While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

June 29, 2020

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or COVID-19 IS BACK!)

(SPX), (TLT), (TBT), (TSLA), (BAC),

(XOM), (CCL), (MGM), (WYNN), (UAL)

This was the week that the Coronavirus came back with a vengeance.

The market had been backing out the pandemic for the past three months. Now it is abruptly pricing it back in.

Hospitalizations soared in 16 states to new all-time highs, as the first wave continues to grow exponentially. Deaths have topped 125,000. The good news is that only 5,000 died last week. That is nearly two 9/11’s, or 12 Boeing 747’s crashes worth of victims.

Apple has closed eight stores in Texas and another 14 stores in Florida. Arizona is on the verge of running out of hospital beds. This is going to weigh heavily on the market until we see another interim peak. It looks like the last one was certainly a false summit, in climber’s lingo.

What was really interesting last week is what DIDN’T happen. While the “reopening” stock LIKE banks (BAC), energy (XOM), cruise lines (CCL), hotels (MGM), casinos (WYNN), airlines (UAL) were absolutely slaughtered, gold, technology, and biotech barely moved. It says volumes about what happens next. You want to use selloffs to buy quality at a discount, not garbage that is going to zero.

Technology and biotech are where you want to focus your buying of stock, futures, and LEAPS. The next big dip is the one you buy.

You can count on the government stepping in and announcing more stimulus on the next down 1,000-point day. Thursday mornings seem to be a favorite time, right before the next horrific Weekly Jobless Claims are announced, which also seem to be reaccelerating.

The Fed can do this for free, without spending any money, simply by expanding the asset classes eligible for quantitative easing. Some $8 trillion in QE certainly buys a lot of friends in the market. I believe that any run in the S&P 500 (SPX) down to 2,700 will be met by government action.

Treasury Secretary Steve Mnuchin expects another stimulus package in July, but only if he gives away the store to Nancy Pelosi. Just what the market needs, more stimulus. Most of the 40 million out of work are still jobless. It could be $1 trillion worth of stimulus checks and other giveaways headed for the stock market, like the last lot. My kids still haven’t spent their first checks! We’re going broke anyway, so why not?

The stock market is clearly running out of gas, at a 26 multiple, the highest since the Dotcom bubble top. Any more stimulus may simply go into bank deposits. The risk/reward for new positions here is terrible. It sits nicely into my sideways range scenario for the rest of the year.

Existing Home Sales are down 9.7% in May, the worst in ten years. They are off 26.6% YOY, the worst figure since 1982 when home mortgage rates were at 18%. Inventories are down an eye-popping 18.8% to 4.8 months as sellers pulled listing to avoid virus-infested buyers. The first-time buyers live, but the action is shifting out of condos and into single family homes in the burbs.

Weekly Jobless Claims jump 1.5 million, far worse than forecast. It looks like we are getting a second wave of jobless as Corona ravages the south and business hangers-on throw in the towel. Some 20 million Americans remain on state unemployment benefits, which will start to run out shortly. Will stocks look through this?

Banks are banned from paying dividends and buying back shares, orders the US Treasury. The Fed estimates that pandemic-related loan losses could reach $700 billion, wiping out their capital. Every bailout comes with a pound of flesh. The banks have made billions off of stimulus loans, like the PPP. The banks rallied because the news wasn’t worse, like a mandatory 5% share giveaway, which happened last time. Buy banks like (JPM), (BAC), and (C) on an expected yield curve steepening.

Tesla (TSLA) is now the world’s most valuable car company, with a market capitalization of over $180 billion. It just passed Toyota Motors (TM). (TSLA) is now worth more than the entire US car industry combined. That could double very quickly. The upcoming model Y is expected to be its biggest seller and a third production plant will be announced imminently. The rush out of public transit and into private cars simply accelerated a pre-existing trend or the company.

When we come out on the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade.

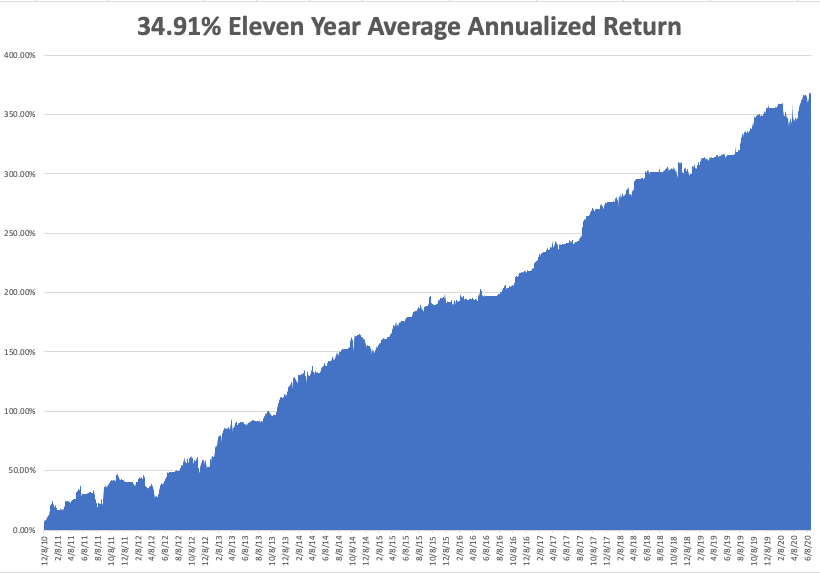

My Global Trading Dispatch enjoyed another respectable week, taking in a welcome 3.87%, bringing June in at +2.56%. Despite the market diving nearly 10%, we pulled in big profits from our short positions and captured accelerated time decay on our longs. My eleven-year performance stands at a new all-time high of 368.75%.

That takes my 2020 YTD return up to a more robust +12.88%. This compares to a loss for the Dow Average of -12.3%, up from -37% on March 23. My trailing one-year return popped back up to 53.27%. My eleven-year average annualized profit recovered to +34.91%.

The only numbers that count for the market are the number of US Coronavirus cases and deaths, which you can find here. It’s jobs week and we should see an onslaught of truly awful numbers.

On Monday, June 29 at 11:00 AM EST, US Pending Home Sales for May are out.

On Tuesday, June 30 at 10:00 AM EST, the April Case-Shiller National Home Price Index is published.

On Wednesday, July 1, at 9:15 AM EST, the ADP Private Employment Report is released. At 10:30 AM EST, the EIA Cushing Crude Oil Stocks are published.

On Thursday, June 2 at 8:30 AM EST, Weekly Jobless Claims are announced.

On Friday, June 3, at 8:30 AM EST, the June Nonfarm Payroll Report is printed. Since last month was a large overstatement, June could be positively diabolical. The Baker Hughes Rig Count is out at 2:00 PM EST.

As for me, I am rushing out and doing errands, like a trip to the barber, haircut, hardware store, dry cleaners, the dentist, and the doctor in case the California economy shuts down once again. We’ve been slightly open for a few weeks.

That may be all we get this year.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

June 26, 2020

Fiat Lux

Featured Trade:

(GETTING READY FOR THE SECOND WAVE)

(DOCU), (TDOC), (NFLX), ($COMPQ)

The coronavirus is dangerously inching towards knocking out the main street economy which would finally land a heavy blow to the tech sector because of the knock-on effect of a substantial drop in future tech budgets.

This leads me to believe that tech stocks are overvalued in the short-term and are due for consolidation.

Daily coronavirus cases have more than doubled from 18,000 to 45,000 as of June 24rd as Americans reclaim the streets and the summer heatwaves kick into gear.

Florida, California, Arizona, and Texas appear to be the new ground zero of the coronavirus and 26 states are experiencing an explosion in cases compared to the prior week.

The blatant disregard for human safety after the reopening means that deaths are likely to spiral out of control in the short-term boding ill for the Nasdaq index but great for shelter-in-place tech stocks.

DocuSign (DOCU), Netflix (NFLX), and Teladoc Health (TDOC) could be in for another run-up.

The jolt in death levels is not baked into tech shares yet, and if things get out of hand, Americans could voluntarily resort back to a shelter-in-place existence.

From March until today, the Nasdaq index has done nothing but sprint upwards due to the eclectic mix of the “re-opening” trade and copious amounts of fiscal stimulus.

If the re-opening trade is killed, the tech market will then go through another contentious referendum to test whether Jay Powell and the Fed are willing to save the equity market yet again.

Propping up the markets ultimately means propping up the tech markets.

If U.S. coronavirus cases re-accelerate from 45,000 to 70,000 then 100,000 per day, the streets could empty out in 1-day.

The risks are certainly to the downside now and the mushrooming of U.S. coronavirus cases could be the catalyst for mass profit-taking in tech names.

Saying the Nasdaq is a little frothy does not mean that tech shares can’t still go higher from here.

They certainly can and there is a legitimate base case surrounding the enormous amount of liquidity sloshing around in the system, meaning that every dip will be bought up.

Then we look forward to the next earnings and news like Apple re-closing 18 stores in coronavirus hot spots doesn’t help.

However, even in the throes of the pandemic, Apple is as innovative as ever - announcing plans to cut ties with Intel during its virtual Worldwide Developers Conference on Monday, saying that it will phase out the use of Intel’s chips in its Mac line of computers over the next two years to use its own in-house chips.

That’s a big deal.

Big tech has so many levers at its disposal.

This goes a long way in a pandemic when specific revenue avenues are blocked off.

Tech is nimble as ever.

Another prime example, after the success of video conferencing software Zoom Communications (ZM), Facebook, Google, and Microsoft posted replica software in a matter of weeks.

Even if their video communication replicas do not catch on, it shows you the vast resources they can muster to harness in whichever direction they please in a blink of an eye.

Many firms are confronting some harsh realities, but investors aren’t penalizing tech firms by selling.

Facebook has seen an ad boycott because of not doing enough against extremism and racism on their platform.

Their algorithms often pit two opposite opinions against each other stoking engagement and more hatred.

Companies including REI, The North Face, Magnolia Pictures, and Upwork have said they won't buy ads on Facebook at least through July as part of a boycott.

The boycott is mostly all bark and no bite and earnings won’t change in a meaningful way.

Uber is a less robust tech firm in the regulatory crosshairs with the state of California about to file court documents that could force Uber and Lyft to reclassify drivers as employees in less than a month.

This could wipe out a small tech company like Uber which is only a $53 billion company.

If the courts rule against Uber, the law would require them to grant drivers employment status while they await the outcome of a pending lawsuit over the issue which would crush the bottom line.

They are having a tough time figuring out how to become profitable.

Investors are doing their best to analyze what the tech industry will look like post-Covid-19 and the assumption is that tech and big tech will dominate which is why any sell-off is temporary.

Every big tech name will survive the pandemic with its business models intact.

Throw in that news of a vaccine and treatment inching forward to fruition and there is a solid bottom for any temporary dip.

It is irrelevant if big tech loses 10% or 20% of revenue this year just as long as they don’t structurally break.

“Technology is now part of the social fabric; it is what is causing dislocation. It is the cause of fear amongst all of us.” - Said Indian-American web and technology writer Om Prakash Malik

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.