“I have lived through many unique events over the past five decades on Wall Street, but this market seems to defy all logic based on historical experience and data,” said Michael Schwartz chief options strategist at Oppenheimer & Co.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Today, I would like to make one more suggestion and it is on a stock that reports on June 25th.

The stock is McCormick & Co., Inc. (MKC).

MKC is trading at $172.46 as I write this.

I am going to recommend a debit spread using the front month June options.

Here is the trade.

Buy to Open June 19th - $175.00 call @ $2.30

Sell to Open June 19th - $180.00 call @ $0.80

The net debit will be $1.50 per spread, with a maximum gain of $3.50 per spread.

Based on the nominal portfolio, limit the trade to 4 spreads or 0.6% of the portfolio.

The trade allocation is small because I am suggesting you trade the front month contracts.

Today, I would like to make a recommendation on a stock that does have weekly options. And I want to suggest a weekly covered call.

And it is a stock we traded recently.

The stock is Clovis Oncology, Inc. (CLVS).

CLVS is trading at $7.31 per share as I write this.

My suggestion is to buy CLVS at the market, which is $7.33 as I write this.

Then Sell to Open (1) June 12th - $7.50 Call for every 100 shares you buy.

You should be able to sell them for $.25 per every option.

Based on the nominal portfolio, limit the share buy in to 600 shares or 4.4% of the portfolio.

Assuming you buy 600 shares, you would sell 6 of the June 12th $8 Calls.

If the calls are assigned this Friday, the return will be 5.7% for 5 days.

Mad Hedge Technology Letter

June 8, 2020

Fiat Lux

Featured Trade:

(ZOOM’S LESSON FOR TECH STOCKS),

(ZM)

All signs point to green – that is the big investing takeaway from Zoom’s (ZM) outstanding earnings report.

It also means you cannot be bearish technology stocks.

Investors can lose their shorts trying to short the monopolies of Amazon, Google, and now the mega growth video communications company Zoom.

I still maintain a nuanced strategy of neutrality with a tactically bullish stance because of the rapid run-up from the March 23 lows.

Zoom has been one of the stalwarts of the work-at-home revolution and the numbers back it up.

Quarterly revenue guidance was up a juicy 64%.

The stunning 169% quarterly revenue increase year-over-year are numbers that dreams are made of.

I would like any reader to dig through the collection of companies trading on the New York Stock Exchange and find me one that beat its quarterly revenue target by over 300% during the pandemic.

That is why you invest in tech and that is why you read my technology letter.

What does this really mean?

There is still money to be made in technology.

This isn’t just a fly-by-night, smash-and-grab ploy to only burn down tomorrow like a Potemkin village.

The staying power is real and the stay-at-home movement will be stickier than ever moving forward as companies cut costs, digitize to the extremes, and hope to stave off the next mega-crisis when it threatens to take the food off our tables again.

Even Zoom itself couldn’t wrap their heads around the dramatic transition from enterprise use to consumers' necessity to keep in touch with family and friends.

The company became the “can’t live without” app of the year and grew from 10 million users to over 300 million users this quarter.

If any analyst had them rated as neutral before, this was the signal to issue a buy recommendation.

It is without exaggeration to say these are the most impressive financial results I’ve ever seen in software, and likely will never be repeated in our lifetimes.

Fresh opportunities also come in the form of education and telemedicine as reasons for a bullish outlook moving forward.

Zoom will need to fend off competitive concerns from Microsoft and Google, but Zoom’s scalable technology and ease of use have created a strong moat around its business model.

The company has an installed base of 265,000 customers with 10 or more employees with ample chances to cross-sell its Zoom Phone and Zoom Rooms services.

There is a basket of stay-at-home stocks that have outperformed the market since the Covid-19 pandemic began, and I am highly convinced that Zoom is the purest way to play this theme.

Even as lockdowns ease, many workers will demand the new normal of working remotely.

A taste of a good life isn’t enough, and the coronavirus proved that companies could function just as well without the traditional cubicle and office space.

The biggest problem with Zoom’s shares is finding a reasonable investing entry point into the best tech story of 2020.

There is just not enough superlatives to say about Zoom and investors would need to wait for the stock to dip near resistant levels at the 50-day moving average around $160 to put new money to work in Zoom shares.

“You renew yourself every day. Sometimes you're successful, sometimes you're not, but it's the average that counts.” – Said current CEO of Microsoft Satya Nadella

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

June 8, 2020

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or HISTORY IS REPEATING),

(SPY), (INDU), (TLT), (TBT) (TSLA), (DAL), (BA)

When I was 13 years old in 1965, the week-long Watts Riots broke out in impoverished South Los Angles, killing 34. It was sparked by a police arrest for reckless driving.

While the ruins were still smoking, my dad drove me downtown to view the wreckage. Prudently, he kept his loaded Marine 1911 Browning .45 caliber automatic under a newspaper on the front seat. It looked like a war zone, with some 256 buildings burned to the ground and another 200 looted.

I have been running towards the sound of guns ever since.

Some 55 years later, we are seeing history repeat itself. However, instead of seeing the riots occur in major cities one at a time, as they did in the 1960s, we saw demonstrations and riots in 356 US cities all at the same time!

The impact on the economy, and eventually the stock market, will be immense.

As a long term follower of the structure of the US economy, what is going on now is utterly fascinating. A million connections within the economy have been severed forever and a million new ones created, which few understand.

The end result will be a far more efficient and profitable form of American capitalism. Companies are rebuilding time-tested business models in weeks. Those who can discern these new connections early will make fortunes. Those who don’t will dry up and blow away like so much dust into the ashcan of history.

Of course, the defining announcement of the week came on Friday morning with the Headline Unemployment Rate, which delivered a blockbuster FALL, from 14.7% to 13.3%, sending stock up 1,000 points. It’s proof that the stimulus is largely going into the stock market.

Economist forecasts were off by a whopping 10 million jobs, delivering the biggest miss in history. Leisure and Hospitality accounted for 1.2 million job gains, half the total.

Something doesn’t smell right here. How do you miss 10 million jobs? The streets and traffic levels tell me the real jobless rate is more like 20%. I can’t even get into my bank to deposit a check.

I believe the streets.

Look for big downward revisions, which may pose another threat to the market, and possibly a secondary crash, but not for another month.

A client told me last week that he wishes there were major market crashes more often where he could load the boat with deep out-of-the-money LEAPS which then double or triple in weeks.

He may get his wish. The faster we rise now, the greater the risk of a secondary crash which could wipe out half the recent gains.

I managed to catch the bottom of the biggest stock market rally of all time with dozens of LEAPS like with (TSLA), (DAL), (UAL), (BRKB), and (BA). I took profits all the way up and went into last week modestly “Risk On.” But the 1,000-point rally on Friday caught me totally by surprise, as it did everyone else.

I’m sorry, but I guess I’m lousy at trading those once in hundred-year events.

My saving grace has been the most aggressive, in-your-face short positions in the bond market (TLT), (TBT) in the 13-year history of this letter at the same time. It’s still a great trade. Selling short US Treasury bonds now with a 0.90% yield is the same as buying the Dow Average at 20,000….again.

Pending Home Sales collapsed 21.8% in April and off 33.8% YOY on a signed contract basis. These are the worst numbers since the data series started. The West was hardest hit, down 50%. No wonder I’ve seen so many real estate agents at the beach. We already know that a sharp rebound is underway as Millennials move to the burbs and flee Corona-infested cities. Home prices will be up this year.

Mortgage Demand is soaring as ultra-low rates spur demand. Housing will lead the recovery of the bricks and mortar economy. It will take another year before jumbo loan rates start to decline as banks avoid risk like the plague. Buy (LEN) and (KHB) on dips.

Stocks are the most overbought in 20 years since the top of the Dotcom bubble. Risk is extreme for new longs. Almost all S&P 500 stocks are trading above 50 day moving average. The technical indicators are screaming “SELL”.

Consumer Confidence is recovering as even the slightest bit of reopening looks like a lot coming off of zero. The Conference Board’s consumer confidence index rose to 86.6 this month from 85.7 in April, well up from an expected 82. Call it “green shoots”.

Used Car Prices have crashed with Hertz going bankrupt and defaults on new car loans reaching record levels. Surviving rental companies have cancelled all new car orders. Vacation travel has vaporized. Wells Fargo has ceased lending to car dealers. Time to upgrade that second car?

The greatest 50-day rally in the S&P 500 is now over, up 40% since March 23. Buyers are getting nervous and exhausted and are overdue for a pullback. But the historical six-month gain after a move like this is another 10.2% up, followed by a one-year gain of 17.3%. Over $14 Trillion in Fed and fiscal stimulus can go a long way.

US Factory Orders collapsed further, down 13% in May after a 14% crash in April. Don’t expect these numbers to decline any time soon. The stock market will never notice.

When we come out on the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil at a cheap $34 a barrel, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade.

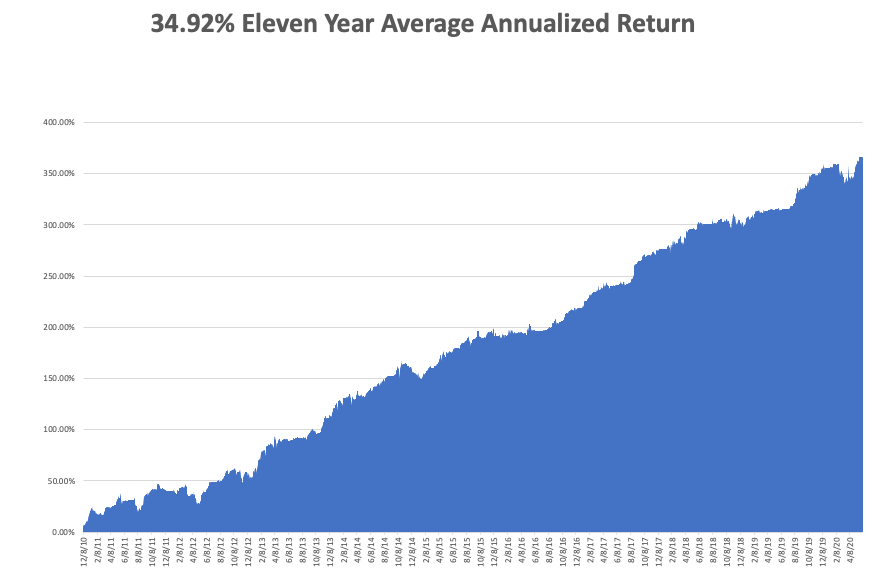

My Global Trading Dispatch performance was up modestly on the week, my downside hedges costing me money in a steadily rising but wildly overbought market. We stand at an eleven-year performance all-time high of 366.68%.

My huge short bond positions, which I have been adding to all the way down, are still delivering big profits. That’s because time decay is really starting to kick in with nine trading days left until the June expiration.

That takes my 2020 YTD return up to a lofty +10.77%. This compares to a loss for the Dow Average of -4.9%, up from -37%. My trailing one-year return exploded to a near-record 52.27%. My eleven-year average annualized profit ballooned to +34.92%.

The only numbers that count for the market are the number of US Coronavirus cases and deaths, which you can find here.

On Monday, June 8 at 8:00 AM EST, Consumer Inflation Expectations for May are announced.

On Tuesday, June 9 at 10:30 AM EST, we learn the NFIB Small Business Optimism Index for May.

On Wednesday, June 10 at 8:15 AM EST, the US Core Inflation Rate for May is printed. At 10:30 AM EST, the EIA Cushing Crude Oil Stocks are published.

On Thursday, June 11 at 8:30 AM EST, Weekly Jobless Claims are announced.

On Friday, June 5, at 10:00 AM EST, the University of Michigan Consumer Sentiment figures are out. The Baker Hughes Rig Count follows at 2:00 PM EST.

As for me, I traveled to the local shopping mall to see how real this 2.5 million gain in jobs really exists. More than 50% of the shops were closed, several had already gone bankrupt and traffic was easily below 10% of pre-pandemic levels. Restaurants had maybe 5% of peak traffic sitting at outside tables. Mall police were there to enforce facemask rules.

Nope, not seeing any recovery here. Caveat Emptor.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Hill 27 on Guadalcanal

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.