When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

September 4, 2020

Fiat Lux

Featured Trade:

(WILL NEUROSCIENCE SUPERCHARGE BIG TECH?)

(NEURALINK)

The wonky world of Tesla’s Elon Musk trucks ahead with his neuroscience firm one step closer to inserting a chip into your brain.

You would think this is straight out of science fiction, but mark my word that in our lifetime, we could all be operating digital devices from our heads if Musk gets his way.

Scary as it does seem now, this will probably be the first of many artificial procedures to infuse humans with more artificial intelligence.

Musk believes humans will be a robot hybrid in the future because competition is trending in that way and this direction in humanity is ultimately existential.

Improvements in the technology will periodically be announced, but we are nowhere close to the actual implementation of these neuro devices into a human brain let alone the consumer and economic implications to this technology.

As for today and now, we are in the early innings and testing it out on pigs.

Better them and not me.

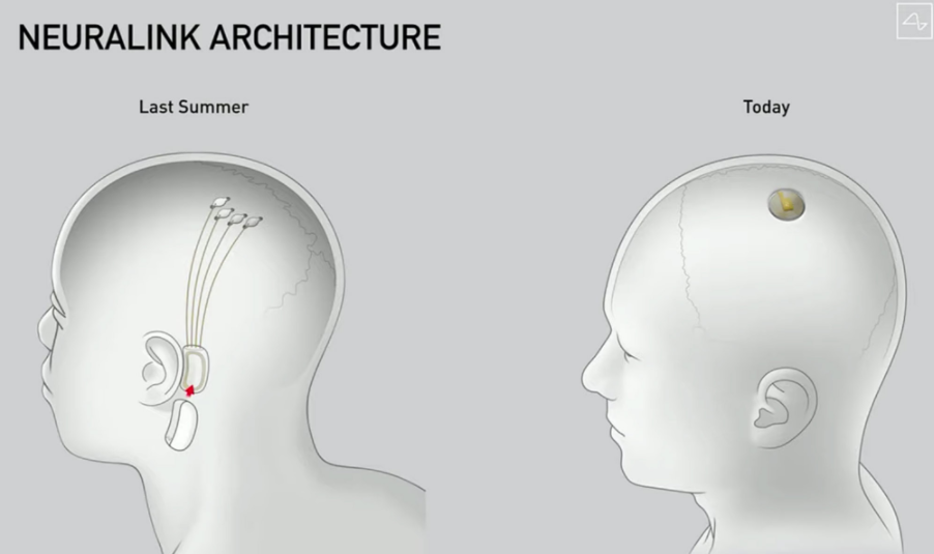

Neuralink’s dramatically simplified design for an implant that hopes to create brain-to-machine interfaces is a big deal and partly because of the star power backing the project who can literally move mountains.

The previous design consisted of a bean-shaped device that would sit behind the ear, but now it is the size of a large coin, and it goes in your skull.

I expect the final iteration to a millimeter wide.

The in-brain device could enable humans with neurological conditions to control technology, such as phones or computers, with merely thoughts.

The other use case is solving neurological disorders from memory, hearing loss, and blindness to paralysis, depression, and brain damage.

The current prototype – referred to as version 0.9 – measures at 23 millimeters by eight millimeters, and has 1024 electrode "threads" attached to it that are implanted into the brain.

It is designed to replace a coin-sized portion of the skull and sit flush so it would be physically unnoticeable. It would be inductively charged, the same way you would wirelessly charge a smartwatch or a phone.

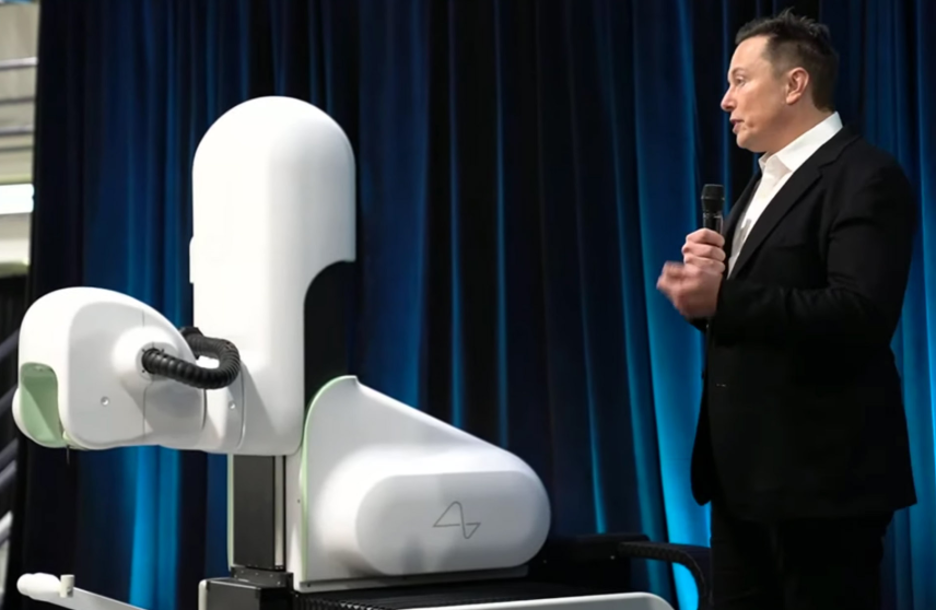

The surgical robot, which is programmed to insert the neural threads safely into the brain, was done by US design company Woke Studios.

Woke Studio’s robot would be able to insert the link in under an hour without general anesthesia, with the patient able to leave the hospital right away.

The robot will eventually do the entire surgery – so everything from incision, removing the skull, inserting electrodes, placing the device, and then closing things up.

It will be completely automated.

Test pigs are being used to test the device which offers important insights into the process of inserting a chip into a brain.

The implant sends real-time signals from the pig’s brain whenever it touches something with its snout.

Described as "healthy and happy", one of the pigs was given an implant two months ago, while another pig has dual Neuralink implants, demonstrating that it is possible to have multiple chips in your head at one time.

A third pig has no implant. According to Musk, each of the animals are "indistinguishable" from each other.

Musk also showed a pig that previously had a chip inserted into its brain, but had since been removed, to show that the procedure is reversible without any serious side-effects.

Neuralink’s Breakthrough Device designation by FDA supports Musk’s neuroscience objectives. The startup is now preparing for its first human test case, pending required approvals, and further safety testing.

When and if this technology is green-lighted by the federal government, I envision a free for all into this technology from the likes of Facebook, Google, Apple, and Microsoft, and so on.

If you thought “tracking” was bad now, then once tech firms are granted access to consumer’s brains, it could open up a pandoras box of moral conflicts of interest as well as an avalanche of revenue opportunities.

Will American society really get to the point where Facebook is selling your “thoughts” to neural advertisers?

It’s scary to think about but that is the track we are headed down.

If you view this through the lens of big tech, battering down the hatches to get access to consumer’s “thoughts” is the holy grail of access points.

In 2020, humans still need to digest thoughts and carry out functions through fingers into a phone interface.

Getting rid of all that and extracting data and behavioral results from the original source is worth trillions of dollars.

Not only will physical devices be useless at that point, but it will spawn a mega cloud storage business that is hooked straight to the mind.

An economic analyst can digest how cloud companies like Amazon and Google would rake in the trillions by storing libraries of data that a mind can tap in at any time.

It really is a gigantic step to the computerization of humans - big tech is first in line to reap the profits and literally control our brains.

“When something is important enough, you do it even if the odds are not in your favor.” – Said Founder and CEO of Tesla and Neuralink Elon Musk

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

September 4, 2020

Fiat Lux

Featured Trade:

(TSLA), (SPY), (GLD), (GDX), (JPM), (BAC), (C), (WFC), (VIX), (VXX), (TLT), (TBT), (USO), (INDU), (SDS),

Below please find subscribers’ Q&A for the September 2 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: Tesla (TSLA) is down 25% today from the Monday high. What are your thoughts?

A: Yes, I've been recommending to people all last week that they dump their big leverage positions, like their one- and two-year LEAPS in Tesla and quite a few people got out at the absolute highs near $2,500 just before the new stock issue was announced. People who bought the Tesla convertible bonds ten years ago got an incredible tenfold return, plus interest!

Q: Are we at-the-money at the bear put spread in (SPY)?

A: Yes, and if we go any higher, you are going to get a stop loss in your inbox because I have good performance this year to protect. I do this automatically without thinking about it. In this kind of crazy market, you cannot run shorts indefinitely. Hope is not a strategy. And it’s easy to stop out of a loser when 90% of the time you know the next one is going to be a winner.

Q: Doesn’t gold (GLD) normally go up in falling stock markets?

A: Yes, in a normal market that’s what it does. The problem is that all asset classes have produced identical charts in the last 2.5 years, and when they all go up in unison, they all go down in unison. This time around, gold will sell off with the stock market and gold miners (GDX) will go down three times as fast. Remember gold miners are stocks first and gold plays second, so when a big stock dive hits, will see big dives in gold miners as well, as we saw in February and March.

Q: Why is JP Morgan (JPM) a good buy?

A: JP Morgan is the quality play in the banks. And once inflation starts to kick in and interest rates rise, and you get a positive yield curve and a strengthening economy—that is fantastic news for banks. They are also one of the few underperforming sectors left in the market, so in any stock market selloff banks will rise. And that’s JP Morgan (JPM), Bank of America (BAC), Citigroup (C) that will lead the charge. Avoid Wells Fargo (WFC). It’s still broken.

Q: I see iPath Series B S&P 500 VIX Short Term Futures ETN (VXX) starting to move up. Should we buy it?

A: Only on dips and only if you expect a dramatic selloff in the stock market very soon, which I do. The (VXX) trade is very high risk. The contango is huge. I tried making money on it a couple of times this year and failed both times; this really is for professional intraday traders in Chicago with an inside look at customer order flows. Retail traders rarely make money on the (VXX) trade—usually, they get killed.

Q: Will gold hold up as interest rates rise?

A: No, it won’t. Rising interest rates are death for gold and other precious metals. Your gold theory is that interest rates stay lower for longer, which the Fed has essentially already promised us.

Q: What do you think of the United States Treasury Bond Fund (TLT)?

A: I’m looking to sell shorts in big size as I did in the spring and I’m looking for five-point rallies to sell into. I missed the last one last week because it just rolled over so fast on an opening gap down that you couldn’t get any trade alerts out, and that’s happening more and more. So, if we get going up to $166-$167, that will be a decent short and then you want to be doing something like the $175-$178 vertical bear put spread in October. I don’t think bonds are going to go to 0% interest rates, I think the real range is 50-95 basis points in a 10-year treasury yield. That is your trading range.

Q: Do you think big oil (USO) will transform into a low carbon energy industry if Biden wins?

A: I’ve been telling big oil that that’s what they’re going to have to do for 20 years. They all read Mad Hedge Fund Trader. And, they always laugh, saying oil will be dominant at least until 2050. Since then, they have become the worst-performing sector of the S&P 500 on a 20-year view, and my thought is that eventually, big oil takes over and buys the entire alternative energy industry, and slowly pulls out of oil. They have the engineering talent to pull it off and they have the cash to make the acquisitions. They will have to reinvent themselves or go out of business, just like everybody else.

Q: What could trigger the stock market pullback you mention in your slides? Because the bullish Fed quantitative easing trade is hard to stop.

A: It’s like the 2000 top, there was no one thing or even a couple things, that could trigger the top. It’s just the sheer weight of prices and exhaustion of new buyers, and that is impossible to see in advance, so all you can do is watch your charts. One down out of the blue the Dow Average ($INDU) will suddenly drop 1,000 points for no reason.

Q: When you say Europe is recovering, which data indicates this?

A: Well, when you look at Q2 GDP growth in Europe, they were only down 10% while the US was down 26%. That is purely a result of Europe having a much more aggressive COVID-19 response than the United States. There is no mask debate in Europe, it’s like 100% compliance. Here you have blue states wearing masks and red states not. The result of that, of course, is that the death rate in the red states is about five times higher than it is in blue states, on a per capita basis. That is why the US has the highest infection rate in the world, the highest death rate, and is why we lost an extra 16% of GDP growth in Q2.

Q: Will you trade a short Tesla again?

A: No, I’ve been hit twice on Tesla shorts in the last six months and we are now in La La land—it’s essentially untradable. I got a lot of people out of Tesla earlier this week, and then they announced their share new $5 billion issue, which they should have done a while ago

Q: Is there any way to play the home mortgage refi boom in the stock market with the 30-year mortgages at a record low 2.88%?

A: You buy the banks. If you call your bank and ask for a refi quote, it might be a week before they get back to you, they are so busy. Banks are also getting enormous subsidies from all these various lending and stimulus type programs, so money is raining down on them right now. Banks are now the cheapest sector in the market, selling at 6x earnings. It is probably the single greatest sector in the stock market right now to buy.

Q: I’ve been holding the ProShares UltraShort 20 year Plus Treasury fund (TBT) and it is moving up and down in the short-range. Should I sell?

A: No, I think we have more room to go on the (TBT), I think we could get to $18, which is about a 0.90% yield in the US Treasury bond market.

Q: Do you have a target on Tesla?

A: Well, my downside target would be its old breakout level. So, divide by five and you get $300. That equates to $1450 in the pre-split price. So, we could have a real monster selloff, like 40%, once this market loses momentum. It’s safe to say don’t buy Tesla up here.

Q: Is the ProShares UltraShort S&P 500 ETF (SDS) offering a good entry point here?

A: It is as soon as we rollover. In these momentum-driven markets, it’s best to wait for proof of a top before you start getting fancy with short plays. You can see how I got hammered several times in the last month by being too early on my shorts; and fortunately, I was able to hedge out most of those losses. You might not be able to do so.

Q: Are you planning on keeping your Fortinet spread?

A: Yes, to expiration, which is only 11 days off, unless we get an out-of-the-blue meltdown.

Q: Do you like Ali Baba (BABA)?

A: Yes; that is essentially a play on a Biden win in the election. If he wins, our war with China will cease and all of the China plays will go ballistic as we return to international trade, which has been powering our economy for the last 70 years.

Q: What about cruise lines like Carnival (CCL)?

A: I know they’re cheap. They’re selling out their 2021 summer cruises with customers betting that there will be a corona vaccine by then, or simply not caring whether there is a pandemic or not. The dedicated cruisers are desperate to cruise. That’s one reason why these stocks are holding up, but I don’t want to touch them. I think the recovery will take much longer than people realize.

Q: When do you buy gold?

A: Wait for a bigger dip.

Q: Should I be holding gold for the long term?

A: Yes; if you don’t want to trade it, just sitting on your position is fine. I think gold eventually goes to 3,000 after hitting an initial target of 2,200.

Good Luck and Stay Healthy

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.