7While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

March 31, 2020

Fiat Lux

Featured Trade:

(MORE PLAYERS ENTER THE RACE FOR A CORONA CURE)

(MRNA), (ARCT), (JNJ), (SNY), (GOVX), (ALT), (NVAX), (GSK), (GNBT), (VXL.V), (INO), (APDN), (CADILAHC)

Mad Hedge Biotech & Healthcare Letter

March 31, 2020

Fiat Lux

Featured Trade:

(MORE PLAYERS ENTER THE RACE FOR A CORONA CURE)

(MRNA), (ARCT), (JNJ), (SNY), (GOVX), (ALT), (NVAX), (GSK), (GNBT), (VXL.V), (INO), (APDN), (CADILAHC)

Special issue on COVID-19 vaccines: Moderna Inc (MRNA), Arcturus (ARCT), Johnson & Johnson (JNJ), Sanofi (SNY), GeoVax (GOVX), Altimmune (ALT), Novavax (NVAX), GlaxoSmithKline (GSK), Generex (GNBT), Vaxil Bio (VXL.V), Inovio Pharmaceuticals (INO), Applied DNA Sciences (APDN), Zydus Cadila (CADILAHC)

The hunt is definitely underway for potential treatments to fight COVID-19 but coming up with vaccines will take a much longer time.

Since we already have the genetic code of the novel coronavirus (click here for the link), researchers can now use the complete blueprint to come up with ways to defeat this disease.

With code in hand, it takes a supercomputer just three hours to create model vaccines. Then it is just a question of how fast you can make them, if at all. Many proposed models are far beyond our existing technology.

To date, there are roughly 35 companies and academic organizations actively seeking ways to come up with a COVID-19 vaccine. While the process will still take time, there are several promising prospects.

Among the companies working on this, Moderna Inc (MRNA) has been recognized as the first biotechnology company to conduct human trials to test its COVID-19 vaccine in March. The trial includes 45 males and non-pregnant females aged 18 to 55.

Moderna’s vaccine utilizes the genetic sequence of the novel coronavirus. Basically, the goal is to build a vaccine out of messenger RNA.

Aside from Moderna, another biotech company called Curevac has been at the forefront of this cutting-edge technology.

In China, RNACure Biopharma has been working with Fudan University and Shanghai JiaoTong University on using the same technique to come up with a vaccine as well.

China’s CDC along with Tongji University and Stermina as well as Duke-NUS in partnership with Arcturus (ARCT) are also using a similar approach.

Although Moderna’s vaccine reached Phase 1 in record time, authorities cautioned that the development time frame is somewhere between 12 and 18 months — and this is even dubbed as an “overly optimistic” timeline.

Meanwhile, there are companies like Sanofi Pasteur (SNY) elected to use previously deployed vaccine platforms in earlier epidemics like SARS.

Johnson & Johnson (JNJ) also decided to employ the same strategy using its Ebola vaccine platform. In fact, JNJ shared that it’ll be ready to conduct human testing of its non-replicating viral vector by November.

Aside from JNJ, another biotechnology company in China called CanSino Biologics (HKG: 6185) in collaboration with the Academy of Military Medical Sciences is utilizing the same technology.

Just last week, Chinese authorities approved CanSino’s Phase 1 clinical trials.

Apart from JNJ and CanSino, other biotechnology companies are also working on a vaccine using the same non-replicating viral vector technology.

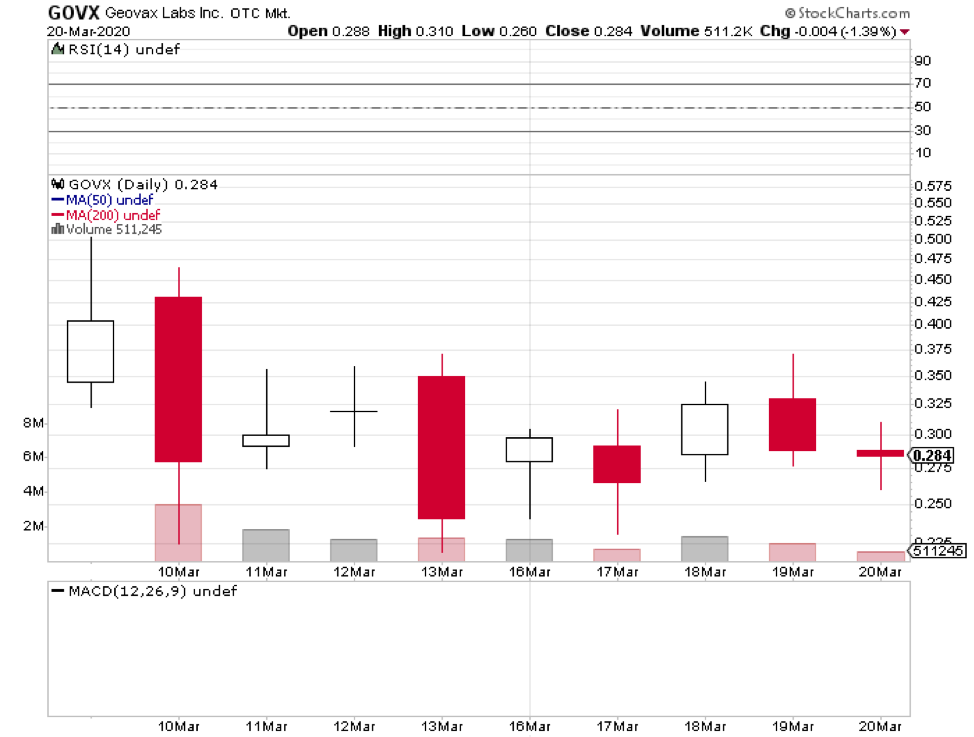

The list includes Wuhan’s BravoVax along with GeoVax (GOVX), Altimmune (ALT), Vaxart (VXRT), Greffex, and the University of Oxford.

Another strategy is employed by Novavax (NVAX), which is to construct a “recombinant” vaccine.

In a nutshell, this strategy entails extraction of the genetic code for the protein found on the Sars-CoV-2. This is a part of the virus that can trigger the immune system. This will then be pasted into the genome of a bacterium or yeast.

In effect, this vaccine will force the microorganisms to produce huge quantities of the protein to be able to fight off the virus.

Big biotechnology companies like Sanofi and GlaxoSmithKline (GSK) are following the same technique.

Smaller firms are also in on the action including Generex Biotechnology Corporation (GNBT), Vaxil Bio (VXL.V), EpiVax, and Clover Biopharmaceuticals.

The University of Georgia, Baylor College of Medicine, and the University of Miami are pursuing the same lead as well.

On top of these, several biotechnology companies use a DNA-based approach to come up with a vaccine.

Last March 12, the Bill & Melinda Gates Foundation provided a $5 million grant to Pennsylvania-based biotech firm Inovio Pharmaceuticals (INO) to help the company speed up the tests needed for its DNA vaccine called INO-4800.

This is on top of the roughly $9 million in funding it received from the Coalition for Epidemic Preparedness Innovations earlier.

At the moment, INO-4800 is in preclinical studies with plans to push it to Phase 1 clinical trials by April.

Aside from Inovio, Applied DNA Sciences (APDN), Zydus Cadila (CADILAHC), Takis, and Evivax are also pursuing the same strategy.

Despite implementing the most effective and even draconian measures to contain COVID-19, these tactics only managed to slow down the spread of the virus.

With the World Health Organization tagging this situation as a pandemic, everyone has become more desperate in the search for a vaccine because only a vaccine can stop people from getting sick.

However, even the unprecedented speeds afforded, the biotechnology companies couldn’t change the fact that developing a vaccine requires at least a year. It’s crucial to not make mistakes along the way especially since the product could potentially be injected into most of the world’s population.

After all, there’s only a single thing that can be considered worse than a bad virus — and that is a bad vaccine.

“The government doesn’t set the timeline, the virus does” said Dr. Antony Fauci, the Director of the National Institute of Allergy and Infectious Diseases.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

March 30, 2020

Fiat Lux

Featured Trade:

(THE NEW CROWN JEWELS OF SOCIAL DISTANCING)

(DOCU), (SIRI), (ZNGA), (NOK), (AMZN), (WORK), (MSFT), (ZM)

The second tier of social distancing tech stocks will do well in this brave new world in which digital lives have superseded physical ones.

Sure, most of you already know that Amazon (AMZN), Slack (WORK), Microsoft (MSFT), Zoom Communications (ZM), and Teladoc Health (TDOC) are the crown jewels of current social distancing tech stocks, but there is another group that should also outperform.

Here are 4 that you should take a look at with DocuSign being the best of the bunch:

DocuSign (DOCU)

Teleconferencing and other niches have come front and center and consummating deals have migrated to one place since people cannot physically sign their name from pen to paper.

Electronic signatures were basically a cottage industry when it came out, but it is here to stay and this company has investors buzzing. Although the volume of business agreements being signed globally may temporarily slip, those that are continuing to work are enabled by DocuSign to close agreements without meeting eye to eye.

I expect resiliency in the type of products DocuSign provides and the remote implementation options.

DocuSign is well-positioned within the defensive category of digital transformation spend. Their recent acquisition of Seal Software will help boost DocuSign’s ability to leverage the power of artificial intelligence in the domain of contract analytics.

The opportunity to mitigate time spent on manual workflows through the addition of Seal to the portfolio can bolster the value proposition and drive ROI (return on investment) for customers.

The trajectory of the company was validated by DocuSign’s strong fourth-quarter earnings results with adjusted earnings increasing 12 cents per share which is a 100% increase year over year.

Just as impressive, DocuSign posted quarterly revenue of $274.9 million, an increase of 38%. As the data suggests, the signals all point to this company continuing its outperformance.

The e-document market has been monopolized by DocuSign with competition shut out, and as business goes 100% virtual in the current environment, this should have a positive network effect that will resonate when the world opens back up.

The next 3 stocks aren’t growth companies like DocuSign but are cheap stocks under $10 that might be worth a look.

Sirius XM Holdings (SIRI)

With all the extra time at home, satellite radio has hit the jackpot, making their services much more appealing.

Since Sirius and XM Radio merged in 2008, the combined Sirius XM Holdings has enjoyed a near-monopoly on satellite radio.

Sirius built on that with the 2018 acquisition of Pandora, the music streaming product, helping to fill the sails again with rapid revenue growth; its audio products now reach more than 100 million people.

Sirius' situation is appearing healthy and added a further 1.1 million subscribers in 2019 alone, bringing its total paying subscribers to roughly 30 million. The company's audacious strategy of partnering with auto manufacturers to pre-install SiriusXM in new models should help steadily grow the business.

Zynga (ZNGA)

This video game stock is cheap and could be a beneficiary of the stay at home revolution.

Zynga's portfolio of popular games, combined with hyper-charged growth, makes it one of the best cheap stocks to buy under $10.

Last quarter, the social gaming developer behind franchises like Words With Friends, Zynga Poker, CSR Racing, and FarmVille set new company revenue records up 48%.

While growth is likely to decelerate quickly from such temporary coronavirus catalysts, I expect double-digit revenue growth in 2020.

Still, Zynga is holding up remarkably well, especially in the COVID-19 era, as people increasingly turn to mobile devices for entertainment.

Nokia Corp. (NOK)

Nokia's expected earnings growth is impressive with Wall Street looking for an 8% bump in 2020 and roughly 30% profit growth in 2021.

Cheap stocks to invest in under $10 don't often come in the form of well-oiled global corporations valued at $15 billion.

The Finnish communication equipment telecom is one of the rare exceptions against the rule.

Sales have grown 14% annually for the last five years. Nokia may end up one of the 5G stocks to watch in the coming years because of the stigma of Huawei forcing many Europeans to go with brands closer to home.

Nokia pays a hefty 8% dividend as well and will never need a last-second bailout.

“Every technological revolution takes about 50 years.” – Said Founder of Alibaba Jack Ma

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.