While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

December 17, 2020

Fiat Lux

FEATURED TRADE:

(PLEASE SIGN UP NOW FOR MY FREE TEXT ALERT SERVICE NOW),

(BIDDING MORE FOR THE STARS)

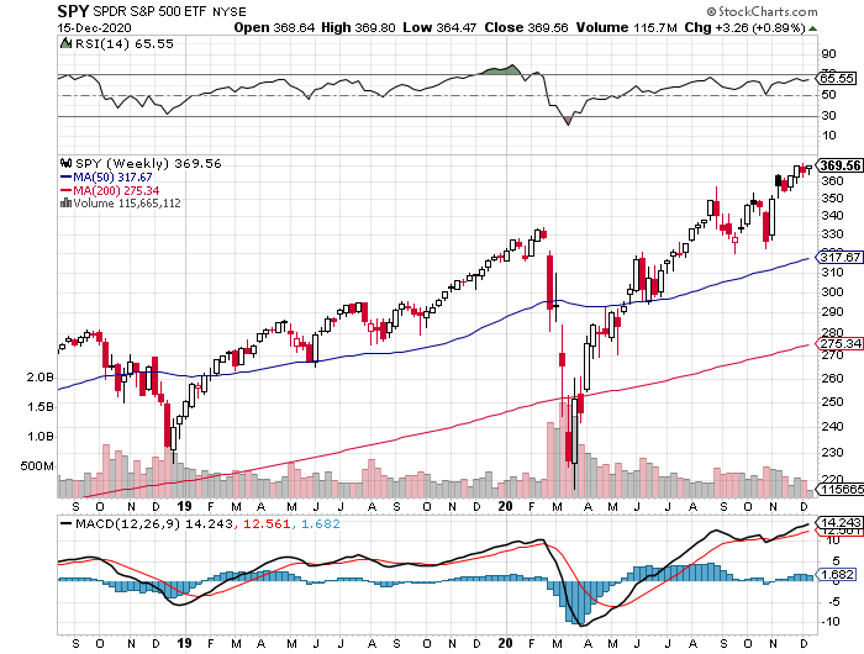

The stock market has turned into the real estate market, where everyone is afraid to sell for fear of being unable to find a replacement. Will it next turn into the Bitcoin market, which has gone ballistic?

Risk assets everywhere are now facing a good news glut.

My 2020 market top target of 30,000 for the Dow Average has come and gone.

This year’s price action really gives you the feeling of an approaching short term blow off-market top. If Covid-19 crashed the market, will the vaccine kill the recovery?

A few years ago, I went to a charity fundraiser at San Francisco’s priciest jewelry store, Shreve & Co., where the well-heeled men bid for dates with the local high society beauties, dripping in diamonds and Channel No. 5.

Amply fueled with Dom Perignon champagne, I jumped into a spirited bidding war over one of the Bay Area’s premier hotties, who shall remain nameless. Suffice to say, she is now married to a well-known tech titan and has a local sports stadium named after her.

Obviously, I didn’t work hard enough.

The bids soared to $27,000, $28,000, $29,000.

After all, it was for a good cause. But when it hit $30,000, I suddenly developed a severe case of lockjaw. Later, the sheepish winner with a rampant case of buyer’s remorse came to me and offered his date back to me for $24,000. I said, “no thanks.” $23,000, $22,000, $21,000?

I passed.

The altitude of the stock market right now reminds me of that evening.

If you rode the S&P 500 (SPX) from 700 to 3,700 and the Dow Average (INDU) from 7,000 to 30,000, why sweat trying to eke out a few more basis points, especially when the risk/reward ratio sucks so badly, as it does now?

And if there was ever an excuse to take a break, it is my blistering 2020 12,000-point rally off the March bottom.

I realize that many of you are not hedge fund managers and that running a prop desk, mutual fund, 401k, pension fund, or day trading account has its own demands.

But let me quote what my favorite Chinese general, Deng Xiaoping, once told me in person: “There is a time to fish, and a time to hang your nets out to dry. You don’t have to chase every trade.

At least then, I’ll have plenty of dry powder for when the window of opportunity reopens for business. So, while I’m mending my nets, I’ll be building new lists of trades for you to strap on when the sun, moon, and stars align once again.

What Am I Bid?

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

December 16, 2020

Fiat Lux

Featured Trade:

(THE NEW SALESFORCE)

(NOW), (CRM), (SAP), (ORCL), (IBM), (MSFT)

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

During Bill McDermott’s leadership as CEO, German software firm SAP's market value increased from $39 billion to $156 billion.

No doubt that this experience at SAP paved the way to become one of the fastest-growing major cloud vendors in 2020.

McDermott is now CEO of ServiceNow (NOW), a company that offers specific IT solutions. It allows you to manage projects and workflow, take on essential HR functions, and streamline your customer interaction and customer service. It does all of this, thanks to a comprehensive set of ServiceNow web services, as well as various plug-ins and apps.

Their market value has doubled to $100 billion and this is just the beginning.

ServiceNow almost doesn’t exist after numerous attempts to be acquired, like the time it was almost sold to VMware for $1.5 billion.

Company founder Fred Luddy, who is now chairman, and the board of directors were intrigued by the VMware offer, but venture-capital firm Sequoia Capital argued that $1.5 billion wasn’t a premium at that time let alone market rate for this burgeoning cloud player.

Then-CEO Frank Slootman was eventually replaced by former eBay Inc. (EBAY) CEO John Donahoe in February 2017, who took the company to $3.46 billion in annual 2019 sales.

Donahoe then bolted for Nike Inc. (NKE), and McDermott joined from SAP, locking in the firm for a new era of meteoric growth.

ServiceNow is now on its way to become the defining enterprise-software company of the 21st century and if you look at their position in the market today, they’re the only born-in-the-cloud software company to have surpassed $100 billion market cap without large-scale M&A.

This underdog cloud company whose automation software is deployed to improve productivity is leading to what is known as a “workflow revolution.”

Their set of software tools fused with the sudden emphasis on digital tracking of employees and business systems — has played into ServiceNow’s strengths.

The seismic shift is accelerating: By 2025, most of the millennial generation will work from home permanently, based on internal company reports.

It expects revenue of $4.49 billion in fiscal 2020 and still has a mountain to climb with revenue of just 20% of Salesforce, one-sixth of SAP, and one-ninth of Oracle Corp. (ORCL).

But ServiceNow is catching up as corporations and government agencies pour billions of dollars into their digital infrastructures.

So far, more than $3 trillion has been invested in digital transformation initiatives. Yet only 26% of the investments have delivered meaningful returns on investment.

This is launching the workflow revolution, where ServiceNow is the missing cog that can integrate systems, silos, departments, and processes, all in simple, easy-to-use cross-enterprise workflows.

A demand surge for “workflow automation” technology went parabolic in 2020 and is part of the puzzle helping ServiceNow sustain 25%-plus revenue growth.

ServiceNow most recently raised its full-year guidance after disclosing it has 1,012 customers with more than $1 million in annual contract value, up 25% year-over-year.

That included 41 such transactions in the third quarter, with new customers such as the U.S. Senate and New York City’s Mount Sinai Hospital.

ServiceNow raised guidance for the full year on subscription-revenue range to between $4.257 billion and $4.262 billion, up 31% year-over-year in constant currency.

The company has detailed a goal of $10 billion in annual sales as something feasible in the mid-term and its bevy of strategic relationships will help, like in July, Microsoft Corp. (MSFT) expanded its relationship with ServiceNow; shortly thereafter, Accenture (CAN) and IBM created new business units in partnership with ServiceNow to develop new opportunities.

In March, ServiceNow added a new computing platform, Orlando, that added artificial intelligence and machine learning that lets the MGM Macau casino resort, for example, use a virtual agent to automate and handle repetitive requests.

The integration of virtual agents will supplement casino employees with 24/7 support experiences when human staff is unavailable.

After hitting the $100 billion market cap, McDermott has identified M&A as the catalyst to take NOW higher with the CEO squarely looking at artificial intelligence targets.

ServiceNow has enabled firms to unite front, middle and back office functions, increasing productivity during this time period when speed and simplicity matter the most to digital customers.

I would describe NOW as a baby brother to Salesforce and its entrance into the first and most likely continuous acquisition cycle will most probably result in higher share prices.

ServiceNow turns out to be placed in the perfect position benefitting from Americans moving their careers online with the added effect of the broad-based secular digital migration to remote work.

As long as this firm is generating revenue in the mid-20% annually, it will be a constant buy-the-dip candidate for the foreseeable future regardless of whether there is a pandemic or not.

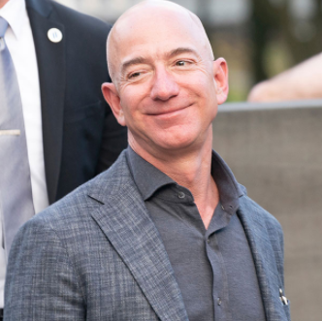

“In the old world, you devoted 30% of your time to building a great service and 70% of your time shouting about it. In the new world, that inverts.” – Said Founder and CEO of Amazon Jeff Bezos

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.