While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

December 17, 2019

Fiat Lux

Featured Trade:

(WEDNESDAY, FEBRUARY 5 MELBOURNE, AUSTRALIA STRATEGY LUNCHEON)

(THE NEXT COMMODITY SUPER CYCLE HAS ALREADY STARTED)

(COPX), (GLD), (FCX), (BHP), (RIO), (SIL),

(PPLT), (PALL), (GOLD), (ECH), (EWZ), (IDX)

Mad Hedge Biotech & Healthcare Letter

December 17, 2019

Fiat Lux

Featured Trade:

(WHY THE M&A BOOM WILL SPILL INTO 2020),

(BMY), (CELG), (NOVN), (LOXO), (ROG), (ONCE), (MRK), (SAN), (ARQL), (THOR), (AMRN), (GSK), (AMGN), (GILD)

The biotech industry is breaking out, with the sector witnessing tremendous growth in the later part of 2019. With the stocks surging, it looks like the new year is setting up to a strong start that could continue well up into 2020.

Despite the anxiety over the feared government price controls in the drug sector, the early thinking in the biotech world remains optimistic. In fact, the stage seems to be set for even bigger news come 2020. This prediction comes on the heels of the over $7 billion deals closed just this summer alone.

To date, approximately $100 billion total potential value of research and development have been spent by biotech companies since June 2019, with $11 billion paid upfront in cash.

Among those deals, the biggest so far is Bristol-Myers Squibb’s (BMY) $74 billion acquisition of Celgene (CELG). Another massive agreement is Novartis AG’s (NOVN) $9.7 billion acquisition of The Medicines Company (MDCO).

Eli Lilly and Co’s (LLY) $8 billion takeover of rare genetic mutation drug Vitakvi creator, Loxo Oncology (LOXO), also signified notable movements in the industry along with Johnson and Johnson’s (JNJ) $5.8 billion buyout of robotic surgery company Auris Health. Even Roche Holding AG (ROG) is expected to complete its $4.3 billion merger with gene therapy company Spark Therapeutics (ONCE) before the year ends.

Not far behind are Merck and Co’s (MRK) $2.7 billion acquisition of ArQule (ARQL) as well as Sanofi SA’s (SAN) $2.5 billion buyout of clinical-stage DNA base pair treatment company Synthorx Inc (THOR).

The majority of the deals were in the oncology space, with three times as many oncology deals made compared to the number two sector, the neurology sector. To put things in perspective, seven of the top 10 deals made in 2019 involved oncology treatments.

What can we expect in 2020?

A number of drug candidates remain in the pipeline, but one mid-cap biotech company is anticipated to make big bucks next year. The catch? It’ll need the help of a bigger and more established company to make it happen. That is, this promising company has become the most eligible buyout candidate for 2020.

Amarin Corporation (AMRN) has taken center stage when it became the first-ever company to hit positive results for its prescription omega-3 treatment, Vascepa -- a feat that none of the other biotech giants managed to accomplish. Actually, competitor GlaxoSmithKline (GSK) created its own omega-3 treatment, Lovaza, only to have it fail to reach its goal.

Barring any major setback, Vascepa is slated as the next blockbuster treatment in the cardiovascular disease space -- possibly even displacing Pfizer’s (PFE) Lipitor as the king of this segment. In fact, several major healthcare groups like the American Heart Association, American Diabetes Association, the European Society of Cardiology have already endorsed Vascepa as an effective treatment for LDL cholesterol.

The Amarin medication is projected to peak at $4 billion in annual revenues by 2028. Considering that its manufacturer’s reported third-quarter earnings this 2019 is only at $112.4 million, the approval of Vascepa will undoubtedly be a game-changer for its investors.

However, Vascepa’s incredible potential along with the fact that Amarin has no other drug candidate in its pipeline makes the company ripe for a takeover. For one, it’s not financially capable of juggling both the marketing of Vascepa and developing or building a solid pipeline to support its growth. With the omega-3 treatment’s projected blockbuster status, a bigger and more established company could undoubtedly be more fit to help it reach its potential.

Who are the potential suitors?

Three heavyweights have been repeatedly linked to Amarin: Pfizer, Novartis, and Amgen (AMGN). Since all three have a budding cardiovascular unit, it could be anyone’s game.

However, Novartis’ recent acquisition of The Medicines Company makes it the least likely candidate in the list right now. After all, the latter already has a potential blockbuster cholesterol-lowering drug in Inclisiran.

That paves the way for a new suitor in the form of Gilead Sciences (GILD). Just a few weeks ago, Gilead added Vascepa to one of its ongoing trials involving nonalcoholic steatohepatitis. Whether or not this signifies interest in buying out Amarin is anybody’s guess.

Heading into the next year, the biotech sector is expected to welcome the new year with strong fundamentals and great opportunities for outperformance. While the election may bring changes to policies, the ongoing growth and innovation in this industry make it impossible to be excited for what’s in store for the future.

After all, more and more life-extending and even life-saving treatments are getting discovered by the day. Aside from following the developments in the industry, why not use your knowledge to fatten your pocketbook along the way?

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to the six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to the six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

December 16, 2019

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE GOOD NEWS IS OUT)

(FXI), (AAPL), (FXB), (VIX), (USO), (BABA), (NSC), (MSFT), (GOOGL)

After a China trade deal, UK election and a NAFTA 2.0 are announced, what is left to drive the stock market?

That is a very good question and explains why the Dow Average was up only a microscopic 3.33 points on Friday. It had spent much of the day down.

It’s not a pretty picture.

Not only is the market running out of drivers, the economic data is still decelerating, with the GDP running a 1.5% rate, inflation rising, and corporate earnings growth at zero, with earnings multiples at 17-year high.

A Wiley Coyote moment comes to mind.

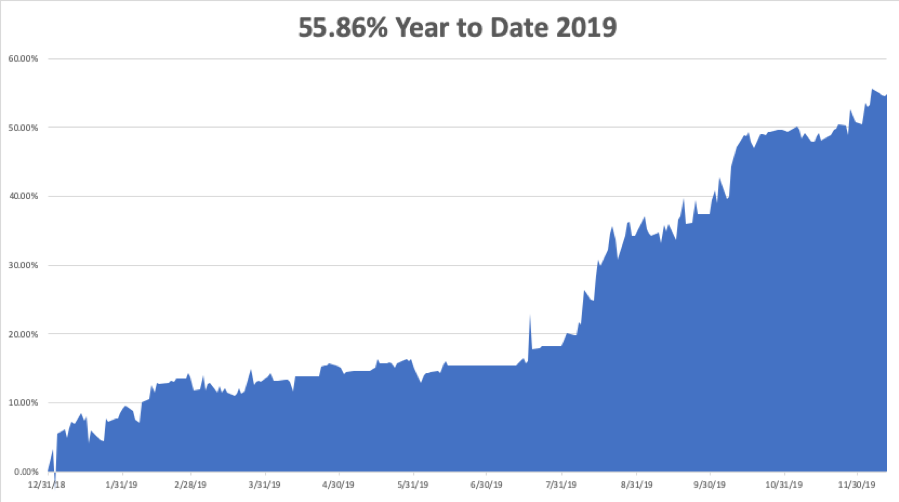

And while we are finishing a great 27% year (56% for the Mad Hedge Fund Trader), we are in effect getting three years of performance packed into one. Not only did we pull forward a good chunk of 2020’s performance, we borrowed heavily from 2018 as well, coming in at such a low start as we did.

Thus 2019 might well get bookended by an 8% gain in 2018 and another 8% year in 2020, with dividends. Blame it all on the massive liquidity burst we got from the Fed that started last December and continues unabated.

Stocks have been floated by a tidal wave of new money creation worldwide. Globally, new money creation is running at a $1 trillion a month rate and much of that is ending up in the US stock market, especially in technology shares.

The rush was enough to drive Apple (AAPL) to a new all-time high at $275, pushing its market capitalization up to a staggering $1.2 trillion. It could surpass Saudi ARAMCO’s $2 trillion valuation in a year or two.

Steve Jobs’ creation now accounts for a mind-blowing 6% of the S&P 500 and 4% of total US stock market capitalization. It’s the best argument I’ve ever heard for becoming a hippy and dropping out of college after one quarter.

Which leads us to paint a picture for the 2020 stock market. Even the most optimistic outlook for next year, that of Ed Yardeni, is calling for only a 10% gain. Many prognostications are calling for negative numbers next year.

You might be better off parking your money in a 2% CD and taking a cruise around the world. I’ve done that before, and it works fantastically well.

You’re only going to have one shot at making money in 2020. Wait for a 10%-20% nosedive to go long. My guess is that happens when it becomes clear that the Democrats are dominating in the polls (Joe Biden is currently 14 points ahead in swing state Pennsylvania). No matter who wins, less borrowing, less spending, and higher taxes will prevail.

Then stocks will rally 10% AFTER the election because the uncertainty is gone. That will get you a 20%-30% profit in 2020, but only of you are a trader and follow the Mad Hedge Fund Trader. After basking in their own brilliance in 2019, 2020 might be a year when indexers wish they never heard of the term.

In the end, corporate earnings growth always wins, especially in tech, which is still growing at 20% a year. Remember, my 2030 forecast for the Dow Average is 125,000.

China (FXI) won big in mini trade deal. We rolled back a tariff increase that was never going to happen and the Chinese buy $50 billion worth of soybeans they were going to buy anyway, except at half the price that prevailed two years ago. All of it will come out of stockpiles built up during the trade war. Only the ag sector is affected, which is 2% of the US economy. The ag markets aren’t buying it. If this were a real trade deal, stocks would be up 1,000 points, not 89.

Conservatives won big in UK election. The British pound (FXB) is up 2% and stocks are soaring. A hard Brexit is coming, so look for Scotland to secede and Northern Ireland to join the Republic. The UK will be gone as we know it. Britain’s standard of living will plummet. Great Britain will no longer be great, and the Russians financed the whole thing.

Volatility crashed, as complacency rules supreme. Don’t buy (VIX) until we see the $11 handle again.

Chinese copper purchases hit a 13-month high, up 12.1% in November, to 483,000 metric tonnes. It explains the 78% move up in Freeport McMoRan (FCX) since October, the world’s largest producer. Obviously, someone believes a trade deal is coming. My long LEAP players love it.

US Consumer inflation expectations rebounded, up 0.1% to 2.5%, accounting to the New York Fed. That’s crawling up from a five-year low, a slightly positive economic note.

Saudi ARAMCO went public, with a 10% pop in the shares on the first two days, providing a $24 billion fund raise. This is one of the top three largest IPOs in history after Alibaba (BABA) and Softbank. It values the company at $1.88 trillion. Oil (USO) is down a dollar on the news, no longer needing artificial support to get the deal done. This could be one of the seminal shorts of our generation.

NAFTA 2.0 was signed, removing a potential negative from the market. It is 90% of the original NAFTA, not the “greatest trade deal in history” as claimed. Buy the main North/South railroad, Norfolk Southern (NSC) on the news.

Weekly Jobless Claims soared to a two-year high, by 49,000 to 252,000. Are stores laying people off from Christmas early this year, or did they never hire in the first place because the retail businesses are gone? Peak jobs are in. US job growth is now far slower than in the Obama era, as is GDP growth.

Most US companies will have fewer staff in 2020, except Mad Hedge Fund Trader. More automation and algos mean fewer humans. Only a capital spending freeze caused by the trade war kept a low of low-skilled people in their jobs.

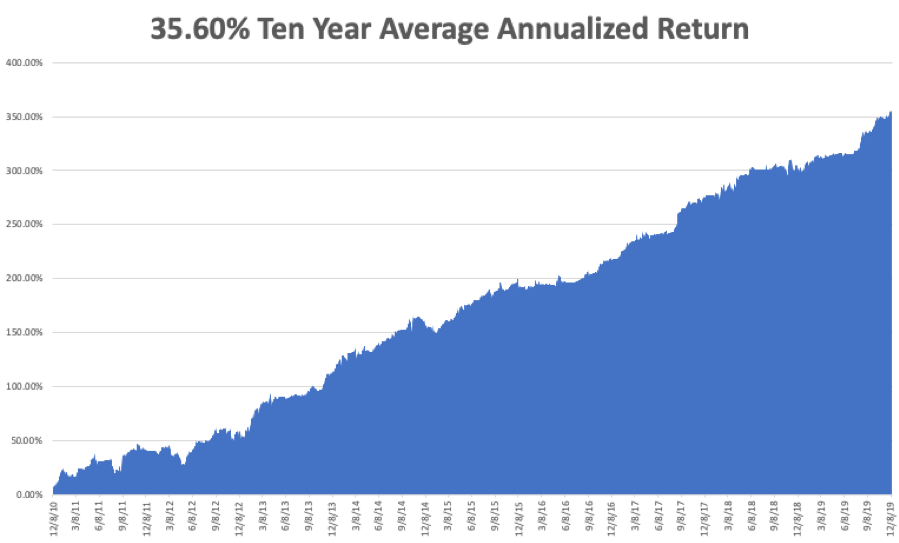

This was a week for the Mad Hedge Trader Alert Service to catapult to new all-time highs.

My long positions have shrunk to my core (MSFT) and (GOOGL), which expire with the coming December 20 option expiration.

My Global Trading Dispatch performance ballooned to +356.00% for the past ten years, a new all-time high. My 2019 year-to-date catapulted back up to +55.86%. December stands at an outstanding +4.85% profit. My ten-year average annualized profit rebounded to +35.59%.

The coming week will be a noneventful one on the data front, with some housing data and the Q3 GDP on the menu. Anyway, everyone else will be out Christmas shopping or attending parties.

On Monday, December 16 at 9:30 AM, New York Empire State Manufacturing Index for December is out.

On Tuesday, December 17 at 9:30 AM, Housing Starts for November are released.

On Wednesday, December 18 at 11:30 AM, US EIA Crude Stocks for the previous week are announced.

On Thursday, December 19 at 8:00 AM Existing Home Sales are published. At 8:30 AM, we get Weekly Jobless Claims.

On Friday, December 20 at 9:30 AM, the final read on US Q3 GDP is printed. The Baker Hughes Rig Count follows at 2:00 PM.

As for me, after blowing out 1,200 Christmas trees, the Boy Scouts will be taking down the tree lot for the year. And who do they turn to when it comes to wielding a chain saw or sledge hammer?

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.