Here is an interesting “software” company for you.

MicroStrategy Inc. (MSTR) is a tech company offering business intelligence, mobile software, and cloud-based services but is it really?

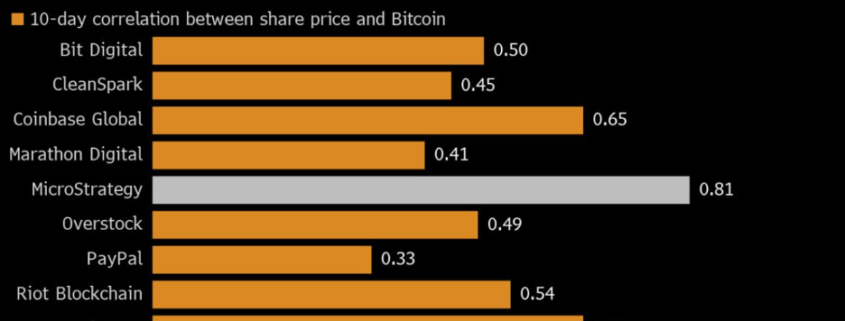

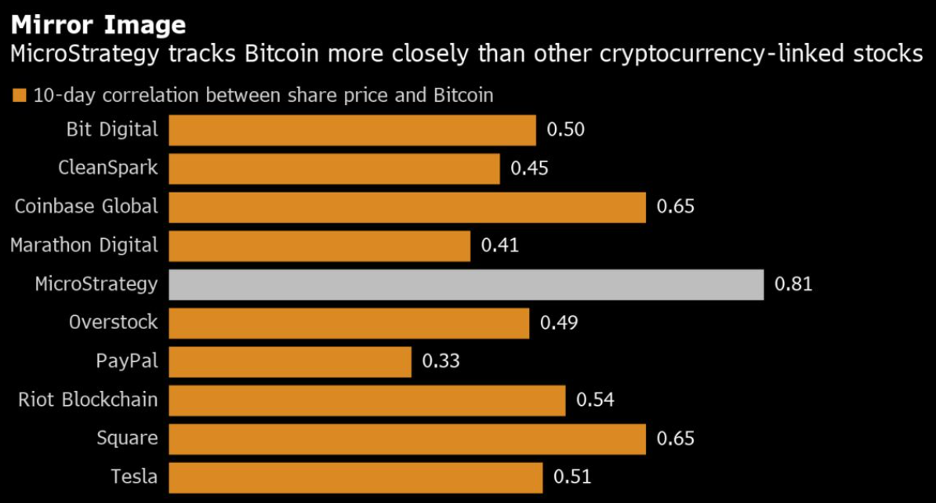

From last year, they have transformed into a de-facto bitcoin proxy because of a relatively progressive strategy of pouring their financial resources into the digital gold asset Bitcoin.

Sure, when riding high, it looks great on the balance sheet, but don’t get me wrong, this is a high-risk proposition for a tech firm that is supposed to be selling business intelligence software.

We all like short-cuts and this is the mother of them as the CEO of MicroStrategy Michael J. Saylor hatched a plan to leapfrog the crowded software scene to make a name for himself.

This is definitely an indictment on smaller software companies showing their plight. It’s not easy competing against the big boys.

In 2017, when the firm had no Bitcoin strategy, MicroStrategy earned $504 million in total annual revenue.

Fast forward to 2020, they did $481 million in revenue.

That is terrible.

A company this small and flaccid isn’t going to find an incremental buyer when they are contracting total revenue.

The game just doesn’t work like that.

It’s plausible to say that Saylor was in desperate straits and his reach for an ultra-high risk, high reward strategy has paid off handsomely so far.

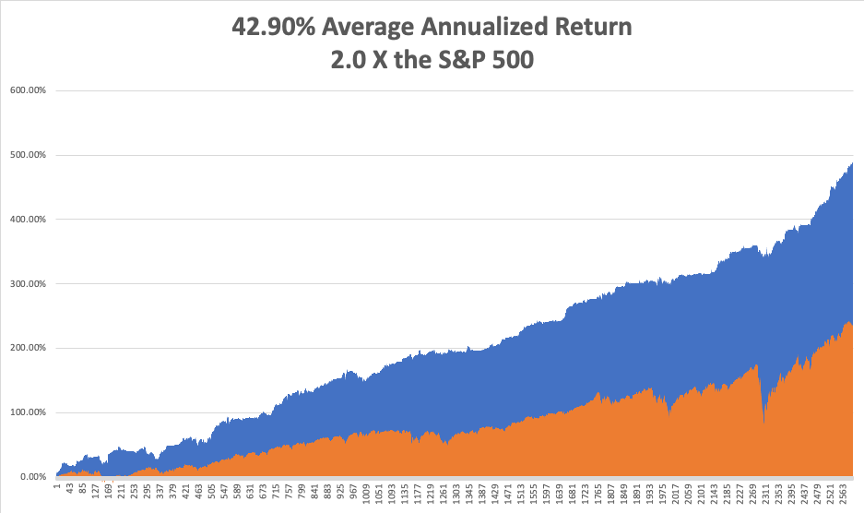

If we roll the clock back a year ago, MSTR had approximately $500 million of cash assets and no expectation of any investment gain from alternative assets.

And as of their earnings report, they had $5 billion in Bitcoin assets, but more like around $2.5 billion today.

If Bitcoin grows, the company is going to benefit, the shareholders will benefit.

Clearly, if you’re a MicroStrategy shareholder and you have a negative sentiment on Bitcoin, then MSTR is not the right company for you, but if you have a positive sentiment about where Bitcoin is headed, it’s worth a look.

MSTR has aligned its balance sheet and shareholders' interests with that sentiment.

Not only does MicroStrategy benefit from the profitability of bitcoin, but they are parlaying it into favorable debt issuances like the past quarter’s convertible debt issuance.

From a revenue standpoint, total revenues in the quarter grew 10% year-over-year which is the strongest quarterly performance in five years, and it beats negative growth.

The prior years’ comp was an easy year over year beat and MSTR was up 69% in perpetual license revenue, and on the cloud side, they were up 26% year over year, and cloud billing is up 19% year over year.

These metrics are some of the best they’ve had in history, and I would say we’ve seen growth because the existing customer base is primarily large enterprises and many are still buying on-prem and obviously, MSTR is not going to turn that down.

The second key factor is they are actively moving people off of perpetual maintenance and moving them to term licenses, which will show up in product license revenue.

HyperIntelligence continues to be an important entrée into new customers and as an important indication to customers of new product innovation. MSTR’s SaaS version of HyperIntelligence has seen increased adoption, as well as serving the foundation of future enterprise business intelligence (BI) SaaS offerings.

That’s great that their business intelligence software is growing 10% year-over-year but it’s their Bitcoin acquisition strategy in the first quarter that is making headlines.

MSTR completed a second convertible notes offering, this time selling $1.05 billion in aggregate principal of notes, and got even better terms than their first convertible notes offering with a 0% coupon and 50% conversion premium.

With this new capital, on April 5, 2021, they announced the purchase of an additional 253 Bitcoins for $15.0 million at an average price of approximately $59,339 per Bitcoin, inclusive of fees and expenses. On April 12, 2021, they announced that going forward, non-employee directors will receive all fees for their services on the company's board in Bitcoin instead of cash.

Before that, they acquired an additional 19,452 Bitcoins for $1.026 billion or approximately $52,765 per Bitcoin. Overall, in the first quarter, they purchased 20,857 Bitcoins for $1.086 billion or $52,087 per Bitcoin and ended the quarter holding 91,326 Bitcoins at an average price of $24,214.

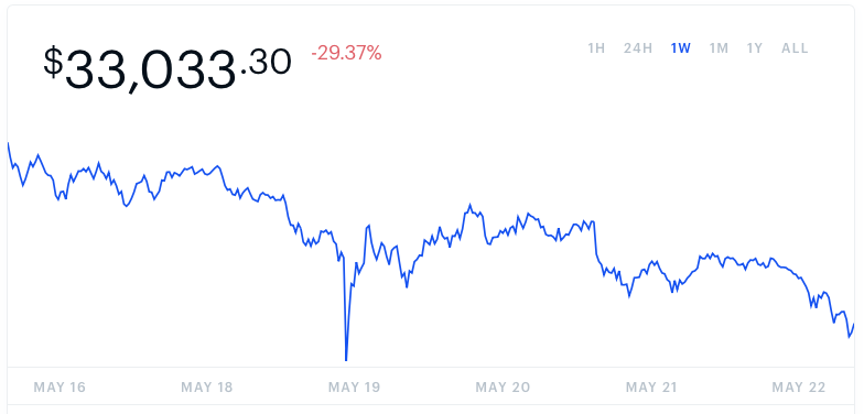

The company estimate that current market value Bitcoin holdings now exceeds $5 billion, including $3.1 billion of unrealized gains, but that amount has halved since Bitcoin sold off.

Management has said they plan “to deploy additional capital into our Bitcoin acquisition strategy.”

I understand they are doing a little “Elon Musk-esque” dip into Bitcoin to gentrify their balance sheet, but what I see is MSTR buying up Bitcoin no matter what the price is even up to the latest peak of around $60,000.

That’s borderline irresponsible.

I get it that their Bitcoin commitment has elevated their brand dramatically in the world and the Bitcoin community is adding something of the order of 10 million people a month, perhaps even more millions a week.

But, and it’s a big but, management shouldn’t be blindly buying up bitcoin with borrowed money at any price.

It’s hard to believe there is no nuance to this strategy.

Aggressively buying Bitcoin with guns blazing is a fool’s game and the balance sheet could get wrecked if Bitcoin has a few bad weeks and drops down to $10,000 which is entirely plausible.

For me, this wreaks of their core products not being able to viably compete with high quality business intelligence products.

I agree that MSTR has a real product, this isn’t a pump and dump scheme, but shareholders really need to question what management is thinking by pouring more capital into Bitcoin at $59,000.

Why not use the debt issuance to build better core products to win more long-dated contracts?

At $59,000, there is a higher chance in the short-term that Bitcoin will retrace to $40,000.

MicroStrategy shareholders must ask themselves at what price will MSTR not buy Bitcoin. I would love to hear that answer.

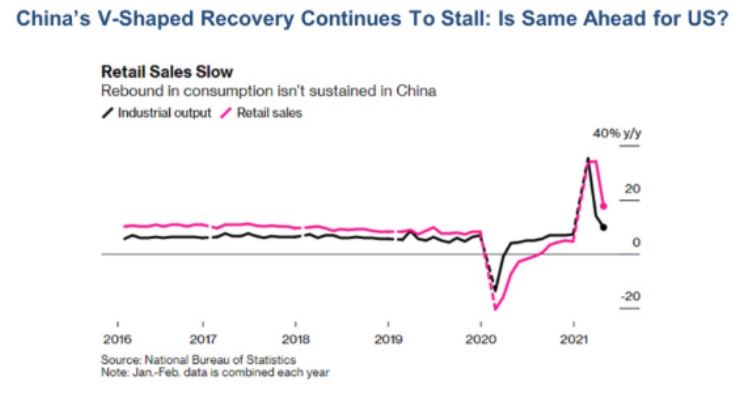

Especially when investors have seen the asset fringes blow up like the weakness in SPACs and perceived inflation scares running riot all over the news wires.

The stock hit a high of $1,272 in the beginning of February and is down 300% from the peak today which is still 300% higher than where it was before the Bitcoin mania hit in mid-2020.

Got all that?

So again, everything is relative, and I wouldn’t touch this one unless it reverts back to $300 where there is technical support which would mean a substantial drop in Bitcoin from the current price today.