When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Mad Hedge Technology Letter

February 12, 2020

Fiat Lux

Featured Trade:

(UBER’S DARK FUTURE)

(UBER), (LYFT), (FB), (AMZN), (NFLX), (GOOGL)

Autonomous or bankrupt; that is the ultimate fate of Uber (UBER).

In the short-term, Uber is a master at moving the goalposts in order to breathe life in the stock.

CEO of Uber Dara Khosrowshahi can only pray that the Fed will continue to pump cheap money into the market because without artificially low-interest loans, tech firms like Uber would implode.

Is it really time to give Uber the benefit of the doubt?

No more hype, just profits? Is the calculus to profits legitimate?

That's what we call a bubble. Bubbles always burst. Here's the scary part.

Many people are counting on the continued existence of Uber and Lyft to provide "cheap transportation."

Commuters will have to get suddenly unused to it.

There are many companies today that are running the same scheme as Uber in the “gig economy.”

It’s true that management loves to use a lot of flowery language to disguise a lack of profitability.

But as the conditions are ripe for a leg up in tech, the tide rises, and even Uber’s boat rises with it.

I have yet to see even one realistic analysis of how Uber or Lyft is going to become profitable - not even basic math!

I have met a plethora of drivers for both companies, and hope they do well, but there is only so long that one can put lipstick on a pig.

So here we are, Uber in the green everyday because they moved the goalposts yet again and promise us earlier than expected profitability but still losing billions of dollars.

Lyft and Uber have apparently increased revenues somewhat by reducing promotional discounts to riders, but that does not project to even a breakeven point and the unit economics tell me no even if my heart says yes.

The only trick up their sleeve seems to be fare increases, but where is the roadmap detailing this treacherous path?

Once we get to the point in time when Uber is supposed to be profitable, I bet that management will call in another trick play and move the goal posts yet again.

It is quite laughable when so called “tech experts” want Uber to join the ranks of Facebook Inc. (FB), Amazon.com Inc. (AMZN), Netflix Inc. (NFLX), and Alphabet Inc.’s Google (GOOGL) as part of a FANGU acronym.

Reasons for this new bundle is thought to be because of the ability to take advantage of its massive scale while working toward profitability.

Uber is the global ridesharing leader and is becoming the global food delivery leader, but do they really add value?

What if the local government finally got their finger out and built a proper transport system?

They are merely taking advantage of a broken system and passing on the costs of paying drivers to the drivers themselves by designating them as hourly workers.

Are we supposed to celebrate when Uber becomes more “rational?”

Meaning that players have limited their attempts to undercut one another with the sorts of pricing and big discounts that had at one time suggested the business might be a race to the bottom.

Uber projected a lower loss than analysts were expecting for 2020, does less loss mean profits in 2020?

And I do agree that it is encouraging that the company is finally disclosing more data, but shouldn’t they be doing that in the first place?

Love it or hate it, there is a “war” going on between profitability and growth at Uber as the company manages the trade-offs.

Uber had previously talked up that it would become Ebitda profitability by the end of 2021, but Khosrowshahi now forecasts profitability for the fourth quarter of this year.

He says it is possible because Uber initiated a “belt-tightening program” in the last half of 2019, exiting unprofitable ventures and laying off about 1,000 employees.

For instance, Uber sold its food-delivery business in India to a local startup, Zomato, in return for a 9.9% stake in that company.

I do believe that they haven’t done enough to build credibility with investors and the stock’s price action is behaving as we should trust Uber’s management with whatever comes out of their mouths.

The lack of visibility and uncertainty around trends in ridesharing and Eats outside the U.S. continue to be hard to quantify.

So that sounds great! Uber is more serious than ever about becoming profitable and investors have backed them up with the stock flying to the moon.

The trend is your friend and I would suggest readers to get out of the way of this one because you could get trampled on just like the Tesla bears.

And I do support Uber in making steps in the right direction and it also can be said that stocks appreciate the fastest when they transform from a horrible company to a less horrible company.

But there is no way that I am giving Khosrowshahi a pass for Uber’s current situation and no chance I am praising him to the hills.

It is what it is, and Uber is less bad than before, and if they don’t meet their targets, I don’t think investors will believe Khosrowshahi version of a spin doctor forecast anymore.

Uber will rise in the foreseeable future and if they fail to become profitable by 4th quarter, expect a massive drawdown.

If they succeed, expect a vigorous wave of new players to buy into Uber shares.

The stakes have never been higher for Uber and Khosrowshahi.

“There are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know.” – Said Harvard economist John Kenneth Galbraith

Global Market Comments

February 10, 2020

Fiat Lux

Featured Trade:

(LEARN MORE ABOUT ME THAN YOU PROBABLY WANT TO KNOW),

(GOOG), (AMZN), (AMGN)

(WHO SAYS THERE AREN’T ANY GOOD JOBS?),

(TESTIMONIAL)

As you may imagine, the most interesting man in the world is impossible to shop for when it comes to Christmas and birthdays.

So, it was no surprise when I opened a box and found a DNA testing kit from 23 and Me. So, I spit into a small test tube to humor the kids, mailed it off, and forgot about it.

I have long been a keeper of the Thomas family history and legends, so it would be interesting to learn which were true and which were myths.

A month later, what I discovered was amazing.

For a start, I am related to Louis the 16th, the last Bourbon king of France who was beheaded after the 1789 revolution.

I am a direct descendant from Otzi the Iceman who is 5,000 years old and was recently discovered frozen in an Alpine glacier. He currently resides in mummified form in an Italian museum.

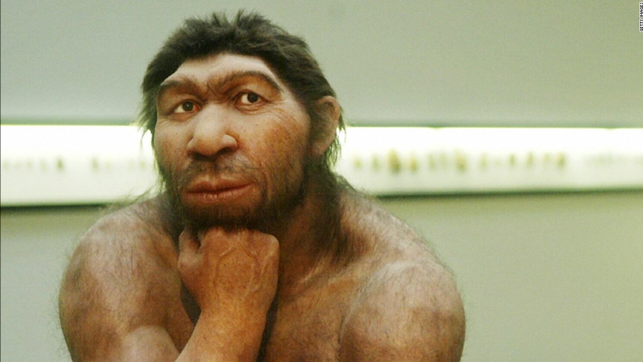

Oh, one more. The reason I don’t have any hair on my back is that I carry 346 gene fragments that I inherited directly from a Neanderthal. Yes, I am part caveman, although past girlfriends suspected as much.

There were other conclusions.

I have a higher than average probability of getting prostate cancer, advanced macular degeneration (my mother had it), celiac disease, and melanoma.

The service also offered to introduce me to 1,107 close relatives around the world who I didn’t know, mostly in New York, California, and Florida.

The French connection I already knew about. During the 16th century, my ancestors rebelled against the French kings over the non-payment of taxes and were exiled to Louisiana. Fleeing a malaria epidemic, they moved up the Mississippi River to St. Louis and stayed there for 200 years. When gold was discovered in California in 1849, they joined a wagon train west. We have been here ever since.

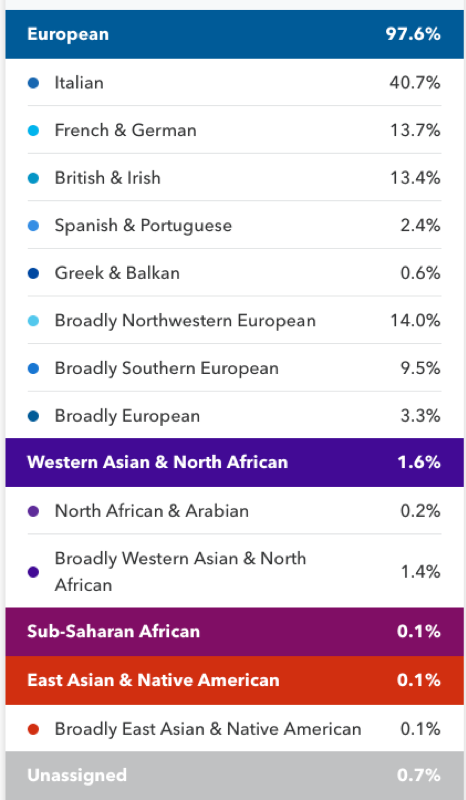

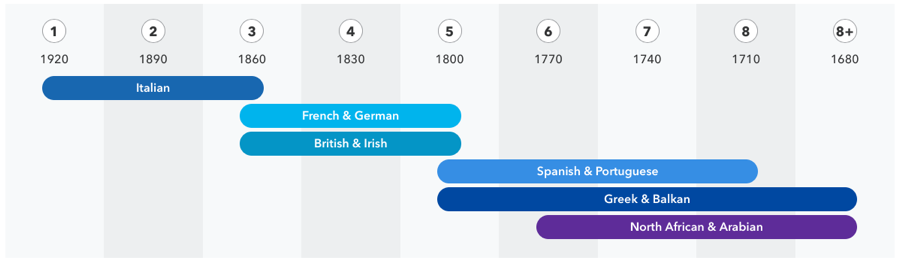

I am half Italian and have birth certificates going back to 1800 to prove it. But 23 and Me says that I am only 40.7% Italian (see table below). It turns out that your genes show not only where you came from, but also who invaded your home country since the beginning of time.

In Italy’s case that would include the ancient Greeks, Vikings, Arabs, the Normans, French, Germans, and the Spanish, thus making up my other 9.3%. Your genes also reflect the slaves your ancestors owned, for obvious reasons, as well as many of the servants who may have worked for them.

It gets better.

All modern humans are decended from a single primordial “Eve” who lived in Eastern Africa 180,000 years ago. Of the thousands of homo sapiens who probably lived at that time, the genes of no other human made it into the modern age. We are all decended from a single “Adam” who lived 275,000 years ago. Obviously, the two never met, debunking some modern conventions.

Around 53,000 years ago, my intrepid ancestors cross the Red Sea to a lush jungle in the Sinai Penninsula probably pursuing abundant game. 53,000 years ago, they moved on the vast grasslands of the Cental Asian Steppes. As the last Ice Age retreated, they moved into the warmer climes of South Europe. We have been there ever since.

23 and Me was founded in 2006 by Anne Wojcicki, wife of Google founder Sergei Brin. It is owned today by her and a few other partners. Its name is based on the fact that humans' entire DNA code is found on 23 chromosomes.

23 and Me and other competitors like Ancestry.com, MyHeritage, and Living DNA have sparked a DNA boom that has led to once unimaged economic and social consequences. DNA promises to be for the 21st century what electricity was to the 20th century. The investment consequences are amazing.

Talk about unintended consequences with a turbocharger.

A common ancestor going back to the early 1800s enabled Sacramento police to capture the Golden State killer. Unsolved for 40 years, it took a week for them to find him after a DNA sample was sent to a DNA database.

Thirty and 40-year cold cases are now being solved on a weekly basis. Long ago kidnapped children are being reunited with parents after decades of separation.

California just froze all executions. That’s because DNA evidence showed that approximately 30% of all capital case convictions were of innocent men. That was enough for me to change my own view on the death penalty. The error rate was just too high. Dozens of men around the country have been freed after new DNA evidence surfaced, some after serving 30 years or more in prison.

23 and Me had some medical advice for me as well. They strongly recommended that I get tested for diabetes and high blood pressure as these maladies are rife among my ancestors. They even name the specific guilty gene and haploid group.

This explains why major technology companies, like Amazon (AMZN) and Apple (AAPL), are pouring billions of dollars into genetic research.

I have long had a personal connection with DNA research. I worked on the team that sequenced the first ever string of DNA at UCLA in 1974. It was groundbreaking work. We obtained our raw DNA from Dr. James Watson of Harvard who, along with Francis Crick, was the first to discover its three-dimensional structure. As for my UCLA professor, Dr. Winston Salser, he went on to found Amgen (AMGN) in 1980 and became a billionaire.

The developments that are taking place today then seemed to us like science fiction that was hundreds of years into the future. To see the paper created by this work, please click here.

As research into DNA advances, it is about to pervade every aspect of our lives. Do you have a high probability of getting a disease that costs a million dollars to cure and is counting on getting health insurance? Think again. That may well bring forward single-payer national healthcare for the US, as only the government could absorb that kind of liability.

And if you can only hang on a few years, you might live forever. That’s when DNA-based monoclonal antibodies and gene editing are about to cure all major human diseases. DNA is about to become central to your physical health and your financial health as well.

To learn more about 23 and Me please visit their website here.

Maybe the next time I visit the Versaille Palace outside of Paris, I should ask for a set of keys now that I’m a relative? Unfortunately, it’s much more likely that I’ll get the keys to my Neanderthal ancestor’s cave.

I've been reading your blog for a while and found it a helpful beacon in a sea of confusing and contradictory information as I try and make sense of the world (and try and make money from sense!).

Kind regards,

Toby

London, England

"The Obamacare website had technical issues all week because of too much web traffic. You can't campaign on the fact that too many people don't have health care, and then be surprised that millions don't have health care. That's like 1-800-FLOWERS being caught off guard by Valentine's Day," said a comedian on Saturday Night Live.

“The bubble is in the bond market, not the stock market,” said Leon Cooperman, CEO of Omega Advisors, an original investor in my 1990s hedge fund.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.