When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

November 18, 2020

Fiat Lux

Featured Trade:

(HOT TECH STOCKS GOING INTO THE RECOVERY)

(YELP), (EXPE), (TRIP)

It’s hard to be net short these days when we are staring at an imminent recovery and by this, I mean not a recovery like the past 6 months where extreme optimism was surrounded by the ceaseless spreading of the virus.

Multiple companies such as Moderna and Pfizer have announced the successful creation of Covid-19 vaccine meaning that consumer behavior and the global economy will come back to normal earlier than first thought.

This is great news for a digital ad company like Yelp (YELP) because they rely on the high volume of businesses open.

Their model is based on consumers offering free reviews and they sell digital ad space on their platform.

With one fell swoop, the virus crushed their business model which was why shares halved during the worst bits of the pandemic.

Sentiment has revered and Yelp stock has been on a remarkable tear, gaining ground for nine straight days and rallying 53% in the process.

The rally started a few days ahead of the company’s better-than-expected third-quarter earnings report, gained momentum when the numbers were released.

Yelp is one of the tech sector’s most outsized profit chances on the reopening of the economy—and investors have jumped aboard.

In my estimation, Yelp is a $40 stock masquerading at $30 today.

Travel-related internet stocks given the potential for a Covid-19 vaccine will feel the same tailwinds and stocks that come to mind are Expedia Group, Inc. (EXPE) and TripAdvisor, Inc. (TRIP).

The beaten-up cyclicals have re-rated over the last several days, Yelp is a standout as a name that should have a clear path towards both multiple and estimate upside from here.

In fact, Yelp’s revenue decline hasn’t been as bad as that of the travel sector, thanks in part to stronger-than-expected restaurant demand.

Even though we have experienced stringent lockdowns, Europeans largely traveled in the summer inside of Europe and Americans still found a way to domestically travel even if more localized.

If the market supports a return post-vaccine for the travel industry, it is clearly confirmation that Yelp’s business will recover fast even if not to the peak of summer 2019.

At these price levels, Yelp has a relatively attractive valuation and improving fundamentals.

When a Covid-19 vaccine is developed and comes available, the company should benefit substantially in terms of foot traffic for businesses on its platform as well as its app volume.

Yelp recently reported a net loss of $1 million, or 1 cent a share, compared with profit of $1 million, or 14 cents a share, in the year-earlier period, and although down, it could have been much worse.

Revenue dropped 16% to $220.8 million from $262.4 million.

"Yelp’s third-quarter results demonstrate our business’s considerable resilience, highlighted by positive year-over-year revenue growth in two key areas of our long-term strategy: home and local services and our self-serve sales channel," Co-Founder and Chief Executive Jeremy Stoppelman said in a statement.

Even though travel and retail outlets were affected, Stoppelman indicated new businesses are being created to serve this new type of economy where the home is the center of businesses.

No doubt there will a surge of new services that will support technological infrastructure for the home and home maintenance.

Yelp’s strong balance sheet and increased sales efficiency will allow Yelp to return to sustainable growth in the new year while still managing the impacts of the pandemic.

The company has clearly shown they are on top of the ball, they use their agility to morph with their times and at this price level, Yelp is an unequivocal buy.

“I fear the day when the technology overlaps with our humanity. The world will only have a generation of idiots.” – Said German-born Theoretical Physicist Albert Einstein

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

November 18, 2020

Fiat Lux

Featured Trade:

(THE QUANTUM COMPUTER IN YOUR FUTURE),

(AMZN), (GOOG),

(THE WORST TRADE IN HISTORY), (AAPL)

When I was a kid, radios were built with vacuum tubes.

I remember my dad taking me to the supermarket where a large display case sporting dozens of sockets identified the tube you needed.

All you had to do then was install it without electrocuting yourself.

Then transistors were invented and everything changed overnight. Suddenly, solid-state electronics took over the market. Everything was lighter, cheaper, and much faster.

A decade later, Intel took over the computer market launching its revolutionary 4004 microprocessor.

It looks like I am going to live long enough to see another great leap forward in computing power.

Imagine a single computer that was so powerful that its processing power exceeded that of all the other computers in the world combined.

Applied to the stock market, such a machine would be able to algorithmically extract hundreds of billions of profits without anyone noticing.

It would be able to break any code in the world in seconds, rendering all security programs useless.

It would also act as an adrenaline shot for all of the artificial intelligence efforts currently out there.

Oh, and to understand how to interpret its output, we will have to invent a new form of advanced high mathematics.

You may be forgiven for thinking I spent my weekend reading science fiction.

But you would be wrong.

I actually got to see a working prototype for such a machine known as a quantum computer at the NASA Ames Research Center in nearby Mountain View, California.

Dominated by an enormous wooden airship hangar once owned by the Navy, the facility is home to a joint venture between NASA and Google to develop the next generation of supercomputers.

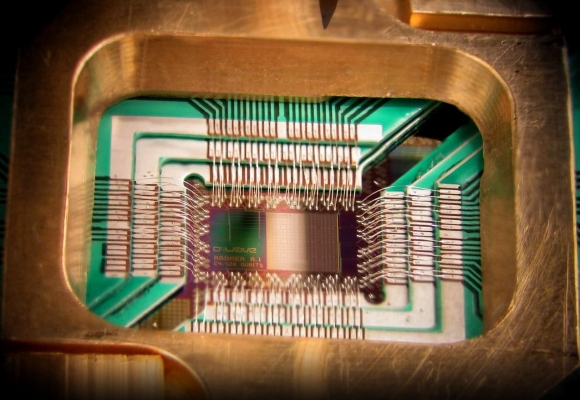

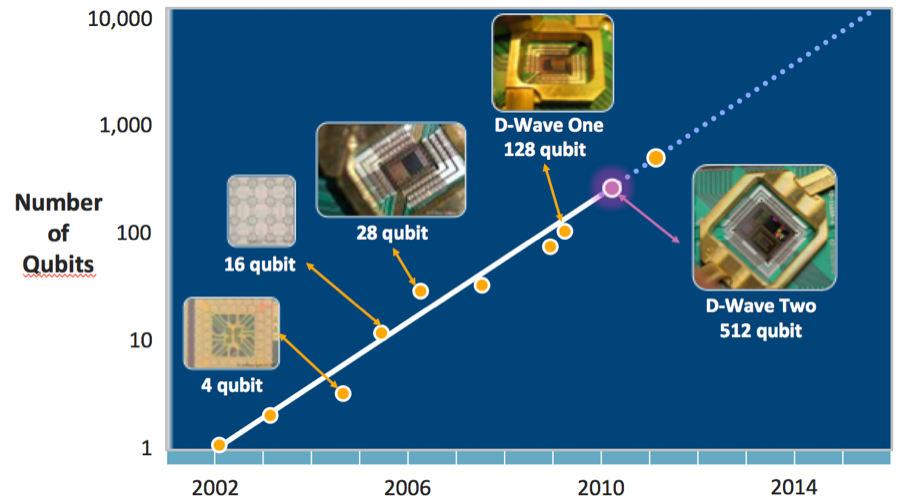

The machine was built by D-Wave, a small Canadian start-up in Burnaby, a suburb of Vancouver, Canada. It was founded in 1999 by a former wrestler, Geordie Rose and Haig Farris.

To understand how such a breakthrough is possible, it is necessary for me to explain some basic particle physics.

Classical computers operate through a system of silicon gates that allow electrons to pass through or not. This is expressed in computer code as a 0, a 1, or nothing at all, known as “bits.”

And yes, I am old enough to have programmed simple computers with only 0’s and 1’s.

The problem is that this technology, launched during the 1960s, is reaching its theoretical limits.

According to Moore’s law, the number of circuits squeezed on a microprocessor doubles every two years until 2015. A few ingenious tweaks and modifications by manufacturers have extended that deadline by five years to 2020.

After that, a Great Depression was supposed to hit, as all progress in technology ground to a halt.

Enter quantum computing.

Instead of only two possible choices in each code entry, the number of possible solutions becomes infinite for quantum computing.

It does this by changing the physical statue of electrons for each piece of code. Some electrons spin clockwise, others counterclockwise, while others still spin on a northeast-southwest axis, and so on.

As a result, the number of calculations that can be performed by a quantum algorithm increased exponentially, as does its speed.

The computational unit of a quantum computer is called a “quantum bit,” or “qubit.”

The machine I saw has 1,000 qubits, powered by two chips containing 500 niobium loops each, and was code-named “Washington.”

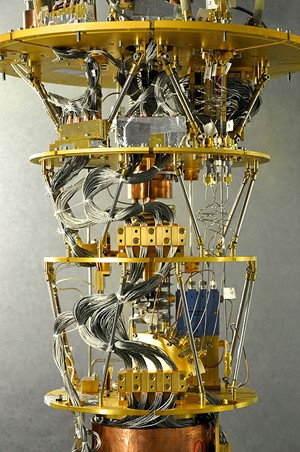

The quantum computer I saw doesn’t look anything like a computer. Instead, it looks like a small walk-in freezer.

That is essentially what it is, as 90% of the hardware is devoted to dissipating heat and shielding it from electromagnetic and magnetic interference.

There is no silicon involved in this computer. Instead, the chips are made of hundreds of 2-micron-wide threads of Niobium, a rare earth, cooled at close to absolute zero.

Gold-plated copper disks are used as heat sinks.

The next-generation quantum computer is expected to have chips made out of aluminum.

The quantum code is now so fragile that the mere presence of matter can erase it and convert it into a useless classical computer.

Its speed is measured through a process known by “entanglement” whereby distant atoms display the mirror image of nearby ones.

And now we’re over my pay grade, and probably yours too.

For that reason, its output can only be transmitted through fiber optic cable.

D-Wave is not alone in its efforts at quantum computing. Do any search on the term, and the number of research institutions involved runs into the hundreds. And who knows what is going on in China and Russia?

D-Wave is a private company. Its largest investors include venture capital firm Draper Fisher Jurvetson, Amazon’s Jeff Bezos, and In-Q-Tel, the venture capital arm of the CIA.

It is possible that D-Wave may never see the light of day as a public company in which you and I can invest. Instead, its total production may be reserved for its original investors.

However, you can invest directly into those shareholders most likely to benefit, including Amazon (AMZN) and Alphabet (GOOG).

There are other models for advanced supercomputing underway that may also reach economic viability, such as DNA-based computing. I’ll be covering those in a future letter.

One of the many goals of the Diary of a Mad Hedge Fund Trader is to discover advanced technologies early, and then get out in front of them with trading recommendations.

Ever wonder why Amazon shares have tripled this year?

This might be the reason.

To learn more about D-Wave and its amazing technology, please click here.

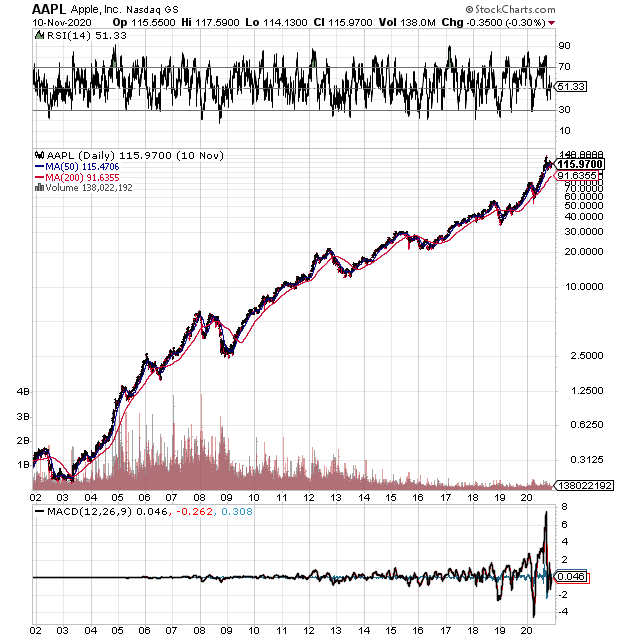

Say you owned 10% of Apple (AAPL) and you sold it for $800 in 1976.

What would that stake be worth today?

Try $80 billion.

That is the harsh reality that Ron Wayne, 84, faces every morning when he wakes up, one of the three original founders of the consumer electronics giant.

Wayne first met Steve Jobs when he was a spritely 21-year-old marketing guy at Atari who never took a bath, the inventor of the hugely successful “Pong” video arcade game.

Wayne dumped his shares when he became convinced that Steve Jobs’ reckless spending was going to drive the nascent startup into the ground, and he wanted to protect his assets in a future bankruptcy.

Co-founders Jobs and Steve Wozniak each kept their original 45% ownership.

Today, Jobs' widow has 0.5% ownership that is worth $4.2 billion, while the Woz’s share remains undisclosed.

Wayne designed the company’s original logo and wrote the manual for the Apple 1 computer which boasted all of 8,000 bytes of RAM (which is 0.008 megabytes to you non-techies).

Today, Wayne is living off of a meager monthly Social Security check in remote Pahrump, Nevada, about as far out in the middle of nowhere you can get where he can occasionally be seen playing the penny slots.

As they say in the stock market, timing is everything.

I am going to suggest you book the profit on the CTXS position.

This alert applies only to you if you put on the trade as recommended

6 days ago.

We can close the position after 6 days and capture almost 50% of

the maximum profit.

So, I would prefer to book the profit and not have to think about an adverse move against the position.

Here is how you close the position:

Sell to Close December 4th - $115.00 Call for $6.70

Buy to Close December 4th - $120.00 Call for $3.30

The net credit will be $3.40 per spread.

The cost to place the trade was $2.00 per spread, which results in a profit of $1.40 per spread.

If you traded the suggested 5 lot, the cash return in total is $700.

The net return is 70% for 6 days.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.