Global Market Comments

April 24, 2020

Fiat Lux

Featured Trade:

(APRIL 22 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (INDU), (GILD), (NEM), (GOLD), (USO),

(SOYB), (CORN), (SHOP), (PALL), (AMZN)

Global Market Comments

April 24, 2020

Fiat Lux

Featured Trade:

(APRIL 22 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (INDU), (GILD), (NEM), (GOLD), (USO),

(SOYB), (CORN), (SHOP), (PALL), (AMZN)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader April 22 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: Will Trump louse up the recovery by bringing people back to work too soon?

A: Absolutely, that’s a risk. Georgia is reopening in a couple of days, which is purely a political decision because all of the scientists have advised against it. If that creates a secondary Corona wave, which we will know in a few weeks, then no one else is going to reopen early and the depression instantly goes from a three-month one to a six or nine-month one. Nobody wants tens of thousands of deaths on their hands. If we do reopen early, it could create a secondary spike in cases and deaths that hit around the Fall, right before the election. That is absolutely what the administration does not want to see, but they’re pursuing a course that will almost guarantee that result, so I wouldn’t be traveling to the Midwest anytime soon. Actually, I'm not going to be traveling anywhere because all the planes are grounded. Trump’s strategy is that Corona will magically go away in the summer, and those are his exact words.

Q: What is the Fed's next move?

A: I don't think they will go to negative interest rates. The disruptions to the financial system would be too widespread. Nobody is having a problem borrowing money right now unless they are in the housing market and that is totally gridlocked. Probably, the best thing is to expand QE and keep buying more fixed income instruments. They are essentially buying everything now, including mortgage-backed securities, junk bonds, securitized student loan debt, and everything except stocks. Today, we heard that the FHA is now buying defaulted mortgages which account for 6% of all the home mortgages out there, so that should help a lot in bringing the 30-year mortgage rate back in line with the 10-year, which would put it in the mid twos. So, more QE is the most likely thing there.

Q: What do you think of Remdesivir from Gilead Sciences (GILD)? Is it a buy at current levels?

A: We recommended this six months ago with our Mad Hedge Biotech & Healthcare Letter and got a spectacular result (click here for the link). This is a broad-spectrum antiviral that worked against MERS and SARS. We think it’s one of many possible treatments for the Coronavirus but it is not a vaccine. Buying the stock here is downright scary, up 30% since January. We love biotech for the long term, but this is a terrible entry point for Gilead. If it drops suddenly 10-20% on this selloff, then maybe.

Q: You seem very confident we’re going lower again. I’m reminded of the December selloff of 2018 where we saw a very quick recovery and a lot of people were shut out.

A: The difference then is that we didn’t have a global pandemic which has killed 47,000 Americans and may kill another 47,000 or more before it's all over. And I think it’s going to take a lot longer for the government to reopen the economy than they think. And corporate share buybacks, the main driver of the bull market of the past decade, are now completely absent.

Q: You seem to prefer spreads to LEAPS. Is that the only strategy you use?

A: I’m not putting long term LEAPS (Long Term Equity Participation Securities) in the model portfolio because they have two years to expiration, and I don’t want to tie up our entire trading portfolio in a two-year position. So, we are doing front months in the model trading portfolio, but every week I’m sending out lists of LEAPS for people to buy on the dips. Of course, you should go out to 2022 to minimize your risks and you should only buy them on the down 500 or 800-point days. Put a bid in on the bid side of the market (the low side of the market), and if you get a sudden puke out, a margin call, or an algorithm, you will get hit with these things at really good prices. That is the way to do long term LEAPS.

Q: Why do you think the true vaccine is a year off?

A: If you took Epidemiology 101, which I did in college, you'll learn that when you have a very large number of cases, the mutation rate vastly accelerates. My doctor here in Incline Village tested blood samples he took in northern Nevada in December and found that there were two Coronavirus variants, two different mutations. So, if there are only two, we would be really lucky. The problem is that these diseases mutate very quickly, and by the time you get a vaccine working, the DNA of the virus has moved on and last year’s vaccine doesn’t work anymore. That’s why when you get a flu shot, it includes flu variants from five different outbreaks around the world every year, and I’ve been getting those for 40 years, so I already have the antibodies for 200 different flu variations floating around my system as antibodies. Maybe that’s why I never get sick. They have been trying to get an AIDS vaccine for 40 years, and a cancer vaccine for 100 years, with no success, and it would be a real stretch for us to get a real working vaccine in a year. The best we can hope for is antivirals to treat the symptoms and make the disease more survivable.

Q: Long tail risk for long term portfolios?

A: The time to buy your long-term tail risk hedges, or the ledges of long term extremely unlikely events, was in January. That’s when they were all incredibly cheap and they were being thrown away with the trash. Now you have to pay enormous amounts for any long-term portfolio hedges. It's kind of like closing the barn door after the horses have bolted, so nice idea, but maybe we’ll try it again in another ten years.

Q: Should I buy gold options two months out or through gold LEAPS?

A: I would do both. Buying gold two months out will probably make more money faster, but for LEAPS—let’s say you bought a $2,000-$2,100 LEAPS two years out—the return on that could be 500-1000%, so it just depends on how much risk you were willing to take. I would bet that the LEAPS selling just above the all-time highs at $1,927 are probably going really cheaply because people will assume we won't get to new all-time highs for a while and they’ll sell short against that, so that may be your play. You can get even better returns on buying LEAPS on the individual gold stocks like Newmont Mining (NEM) and Barrick Gold (GOLD).

Q: How soon until we take a profit on a LEAPS spread?

A: Usually if you have 80% of the maximum potential profit, that’s a good idea. You typically have to hang out for a whole year to capture the last 20% and you’re better off buying something else unless you have an idea on how to spend the money first—then you can sell it whenever you have a profit that you are happy with. I know a lot of you who bought the 2-year LEAPS in March on our advice already have enormous profits where you’ve made 500% or more in four weeks. If you bought the 2021 LEAPS, I would roll out of those here and then buy the two-year LEAPs on the next selloff to protect yourself against a second Corona wave. Take some good profits, roll that money into longer two-year LEAPS.

Q: There seems to be a real consensus we will retest the lows. Is it possible that the low we recently had was actually a retest of the 2018 lows?

A: We actually got well below the 2018 lows, and with all of the stimulus out there now, I don’t see us going back to 18,000 in the Dow (INDU), 2,200 in the SPY, unless things get worse— dramatically worse, like a sudden spike in cases coming out of the Midwest (that’s almost a certainty) and the south. They opened their beaches and essentially created a breeding ground for the virus to then return to all the states from the visiting beachgoers. So, everyone’s got their eyes on this combined $14 trillion of QE and stimulus and they don’t want to sell their stocks now, so I don’t see a retest of the lows in that situation. I would love it if we did, then that would be like LEAPS heaven, loading up on tech LEAPS at the bottom. But even if we go retest the lows, the tech stocks aren’t going back to the lows—too many buyers are under the market.

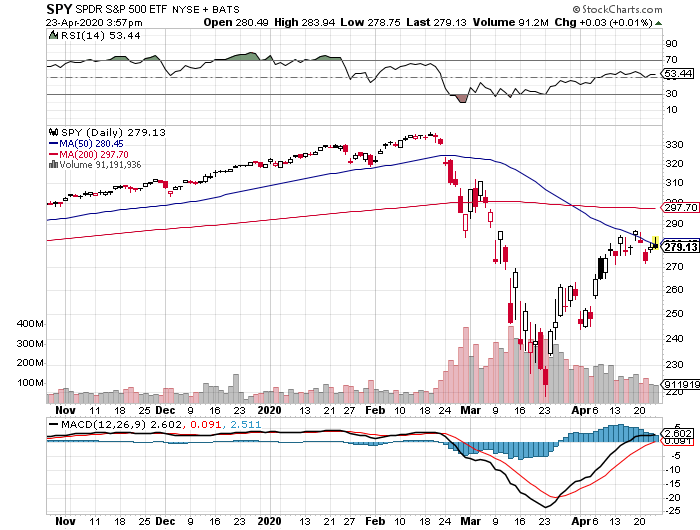

Q: Are you using the 200-day moving average as a top?

A: That’s just one of several indicators; it’s almost a coincidence that the 200-day is right around 300 in the (SPY)’s, but also we have earnings multiples at 100-year highs—that’s another good one. And margin requirements have been greatly increasing. Any kind of leverage has been stripped out of the system, you can’t get leverage (even if you’re a well-known hedge fund) because all lenders are gun-shy after the meltdown last month, so you’re not going to be able to get that kind of leverage for a long time. And you can also bet all the money in the world that companies are not buying their stocks back, and that was essentially the largest net buyer of stocks for the last decade in the market, some $7 trillion worth. So, without companies buying back stocks, especially in the airlines, $300 in the (SPY) could be our top for the next month, or for the next six months.

Q: With Goldman Sachs forecasting four times the worst case of the 2008 great recession, will stocks not retest the market?

A: No. Remember, the total stimulus in 2009 was only $787 billion. We’re already at $6 trillion and $8 trillion in QE so we have more than ten times the stimulus that we had in 2009; so that should offset Goldman’s worst-case scenario. And they’re probably right.

Q: Why are you not shorting oil here?

A: The (USO) was at $50 three months ago, it’s now at $2. I don’t short things that have just gone from $50 to $2. And even though there’s no storage at this price, you want to be building storage like crazy, and it doesn’t take very long to build a big oil storage tank. Another outlier out there is that the US government could step in and buy 20 million barrels to top up the strategic petroleum reserve (SPR). Buying it for free is probably not a bad idea and then sell it next time we go to $20, $30, or $40 a barrel. The other big thing is that the government is mad not to impose punitive import duties on all foreign oil. Any other administration would have already done that long ago because oil prices are destroying the oil industry. But a certain president seems to have an interest in building hotels in the Middle East, and I think that’s why we don’t have import duties on Saudi oil—pure conflict of interest.

Q: Will Coronaviruses be weaker or stronger?

A: We just don’t know. This is a virus that has been in existence for less than a year; most diseases have been around for hundreds of years and we’ve been researching them forever, this one we know essentially nothing. Best case is that it goes the route of the Spanish Flu, which mutated into a less virulent form and just went away. The Black Plague from the Middle Ages did the same thing.

Q: Thoughts on food inflation going forward?

A: Food prices are collapsing and that’s because all of the distribution chains for food are broken. Farmers are having to plow food under in the field, like corn (CORN), soybeans (SOYB), and fruit, because there is no way to get it to the end-user or to the food bank. Food banks are struggling to get a hold of some of this food before it’s destroyed. I know the one in Alameda County, CA is calling farmers all over the west, trying to get truckloads of just raw food sent into the food banks. But those food banks are very poorly funded operations and don't have a lot of money to spend. In California, we have the national guard handing out food at the food banks but there is not enough—they are running out of food. Long term, agriculture is a big user of energy. They should benefit from low oil prices, but it doesn’t do any good if they can’t get their product to the market. Look at any food price and you can see it’s in free fall right now caused by the global deflation and the depression. By the way, the same thing happened in the Great Depression in the 1930s.

Q: Would you short Shopify (SHOP)?

A: No. Shopify is essentially the mini Amazon (AMZN) and has a great future; they are basically having a Black Friday every day. It’s also too late to buy it unless we have a big dip.

Q: Would you include Palladium (PALL) in your precious metals call?

A: No. Palladium especially went into this very expensive, and they are dependent on the car industry for catalytic converters, which has just fallen from a 16 million unit per month to 5 million on the way to zero. Don’t go with the alternative white metals at this time.

Q: What’s your favorite 10 times return stock?

A: Tesla, if you can get it at $500. It’s already delivered me two ten-time returns, and I’m going to go for another tenfold return on a five-year view.

Good Luck and Stay Healthy

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Biotech & Healthcare Letter

April 23, 2020

Fiat Lux

Featured Trade:

(POST-PANDEMIC STOCKS TO DIVERSIFY YOUR PORTFOLIO)

(BPMC), (NVTA)

The biotechnology sector had been starved for love on Wall Street for the past few years despite the life-changing research and the introduction of fresh and innovative treatments for previously incurable conditions.

A year ago, the sector had the lowest price earnings multiple with the fastest earnings growth.

That couldn’t last.

With the outbreak of the catastrophic coronavirus disease (COVID-19) pandemic the public has fallen in love with the sector. While the biotechnology sector tanked in March with everything else, several industry benchmarks have been outperforming the broader market so far.

The harsh truth is that cures and vaccines remain far off.

The biotech sector is likely to become the next decade’s largest growth story.

The key is to find companies with strong balance sheets along and leadership that can manage any financial storm.

Nonetheless, there are biotech companies worth considering now, particularly those selling at bargain bin prices but with mature pipelines and promising soon-to-launch commercial products.

One compelling stock for long-term holding is Blueprint Medicines (BPMC).

This company develops targeted medicines for rare genetic types of cancer. So far, Blueprint has three treatments lined up for release in the market in the next 18 months. Just last month, the company announced the FDA approval of its first-ever cancer drug Ayavakit.

Ayavakit, which will be marketed as a treatment for a rare, genetically linked kind of gastrointestinal cancer, comes with a jaw-dropping price tag of $32,000 for a 30-day supply.

This cost is twice the amount of what was originally forecasted. However, analysts claim that this price is “justifiable” considering Ayavakit’s effectiveness and the absence of competition.

Riding the momentum of Ayavakit’s FDA approval, Blueprint has already filed for a second application in a bid to expand the indication for the drug to include patients suffering from gastrointestinal stromal tumors who already underwent three other treatments but failed.

According to the World Health Organization, 5,000 to 6,000 Americans are diagnosed with these tumors every year. Blueprint believes there's a strong chance this gets approved since 86% of their participants in the clinical trial responded to the drug.

Another potential blockbuster for Blueprint is a lung cancer drug currently dubbed as Pralsetinib. If the company gets approved, it can tap into a lucrative market as lung cancer comprises almost 25% of all cancer diagnoses.

Despite the COVID-induced economic crisis, Blueprint remains an attractive investment since it raised money prior to the pandemic. That means the company is well-capitalized.

Admittedly, the stock has gone down by 42% since its July 2019 high and only trades for $57 these days.

Although the company may experience disruptions in the near term, it’s undeniable that patients will still need their medications. Hence, business will definitely come back.

Another scenario is that Blueprint attracts more attention from aggressive acquirers.

So, if you’re looking into how to maximize this opportunity, keep it in mind that your reward all depends on the size of the position you plan to take.

Obviously, this stock comes with its own risks so it might not be an attractive option as a cornerstone of your portfolio. However, adding it to your diversified portfolio could offer you with market-beating returns in the long run.

Another stock that has been disrupted but still presents enticing rewards in the post-COVID days is Invitae (NVTA).

It peaked around February at $28 but went down to trade at a measly $9 to $12 as the coronavirus situation worsened. In fact, Invitae shares bottomed sometime in March at around $7. Since then, investors have been snapping it up at this low price.

Invitae offers genetic testing for kids with developmental issues, so you can easily see why the company isn’t going out of business anytime soon.

Fueling investors’ enthusiasm on this biotech stock are the series of acquisitions it made recently, with the company pouring money on virtual medicine.

In a way, you can say that Invitae is actually quite prepared for what’s happening today.

Just last month, Invitae acquired Orbicule BV otherwise known as Diploid. This recently acquired company develops an AI software that analyzes next-generation sequencing data combined with a patient’s information in order to diagnose genetic disorders.

The terms had Invitae buy 2,800,623 shares of Diploid’s common stock plus roughly $32 million in cash.

In April, Invitae acquired two companies.

One is YouScript Incorporated, which offers clinical decision support and functions as an analytics platform. This deal consisted of 2,293,452 shares of common stock plus $25 million in cash.

The second is Genetic Solutions, operating under the name Genelex, which is a precision medicine company.

With these acquisitions, Invitae needed to raise capital at a bargain-basement price. Does that mean that this genetic testing stock bottomed out?

That’s highly unlikely, but it’s virtually impossible to time market peaks and troughs anyway. The only reasonable means to deal with the current situation is to adopt a long-term mindset.

Keep in mind that this coronavirus pandemic will eventually pass. When it does, the biotechnology industry will return to growth.

After all, the revolutionary and groundbreaking drugs developed by this sector are critical.

For any growth investor on the lookout for high-value and sustainable options, the biotech industry can turn out to be the most lucrative one out there.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

April 23, 2020

Fiat Lux

Featured Trade:

(HOW TO FIND A GREAT OPTIONS TRADE)

DBX is trading about $20 per share as I write this.

And they report earnings on May 7th. This appears to be reflecting in the option pricing on the stock.

Because of this, I am going to suggest selling calls against DBX.

My suggestion is to sell the calls that expire next Friday.

Here is the suggestion:

Sell to Open (1) May 1st - $20.50 call for every 100 share you own.

You should be able to sell them for $.50.

These are the calls that expire next Friday.

This alert applies to you if you own share in DBX only. In other words, do not sell naked calls.

Assuming you collect 50 cents per share, it will mean you will have collected $1.25 per share in call premium on DBX.

Mad Hedge Technology Letter

April 22, 2020

Fiat Lux

Featured Trade:

(HERE’S A MINI AMAZON TO BUY)

(SHOP)

This company is “handling Black Friday traffic every day” during the era of Covid-19 and it “won’t be long until traffic has doubled or more.”

Those were words right out of Shopify's CTO (Chief Technology Officer) Jean-Michel Lemieux while having one of the best seats to the biggest migration from offline to online in human history.

Investors are out there scrounging for the best coronavirus tech stocks, there never has been a time when losers lose more than ever, and winners win more than ever.

Take a look at Shopify (SHOP) if you want to associate yourself with the great coronavirus tech stocks.

The name does exactly what it sounds like and shares have almost doubled in the past 30 days to $600 per share.

In short, Shopify is a cloud-based commerce platform for small and medium-sized businesses in Canada.

Shopify was founded in 2004 by Tobias Lütke, Daniel Weinand, and Scott Lake after attempting to open Snowdevil, an online store for snowboarding equipment.

Lütke decided to do it himself after he was unable to find the right snowboarding gear online and launched it after two hasty months of development.

The platform grew wildly and was named Ottawa’s Fastest Growing Company by the Ottawa Business Journal in 2010.

Like so many other tech companies, the success was parlayed into more funding with $7 million from an initial series A round of venture capital financing in December 2010 and another Series B round raised $15 million in October 2011.

By 2014, Shopify supported 120,000 online retailers and was doubling revenue every year.

Most people don’t know this, but they have been public since 2015 and became so successful that Amazon integrated with them to allow merchants to sell on Amazon from their Shopify stores.

The stock exploded 10% on this news and they have been largely unstoppable as Canada’s go-to online platform even licensing out the software for online cannabis sales in Ontario when the drug was legalized in October 2018.

Shopify's software was also integrated with in-person cannabis sales in Ontario when it is legalized in 2019.

They have really touched on many bases and pivoted nimbly when they announced that 5,000 staffers would work remotely from home due to the global pandemic.

Shopify keeps marching towards profits and not even a pandemic can knock them off their perch.

Shopify has two routes of making money - subscription fees and transactional fees for services like payments or shipping.

Transactional fees are part of its merchant solutions segment and connected to merchants' success incentivizing merchants to sell more.

Growth has been breathtaking with compound 65% annual growth rate (CAGR) since 2015 and its merchant solutions segment growing faster at a 76% CAGR.

Shopify management projected first-quarter revenue to increase 38% year over year and 2020 full-year growth at 42% to $2.145 billion, but that was in February before they could take into consideration a world that involves online buying first.

59% of total revenue are fees tied to merchants' sales and volume has mushroomed.

The company will smash revenue projections and even though valuation is sky-high, the momentum suggests that shares will go higher.

Buyers should wait for the next big dip as the next entry point into Shopify.

“I discovered Buddha did not set out to found a world religion.” – Said CEO of Microsoft Satya Nadella

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.