While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to the six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

January 7, 2020

Fiat Lux

Featured Trade:

(MONDAY FEBRUARY 3 BRISBANE, AUSTRALIA STRATEGY LUNCHEON),

(HOW “HIGH” CAN MARIJUANA STOCKS GO?)

(TLRY), (CGC), (TOKE)

Mad Hedge Biotech & Healthcare Letter

January 7, 2020

Fiat Lux

Featured Trade:

(WHAT’S NEXT IN THE BIOTECH PIPELINE?)

(ITCI), (AIMT), (BIO), (JNJ)

Investing in biotech stocks demands prudence combined with a sprinkling of optimism. This means taking in announcements from companies bragging about potential blockbuster drugs with a grain of salt.

After all, a single misstep towards gaining FDA approval could easily set back any progress, erase any hope of salvaging the discovery, and eventually, send their share prices spiraling down.

On the other hand, choosing a biotech stock that would deliver on its promise means reaping rich dividends in the future.

With all the developments in store though, it’s hard to see why 2020 can’t easily go down as The Year of Biotech. Here are some things that caught my eye.

Christmas came early for Intra-Cellular Therapies (ITCI) as its long-awaited schizophrenia drug, Caplyta, received the green light from the FDA.

Although it has taken a few years for the biotech firm to announce the results of its schizophrenia trials, its investors are confident that Calpyta’s journey from this highly sought approval to marketing will be smooth sailing.

While the number of people suffering from schizophrenia and bipolar disorder is not as many as those facing major depressive disorder, treatments for the former conditions remain lacking. In fact, health specialists have been looking for more convenient options -- one that won’t hinder the daily lives of patients taking it.

This blockbuster drug, pegged as a safer and better alternative to Johnson and Johnson’s (JNJ) Risperidone, is expected to expand Lumateperone’s reach in the mental health market.

Despite earning an early victory, ITCI is already gearing up to tweak Calpyta’s indications and seek bipolar depression approvals as well. At the moment, this schizophrenia drug is estimated to cross $1 billion in sales following its 2020 launch in the market.

Meanwhile, there’s another big market drug that’s projected to make a major launch in 2020. Aimmune Therapeutics’ (AIMT) AR101. Otherwise known Palforzia, this will be the first-ever treatment for peanut allergies.

Although there’s no price tag released yet, a year’s supply of Palforzia is estimated to cost $4,200 per patient.

These pull-apart capsules, which are basically comprised of unmodified peanut flour plus a bunch of inactive ingredients, aim to provide medication for a food allergy that affects one in 13 children today.

The FDA is expected to release its decision on Palforzia sometime in January 2020, so it’ll definitely be a prosperous New Year for its investors.

Another biotech company that’s set to make a splash in a lucrative market is Bluebird Bio (BIO).

At the moment, investors are chomping at the bit for good news concerning the company’s future crown jewel: genetic blood disease treatment Zynteglo.

In 2019, Zynteglo gained approval in the European market. Now, Bluebird is setting its sights to also conquer the US market as one in every 100,000 people is afflicted by this rare condition.

More than that, the only approved therapy for this genetic blood ailment is a blood transfusion done regularly.

Given the rarity of the disease and the efficacy of the treatment, Zynteglo’s price tag will obviously be on the high end.

This therapy is expected to cost roughly $1.8 million in total for every patient. To ease the burden though, Bluebird shared that it’s open to four- and five-year installment plans. That puts every gene therapy infusion at $355,000 per session.

Despite this massive expense, Bluebird actually believes that it’s selling its treatment at a discount of about 15% compared to the actual market value of $2.1 million.

This conviction comes from the fact that the company estimates adding 22 quality-adjusted life years to the lives of every successfully treated patient.

All three biotech stocks could easily skyrocket, especially Bluebird Bio. As for Aimmune Therapeutics, the company is currently financially healthy so it shouldn’t encounter any trouble meeting obligations. Meanwhile, ITCI has been gifting its investors with early Christmas presents since it first released promising results of its schizophrenia study.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Mad Hedge Technology Letter

January 6, 2020

Fiat Lux

Featured Trade:

(THE FUTURE IS HERE)

(USHIO)

Transistor capacity has always put the kibosh on semiconductor chip performance.

Chipmakers have for decades drained investment into a revolutionary Japanese technique to stretch the limits of physics and cram more transistors onto pieces of silicon.

A secretive Japanese company that mastered the skill of manipulating light for applications is about to go mainstream with cutting-edge technology.

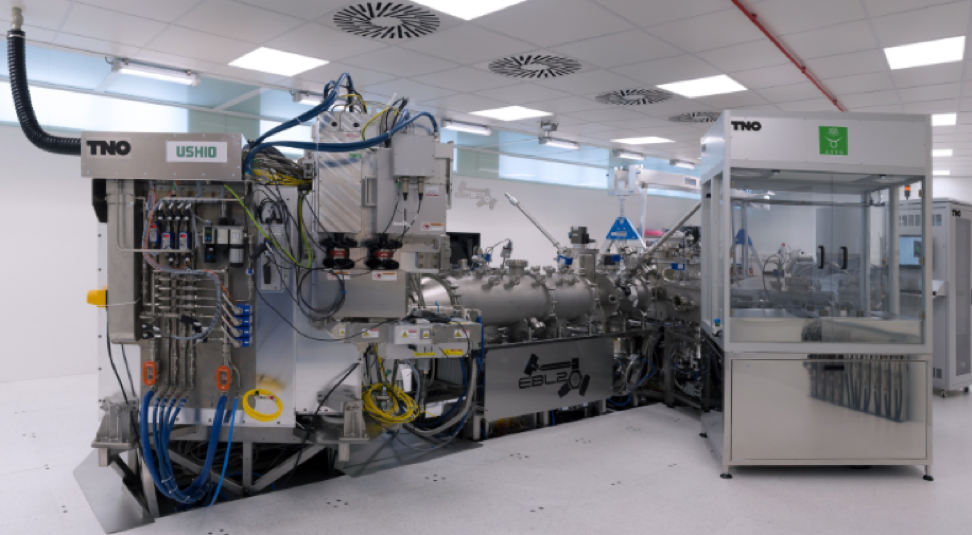

Ushio Inc. achieved the once thought impossible task of refining powerful, ultra-precise lights needed to test chip designs based on extreme ultraviolet lithography (EUV), a process through which the next generation of semiconductors will be made.

The milestone means that the Japanese company will become a prominent player in future chipmaking and the technology that harnesses it.

“The infrastructure is now mostly ready,” said CEO Koji Naito in an interview.

Testing equipment was primarily holding back extreme ultraviolet lithography (EUV), but with that hold-up dealt with, production efficiency and yields can finally go up setting the stage for electronic manufacturers with the possibilities of producing substantially better consumer products.

The Tokyo-based company developed a light source for equipment used to test what are known as masks: glass squares slightly bigger than a CD case that act as a stencil for chip designs. These templates must be picture-perfect, even an iota of error in one of them can render every chip in a large batch unfit.

That’s where Ushio seamlessly slots in.

Its technology operates lasers to vaporize liquid tin into plasma and produce light closer in wavelength to X-rays than the spectrum visible to the human eye.

That light aids chipmakers in detecting errors in the product.

This process takes a room-sized machine that looks like a sci-fi death ray and requires a phalanx of workers to operate.

After 15 years of industrious development, the EUV business will generate profits next year.

Only Intel Corp. (INTC), Samsung Electronics Co., and Taiwan Semiconductor Manufacturing Co. (TSM) desire to go smaller than the 7-nanometer processes that are the current status quo of central processing unit (CPU) design.

The focus on niche areas and creating things that others can’t is set to pay dividends for Ushio.

Ushio is poised to seize control of the market for light sources used in the testing of patterned EUV masks, there are several boutique tech companies in the Tokyo area that are incessantly focused on high-precision manufacturing.

Ushio dominates lithography lamps used to make liquid crystal displays with 80% market share and controls 95% of the supply of excimer lamps used in silicon wafer cleaning.

Their secret sauce is balancing mass production with craftsmanship.

Materials like quartz glass are arduous to work with and possess peculiar thermal expansion properties from metals like the molybdenum in which they are housed.

I know this stuff seems like out of the realm of science fiction, but Japanese-specialized firms have always been at the vanguard of the semiconductor technology and that is still the same today.

Ushio was established in 1964, and it was the first Japanese company to develop and produce halogen lamps.

Starting from 1973, fishermen used its lights to catch squid in Tokyo Bay.

The firm has succeeded in more than tripling its sales over the past 25 years.

The company is now venturing into the use of sodium lamps to nurture plants and using ultraviolet light calibrated to such a precise wavelength to kill bacteria without damaging human skin.

“If you can't make it good, at least make it look good.” – Said Founder of Microsoft Bill Gates

Global Market Comments

January 6, 2019

Fiat Lux

2020 Annual Asset Class Review

A Global Vision

FOR PAID SUBSCRIBERS ONLY

Featured Trades:

(SPX), (QQQQ), (XLF), (XLE), (XLY),

(TLT), (TBT), (JNK), (PHB), (HYG), (PCY), (MUB), (HCP)

(FXE), (EUO), (FXC), (FXA), (YCS), (FXY), (CYB)

(FCX), (VALE), (AMLP), (USO), (UNG),

(GLD), (GDX), (SLV), (ITB), (LEN), (KBH), (PHM)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.