It was February 19 when the tech comprised Nasdaq index swan dived from a liquidity crisis of epic proportions triggered by the virus only to recover the 30% of loss gains in 3 months.

When the Nasdaq made a V-shaped recovery, experts were shocked by the pace of the recovery as the Fed deployed every tool in the toolbox at saving the stock market.

Well, three months on from the Nasdaq index pulling level year to date, tech stocks are 20% higher as main street still labors under an economy that has seen net job losses of 10s of millions.

The liquidity poured into the system has been overwhelming, but many investors aren’t complaining.

Insane price action is the crucial signal to this market frothiness and can be seen in Tesla (TSLA) whose stock has gone from $85 in March to almost $500.

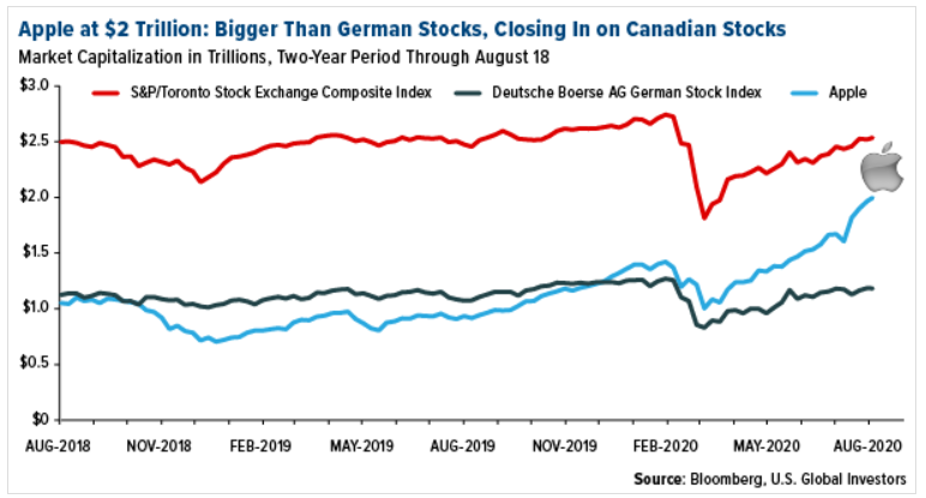

Apple (AAPL) has surpassed the $2 trillion mark.

The market is “looking through” any bad news and is putting a high premium on tech shares that have usurped the mojo of the rest of the broader economy.

Investors need to be in tech because it’s not only where the growth is, but it is where business models are mostly protected.

Last time I checked, computers and smartphones cannot get the coronavirus.

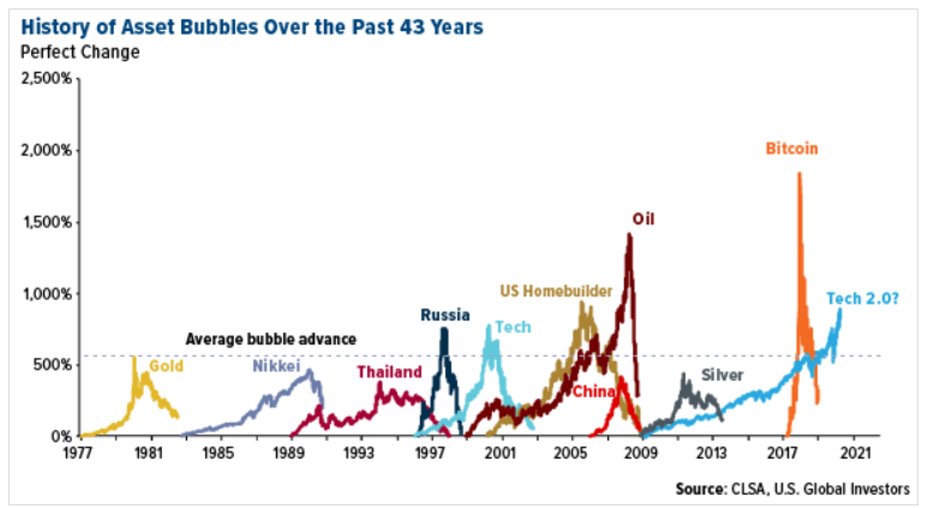

Billionaire Mark Cuban, team owner of Dallas Mavericks in the NBA, sees a huge tech bubble reminiscent of the infamous dot.com fiasco in the late 1990s and early 2000s.

Suddenly, the get-rich-quick crowd is investing with reckless abandon. It seems these upstarts have a fear of missing out and are chasing the market. Cuban is skeptical about the market rally and the bubble could burst in a couple of years.

Unlike the tech debacle at the turn of the millennium, Cuban opines that this year’s version has the Federal Reserve’s help. The U.S. central bank is pumping money into the pandemic-battered economy, but unintentionally supporting risk appetite on Wall Street. Bolder investors are even picking up shares of bankrupt companies.

People have a newfound interest in the stock market and hopping on the bandwagon because the Feds are injecting money to prop up the economy.

Cuban has investments in Amazon (AMZN) and Netflix (NFLX).

Shopify happens to be the largest publicly-listed company in Canada as of July 31, 2020, besting bank giant Royal Bank of Canada.

The 16-year old e-commerce company year-to-date gain is 170%.

I believe in the wisdom of crowds, and that markets have gotten it right far more often than they’ve been wrong.

Ultimately, there are simply too many dollars chasing too few trades.

Tech stocks have driven much of the U.S. market’s gains since March. Were it not for a handful of them, the S&P 500 may have performed more in line with other economies’ stock indices.

Between the market bottom on March 23 and August 20, shares of Apple, Amazon, Microsoft, Facebook, Alphabet, and graphics processor designer NVIDIA were responsible for a heart-stopping 33 percent—an entire third—of the uptrend in the S&P 500.

Apple alone was responsible for more than 11 percent of the market’s moves. Last week, the iPhone-maker became the first U.S. company to surpass $2 trillion in market capitalization, nearly as much as all the companies in the Russell 2000 Index of small-cap stocks combined. Apple is now valued more highly, in fact, than German stocks in the Deutsche Boerse Index and is closing in on Canadian stocks in the S&P/TSX Composite Index.

We are seeing unprecedented price action in the tech sector with the old normal of 1% gains in one trading day turning into 3% or 5%.

We will need some type of liquidity prevention event to experience a real major sell-off in technology and it is true, the higher we go, the harder we will fall.