When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Dear John Thomas,

I want to thank you for getting me and my portfolio through this stressful year. Through the use of breathing techniques and devotion to reading your new letters, I managed to have a monster year. I am up 338% YTD.

I look forward to trading alongside you in the years ahead and can't wait to meet you in person at one of your Tahoe seminars.

Sincerely,

Justin in Santa Rosa

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

January 11, 2021

Fiat Lux

Featured Trade:

(STRIKE WHILE THE IRON IS HOT WITH CLOTHES TECH)

(SFIX)

Stitch Fix and its updated prognosis from management predicts 2021 results to look something like sales growth of 20% to 25% and that’s pretty damn good considering the less-than-ideal backdrop that corporate America is facing.

Even though I am not a big clothes guy personally, this tech apparel company is delivering value to customers by sending individually picked clothing and accessories items for a one-time styling fee. Customers fill out a survey online about their style preferences. A professional stylist at the company picks five items to send to the customer.

Last year, e-commerce could do no wrong and many stocks in the industry performed sensationally even hitting triple-digit percentages.

Employment is having a tough time coming back, the latest data suggest a long road to recovery and the vaccine rollout has been a pitiful exercise in efficient logistics.

This all means that 2021 will be more or less another year of click and collect from the confines of your abode made possible by ever-improving digital portals.

One of the disastrous industries last year, among many, was apparel, especially brick-and-mortar clothing and department stores.

Shelter-at-home lifestyles didn’t necessarily encourage consumers to handpick expensive dresses and suits, but as the economy slowly trends favorably, it can’t really get much worse than 2020, Stitch Fix should be one of the few winners in apparel among many losers.

Cutting to the chase, retail sales for apparel and accessories ended 2020 down nearly 30% year over year and you couldn’t make up what happened last year if you tried.

Restaurants experienced a 20% drop in sales because consumers simply evaporated highlighting the plight of many foundational industries.

Remote jobs and a wave of fresh self-employment are transforming consumer behavior in this shopping category, and I would bet that apparel consumption will never come back in the form it once was pre-pandemic which is why the use case of Stitch Fix's data-driven shopping experience could never be stronger.

That’s not to say that Stitch Fix had a record year in 2020.

They certainly didn’t.

Stitch Fix still had a bucket of problems in 2020 with a 9% year-over-year revenue decline during its fiscal 2020 third quarter (the three months ended May 2, 2020).

But even with such poor performance, it still represented a massive outperformance relative to other competition and finding those silver linings can be the most important for forward guidance.

This sets up Stich Fix for a massive rebound as consumers got used to the new lifestyle and sales returned with a reported 10% year-over-year growth in the first quarter of fiscal 2021 (ended Oct. 31, 2020).

And throughout the pandemic, Stitch Fix has continued to grow its client base around 9% to 10%.

The forecasted sales growth of 20% to 25% represents a substantial acceleration suggesting that 2020 was a “one-off” even likely to never reoccur.

Their total active clients stood at 3.76 million as of Oct. 2020, up from 3.42 million a year ago, and the company will improve on this growth while retaining past clients.

E-commerce is here to stay as consumers become conditioned to purchasing items in this fashion and a game-changing reason why Stitch Fix's own outlook is so rosy.

Looking forward the company's growth strategy revolves around acquiring new customers and entering new markets like many tech stalwarts before them.

Longer-term, Stitch Fix's data and machine learning capabilities, which helped the company get to where it is today, could be a real competitive advantage if it decides to make a foray into new clothing categories and beyond.

One issue to be aware of is that Stitch Fix generally caters to a pretty specific clientele and its services are only targeting specific price points.

The lower end of that range is still higher than what thrifty consumers may choose to spend and might even be considered a luxury for many.

The lower income tier of America simply won’t be able to make this work in its current form, and margins would drop if Stitch Fix ever accommodated this consumer group.

Despite the convenience Stitch Fix offers, many consumers like the idea of hand-picking clothing and trying it on in stores, where they have the option to instantly swap in and out a size for a better fit.

Stitch Fix does its best to estimate sizing based on user inputs and algorithms, but people are sized in different odd shapes and sizing can still miss the mark.

I don’t think Stitch Fix’s popularity will start to wane if working from home becomes the status quo in 2021 and 2022 and the need for higher-end wardrobes begins to decline because the company will simply need to adapt and focus more on pajama or comfortable clothing if the environment forces them to do so.

Believe me, I have noticed the uptick in the preference for outdoor sweatpants as the crisis went from bad to worse.

People simply don’t have time to dress up in these conditions, but consumers still need to wear clothes every day unless I am totally missing something.

Stitch Fix, in its current iteration, won’t replace department stores because it is too big of a swath from a low-income group that needs to access these services, but as scale terms into a positive input for the company, they can start looking at lower-income tiers for a revenue grab.

As Stitch Fix focuses on higher-end business, the runway is still mind-numbingly long and the optionality they possess is the envy of others.

They have too many good problems to have.

Stitch Fix looks like the cutting-edge apparel company that brings an innovated technology-based model to a stale industry.

It’s working and the first-mover advantage really means something here.

I would wait for a pullback to the low $50s range from the current $56.50 as shares are a little over their own skis.

“Often you have to rely on intuition.” – Said Founder and Former CEO of Microsoft Bill Gates

Global Market Comments

January 11, 2021

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or A WEEK FOR THE HISTORY BOOKS),

($INDU), (TSLA), (TBT), (TLT), (JPM), (WFC)

A man came at me with a crowbar last week.

I drove into Reno to buy some used backpacks for my Boy Scout troop and parked my Tesla in a nice residential neighborhood. Out of nowhere, a man ran down the street at me screaming profanities, crowbar in hand.

He shouted that I was from Antifa and that I had hired people to invade the Capitol Building to make President Trump look bad.

I reached into my car for my own crowbar. Then the local residents interceded, separating us. The man turned around and walked away, fuming.

“Who the heck was that?” I asked.

“He has mental issues,” said a neighbor. “We’ve had many problems with him before.”

Another said “He’s a Trump supporter. He saw your Tesla and thought you were a liberal.”

Wow! Looks like the nation has a very long way to heal.

Last year, the US defense budget amounted to $622 billion. When the greatest threat to congress in the nation’s history presented itself, it was antique chairs piled against the door that provided the best defense. Maybe we should ditch some big-ticket nuclear missiles and buy more chairs.

Of course, once the insurrection started on Wednesday, I was inundated with international calls from investors asking if they should pull all their money out of the US. I answered “NO” and that it was in fact time to double down. Those who did made a killing.

Ask any professional money manager what his reaction to a coup d’état in Washington would be, their response definitely would NOT be to run out and buy a ton of Tesla (TSLA). Yet, that was exactly the perfect thing to do, the stock soaring an astonishing $135, or 18% in two days. I have many followers who did exactly that and they made millions.

All I can say is that if a market gets hit with an insurrection, and exploding pandemic, and a crashing economy and only goes down 400 points and then bounces back the next day, you want to buy the hell out of it.

I’m talking about going on margin and taking a second mortgage on your home and pouring it into stocks. You might even consider going to a loan shark and borrowing at 18% because you can easily make double that in the right stocks.

After the Biden win and the Georgia sweep, there is now more rocket fuel pouring into the stock market than ever. Call it the “Biden blank check”. Estimates of new spending and subsidies about to hit the market now go up to $10 trillion. Let me list some of them:

*$2 trillion in enforced savings by locked up American consumers.

*Credit card balances have collapsed to multi-year lows, making available hundreds of billions in spending power.

*Trillions of Money market balances sitting on the sidelines yielding zero

*$908 billion stimulus package passed in the closing days of 2020

*A further $2 trillion stimulus package to pass shortly, including $2,000 checks for all 150 million US taxpayers.

*Add another $2 trillion infrastructure budget

*$1 trillion in student loan forgiveness for 10 million borrowers at $10,000 each

*Enormous subsidies for any alternative energy companies and Tesla cars

*The return of the deductibility of $1 trillion worth of state and local real estate taxes (known as (SALT)).

MUCH OF THIS CASH MOUNTAIN IS GOING STRAIGHT INTO THE STOCK MARKET!

It all sets up a stock market that has the potential to have “extreme” moves to the upside, according to my friend, Fundstrat’s Tom Lee.

All you need to retire early is someone to point you in the right direction, into the right sectors and the right stocks. Actually, I happen to know just the right person who can do that and that would be me!

Storming of the Capital shut down markets. After the initial crash, markets flatlined as the entire country dropped what they were doing and glued themselves to a TV, their jaws hanging open. The Dow dove 400 points, bonds and the US dollar stabilized, Tesla and oil took big hits, and gold and silver took off. The electoral college vote has been suspended, gunfights broke out on the house floor, and several explosive devices placed. Trump incited his followers to attack the capitol and they did exactly that. Washington DC is now subject to a 6:00 PM curfew for two weeks. Is this the beginning of the 2024 presidential election? It’s the worst day in Washington since the British burned it in 1814.

Democrats took Georgia, giving them Senate control and a blank check on spending for at least two years. Trump clearly blew the election for his party. My 3X short in bonds soared as the market crashed. Banks rocketed on a 10-basis point leap in interest rates. Infrastructure plays went ballistic. The US dollar faded. Add another couple of percentage points of US GDP growth for 2021.

Tesla Shorts posted biggest loss in history, setting on fire a staggering $38 billion in short positions. Many of these were financed by big oil looking to put Tesla out of business. The short interest in the stock has plunged from 37% to 5%. Did I mention that Tesla was the biggest Mad Hedge long of 2020? I’ve been buying it since it was a split-adjusted $3.30 a share in 2010 against a Friday close of $880, a gain of 290X. Elon Musk is now the richest man in the world and he’s only just getting started!

Tesla met its 500,000-unit 2020 target, far in excess of analyst forecasts. Q4 came in at a surprise 180,570 units. The firm’s 2021 target is 1.1 million units. The market Cap is about to touch $1 trillion, more than all of the global car industry combined. The Model 3 is doing the heavy lifting. Model Y production in Shanghai is about to ramp up and Berlin is to follow. If Tesla can mass-produce their solid-state batteries, they’ll attain a global monopoly in the car industry with 25 million units a year and a share price of $10,000.

A Saudi surprise production cut, a million barrels a day, sent oil over $50. But with demand that weak, how long can the rally last? The market is entering short-selling territory. I bet you didn’t use much gas today commuting from your bedroom to your home office. Use the rally to unload what energy you have left. Sell the (XLE) on rallies.

Bitcoin topped $42,000, more than doubling in a month, and exceeded $1 trillion as an asset class. A Biden-run economy means more money creation which has to find a home. My friend’s pizza purchase for 8 Bitcoin a decade ago is now worth $320,000. I hope it was good!

The Nonfarm Payroll came in at a loss of 140,000, giving more credence to the Q1 double-dip scenario and far worse than expected. The headline Unemployment Rate came in unchanged at 6.7%, Leisure & Hospitality lost a mind-blowing 498,000 and an incredible 3.9 million since January. Private Education lost 63,000 and Government 45,000. Professional & Business Services gained 161,000. The real U-6 Unemployment Rate is a very high 11.6%.

The bond crash has only just begun, with the (TLT) down $8 on the week. The risk/reward is the worst of any financial asset anywhere. I am maintaining my triple short position. Massive government borrowing will be a death knell for fixed income investors.

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

My Mad Hedge Global Trading Dispatch closed out a blockbuster 2020 with a blockbuster 10.20% in December, taking me up to an eye-popping 66.64% for the year. I’m up 81% since the March low. In 2021, I shot out of the gate with an immediate 5.93% profit for the first four trading days of the year.

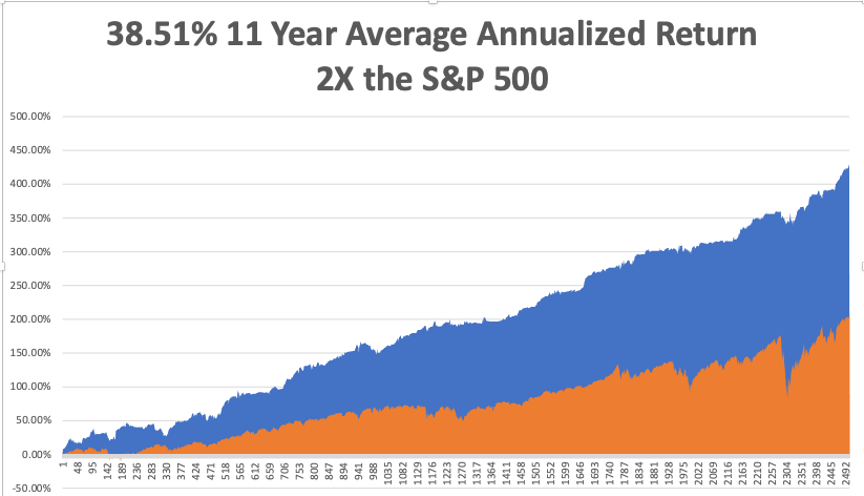

That brings my eleven-year total return to 428.48% double the S&P 500 over the same period. My 11-year average annualized return now stands at a nosebleed new high of 38.51%. My trailing one-year return exploded to 72.57%, the highest in the 13-year history of the Mad Hedge Fund Trader. We have earned 89% since the March low.

The coming week will be a slow one on the data front after last week's fireworks. We also need to keep an eye on the number of US Coronavirus cases at 22 million and deaths 370,000, which you can find here.

When the market starts to focus on this, we may have a problem.

On Monday, January 11 at 11:00 AM EST, US Inflation Expectations are released, which will increasingly become an area of interest.

On Tuesday, January 12 at 4:30 PM, API Crude Inventories are published.

On Wednesday, January 13 at 8:30 AM, the US Inflation Rate for December is announced.

On Thursday, January 14 at 8:30 AM, the Weekly Jobless Claims are published. We also get November Housing Starts.

On Friday, December 15 at 8:30 AM, December Retail Sales are printed. Q4 earnings seasons starts, with JP Morgan Chase (JPM) and Wells Fargo (WFC) reporting. At 2:00 PM we learn the Baker-Hughes Rig Count.

As for me, I’ll be taking my old Toyota Highlander down to the dealer in Reno. Squirrels moved into the engine and ate the wiring, knocking out the heater and the fan. All part of the cost of living in a mountain paradise. However, you have to share it with the critters.

I’ll also be investing in some pepper spray.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

“Getting rid of your great companies and adding to you bad companies is like cutting the flowers and watering the weeds,” said my former client and mentor, Magellan Fund’s Peter Lynch.

Mad Hedge Technology Letter

January 8, 2021

Fiat Lux

Featured Trade:

(UNSTOPPABLE FACEBOOK)

(AMZN), (FB), (APPL), (MSFT), (GOOGL)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.