When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to the six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

March 5, 2019

Fiat Lux

Featured Trade:

(THE BIPOLAR ECONOMY),

(AAPL), (INTC), (ORCL), (CAT), (IBM),

(TESTIMONIAL)

Corporate earnings are up big! Great!

Buy!

No, wait!

The economy is going down the toilet!

Sell!

Buy! Sell! Buy! Sell!

Help!

Anyone would be forgiven for thinking that the stock market has become bipolar.

According to the Commerce Department’s Bureau of Economic Analysis, the answer is that corporate profits account for only a small part of the economy.

Using the income method of calculating GDP, corporate profits account for only 15% of the reported GDP figure. The remaining components are doing poorly or are too small to have much of an impact.

Wages and salaries are in a three-decade-long decline. Interest and investment income are falling because of the ultra-low level of interest rates. Farm incomes are at a decade low, thanks to the China trade war, but are a tiny proportion of the total, and agricultural prices have been in a seven-year bear market.

Income from non-farm unincorporated business, mostly small business, is unimpressive.

It gets more complicated than that.

A disproportionate share of corporate profits is being earned overseas.

So, multinationals with a big foreign presence, like Apple (AAPL), Intel (INTC), Oracle (ORCL), Caterpillar (CAT), and IBM (IBM), have the most rapidly growing profits and pay the least amount in taxes.

They really get to have their cake and eat it too. Many of their business activities are contributing to foreign GDPs, like China’s, far more than they are here.

Those with large domestic businesses, like retailers, earn less but pay more in tax as they lack the offshore entities in which to park them.

The message here is to not put all your faith in the headlines but to look at the numbers behind the numbers.

Caveat emptor. Buyer beware.

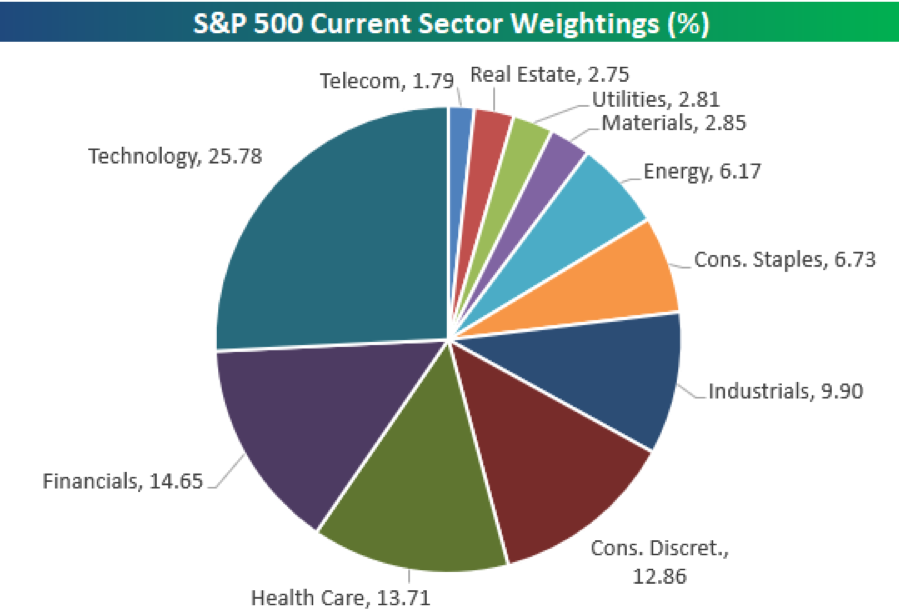

What’s In the S&P 500?

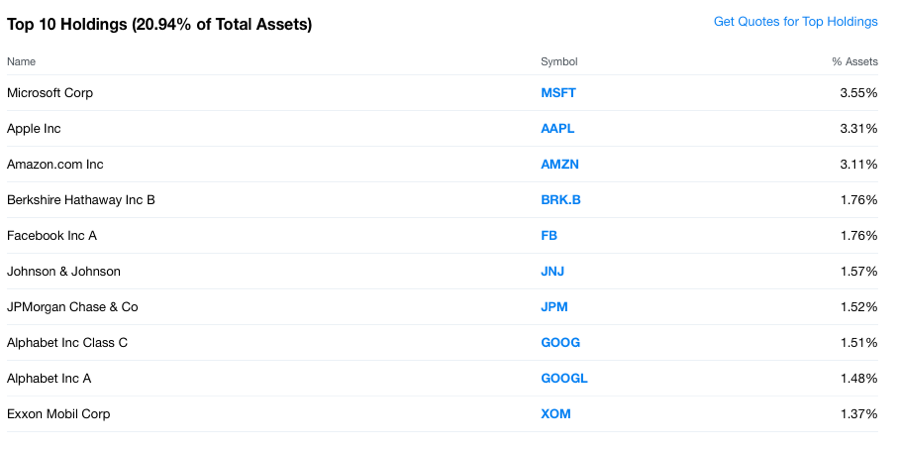

S&P Top 10 Holdings 3-4-2019

S&P Top 10 Holdings 3-4-2019

Has the Market Become Bipolar?

Has the Market Become Bipolar?

Mad Hedge Technology Letter

March 5, 2019

Fiat Lux

Featured Trade:

(MEET THE PREMIER DINOSAUR OF OUR TIME),

(HPQ), (LNVGY), (DVMT), (AAPL)

Stay away from HP Inc. (HPQ).

If you want the definition of a legacy tech company, then we have found one of the premier dinosaurs of our time.

The first iteration of Hewlett Packard was in the 1960s when they partnered with Sony to manufacture digital equipment.

They are widely considered the founders of the Silicon Valley establishment that snowballed into what it is today.

In 1939, the Silicon Valley company was established in a one-car garage in Palo Alto by Bill Hewlett and David Packard and initially produced a line of electronic test equipment for Walt Disney.

The garage is classified as a California State historical landmark.

It then developed its products enough to hail itself as the world's leading PC manufacturer from 2007 to 2013, a 6-year reign at the top.

Its long history doesn’t mean the trajectory has been heightened, the company has presided over some major messes such as its purchase of the ill-fated PDA firm Palm and the once discount PC manufacturer Compaq.

HP has had a great seat being able to observe the massive shifts in the tech scene, but unfortunately, its own business model and revenue stream have not been one of the main recipients of this major shift.

According to market research firm IDC (International Data Corporation), China’s Lenovo (LNVGY) recently eclipsed HP (HPQ) becoming top dog in the global PC (personal computers) market.

Lenovo supplanted HP bagging market share of 24.6% on the back of a joint venture with Fujitsu in May 2018 that fueled major incremental gains.

HP still commanded 23.6% share in Q4 2018 among laggards of the likes of Dell (DVMT), Apple (AAPL), and Acer Group with shares of 16.5%, 7.2%, and 6.7%, respectively.

The downtrodden numbers signify that demand for HP personal computers is waning and this is just the tip of the iceberg.

The personal computer industry has been growing in the single digits the last few years and is no more the uber growth industry it once was at the outset of the century.

Last quarter only saw HP’s personal systems segment revenue increase 2.3% YOY.

Total unit sales dropped 3% YOY.

HP blamed the 1% slide on notebook shipments and an 8% decline in desktop shipments.

Evidence tells us that consumers are increasingly valuing mobility more than ever and giving ground to smartphones is inevitable.

Making matters worse, smartphone companies such as Apple, Microsoft, and Google produce outstanding desktop computers that seamlessly integrate into a rich ecosystem.

Consumers are repeatedly buying computers and phones of the same brand that can easily mesh cohesively, a nod to continuity that consumers love.

Professional work stations have also taken the form of an onslaught of one brand of manufacturer whether it be Android-based Microsoft products of iOS-based Apple.

I can vouch for rarely finding someone with a package of Apple’s iPhone and an HP desktop as a professional work hybrid solution unless they are forced by external circumstances.

Essentially, HP is on the wrong side of the pivot to mobile and the lack of innovation is hurting them in a multi-faceted way.

These companies that fail to evolve have a tendency to act as if market conditions never change, only for one bad earnings report to morph into a string of misses tanking the share price.

I believe HP is on that train to nowhere and its lack of investment into creating more advantageous business opportunities sticks out like a sore thumb right now when you compare them to other tech heavyweights.

CEO of HP Dion Weisler had the quote of the century telling analysts on the call that “we’re now engaging on a new battlefield and it’s called online.”

This quote is a microcosm of the state of HP and reflects poorly on the leadership.

One of HP’s largest cash cows is the printing supplies business and for management to blame “online” forces on crimping sales is an insult to shareholders.

“Online” consumer business has been around for more than 30 years, and to reference this external force as a new engagement dragging down sales condemns this company to pariah-status.

Management must wake up and smell the coffee and understand that if selling overpriced print ink and printers was a god given right then HP is doomed strategically.

An unexpected 3% revenue drop in the printer supplies business was written in the stars, and HP has been lucky to even reap what they have to this point.

It’s an ongoing renaissance for consumer prices in a deflationary environment and finding cheaper alternatives is just an Amazon.com visit away.

Selling ink and toner cartridges is a high-margin business that has no business being a high-margin business.

The EMEA region (Europe, Middle East and Africa) printing supplies revenue cratered 9% as most of the world rather buy cheaper alternatives online where they can price compare easily.

Manufacturing cartridges with ink inside it is not high-tech and is due for a margin reckoning.

Apparently, HP has technology that can detect counterfeit ink, but isn’t ink just ink?

HP classifies ink not branded HP as counterfeit ink, once again, a vividly low barrier to entry screaming overpriced.

Such a low-tech competitive advantage should be pounced on - we are seeing that in real time and rightly so.

If business and consumers aren’t allowed to use outside ink to place inside of non-HP cartridges, the business will migrate to non-HP, cheaper replacements such as Canon while either filling up ink cartridges themselves or substituting a cheaper alternative.

The dialogue on the conference call was shocking, appearing if HP executives were caught off-guard from this magical thing called the “internet” and the competition derived from it could potentially suppress sales.

I was leaning towards becoming bearish HP before this earnings report and the awful performance vindicated my initial prognosis.

I am bearish HP – sell on any and every rally.

I cannot give higher marks to John's style of approaching the market. My wife has learned so much from him that we are actually having conversations about the global economy. Wow! You will learn money management, the concept of risk versus reward, and how to take advantage of trades that are worth taking.

Thanks John!

Robert

“Truly good businesses are exceptionally hard to find. Selling any you are lucky enough to own makes no sense at all,” said Oracle of Omaha Warren Buffet.

“When you innovate, you've got to be prepared for everyone telling you you're nuts.” Said Founder and CEO of Oracle Larry Ellison

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.

S&P Top 10 Holdings 3-4-2019

S&P Top 10 Holdings 3-4-2019