While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

June 16, 2020

Fiat Lux

Featured Trade:

(THE IDIOT’S GUIDE TO INVESTING),

(TSLA), (BYND), (JPM)

(TESTIMONIAL)

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Today I would like to make one more suggestion. And it will be a covered call.

The stock is DXC Technology Co. (DXC).

DXC is trading at $16.34 as I write this.

My suggestion is to buy DXC at the market.

Then Sell to Open (1) June 19th- $17 call for every 100 share you buy.

The June 19th - $17 calls can be sold for $.55.

Based on the tracking portfolio, limit the stock buy in to 300 shares or 4.9% of the tracking portfolio.

If the calls are assigned this Friday, the return will be 7.4% for five days.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

We were able to sell the $4 call on MFA that expires this coming Friday for $0.65.

And today, we can close it for $0.10.

Ordinarily, I would leave the position alone and hold until expiration.

But MFA reports this Thursday and we can capture 85% of the profit on the call that was sold.

My suggestion will be to close the short calls.

Here is how you do it.

Buy to Close June 19th - $4 call for $0.10.

Close the entire short call position. So, if you followed the alert, you would be buying back 10 calls.

Of course, this alert only applies if you sold the June $4 calls.

If you did sell the 10 calls, the cash profit is $550.

If the stock makes a run into earnings, I will suggest you sell more call options.

Mad Hedge Technology Letter

June 15, 2020

Fiat Lux

Featured Trade:

(DON’T TAKE YOUR EYES OFF BIG TECH SHARES),

(GOOGL), (AAPL), (MSFT), (NFLX), (FB), (AMZN), (IBM), (CSCO)

There is literally no possible scenario in a post-second-wave lockdown where the 7 tech stocks of Facebook, Google, Apple, Microsoft, Netflix, Facebook, and Amazon don’t shoot the lights out unless the world ceases to exist.

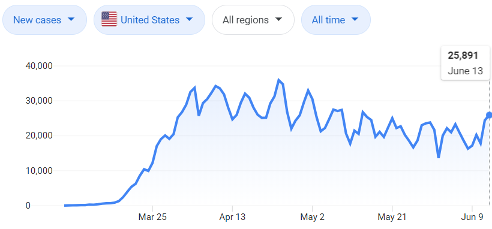

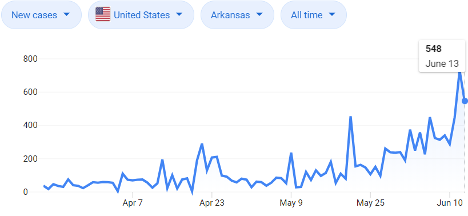

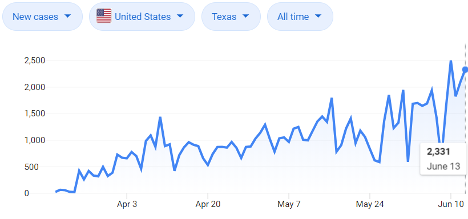

25,891 – that is the number of new coronavirus cases registered in the U.S. on June 13th, 2020 which is about in line with the recent near-term peaks of total daily U.S. coronavirus cases.

Why is this important?

Traders are calculating whether a “second wave” will possibly rear its ugly head to crush the frothy momentum in tech stocks.

That is where we are at now in the tech market.

Tech stocks could possibly ride another magnificent ride up in share appreciation if the reopening of the economy can kick into second gear.

Skeptics are sounding the alarms that this is not even the “second wave” and we still in the latter half of the first wave.

Consensus has it that this could be just a head fake.

The jitters are real with recent dive in tech shares.

The five biggest tech companies burned more than $269 billion in value last Thursday - the worst day for U.S. stocks since March and the 25th worst day in stock market history.

Nasdaq stocks ended the day largely 5% in the red with Microsoft shedding $80 billion in market cap in just one day.

Larger drops were led by IBM who lost 9% and Cisco who lost 8%.

It was a dreadful day at the office, to say the least.

We are teetering on a knife's edge and the tension is running high in the White House with Treasury Secretary Steven Mnuchin already announcing that the U.S. can’t afford another lockdown.

It’s not up to him in the end, it’s about how consumers will assess the confronted health risks.

Tech will undoubtedly be dragged down with the rest on the next lockdown sparing few survivors.

The housing market might actually go down as well as the initial push to the suburbs will dissipate and fresh forbearances will explode higher.

Consumers might not even have the cash to pay for their monthly Apple phone service or internet bill if the worst-case scenario manifests itself.

The health scare has already dented new software purchases by small and medium businesses (SMBs) and tech companies in industries such as travel, retail, and hospitality; online ad spending by the likes of automakers and online travel agencies; and smartphone, automotive and industrial chip purchases.

Small business has held off on reducing their tech software spending too much on the expectation that macro conditions will perform a V-shaped recovery.

Numerous tech firms have cited “demand stabilization,” but it’s not guaranteed to last if we revert to another lockdown.

If a lockdown happens again, it will be another referendum on Fed’s enormous liquidity impulses versus the drop in real earnings or flat out losses to tech business models.

Even with the media’s onslaught of vicious fearmongering campaigns, I do believe this is the time for long-term investors to scale into the best of tech such as Amazon, Apple, Google, Microsoft, Facebook, Netflix.

If you thought these 7 companies had anti-trust issues before, then look away.

We could gradually head into an economy where up to 40% of the public markets comprise of only 7 tech stocks which is at a mind-boggling 25% now.

Never waste a good crisis – tech is following through like no other sector!

Bonds don’t make money anymore and hiding out now means putting your life savings into these 7 premium tech stocks.

In the short-term, this is a good opportunity for a tactical bullish tech trade.

“Microsoft isn't evil, they just make really crappy operating systems.” – Said Finnish-American software engineer Linus Benedict Torvalds who is the creator Linux, Android, and Chrome OS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.