When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Biotech & Healthcare Letter

October 1, 2020

Fiat Lux

FEATURED TRADE:

(IS AMGEN THE NEW CHAMPION OF THE BIOTECH WORLD)

(AMGN), (ABBV), (JNJ), (BMY)

Amgen (AMGN) grabbed headlines in August when it became the first biotechnology stock listed in the prestigious Dow Jones Industrial Average, offering mutual funds and exchange-traded funds that follow the index more access to the company’s shares.

With its share price worth $243.21, Amgen has been hailed responsible for roughly 1,600.20 Dow points – roughly 5.8% of its total.

Does this make Amgen the new champion of the biotechnology sector?

Although it has not explicitly declared that it is developing drugs mainly for older adults, Amgen’s pipeline notably focuses on the fast-rising senior population across the globe.

This is quite strategic considering that the world population of seniors is projected to double from the current number to reach more than 2 billion by 2050.

A noteworthy strategy it employed to expand its market share is cutting the prices of some of its most popular products.

For example, Amgen lowered the price of its heart disease treatment Repatha by as much as 60% in 2018. Since the drug has become one of the more affordable options in the market, making it more accessible to more users.

This led to a 20% rise in sales revenue by 2019, with Repatha expected to rake in a higher number in 2020 – a highly probable expectation considering the 32% climb it recorded in its second quarter earnings report this year. So far, Repatha has generated $200 million in sales in the second quarter.

Another notable drug that recorded a climb in sales is Evenity, which targets postmenopausal women with osteoporosis.

Evenity generated an impressive increase of $101 million compared to the $28 million it earned in the same period in 2019.

Despite its $142.08 billion market capitalization, Amgen is not immune to the effects of the pandemic.

For one, sales of arthritis drug Enbrel fell by 9% year over year to record only $1.2 billion while cancer therapy Neulasta showed a 28% decline to $593 million.

The drop in their performance was attributed to pricing pressure and biosimilar competition.

In addressing the issue, Amgen also ventured in creating a competitive and lucrative biosimilar portfolio.

So far, its biosimilar version of AbbVie’s (ABBV) best selling drug arthritis drug Humira has managed to rake in over $200 million in sales in 2019.

Two more oncology biosimilars, MVASI and KANJINTI, which were only launched in the US last year, generated $588 million in sales.

This year, Amgen will launch another potential biosimilar blockbuster called AVSOLA. This would be in direct competition with Johnson & Johnson’s (JNJ) antitumor treatment Revicade.

Outside these biosimilars, Amgen has over 50 clinical trials queued, which include more than 20 Phase 3 studies. Ultimately, the company’s goal is to displace all the deadweights in its current portfolio.

One of the most exciting products in Amgen’s pipeline right now is its heart failure drug Omecamtiv Mecarbil, which recently completed Phase 3 clinical trials.

With cardiovascular diseases identified as one of the leading causes of death worldwide, the success of Omecamtiv Mecarbil would translate into a strong foothold for Amgen in this huge market and a key growth driver in the long run.

Another blockbuster in Amgen’s portfolio is Otezla, which it acquired from its $13.4 billion deal with Celgene prior to its merger with Bristol Myers Squibb (BMY) in 2019.

Although Otezla has already been marketed as an adult arthritis and psoriasis treatment, Amgen has been working on expanding its indication to include Behcet's disease, pediatric psoriasis, and pediatric arthritis.

Even without the expanded indications, Otezla has been a hot seller for Amgen.

In fact, the pandemic did not stop it from reaching a 14% year over year revenue growth every quarter, with its second quarter earnings reaching $561 million.

Other than the expanded use to cover more age ranges in the arthritis and psoriasis sector, Amgen is also studying whether Otezla can be used as a COVID-19 treatment.

If these studies prove to be successful, then Amgen will easily make up the price of the Otezla purchase quicker than anticipated.

More importantly, it would be able to add another massive moneymaker in its already formidable anti-inflammation program. By the end of 2021, Amgen’s revenues would be considerably bigger.

Amgen’s second quarter earnings reports showed a respectable 6% rise in its year over year revenue, with the company generating $6.2 billion despite the ongoing health and financial crises.

Beyond its growth in the US market, Amgen has been busy with international expansion. To date, the company has established a key partnership with China’s BeiGene (BGNE).

It further strengthened its presence in Asia thanks to its acquisition of Japan’s Astellas Pharma earlier this year.

These moves are promising since China and Japan are the second and third biggest pharmaceutical markets in the world, and both countries are showing strong growth in their senior populations.

Needless to say, these partnerships would put Amgen in a strategic position to capture a share of that growth.

Investing in healthcare and biotechnology stocks has always been one of my go-to advice to people.

National healthcare spending is expected to increase at an average rate of 5.5% annually until 2027.

By then, the cost would reach a whopping $6 trillion, resulting in an estimated $1 in every $5 of the GDP getting allocated to healthcare spending within this decade.

Amgen is a blue chip biotechnology stock that has a presence in over 100 countries and develops groundbreaking treatments that can help people across the globe.

As a leading company in the healthcare and biotechnology industry, Amgen holds a strong position to leverage this growth to its advantage.

While the 2.48% trailing annual dividend yield is pretty average, Amgen also prides itself of consistently boosting its dividend every year since 2011.

It also engages in opportunistic share buybacks, so its investors have more ways to get rewarded.

Since Amgen stock shares are not exactly cheap right now, income-oriented investors should be on the lookout for a market crash and seize the opportunity to scoop up shares of this valuable biotechnology giant.

I am going to suggest you go ahead and book the profit on the MSFT debit spread.

MSFT is trading around $212.73 as I write this. And by closing the position today, the gain will be about 40% for 4 days.

Here is how you close the position:

Sell to Close October 16th - $207.50 Call for $8.20

Buy to Close October 16th - $212.50 Call for $5.00

The net credit will be $3.20 per spread. The debit when the trade was initiated was $2.30 per spread.

If you traded the suggested 6 lot, the cash return will be $.90 per spread or $540 for the 6 lot.

This works out to a gain of 40% for 4 days.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

October 1, 2020

Fiat Lux

Featured Trade:

(HOW TO RELIABLY PICK A WINNING OPTIONS TRADE)

Mad Hedge Technology Letter

September 30, 2020

Fiat Lux

Featured Trade:

(AN EASY WAY TO MILITARIZE YOUR TECH PORTFOLIO)

(PLTR)

With funding from the CIA’s non-profit venture capital arm In-Q-Tel, Palantir (PLTR) is named after mystical orbs in J.R.R. Tolkien’s “The Lord of the Rings” universe that can see both the past and present and allow users to communicate over vast distances.

Palantir is effectively a secretive big-data firm co-founded by billionaire venture capitalist Peter Thiel that will make its stock market debut via a direct listing on Sept. 30 with a valuation of $22 billion.

It’s the gold standard of data mining stocks and I recommend investors consider buying and holding if you’re currently eyeing new opportunities.

The foundations beneath it could not be more rock solid with the CIA affording the company major access to recurring government revenue.

Not even a pandemic would be able to knock off this business model from the perch it sits on.

Up until now, what Palantir does and how it uses its troves of data is somewhat lost to all but the industry analysts and government officials, but that is all about to change with quarterly earnings reports.

In a nutshell, Palantir provides customized software to clients analyzing large tranches of data for reasons ranging from finding suspected criminals to improving companies’ manufacturing capabilities.

Summarizing their strategic operational zone even further, Palantir’s data platform is the go-to platform for U.S. intelligence agencies.

In the media, they have attracted significant controversy due to its work with government agencies, including Immigration and Customs Enforcement (ICE).

Palantir has yet to spin a profit, losing $580 million in 2018 and $579 million in 2019, but does that even matter when their products are so deeply embedded in the U.S. intelligence agencies’ everyday work?

As long as they are trending towards margin improvement, investors are most likely willing to give them a free pass.

Palantir's claim to fame is that its technology reportedly helped locate Osama bin Laden while zeroing in on terrorists in Afghanistan and Iraq.

The company acknowledges that government customers use its technology to kill people so investors not comfortable with the deeper meaning behind the technology should avoid this one and go with the softball versions of big tech.

Palantir gets both criticism and praise for the powerful nature of its data analytics software. For example, critics allege Palantir's profiling tools used by intelligence and immigration agencies sometimes operate under a cloak of secrecy with zero oversight.

Palantir’s tools are not just for killing bad guys, they have also signed up companies from sectors that include healthcare, energy, and manufacturing.

Another noteworthy development is the stranglehold on company decisions that the co-creators will have no matter what.

The Palantir IPO established three classes of stock, meaning the stock structure guarantees control of the company stays in the hands of creators Thiel, Karp, and Cohen.

The company’s financials are still behaving like a growth asset leading up to the IPO.

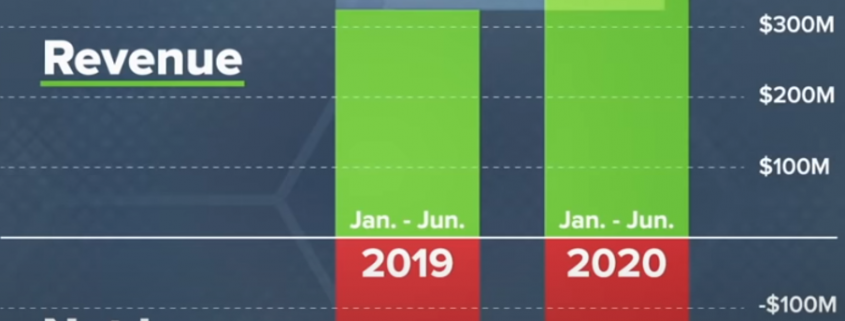

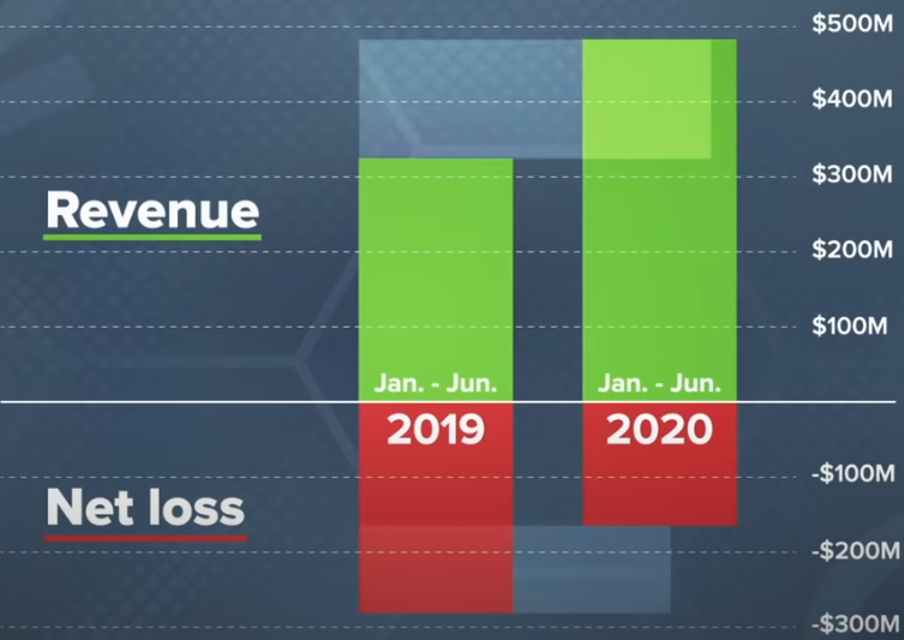

For the first half of 2020, Palantir reported revenue of $481.2 million, up 49% from a year ago. Also, it reported a net loss of $164.7 million, vs. a loss of $280.5 million year-over-year.

Palantir expects revenue to rise by about 47%, to around $278 million to $280 million for the rest of the year. For 2020, it expects revenue of about $1 billion, up 42%.

Palantir has two main services that analyze data: Palantir Gotham and Palantir Foundry.

A customized option, Palantir Gotham is used by companies, government agencies, and law enforcement to combine information to decipher previously unseen patterns and identify relationships between sets of data ranging from social media posts and addresses to license plate numbers and personal relationships.

The algorithm then summarizes content together to make broader conclusions from the data.

Meanwhile, Foundry is a ready-made solution focusing on clients ranging from pharmaceutical and automotive businesses to aviation companies like Airbus and is meant to cut down on the costs associated with Gotham, such as the need for multiple on-site engineers.

Who is the CEO?

Alex Karp.

A graduate of Stanford Law School.

Karp has been explicit in his belief for the need for Silicon Valley companies to work with the U.S. government and law enforcement agencies precisely because they are American companies.

Palantir refers to effective applications of its software such as combatting Ponzi conman Bernie Madoff to disaster recovery to thwarting cyberattacks and fighting child exploitation.

Not only that, Palantir’s software was deployed in the aftermath of Hurricane Florence in 2018 alongside Team Rubicon, an organization of military veterans that responds to disaster areas. With Palantir’s Gotham Operations module, the group identified and responded to neighborhoods in the greatest need of assistance.

Palantir also assisted the Center for Public Integrity and Georgetown University’s Journalism Program for an investigation into the death of Wall Street Journal reporter Daniel Pearl by militants in Pakistan in 2007.

The company says the software helped identify 27 individuals who took part in the kidnapping and killing of Pearl, tracking relationships and offering answers to questions surrounding his death.

How does the software directly help real-time U.S. soldiers in the field?

The firm also claims its software helped the U.S. military track insurgents in Afghanistan planting improvised explosive devices (IEDs) by finding correlations between weather patterns, command wire IED attacks, and biometric information found on explosive devices.

Palantir has also sold its software to the Salt Lake City Police Department, helping officers reduce the time it takes to perform complex investigations by 95%.

Predictive policing models that base conclusions on historical data can sometimes not work, meaning that there is the chance of a slipup or wrongfully identifying a problem that isn’t a problem.

Reading about Palantir’s business model, it’s easy to see how they could put themselves in a political mess with the software being used to “find people in the U.S. who are undocumented.”

Granted, this tech company is not for everyone which is why many global brands such as Hershey’s, Coca-Cola, Home Depot, and American Express have terminated relationships.

Lastly, there is word that their services are not exactly cheap, but that is the cost of doing business in 2020 where data analysis is the new oil.

With a roadmap of constant 40% revenue growth for the foreseeable future and a death grip on recurring revenue provided by the CIA, it’s hard to ignore the robustness of their plan moving forward.

If you thoroughly believe in the U.S. military and are okay supporting a data firm that offers software services to it, then I would suggest buying every dip in Palantir from now to eternity.

There are worse investments out there.

“The best entrepreneurs know this: every great business is built around a secret that's hidden from the outside.” – Said Venture Capital Peter Thiel

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.