While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

May 20, 2019

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, OR I’LL TAKE SOME OF THAT!)

(FXI), (CYB), (TSLA), (AAPL), (BA), (WMT), (TLT), (INTU), (GOOGL)

Whatever the market is drinking right now, I’ll take some of that stuff. If you could bottle it and sell it, you’d be rich. Certainly, the Viagra business would go broke.

To see the Dow average only give up 7% in response to the worst trade war in a century is nothing less than stunning. To see it then make half of that back in the next four days is even more amazing. But then, that is the world we live in now.

When the stock market shrugs off the causes of the last great depression like it’s nothing, you have to reexamine the root causes of the bull market. It’s all about the Fed, the Fed, the Fed.

Our August central bank’s decision to cancel all interest rate rises for a year provided a major tailwind for share prices at the end of 2018. The ending of quantitative tightening six months early injected the steroids, some $50 billion in new cash for the economy per month.

We now have a free Fed put option on share prices. Even if we did enter another 4,500-point swan dive, most now believe that the Fed will counter with more interest rate cuts, thanks to extreme pressure from Washington. A high stock market is seen as crucial to winning the 2020 presidential election.

Furthermore, permabulls are poo-pooing the threat to the US economy the China (FXI) trade war presents. Some $500 billion in Chinese exports barely dent the $21.3 trillion US GDP. It’s not even a lot for China, amounting to 3.7% of their $13.4 trillion GDP, or so the argument goes.

Here’s the problem with that logic. The lack of a $5 part from China can ground the manufacture of $30 million aircraft when there are no domestic alternatives. Similarly, millions of small online businesses, mostly based in the Midwest, couldn’t survive a 25% price increase in the cost of their inventory.

As for the Chinese, while trade with us is only 3.7% of their economy, it most likely accounts for 90% of their profits. That’s why the Chinese yuan (CYB) has recently been in free fall in a desperate attempt to offset punitive tariffs with a substantially cheaper currency.

The market will figure out all of this eventually on a delayed basis and probably in a few months when slowing economic growth becomes undeniable. However, the answer for now is NOT YET!

Markets can be dumb, poor sighted, and mostly deaf animals. It takes them a while to see the obvious. One of the problems with seeing things before the rest of the world does, I can be early on trades, and that can translate into losing money. So, I have to be cautious here.

When that happens, I revert to an approach I call “Trading devoid of the thought process.” When prices are high, I sell. When they are low, I buy. All other information is noise. And I keep my size small and stop out of losers lightning fast. That’s how I managed to eke out a modest 0.63% profit so far this month, despite horrendous trading conditions.

You have to trade the market you have, not what it should be, or what you wish you had. It goes without saying that the Mad Hedge Market Timing Index become an incredibly valuable tool in such conditions.

It was a volatile week, to say the least.

China retaliated, raising tariffs on US goods, ratcheting up the trade war. US markets were crushed with the Dow average down 720 intraday and Chinese plays like Apple (AAPL) and Boeing (BA) especially hard hit.

China tariffs are to cost US households $500 each in rising import costs. Don’t point at me! I buy all American with my Tesla (TSLA).

The China tariffs delivered the largest tax increases in history, some $72 billion according to US Treasury figures. With Walmart (WMT) already issuing warnings on coming price hikes, we should sit up and take notice. It is a highly regressive tax hike, with the poorest hardest hit.

The Atlanta Fed already axed growth prospects for Q2, from 3.2% to 1.1%. This trade war is getting expensive. No wonder stocks have been in a swan dive.

US Retail Sales cratered in March while Industrial Production was off 0.5%. Why is the data suddenly turning recessionary? It isn’t even reflecting the escalated trade war yet.

European auto tariff delay boosted markets in one of the administration’s daily attempts to manipulate the stock market and guarantee support of Michigan, Wisconsin, and Pennsylvania during the next presidential election. All government decisions are now political all the time.

Weekly Jobless Claims plunged by 16,000 to 212,000. Have you noticed how dumb support staff have recently become? I have started asking workers how long they have been at their jobs and the average so far is three months. No one knows anything. This is what a full employment economy gets you.

Four oil tankers were attacked at the Saudi port of Fujairah, sending oil soaring. America’s “two war” strategy may be put to the test, with the US attacking Iran and North Korea simultaneously.

Bitcoin topped 8,000, on a massive “RISK OFF” trade, now double its December low. The cryptocurrency is clearly replacing gold as the fear trade.

The Mad Hedge Fund Trader managed to blast through to a new all-time high last week.

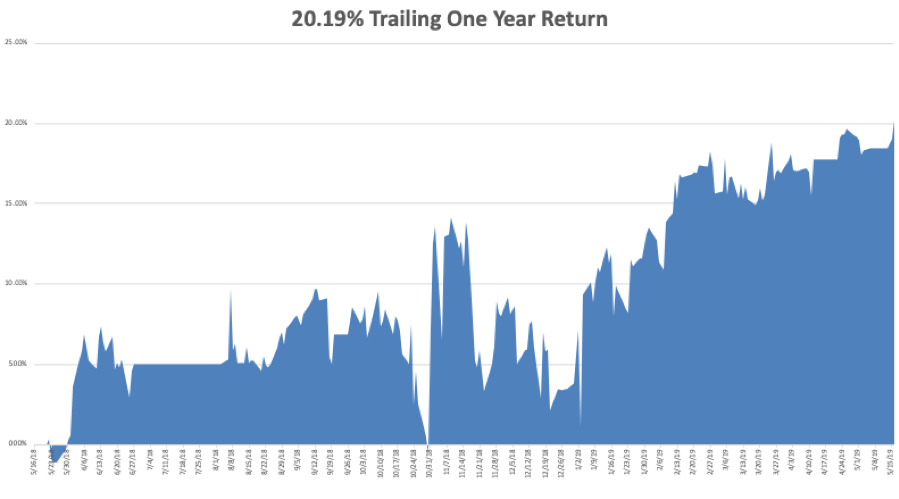

Global Trading Dispatch closed the week up 16.35% year to date and is up 0.63% so far in May. My trailing one-year rose to +20.19%. We jumped in and out of short positions in bonds (TLT) for a small profit, and our tech positions appreciated.

The Mad Hedge Technology Letter did OK, making some good money with a long position in Intuit (INTU) but stopping out for a small loss in Alphabet (GOOGL).

Some 10 out of 13 Mad Hedge Technology Letter round trips have been profitable this year.

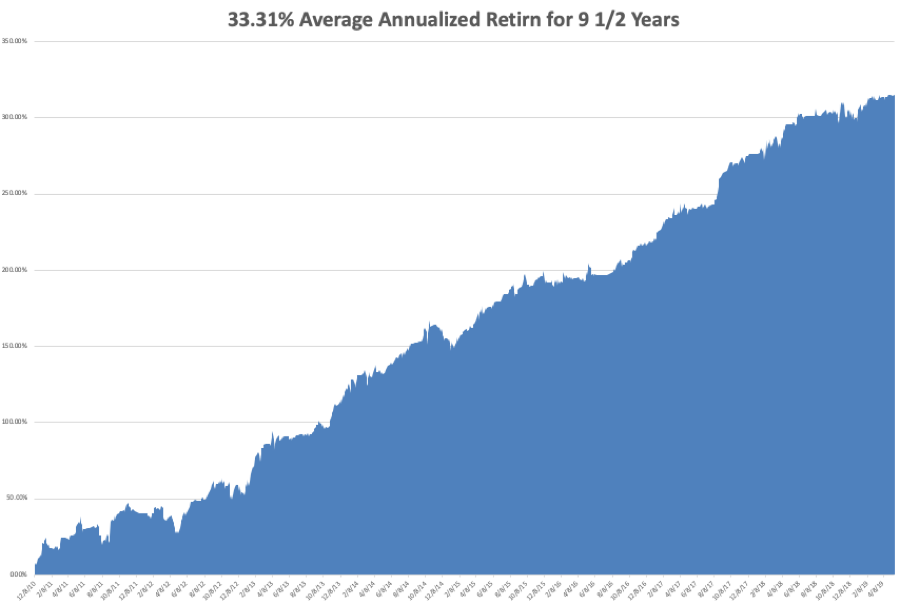

My nine and a half year profit jumped to +316.49%. The average annualized return popped to +33.21%. With the markets incredibly and dangerously volatile, I am now 80% in cash with Global Trading Dispatch and 80% cash in the Mad Hedge Tech Letter.

I’ll wait until the markets retest the bottom end of the recent range before considering another long position.

The coming week will see only one report of any real importance, the Fed Minutes on Wednesday afternoon. Q1 earnings are almost done.

On Monday, May 20 at 8:30 AM, the April Chicago Fed National Activity Index is out.

On Tuesday, May 21, 10:00 AM EST, the April Existing Home Sales is released. Home Depot (HD) announces earnings.

On Wednesday, May 22 at 2:00 PM, the minutes of the last FOMC Meeting are published. Lowes (LOW) announces earnings.

On Thursday, May 16 at 23 AM, Weekly Jobless Claims are published. Intuit (INTU) announces earnings.

On Friday, May 24 at 8:30 AM, April Durable Goods is announced.

As for me, I’ll be taking a carload of Boy Scouts to volunteer at the Oakland Food Bank to help distribute food to the poor and the homeless. Despite living in the richest and highest paid urban area in the world, some 20% of the population now lives on handouts, including many public employees and members of the military. It truly is a have, or have-not economy.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Technology Letter

May 20, 2019

Fiat Lux

Featured Trade:

(THE BIG PLAY IN CISCO)

(CSCO), (JNPR), (ANET), (INTC), (GOOGL), (AMZN)

You can’t steal the mojo from the company that sells network software and infrastructure equipment.

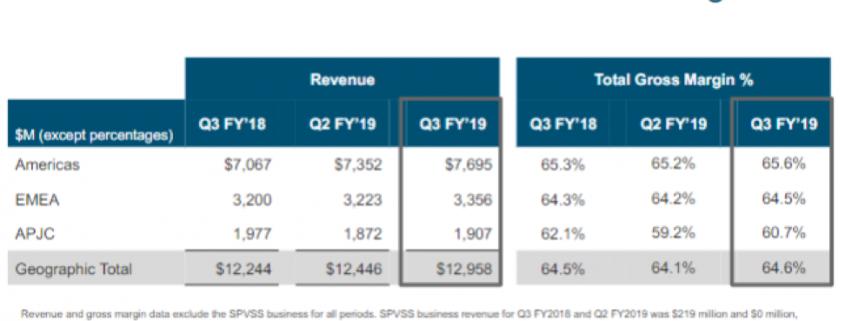

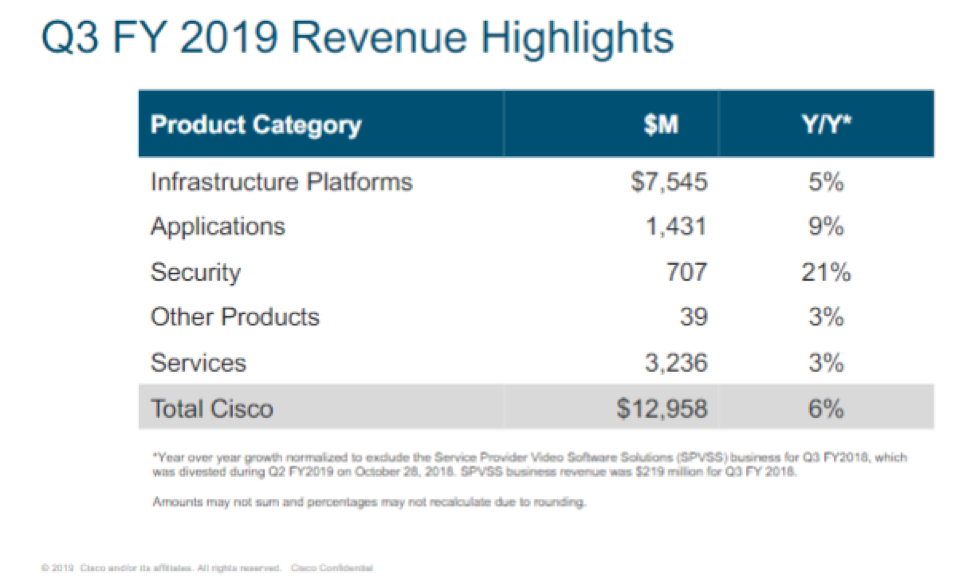

Cisco (CSCO) is effectively an indirect bet on people using the internet because companies need the network infrastructure to offer all the cool and useful services that tech provides.

Technology and the services that result from it continues to be at the heart of customer strategy and now more than ever, Cisco’s market-leading portfolio and differentiated innovation are resonating with them as they transform their IT infrastructure.

Cisco is also a fabulous bet on 5G as the most recent technologies like cloud, AI, IoT, and WiFi 6 among others are developing together to revolutionize the way business operates and delivers new experiences for customers and teams.

Cisco is fundamentally changing the way customers approach their technology infrastructure to address the rising complexity in their IT environments.

They have constructed the only integrated multi-domain intent-based architecture with security at the foundation.

This is designed to allow customers to securely connect their users and devices over any network to any application.

Enterprise networks today must be optimized for agility and heightened security, leveraging cloud and wireless capabilities with the ability to extract insights from the data and security integrated throughout.

Cisco is in pole position to deliver this to customers.

Last quarter saw the launch of new platforms expanding the enterprise networking assets with the launch of subscription-based WiFi 6 access points and Catalyst 9600 campus core switches purpose-built for cloud-scale networking.

By combining automation and analytics software with a broad portfolio of switches, access points, and controllers, Cisco is creating a seamless end-to-end wireless first architecture.

With the newest Catalyst 9000 additions, Cisco has completed the most comprehensive enterprise networking portfolio upgrade in their history.

Cisco rebuilt their entire access portfolio with intent-based networking across wired and wireless.

Cisco also now have one unified operating system and policy management platform to drive simplicity and consistency across networks all enabled by a software subscription model.

In the data center, their strategy is to deliver multi-cloud architectures that bring policy and operational consistency no matter where applications or data resides by extending Application Centric Infrastructure (ACI) and offering HyperFlex to the cloud.

According to Cisco’s official website, its HyperFlex product is “a converged infrastructure system that integrates computing, networking and storage resources to increase efficiency and enable centralized management.”

Cisco’s partnerships with Amazon Web Services (AWS), Google Cloud, and Microsoft Azure are great examples of how they continue to work with web-scale providers to deliver new innovation.

Some new additions are Cisco’s cloud ACI for AWS, a service that allows customers to manage and secure applications running in a private data center or in Amazon Web Services cloud environments.

They also expanded agreements with Alphabet (GOOGL) by announcing support for their multi-cloud platform Anthos to help customers build secure applications everywhere from private data centers to public clouds with greater simplicity.

Going forward, Cisco will integrate this platform with its broad data center portfolio, including HyperFlex, ACI, SD-WAN, and Stealthwatch cloud to deliver the best multi-cloud experience.

Organic growth has surpassed 4% for five straight quarters and expanded margins and positive guidance for the current quarter will reaccelerate PE multiples, increasing as more investors buy into the strong narrative.

CEO of Cisco CEO Chuck Robbins boasted on the call that “we see very minimal impact at this point based on all the great work the teams have done, and it is absolutely baked into our guide going forward” when referring to the headwinds of the global trade war.

It’s been quite the new normal for chip firms to guide down for the rest of 2019, and Intel’s (INTC) worries are emblematic of the growing challenges facing the tech industry.

Cisco bucked the trend by issuing strong forward guidance of 4.5% to 6.5% revenue growth in its fiscal fourth quarter, and earnings of 80 cents to 82 cents per share.

In an in-house survey, Cisco found that 11% of respondents have upgraded networking infrastructure and 16% expect to do so in the next 12 months.

The “minimal impact” of the trade war indicates to investors that even with negative tech sentiment brooding around the world, Cisco’s best in class tech infrastructure still cannot be sacrificed and the migration of companies to digital directly benefits Cisco who provides the building blocks for software and hardware tech companies to develop around.

Cisco even felt bold enough to hike prices giving consternation to current customers.

Both Juniper (JNPR) and Arista (ANET), lower quality network infrastructure companies, have indicated their enterprise businesses are growing faster than the overall market and Cisco’s price hike was probably a bad time to up margins in the current frosty climate.

Even more worrying is data that suggests a general Enterprise pause in spending at a minimum and could entrap the broader tech market as many capital expenditures could be put on hold in the late economic cycle.

Keep in mind that Cisco’s Catalyst 9000 line had an abnormally strong last fourth quarter due to brisk adoption accelerating meaning comps will be hard to beat in the next earnings report.

However, these are minor bumps on the road at a time when the major narrative is running smoothly and shows no signs of stopping.

Cisco shares will continue to rise if they continue to upgrade their products and back it up with their best of breed reputation that could spur more price hikes.

Investors should wait for dips to buy in this name until there are any signs of product quality erosion which I believe will not happen in 2019.

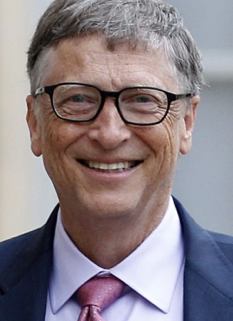

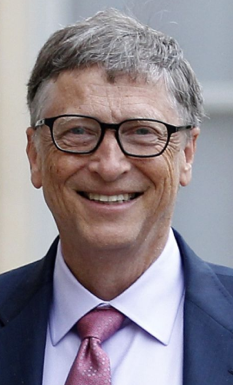

“The future of advertising is the Internet.” – Said Founder and Former CEO of Microsoft Bill Gates

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Hot Tips

May 17, 2019

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) The China Tariffs Deliver the Largest Tax Increase in History, according to US Treasury figures. With Walmart (WMT) already issuing warnings, we should sit up and take notice. Click here.

2) April Housing Starts to Jump, up 5.7%. Permits are also up 0.5%. With the 30-year fixed rate loan down to 2.12%, low rates are having their desired effect. On the other hand, Chinese tariffs are driving costs through the roof. Click here.

3) Wall Street Slammed by Trade Fears. Stocks made back exactly half of their May loss, then faded. I covered my short in bonds for a small profit. The bond market seems to be expecting a recession. Click here.

4) Atlanta Fed Axes Growth Prospects, for Q2, from 3.2% to 1.1%. This trade war is getting expensive. No wonder stocks have been in a swan dive. Click here.

5) Heard at SALT. Don’t put your DNA on the web. Not only will you be denied health insurance, so will all of your future decedents.

Published today in the Mad Hedge Global Trading Dispatch:

(MAY 15 BIWEEKLY STRATEGY WEBINAR Q&A),

(MSFT), (GOOGL), (AAPL), (LMT), (XLV), (EWG), (VIX), (VXX), (BA), (TSLA), (UBER), (LYFT),

(ADBE),

(HOW TO HANDLE THE FRIDAY, MAY 17 OPTIONS EXPIRATION),

(INTU)

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

May 17, 2019

Fiat Lux

Featured Trade:

(APRIL 15 BIWEEKLY STRATEGY WEBINAR Q&A),

(MSFT), (GOOGL), (AAPL), (LMT), (XLV), (EWG), (VIX), (VXX), (BA), (TSLA), (UBER), (LYFT), (ADBE),

(HOW TO HANDLE THE FRIDAY, MAY 17 OPTIONS EXPIRATION), (INTU),

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.