While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

September 3, 2020

Fiat Lux

Featured Trade:

(JMBS), (SGVAX)

I already know what you’re thinking about.

Energy Master Limited Partnerships (MLPs), junk bonds, airlines on the verge of bankruptcy?

Nope.

There are in fact tremendous opportunities in mortgage-backed securities.

Mortgage-backed what, you may ask?

A Mortgage-Backed Security (MBS) is a type of instrument which is secured by a basket of mortgages. These mortgages are aggregated and sold to banks which then securitize, or package, them together into single securities that investors can buy.

MBSs in effect turn banks into middlemen between the individual homeowner and a fixed income end investor. The housing market can’t work without it. The majority of home mortgages in the United States end up in MBS’s one way or the other.

MBS’s are further subdivided into residential or commercial ones, depending on whether the underlying assets are home mortgages taken out by borrowers or assets for commercial purposes ranging from office space to multi-dwelling buildings.

And here’s the part you want to hear. Some MBSs yield as much as 11%, and high single digits are common.

MBSs basically are bonds with a few bells and whistles. They are supposed to trade in line with ten-year US Treasury bonds (TLT). The problem now is that right now they are not. In fact, MBSs are currently trading at the great spread over Treasuries since the 2008-2009 Great Recession.

Part of the problem is that MBSs have a terrible history, leading the charge to the downside when the housing market collapsed, some collateral properties dropping as much as 80%. That took the value of most leveraged MBSs to zero.

Trillions of dollars were lost. Indeed, vast fortunes were made by hedge funds selling short these securities.

Today, these are not your father’s MBSs. In the wake of the 2008-2009 crash, the heavy hand of regulation came down hard.

Today, an MBS must be issued by a government-sponsored enterprise (GSE) or a heavily capitalized private financial company. The mortgages must have originated from a regulated and authorized financial institution. And the MBS must have received one of the top two ratings issued by an accredited credit rating agency.

As a result, much of the risk has been taken out of these securities.

So if these things are so safe now, why are they presenting such astronomical returns? A lot depends on your long term view of these US housing market.

There are currently 4 million homes in mortgage “forbearance” meaning that they have a temporary holiday on making their monthly mortgage payments. This government program runs out at the end of 2020. This has crushed the MBS market.

If you believe that the majority of these homes are going the default on their loans, you probably should steer clear of MBSs as the market has it right.

However, if you think that the majority of these bowers obtained forbearances without actually needing them and will return to regular timely payment once the program ends, plus back payments, then MBSs now offer incredible value and you want to be loading the boat with them.

I believe in the latter.

There happen to be dozens of publicly listed MBSs which you can buy. I focus on a couple of the highest quality ones.

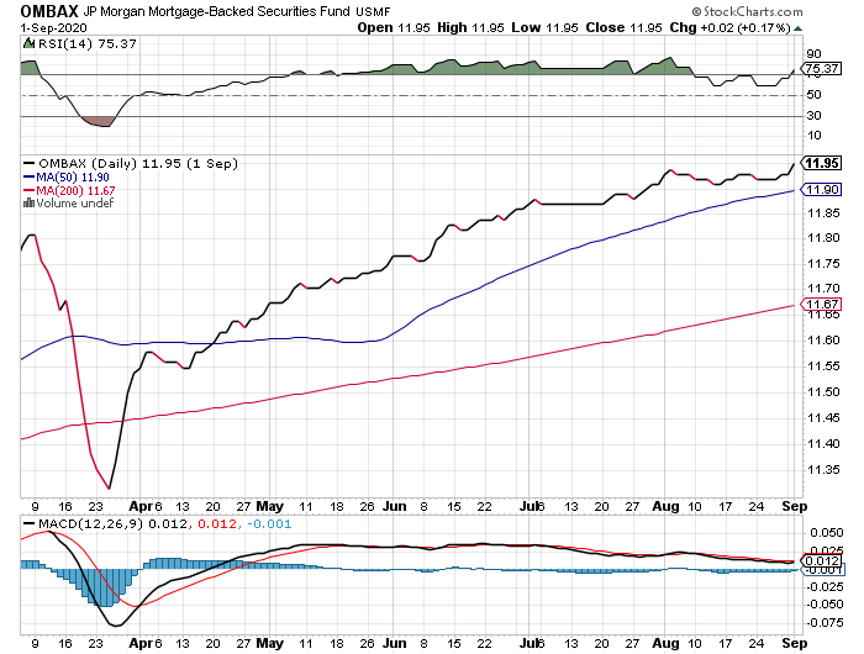

The Janus Henderson Mortgage-Backed Securities ETF (JMBS) is offering a 4.34% yield invests primarily in ten and 30 conventional home mortgages. Click here for more details.

The Franklin Templeton Western Asset Mortgage Back Securities Fund (SGVAX) pays a 3.75% yield and invests in a broader range of asset-backed securities. For more details on this fund please click here.

While these yields are attractive, you really need institutional access to get the Holy Grail, the true double-digit return. That will let you soak up the mortgages directly, as hedge funds do. That will let you bypass the hefty management fees and expenses charged by the exchange-traded funds and other middlemen.

You may also have to go out on the risk spectrum to get the big numbers, which means investing in more commercial backed securities. It’s no great revelation that people will default on their office or their small business before they do so on the residence.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

September 2, 2020

Fiat Lux

Featured Trade:

Mad Hedge Technology Letter

September 2, 2020

Fiat Lux

Featured Trade:

(THE 2020 TECH BUBBLE)

(TSLA), (APPL), (AMZN), (NFLX)

It was February 19 when the tech comprised Nasdaq index swan dived from a liquidity crisis of epic proportions triggered by the virus only to recover the 30% of loss gains in 3 months.

When the Nasdaq made a V-shaped recovery, experts were shocked by the pace of the recovery as the Fed deployed every tool in the toolbox at saving the stock market.

Well, three months on from the Nasdaq index pulling level year to date, tech stocks are 20% higher as main street still labors under an economy that has seen net job losses of 10s of millions.

The liquidity poured into the system has been overwhelming, but many investors aren’t complaining.

Insane price action is the crucial signal to this market frothiness and can be seen in Tesla (TSLA) whose stock has gone from $85 in March to almost $500.

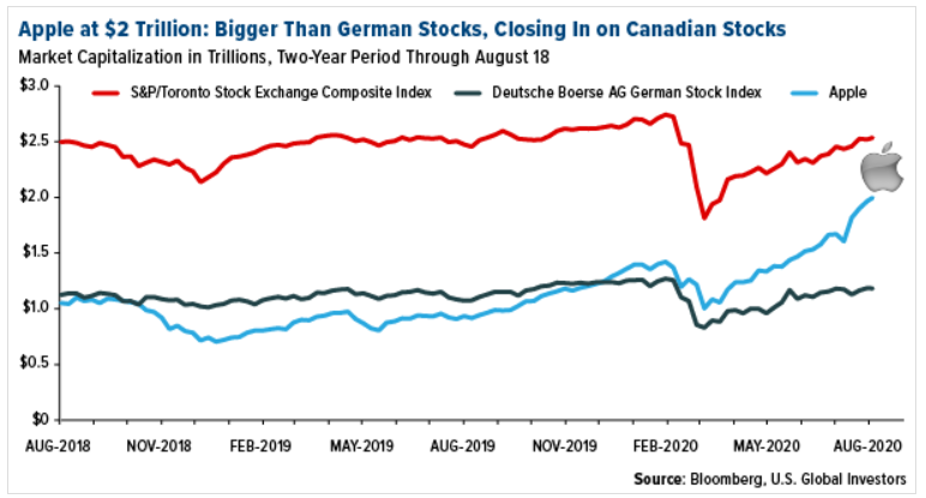

Apple (AAPL) has surpassed the $2 trillion mark.

The market is “looking through” any bad news and is putting a high premium on tech shares that have usurped the mojo of the rest of the broader economy.

Investors need to be in tech because it’s not only where the growth is, but it is where business models are mostly protected.

Last time I checked, computers and smartphones cannot get the coronavirus.

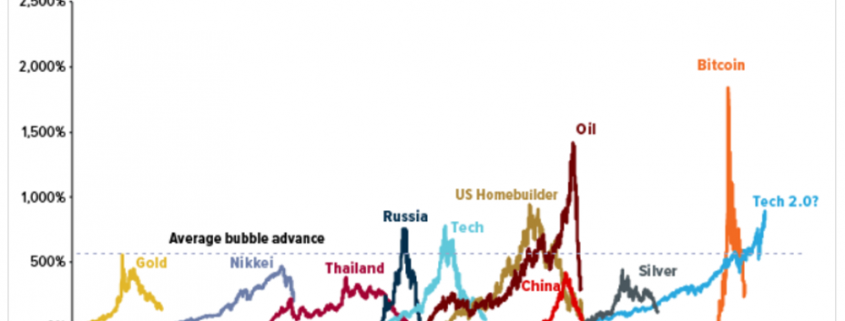

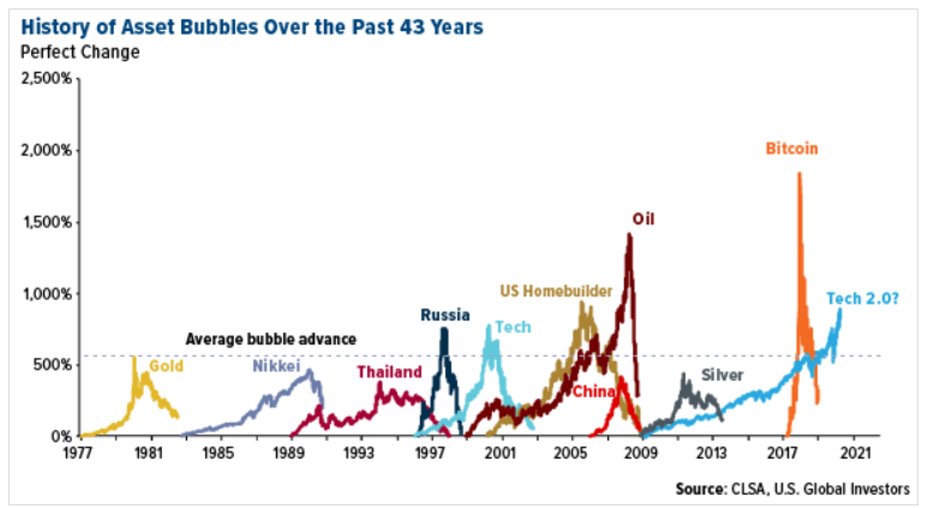

Billionaire Mark Cuban, team owner of Dallas Mavericks in the NBA, sees a huge tech bubble reminiscent of the infamous dot.com fiasco in the late 1990s and early 2000s.

Suddenly, the get-rich-quick crowd is investing with reckless abandon. It seems these upstarts have a fear of missing out and are chasing the market. Cuban is skeptical about the market rally and the bubble could burst in a couple of years.

Unlike the tech debacle at the turn of the millennium, Cuban opines that this year’s version has the Federal Reserve’s help. The U.S. central bank is pumping money into the pandemic-battered economy, but unintentionally supporting risk appetite on Wall Street. Bolder investors are even picking up shares of bankrupt companies.

People have a newfound interest in the stock market and hopping on the bandwagon because the Feds are injecting money to prop up the economy.

Cuban has investments in Amazon (AMZN) and Netflix (NFLX).

Shopify happens to be the largest publicly-listed company in Canada as of July 31, 2020, besting bank giant Royal Bank of Canada.

The 16-year old e-commerce company year-to-date gain is 170%.

I believe in the wisdom of crowds, and that markets have gotten it right far more often than they’ve been wrong.

Ultimately, there are simply too many dollars chasing too few trades.

Tech stocks have driven much of the U.S. market’s gains since March. Were it not for a handful of them, the S&P 500 may have performed more in line with other economies’ stock indices.

Between the market bottom on March 23 and August 20, shares of Apple, Amazon, Microsoft, Facebook, Alphabet, and graphics processor designer NVIDIA were responsible for a heart-stopping 33 percent—an entire third—of the uptrend in the S&P 500.

Apple alone was responsible for more than 11 percent of the market’s moves. Last week, the iPhone-maker became the first U.S. company to surpass $2 trillion in market capitalization, nearly as much as all the companies in the Russell 2000 Index of small-cap stocks combined. Apple is now valued more highly, in fact, than German stocks in the Deutsche Boerse Index and is closing in on Canadian stocks in the S&P/TSX Composite Index.

We are seeing unprecedented price action in the tech sector with the old normal of 1% gains in one trading day turning into 3% or 5%.

We will need some type of liquidity prevention event to experience a real major sell-off in technology and it is true, the higher we go, the harder we will fall.

“I want to put a ding in the universe.” – Said Co-Founder of Apple Steve Jobs

CERN has made a jump today and I am going to suggest you book the profit on the position.

This is mainly because of a technical condition. It is right up against the upper band band on the 60-minute chart and it seems to be a great place to book the profit.

Here is how you close the position:

Sell to Close September 19th - $72.50 Call for $3.60

Buy to Close September 19st - $77.70 Call for $.70

The net credit will be $2.90 per spread. When the trade was initiated, the debit was $1.35 per spread, so this results in a profit of $1.55 per spread.

If you traded the suggested 8 lot, the overall cash return will be $1,240 on an investment of $1,080.

This works out to a return of 115% for about 2 weeks.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.