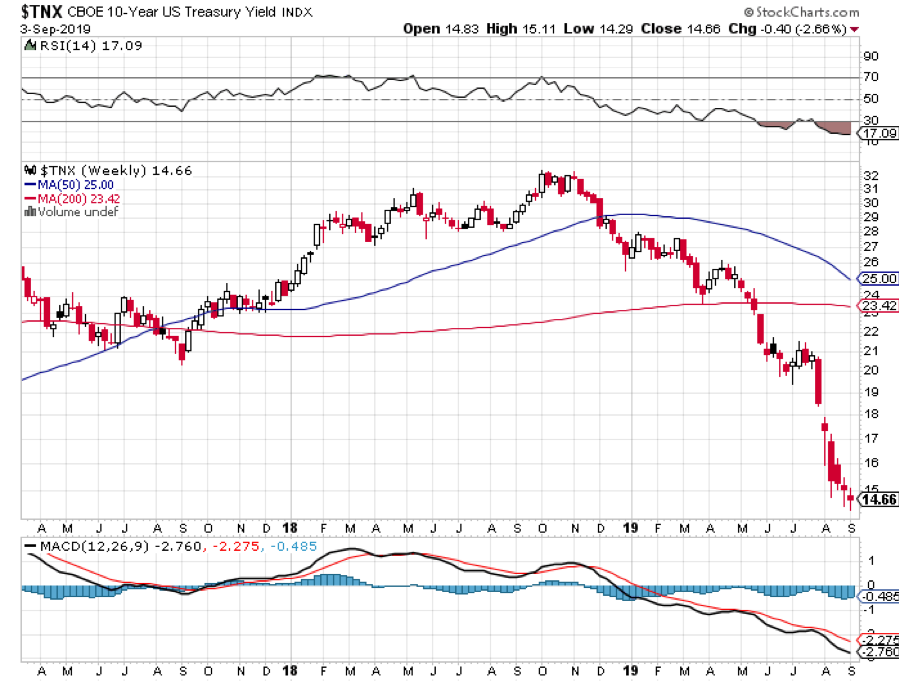

Eventually, it all ends up in the bond market, where positions are never sold to avoid paying taxes. In other words, it stagnates and is one of the causes of our present low 2.5% GDP growth rate.

It is also where the 1.46% ten-year Treasury bond (TLT) comes from.

It is usually NOT placed with higher risk, job-creating, equity type investments. For more on this, click here for “The Bond Market and the 1%”.

This always happens when you have a big bulge generation retire all at once, like the 85 million baby boomers.

Another reason I lost my guarantee of the best table in every restaurant I walk into is that I am paying a lot more in taxes than I used to.

This is because I shifted careers from the hedge fund business, where I paid a bargain 15% tax rate on my realized carried interest, to the newsletter game where I am tagged for a heart-rending 43.4%, including the Obamacare add on.

As a result, I pay more in taxes in a single year than most people earn in a lifetime. In other words, for the first time in my life, I am paying taxes like everyone else.

Ouch, and double ouch!

Want to know why I am so interested in what happens in Washington? BECAUSE IT’S MY MONEY THEY’RE SPENDING!

It is also why I have come to learn so much about our arcane and abstruse tax system, and how I am able to periodically pass on insights to you.

I have to pay my accountants tens of thousands of dollars to ferret this stuff out, for your benefit.

When I had dinner with former Federal Reserve Chairman Ben Bernanke, he told me that “rising income inequality is the biggest structural problem we face.”

To find out where you stand in the country’s multi-tiered income structure, I have reproduced the New York Times data below.

Who has seen the greatest accumulation of wealth since the 2009 low? The Koch Brothers, whose combined net worth has soared from $26 billion to $90 billion since then.

Go Figure.

For one more piece on the 1%, please click here for “Mixing With the 1% at Pebble Beach”.

These days, I get to download my papers on my iPad every morning no matter where I am in the world, which then update themselves throughout the day.

I now get up even earlier than when I delivered the papers by bike.

Come to think of it, that “Horatio Alger Effect” that Ben Bernanke mentioned to me over dinner the other day applies to me as well.

I bet it has worked for a lot of you too.

Being a Hedge Fund Manager Did Have Its Advantages

Mad Hedge Technology Letter

September 4, 2019

Fiat Lux

Featured Trade:

(HERE’S YOUR NEXT GENERATION SEMICONDUCTOR)

(USHIO)

Transistor capacity has always put the kibosh on semiconductor chip performance.

Chipmakers have for decades drained investment into a revolutionary new Japanese technique to push the limits of physics and cram more transistors onto pieces of silicon.

A secretive Japanese company that mastered the skill of manipulating light for applications is about to go mainstream with cutting edge technology.

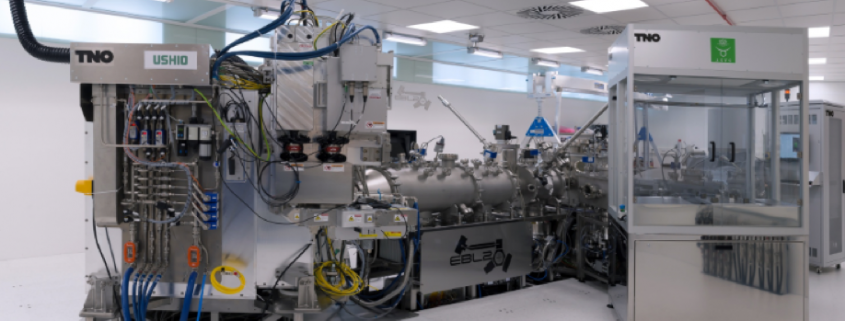

Ushio Inc. announced it had achieved the once thought impossible task of refining powerful, ultra-precise lights needed to test chip designs based on extreme ultraviolet lithography (EUV), a process through which the next generation of semiconductors will be made.

The milestone means that the Japanese company will become a prominent player in future chipmaking and technology that harnesses it.

“The infrastructure is now mostly ready,” said CEO Koji Naito in an interview.

Testing equipment was primarily holding back EUV but with that hold-up dealt with, production efficiency and yields can finally go up setting the stage for electronic manufacturers with the possibilities of producing substantially better consumer products.

The Tokyo-based company developed a light source for equipment used to test what are known as masks: glass squares slightly bigger than a CD case that act as a stencil for chip designs. These templates must be picture-perfect, even a minute of malfunction in one of them can render every chip in a large batch unfit.

That’s where Ushio seamlessly slots in.

Its technology operates lasers to vaporize liquid tin into plasma and produce light closer in wavelength to X-rays than the spectrum visible to the human eye.

That light aids chipmakers in detecting errors in the product.

This process takes a room-sized machine that looks like a sci-fi death ray and requires a phalanx of workers to operate.

After 15 years of industrious development, the EUV business will generate profits next year.

Only Intel Corp., Samsung Electronics Co., and Taiwan Semiconductor Manufacturing Co. desire to go smaller than the 7-nanometer processes that are the current status quo of CPU design.

The focus on niche areas and creating things that others can’t is set to pay off for Ushio.

Ushio is poised to seize control of the market for light sources used in testing of patterned EUV masks, there are several boutique tech companies in the Tokyo area that are incessantly focused on high-precision manufacturing.

Ushio dominates lithography lamps used to make liquid crystal displays with 80% market share and controls 95% of the supply of excimer lamps used in silicon wafer cleaning.

Their secret sauce is balancing mass production with craftsmanship.

Materials like quartz glass are arduous to work with and possess peculiar thermal expansion properties from metals like the molybdenum in which they are housed.

Ushio was established in 1964, and it was the first Japanese company to develop and produce halogen lamps.

Starting from 1973, fishermen used its lights to catch squid.

The firm has succeeded in more than tripling its sales over the past 25 years.

The company is now venturing into the use of sodium lamps to nurture plants and using ultraviolet light calibrated to such a precise wavelength to kill bacteria without damaging human skin.

“If you can't make it good, at least make it look good.” – Said Founder of Microsoft Bill Gates

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to the six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.