While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to the six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

December 9, 2019

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE MELT-UP CONTINUES),

(SPY), (TLT), (VIX), (FXI)

Mad Hedge Technology Letter

December 9, 2019

Fiat Lux

Featured Trade:

(THE BEYOND MEAT BOMB),

(BYND), (TSN), (KRL), (K), (CAG)

Food tech stock Beyond Meat, Inc. (BYND) went from euphoric to absolute dud when shares surged above $240 at the end of July only to crash.

In general, tech stocks have had a successful year, but the second half of the year has been inordinately unkind to growth stocks and Beyond Meat bore the full brunt of the change in market sentiment.

Let me remind you that I am not saying this is a bad company or a bad stock like Uber (UBER) or Lyft (LYFT).

Hardly so.

Investors can take away many positives from their overarching story and even more so as the stock has come down from the heavens settling in the mid-70’s range.

First, plant-based food is not going away anytime soon and is intertwined with the Millennial ethos of living healthier and protecting the planet.

Nonprofit organization The Good Foods Institute has forecasted that the plant-based food market is valued at more than $4.5 billion in the U.S. and grew 11% year over year.

Plant-based meat rose 10% last year, a substantial decrease of 25% year over year, but industry experts believe there is a significant pipeline of international revenue just waiting there for the taking.

More than one-third have tried at least one plant-based meat product, a low figure, but of those that have tasted, 57% make a repeat purchase.

Internationally, sales are expected to go from a $12.1 billion market in 2019 to a $27.9 billion market by 2025. In 2018, plant-based meat sales comprised 1% of all dollar sales in total retail meat in the U.S. and that number is only going to rise.

Let’s compare it with another successful plant-based product that has matured into a winner – milk.

This market has developed into a $1.86 billion market and plant-based milk is further ahead than the plant-based dairy and meat market.

Fortunately, these juxtaposed markets represent substantially overlap and positive demographic correlation of plant-based milk and meat consumers could mean that plant-based meat companies could achieve a similar rise like the plant-based milk companies experienced.

Domestically, plant-based milk now has a 13% share of the overall retail milk market, exploding by 61% from the years 2012 to 2017 and a further 6% rise in 2018.

If plant-based meat enters into the same trajectory as their cousins’ plant-based milk, grabbing 10% of market share from the overall retail meat market is feasible.

The special sauce that initially propelled the share price to the Himalayan highs of July was the insane growth rate which last quarter came in at 211.5% year-over-year.

The company is also surprisingly profitable eking out a $4.10 million performance last quarter on almost $92 million of quarterly revenue.

But I would like to bring investors back to reality and remind them that the company only does $92 million of revenue per quarter and the one before that a touch above $67 million.

This company is still in its infancy and just because it bursts with life in its formative stages does not mean investors can extrapolate that for years ahead.

What are the headwinds and how far off are they?

The most unstable variable rearing its ugly head is intense competition imminently barreling towards Beyond Meat.

An outsized dosage of competition would take an axe to profit margins with minimal chance of a quick reversal even if Beyond Meat manages to offer an outperforming product.

Beyond Meat is the disruptor and reaped a dividend from the first-mover advantage and the subsequent network effects.

But that doesn’t mean larger companies can’t copy them and that is exactly what is happening as we speak.

The competition is rapidly intensifying, specifically from big box protein processors and packaged food players who plan to undercut Beyond Meat price points using excess capacity and a lower gross margin rate profile.

The companies coming for Beyond’s bacon are Tyson Foods Inc. (TSN), Kellogg Co. (K), Hormel Foods Corp. (HRL), and Conagra Brands Inc. (CAG).

These big players will dump volume onto the plant-based food market and Kroger Co. just announced it would introduce 58 plant-based items under its private label Simple Truth in 2020.

Beyond Meat’s strategic position could suffer if consumers prove less brand loyalty and more price-conscious, then Beyond Meat’s first-mover advantage could dissipate and dynamics could revert closer to commodity industry profit margins.

Investors are laser-like focused if Beyond Meat can maintain gross margins over 35% by layering strategic partnerships with businesses that have a widespread addressable audience base.

If Beyond Meat fails in this respect, the competition will gradually destroy its competitive advantage and tank its share price.

The quality of the product has a large role to play in this too.

Another possible headwind is that Impossible Foods’ Impossible Burger is favored by many taste experts in taste tests diminishing Beyond’s product to the second tier.

But If the company can mimic the taste of a high-quality burger and replicate at least 80% of that experience, the products are likely to stick leading to more investment to capture that last 20% of the taste experience.

It is yet to be determined if Beyond Meat can muscle itself through the gauntlet of rigmaroles, and technically, its overhyped beginnings have given way to a more modest share price as of late.

If the stock enters into the $50 price range, it would be an advantageous price point to scale into this leader of food tech, but I would monitor it closely because the narrative could change on a dime and the story could sour if their strategy begins to fail.

I can tell you that the way to NOT start writing a newsletter is to first swing a 20-pound sledgehammer for three hours. That's what I did this morning helping the Boy Scouts mount 700 trees on rebar stands as part of the annual Christmas tree fundraiser.

Nor is it advisable to start writing a newsletter by hauling 50-pound trees on to car rooftops and tying them down.

However, I am a man of my commitments, so here I am with the aid of a long hot bath and some Epsom salts.

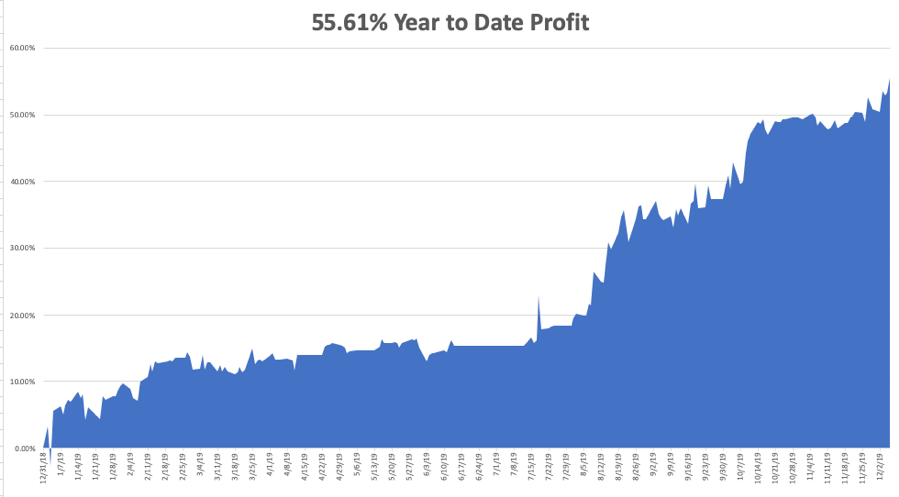

With that said, I have only one number to announce: 55.61%. That is the profit that followers of the Mad Hedge Fund Trader have earned so far in 2019, and I know many of you are up a lot more than that.

All it took for me to achieve a new all-time high was to turn aggressive at the bottom of last week’s 900 selloff in the Dow Average.

With super liquidity flooding the financial system and ultra-low interest rates fanning the flames, I didn’t believe my Mad Hedge Market Timing Index would not fall below 60, where it held.

I also thought that, with so many buyers clamoring to get into the market, no pullbacks would go beyond 3%, which also turned out to be true.

This prompted me to increase my “RISK ON” positions from 20% to 50%, the timing of which turned out to be perfect. That enabled me to coin a breathtaking +4.81% in performance last week, quite a big bite for this normally sedentary time of the year.

A sledgehammer of a different sort was taking to the shorts last week as a robust November Nonfarm Payroll Report sent share flying, up 266,000, a ten-month high. The Headline Unemployment rate dropped to 3.5%.

It was not entirely a rosy report, with 50% of the gains by those 55 and overtaking second jobs at paltry minimum $8-$12 an hour minimum wages to put food on the table during the Christmas season. On the other hand, only 25% of the gains were accounted for my Millennials who now make up 50% of the population.

The other sobering fact is that 100% of America’s economic growth is currently debt-driven. If the government were running a balanced budget as it should at this point in the economic cycle, the country’s GDP growth rate would be zero, and stocks would be in free fall.

As a result, risk in the market is at century highs. The second the government starts to reduce its gargantuan deficit, the stock market will crash.

Trump said the China (FXI) Trade Deal may have to wait until the 2020 election. I told you so. The Volatility Index (VIX) jumped 40% providing a great entry point for one more bite of the apple (AAPL).

Bonds (TLT) soared, opening up one of the best short-selling opportunities of 2019, which I took. The Chinese aren’t going to lift a finger to help Trump get reelected. Farmers are going to have to endure a third year of depression.

The November Nonfarm Payroll blew it away with a 266,000 report, a ten-month high. I’m hiring, that’s for sure. Maybe trade doesn’t matter after all.

China banned US warship visits in response to the US human rights stand on Hong Kong. It’s not exactly a step towards a trade deal, which is why the Dow is diving. The very long overdue correction in the US stock market is starting. Is the marketing finally starting to notice the still weak economic data?

Cyber Monday sales soared by 19% to an all-time record of $9.4 billion. Some 49% of sales were on smartphones, which to me who can bare read one is amazing. The internet was barely functioning on Monday, slowed to a snail’s pace by a glut of business. Now, if I can only get the Victoria’s Secret website to open….

A bigger oil glut looms as OPEC+ went into the Vienna meeting last week. If they don’t cut production substantially, oil prices will crash….again. High prices now are artificially high in front of the Saudi ARAMCO IPO. Avoid all energy plays on pain of death. The end of carbon-based energy forms has begun.

This was a week for the Mad Hedge Trader Alert Service to catapult to new all-time highs.

My long positions have shrunk to my core (MSFT) and (GOOGL).

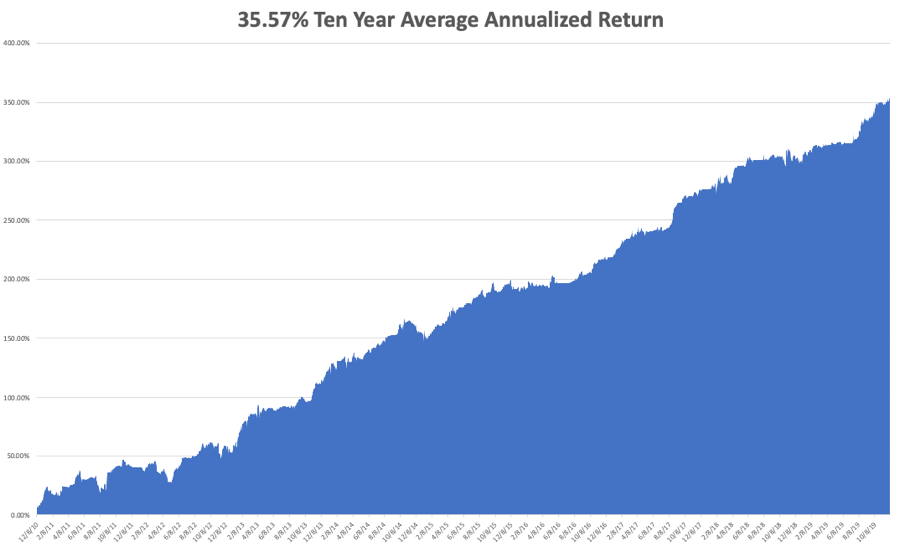

My Global Trading Dispatch performance held steady at +352.76% for the past ten years, pennies short of an all-time high. My 2019 year-to-date catapulted back up to +52.62%. We closed out November with a respectable +3.07% profit. My ten-year average annualized profit ground back up to +35.28%.

The coming week will be a noneventful one on the data front.

On Monday, December 9 at 9:00 AM, Consumer Inflation Expectations for November are out.

On Tuesday, December 10 at 2:30 PM, the NFIB Business Optimism Index is released.

On Wednesday, December 11, at 6:15 AM, US Core Inflation is announced.

On Thursday, December 12 at 8:30 AM, Weekly Jobless Claims come out.

On Friday, December 13 at 9:30 AM, November US Retails Sales are printed.

The Baker Hughes Rig Count follows at 2:00 PM.

As for me, I’ll be wrapping presents and doing some last-minute Christmas shopping. Only 200 Christmas trees left to sell.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

“You may think using Google's great, but I still think it's terrible.” – Said Co-Founder of Google Larry Page

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

December 6, 2019

Fiat Lux

Featured Trade:

(DECEMBER 4 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (TSLA), (TLT), (BABA), (CCI), (VIX)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader December 4 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: How do you see the markets playing out in 2020?

A: Well, I’m looking at small single-digit positive returns with a lot of volatility. Much of this year’s performance—30% in the S&P 500 (SPY), up 56% for the Mad Hedge Fund Trader—has already been pulled forward from 2020, thanks to super low interest rates and massive deficit spending. So, the more money we make now, the less money we make next year.

Q: How deep will the next recession be?

A: I’m looking for two quarters of small negative numbers like -0.1% or -0.2%, and then it’s off to the races again. That’s when the Golden Age of the Next Roaring Twenties starts, which I have already written a book about (click here).

And it’s possible we may not even see any negative numbers on a quarterly basis; we may just get close to zero, threatening it without actually breaking it. Of course, you could still get a 20% correction in the overall stock market if they only THINK we are going into recession, which has happened many times in the last 10 years.

Q: Are you expecting a market crash?

A: No; I do expect a meaningful pullback but frankly, right now, I do not see the conditions in place for that. None of the traditional causes of recessions, high-interest rates or high oil prices, are evident yet. The biggest threat to the market right now is the 2020 presidential election. And we are at a 14-year high in stock valuations.

Q: How bad will it get for car makers, and will the Tesla (TSLA) plant in Germany affect sales for European cars?

A: European carmakers have already been badly affected by Tesla, with Tesla taking over practically the entire luxury end of the market—that’s why companies like Mercedes, Audi and BMW are doing so badly with their shares, and they’re so far behind it’s unlikely they’ll ever catch up. The Berlin factory, I believe, is a battery factory, and after that, there will be a vehicle production factory, probably somewhere in eastern Europe where the cost basis is much lower.

Q: Double Line Capital’s CEO Jeff Gundlach says the US will get crushed in the next recession? Do you agree with him?

A: Well, my first advice to you is never take stock advice from a bond trader. Jeff Gundlach makes these spectacular forecasts, but the timing can be terrible. He can be wrong for 9 months before they finally turn. So, you can go out of business trading off of Jeff Gundlach’s stock advice, though his bond advice is valuable.

Q: Do you have any good recommendations for dividend stocks?

A: Yes, look at the entire cellphone towers REIT sector. That will be a growth sector next year with 5G rolling out and they have very high dividend yields. We’re going to get a significant increase in the number of cell towers thanks to 5G, and there are REITs specifically dedicated to cellphone towers. An example is Crown Castle (CCI), which has a generous 3.45% dividend yield.

Q: Are we in the final stages of a blow-off top for the stock market?

A: Yes, but blow-off tops can continue for many months, so don’t rush to sell short. However, next time the VIX gets down to 11, start buying six-month call options on the Volatility Index (VIX) at the $20 strike price. Go far out in the calendar to minimize time decay and far out of the money on strike prices to maximize your bang per buck.

Q: Gold had a nice day on Monday—is this the start of a reversal from the selling pressure?

A: No, as long as the market is pushing to new highs, which it seems to be doing—you don’t want to be anywhere near gold; wait for a better opening lower down.

Q: Are you sending Trade Alerts out on the Mad Hedge Biotech & Healthcare letter?

A: Not in the form that we see in Global Trading Dispatch or the Mad Hedge Technology Letter. Essentially, everything we’ve put out so far has been a long term buy. Most people know nothing about these sectors and we’re trying to get them into buyable names. So far, we’ve issued “BUYS” for 20 different companies; all of them have gone straight up. So, it’s really more of a long term buy-in hold situation. Since we’re in the very early days of the boom in biotech and healthcare stocks, you don’t want to leave money on the table with short term trade alerts for call spreads when there is a double or triple in the stock at hand. We are doing call spreads in the main market where most stocks are already at all-time highs in order to limit our risk.

Q: Fidelity just said that 50% of baby boomers who manage their own portfolio should rebalance it. What do you think is the best way to optimize my portfolio, as a baby boomer born in 1954?

A: You should always rebalance every year, especially when you get enormous moves in single sectors. The interesting thing this year is that everything went up, so you may not need to rebalance that much. When I say rebalance, I’m referring to rebalancing your weightings of stocks vs bonds. If you’re over 50, you want to have roughly a 50/50 ratio on those. That would suggest pairing back some of your equity weightings, increasing your bond weighting because stocks (SPY) (30% total return) have risen a lot more than bonds (TLT) (19% total return) this year.

Q: Marijuana stock Tilray (TLRY) has just had a pitiful year going from $100 to $20 and missed earnings targets for 4 for straight quarters. Could this go to zero?

A: Yes; after all, how hard is it to grow a weed? I never bought the story on the whole marijuana sector, not only because they are not allowed to participate in the financial sector. It’s an all-cash business; you hear about people moving around suitcases full of $100 bills doing deals in Oakland and Denver. I believe anybody can do this. My real estate agent is quitting his business to go into cannabis farming. Additionally, they’re getting a lot of competition from the black market where everybody used to buy their marijuana because it’s tax-free. There’s about a 40% price difference between the tax-paying legal form of marijuana and the tax-free black market where people used to get their marijuana. There’s no great value added there. It’s not like they’re designing a 96 stack microprocessor.

Q: What do you think about Ali Baba (BABA), the Chinese internet giant?

A: I love it long term. Short term, it will be subject to trade war gyration; so use the big dips to buy into it because long term we come out of this.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.