While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

November 23, 2020

Fiat Lux

FEATURED TRADE:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE VACCINE PUT IS IN),

($INDU), (SPY), (TLT), (GLD), (TSLA)

You’ve all heard of the Fed Put which has put a floor under stock markets for the past decade, although it didn’t work so well this year.

Now, we have the Vaccine Put. Traders and investors have been more than willing to look through the pandemic to the other side, when multiple vaccines bring an end to the pandemic next summer.

That explains the ballistic $3,800 point rally in the Dow Average that launched in the run-up to the election. At 200,000 new cases and 2,000 deaths a day, we are losing the battle, but the cavalry is on the way and we can even hear the bugles.

That’s why I have recently been more aggressive in the market than usual, breaking all of my 13-year performance records. I don’t expect a market correction of more than 6% from here, or $1,800 Dow points. All of my current positions are geared to handle such a hit. After that, the market runs to new all-time highs.

We have ample reasons to see that 6% drawdown. While the pandemic rages, the president plays golf. Treasury Secretary Steven Mnuchin has moved to cancel the stimulus program in progress, despite vociferous Fed opposition. It was enough to prompt a $300 point selloff in the Dow and a near $2.00 spike in the bond market (TLT).

It is a scorched earth policy the Russians would be proud of. Trump is attempting to saddle Biden with a deeper depression and worse pandemic that will take longer to get out of. You and I will pay the price. In the meantime, there is a bull market in refrigerator trucks.

But if you believe that the Dow is headed for $120,000 in a decade as I do, why bother selling to avoid a mere $1,800 correction? You’d probably miss the bottom and the next leg up.

American Consumers are loaded with cash, after enduring a spending diet that is approaching a year. No business travel, no vacations, no shopping. Debt service ratios are also at decade lows, thanks to ultra-low interest rates. It all sets up a new American Golden Age starting in 2021.

Moderna announces 94.5% effective vaccine, triggering another monster rally in stocks for the second week in a row. The vaccine seems to block all of the most severe cases. Seniors may be able to get it by April. Mad Hedge Biotech Letter subscribers made a killing, getting into (MRNA) a year ago, pre-pandemic. Keep buying (MRNA) on dips. As for me, I’m running out of longs as they have all worked.

Mass tourism will return this summer after we all get our shots, says the CEO of Expedia, Peter Kern. The discount airline ticket reseller has been hanging on by its fingernails for the past nine months and just announced horrific earnings. Hint: this is not Rome’s first plague. A lot of travel businesses will get under, then resurface under new ownership. Summer booking is already picking up.

Tesla joins the S&P 500 and at a $480 billion market cap is the largest new entrant ever to do so. The stock was up a mind-blowing $108, or 27% on the news. This opens up new categories of institutional investors for Elon Musk’s dream come true, such as the $4.5 trillion in (SPX) index funds, which are now required by law to buy it. It gives the (SPX) more of a technology bent.

S&P finally got past the issue that most of the company’s profits come from ZEV, or green credits. Goldman Sachs figures that this will generate at least $9 billion of net buying of Tesla shares when there are no sellers. At this point, Tesla is the largest position of most Mad Hedge followers, primarily through capital appreciation.

Warren Buffet is pouring money into big pharma, and maybe you should too. It’s the cheapest sector in the market. AbbVie (ABBV), Bristol Myers (BMY), Merck (MRK), and Pfizer (PFE) were his biggest picks, according to regulatory filings, all names well known to the subscribers of the Mad Hedge Biotech & Healthcare Letter. It’s not all about Covid-19. Every major human disease will be cured in the next decade, spinning of billions in profits.

Homebuilders Sentiment Index breaks new record, at 90. The residential real estate market is on fire. After a great run, the homebuilders are still getting fabulous data. Builders are seeing supply shortages everywhere. Buy (LEN), (DHI), and (KBH) on dips. This trend has another decade to run.

Housing Starts rocket in October to a staggering 1.53 million, the highest since the last housing bubble top in 2007. Good luck finding something for sale. Which vacation destination resort is seeing the highest growth in sales? Good old Incline Village, NV, up 87% YOY. Many are buying homes after simply looking at zoom videos. Could housing be presaging what the entire economy is going to do in 2021? Buy everything on dips!

The Boeing 737 MAX flies again, with the beleaguered company regaining FAA certification after a 20-month break. It’s amazing this company is still alive after the grounding of its main product and thousands of order cancellations from the pandemic. Taking their debt from $9 billion up to an eye-popping $63 billion is what did it. American Airlines (AA) will be the first to take the troubled aircraft back to the skies. Buy (BA) on dips.

Global Debt to hit $227 trillion by end of 2020, thanks to the pandemic. Governments accounted for half of the increase. US Debt jumped from $71 in 2019 to $80 trillion. Sounds like a short to me! Sell (TLT) on every five-point rally.

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

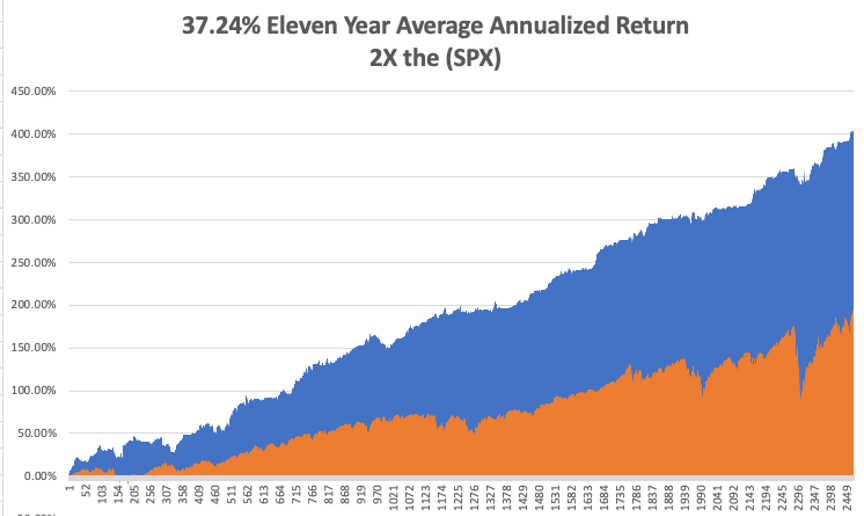

My Global Trading Dispatch exploded to another new all-time high last week. November is up 14.70%, taking my 2020 year-to-date up to a new high of 50.73%. That brings my eleven-year total return to 406.64% or double the S&P 500 over the same period. My 11-year average annualized return now stands at a new high of 37.24%. My trailing one-year return exploded to 58.48%.

It was a week of profit-taking on my November expiring positions and rolling forward to a new batch of December options. I managed to catch the Tesla melt-up with a double long position, which is always nice for performance.

My only hickey of the week was a short in the (SPY) which I was forced out of in the tag ends of this rally. Four days later, they expired at their maximum profit point.

The coming week will be a sleeper thanks to the national holiday. We also need to keep an eye on the number of US Coronavirus cases and deaths, now over 11.5 million and 250,000, which you can find here.

When the market starts to focus on this, we may have a problem.

On Monday, November 23 at 9:30 AM EST, the Chicago Fed National Activity Index for October is released.

On Tuesday, November 24 at 10:00 AM EST, the S&P Case Shiller National Home Price Index for September is announced.

On Wednesday, November 25 at 9:30 AM EST, the Weekly Jobless Claims are announced a day early because of the holiday. The Q3 US GDP second estimate is printed at the same time.

On Thursday, November 26 Americans celebrate Thanksgiving Day. All markets are closed.

On Friday, November 27, no data points are released.

As for me, thanks to the pandemic I have been watching a lot more TV lately. I have started watching The Crown on Netflix, which is fascinating for me because I personally knew most of the royal family.

I’ll never forget the chief of protocol loudly calling out my name, “Captain John Thomas”, at the Buckingham Palace garden party where I met Queen Elisabeth and Lady Diana.

I also knew many of the postwar prime ministers, including the Iron Lady, Margaret Thatcher. She despised my macroeconomic press conference questions at a time when UK unemployment rate was a sky-high 14% and the pound was in free fall. Still, she toughed it out.

During the Falklands War, I was the Washington Bureau Chief for The Economist magazine. One day, an unusual message came through from London which I was asked to personally take to my old friend, CIA Director William J. Casey. It was a list of 10,000 military items which the British military needed delivered to the South Atlantic in 24 hours! And you know what? They did it!

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

You Need a Real Gunslinger on your Side in this Market

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

November 20, 2020

Fiat Lux

Featured Trade:

(DON’T STRIKE OUT WITH THE CLOUD)

(WCLD), (EMCLOUD)

Success in 2020 is predominantly decoding complicated data and finding perfect solutions for it; and trading in technology stocks is no different.

Investing in software-based cloud stocks has been one of the overarching themes I have promulgated since the launch of the Mad Hedge Technology Letter in February 2018.

Now as we cruise into 2021, the bull-case for technology stocks has never been more relevant.

Instead of racking your brain to find the optimal cloud stock to invest in, I have the idiot’s way to just deploy money and sit back and relax.

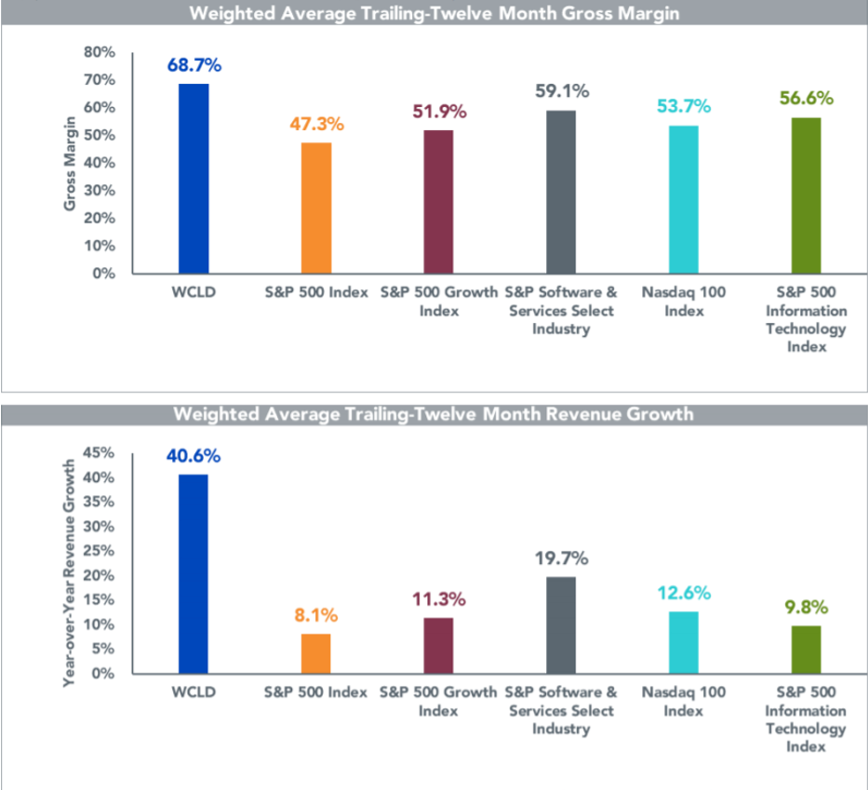

Invest in The WisdomTree Cloud Computing Fund (WCLD) which aims to track the price and yield performance, before fees and expenses, of the BVP Nasdaq Emerging Cloud Index (EMCLOUD).

What Is Cloud Computing?

The “cloud” refers to the aggregation of information online that can be accessed from anywhere, on any device remotely.

This is the idea that is powering the “shelter-at-home” trade which has been hotter than hot in 2020.

Cloud companies provide on-demand services to a centralized pool of information technology (IT) resources via a network connection.

Even though cloud computing already touches a significant portion of our everyday lives, the adoption is on the verge of accelerating due to advancements in artificial intelligence and the Internet of Things (IoT).

The Cloud Software Advantage

Cloud computing has particularly transformed the software industry. Over the last decade, cloud Software-as-a-Service (SaaS) businesses have dominated traditional software companies as the new industry standard for deploying and updating software. Cloud-based SaaS companies provide software applications and services via a network connection from a remote location, whereas traditional software is delivered and supported on-premise. I will give you a list of differences to several distinct fundamental advantages for cloud versus traditional software.

Product Advantages

- Speed, Ease, and Low Cost of Implementation – cloud software is installed via a network connection; it doesn’t require the higher cost of on-premise infrastructure setup and installation.

- Efficient Software Updates – upgrades and support are deployed via a network connection, which shifts the burden of software maintenance from the client to the software provider.

- Easily Scalable – deploying via a network connection allows cloud SaaS businesses to grow as their units increase, with the ability to expand services to more users or add product enhancements with ease. Client acquisition can happen 24/7 and cloud SaaS companies can more easily expand into international markets.

Business Model Advantages

- High Recurring Revenue – cloud SaaS companies enjoy a subscription-based revenue model with smaller and more frequent transactions, while traditional software businesses rely on a single, large, upfront transaction. This model can result in a more predictable, annuity-like revenue streams making it easy for CFOs to solve long-term financial solutions.

- High Client Retention with Longer Revenue Periods – cloud software becomes embedded in client workflow, resulting in higher switching costs and client retention. Importantly, many clients prefer the pay as-you-go transaction model, which can lead to longer periods of recurring revenue as upselling product enhancements does not require an additional sales cycle.

- Lower Expenses – cloud SaaS companies can have lower R&D cost because they don’t need to support various types of networking infrastructure at each client location.

I believe the product and business model advantages of cloud SaaS companies have historically led to better margins, growth, free cash flow, and efficiency characteristics as compared to non-cloud software companies.

How does the WCLD ETF select its indexed cloud companies?

Each company must suffice critical criteria such as they must derive the majority of revenue from business-oriented software products, as determined by the following checklist.

+ Provided to customers through a cloud delivery model – e.g., hosted on remote and multi-tenant server architecture, accessed through a web browser or mobile device or consumed as an application programming interface (API).

+ Provided to customers through a cloud economic model – e.g., as a subscription-based, volume-based or transaction-based offering Annual revenue growth, of at least:

+ 15% in each of the last two years for new additions

+ 7% for current securities in at least one of the last two years

Some of the stocks that would epitomize the characteristics of a WCLD stock are Salesforce, Microsoft, Amazon-- I mean, they are all up, you know, well over 40% from the lows they saw in March and contain the emerging growth traits that make this ETF so robust.

If you peel back the label and you look at the contents of many tech portfolios, they tend to favor some of the large-cap names like Amazon, not because they are “big” but because the numbers behave like emerging growth companies even when the law of large numbers indicate that to push the needle that far in the short-term is a gravity-defying endeavor.

We all know quite well that Amazon isn't necessarily a direct play on cloud computing, but the elements of its cloud business are nothing short of brilliant.

But with ETF funds like WCLD, what they look to do is to cue off pure plays and include those that are growing faster than the broader tech market at large. So you're not going to necessarily see the vanilla tech of the world in that portfolio. You're going to see a portfolio that's going to have a little bit more sort of explosive nature to it, names with a little more mojo, a little bit more risk because you're focusing on smaller names that have the possibility to go parabolic and gift you a 10-bagger.

In a global market where the search for yield couldn’t be tougher right now, right-sizing a tech portfolio to target those extra-ordinary tech growth companies is one of the few ways to produce alpha without overleveraging.

No doubt there will be periods of volatility, but if a long-term horizon is something suited for you, this super-growth strategy is a winner.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.