When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

-

Global Market Comments

May 11, 2021

Fiat LuxFeatured Trade:

(THE NEXT TRADE OF THE CENTURY IS HERE!),

(TLT), (TBT), $TNX)

We are getting to the point where great equity trades with potential huge returns are becoming few and far between. At the very least, they are only a fraction of the opportunities we saw a year ago, which was a once-in-a-century event.

So, when your trade of the century runs out, what do you do?

You find another trade of the century!

It just so happens I have such an animal.

You are all well aware of the short-selling opportunities available in the US Treasury bond market (TLT), where I have been running triple short positions since the beginning of the year. That has allowed us to rake in 6% a month in profits like clockwork.

How would you like to make more than that, a lot more, like three times more?

I have been dealing in the front-month options so far and managed to catch a $25 crash in the United States Treasury Bond Fund (TLT). If you believe that there is another $25 in the works, there are much bigger fish to fry. Simply extend your maturities and lower your strike prices through LEAPS, or Long-Term Equity Anticipation Securities.

I’ll show you how to do that, first with a conservative position, and then a much more aggressive one. Better yet, an excellent entry point for both positions is close.

The case for lower bond prices and higher interest rates is overwhelming.

With 2021 expected to be one of the strongest years for economic growth in history, there is no chance you’ll see a major rally in the US Treasury bond market from here. The only question is how fast it will fall.

This trade is basically betting that interest rates will rise in front of the biggest borrowing since civilization began.

The national debt rose from a record $23 trillion to an eye-popping $28 trillion in 2020. In 2021, it is expected to explode to $32 trillion, and possibly as high as $37 trillion by the end of 2022. The US Treasury demands on the bond market are going to be incredible.

As much as you may admire or despise Biden’s “guns and butter” policy (the guns being aimed at Covid-19), a flood over government bond selling is on our doorstep.

It is almost mathematically impossible in this environment for bond prices to rise and interest rates to fall substantially from here. They can only go sideways at best, or down big in the worst case.

Sounds like a great short to me.

Currently, LEAPS are listed for the (TLT) all the way out until January 2023.

However, the further expiration dates will have far less liquidity than near-month options, so they are not a great short-term trading vehicle. That is why entering limit orders in LEAPS only, as opposed to market orders, is crucial.

These are really for your buy-and-forget investment portfolio, defined benefit plan, 401k, or IRA.

Because of the long maturities, premiums can be enormous. However, there is more than one way to skin a cat, and the profit opportunities here can be astronomical.

Like all options contracts, LEAPS gives its owner the right to "exercise" the option to buy or sell 100 shares of stock at a set price for a given time.

LEAPS have been around since 1990 and traded on the Chicago Board Options Exchange (CBOE).

To participate, you need an options account with a brokerage house, an easy process that mainly involves acknowledging the risk disclosures that no one ever reads.

If LEAPS expires "out-of-the-money" by the expiration date, you can lose all the money you spent on the premium to buy it. There's no toughing it out waiting for a recovery, as with actual shares of stock. Poof, and your money is gone.

Note that a LEAPS owner does not vote proxies or receive dividends because the underlying stock is owned by the seller, or "writer," of the LEAPS contract until the LEAPS owner exercises.

Despite the Wild West image of options, LEAPS are actually ideal for the right type of conservative investor.

They offer vastly more margin and more efficient use of capital than traditional broker margin accounts. And you don’t have to pay the usurious interest rates that margin accounts usually charge.

And for a moderate increase in risk, they present hugely outsized profit opportunities.

For the right investor, they are the ideal instrument.

So, let’s get on with my specific examples for the (TLT) to discover their inner beauty.

By now, you should all know what vertical bear spreads are. If you don’t, then please click this link for my quickie video tutorial (you must be logged in to your account).

Warning: I have aged since I made this video.

Today, the (TLT) is trading at $139.75

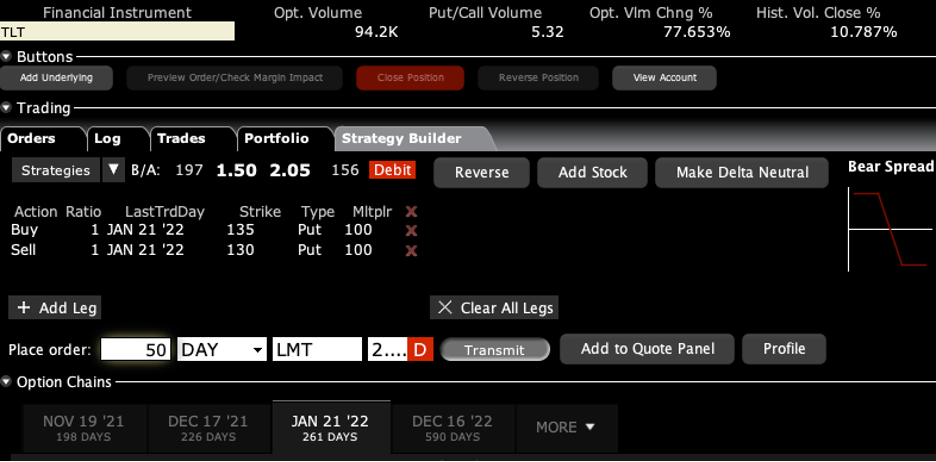

The cautious investor should buy the (TLT) January 2022 $130-$135 vertical bear put debit spread for $2.00. Some 50 contracts get you a $10,000 exposure. This is a bet that ten-year US Treasury yields will rise above 1.75% in eight months. Sounds like a total no-brainer, doesn't it?

expiration date: January 21, 2022

Portfolio weighting: 10%

Number of Contracts = 50 contracts

Here are the specific trades you need to execute this position:

Buy 50 January 2022 (TLT) $135 puts at………….………$6.00

Sell short 50 January 2022 (TLT) $130 puts at…………$4.00

Net Cost:………………………….………..………….........….....$2.00

Potential Profit: $5.00 - $2.00 = $3.00

(50 X 100 X $3.00) = $15,000 or 150.00% in eight months. In other words, your $10,000 investment turned into $15,000 with an almost sure thing bet.

This is a bet that the (TLT) will stay below $130.00 by the January 21, 2022 options expiration in eight months. To lose money on this position, ten-year US Treasury yields would have to stay below 1.75% from the current 1.57%, which they won’t.

Pigs would have to fly first.

Let’s say that you’re so convinced that exploding US debt will cause the (TLT) to crash again that you’re willing to take on more risk and place a bigger bet.

Here is your dream trade:

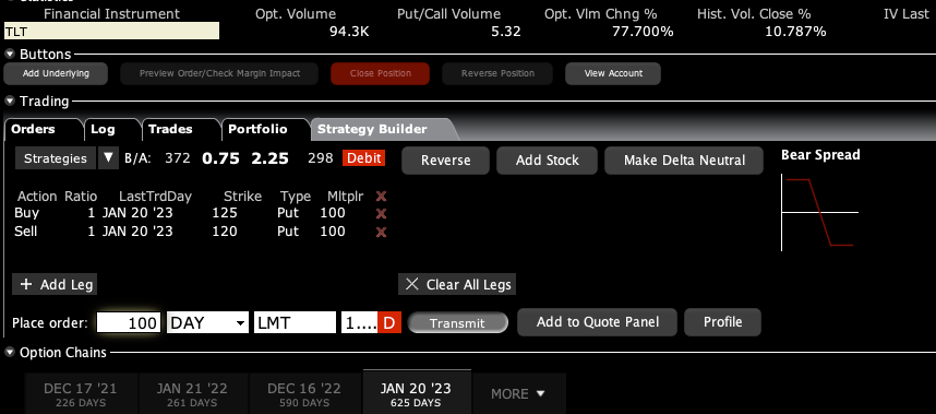

Buy the (TLT) January 2023 $120-$125 vertical bear put debit spread for $1.00. Some 100 contracts get you a $10,000 exposure. This is a bet that ten-year US Treasury yields will rise above 2.25% in 20 months.

That’s what you would expect to see during a normal economic recovery. This is the greatest economic recovery of all time.

expiration date: January 20, 2023

Portfolio weighting: 10%

Number of Contracts = 100 contracts

Here are the specific trades you need to execute this position:

Buy 100 January 2023 (TLT) $125 puts at………….………$7.75

Sell short 100 January 2023 (TLT) $120 puts at…………$6.75

Net Cost:………………………….………..………….….....$1.00

Potential Profit: $5.00 - $1.00 = $4.00

(100 X 100 X $4.00) = $40,000 or 50.00% in 20 months. In other words, your $10,000 investment turned into $40,000 with an almost sure thing bet.

This is a bet that the (TLT) will stay below $120.00 by the January 20, 2023 options expiration in 20 months.

Why do a put spread instead of just buying the $130 puts outright?

You need a much bigger downside move to make money on this trade. By paying only $2.00 instead of $6.00 for a position, you can triple your size, from 16 to 50 contracts for a $10,000 commitment. That triples your downside leverage on the most probable move in the (TLT), the one from $135 to $130.

That’s what real hedge funds do all day long, find the most likely profit and leverage up on it like crazy.

Let’s do the math on the two positions. If you buy the (TLT) January 2022 $130-$135 vertical bear put debit spread for $2.00, you reach a maximum value of $5.00 on expiration day at $130.

If you buy the (TLT) January 2022 $130 puts outright, at $130 on expiration day, your position is worth zero, nada, bupkiss. It gets worse. To make the same amount of profit as the spread the (TLT), or $15,000, it has to fall all the way to $122.50 to break even. Below that, you make more money than the spread, but at half the rate.

How could this trade go wrong?

There is only one thing. We get a new variant on Covid-19 that overcomes the existing vaccines and brings a fourth wave in the pandemic.

In this case, the (TLT) doesn’t crash to $120 but soars to $160 or more. We go back into recession. Both of the above positions go to zero. But if we get a fourth wave, you are going to have much bigger problems than your options positions.

So there it is. You pay your money and take your chances. That's why the potential returns on these simple trades are so incredibly high.

Enjoy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

The Fat Lady is Singing for the Bond Market

“The market is untradable now. We are one tweet away from a new all-time high, or a 10% correction,” said a hedge fund friend of mine.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

May 10, 2021

Fiat Lux

Featured Trade:

(WILL INVESTORS PAY THE HIGH PREMIUM FOR ZILLOW?)

(Z)

In a typical year, spring begins the traditional home-buying season. But we know that this past year was anything but ordinary.

An internal Zillow (Z) report indicated that the pandemic has indeed caused people to rethink where they live and concludes that approximately 8 million existing homeowner households that have been on the sidelines may enter a real estate market already beset by unrelenting demand.

Also, 8.9% of consumers plan to purchase a home in the next six months near a 20-year high per the conference board's April consumer confidence survey.

The housing market is underpinned by demographic and economic tailwinds that will persist for the foreseeable future.

Millennials are moving up.

Baby Boomers are downsizing and in between, people of all generations are rethinking their lives.

Zillow (Z) is the most popular real estate portal in the country with hundreds of millions of consumers visiting the platform.

It’s easy to put up an advertisement on Zillow, while other competitors need to spend tens of millions of dollars to generate those leads.

It’s a sustainable competitive advantage which is one of the main factors for the stock going from $20 to $200 last year.

This effectively makes Zillow’s customer acquisition cost zero!

And because of that, it’s disappointing that they aren’t more profitable.

The PE ratio is currently 517 and as we look forward, we need to ask ourselves, will investors continue to bid up this high growth real estate tech stock?

This past quarter’s revenue growth was strong with Zillow reporting Q1 revenue of $1.2 billion, exceeding the high end of the forecast.

Q1 Internet, media, and technology (IMT) segment revenue was $446 million, grew 35% year-over-year, as this company continues to see accelerated growth in Premier Agent and strong growth in rentals.

This is Zillow’s bread and butter and represented over 37% of their total revenue.

Premier Agent revenue that connects realtors to consumers grew 38% year-over-year in Q1, the accelerated growth was primarily driven by connections growing faster than traffic, as well as focus on providing outstanding service and optimizing to connect high intent customers with high performing partner agents.

The inherent strength of the company lies in being the Uber of real estate and matching up ad-paying agents to customers.

However, I do believe we are hitting the high-water mark in the short-term as housing inventory levels hit generational lows and sellers stop putting their homes up for sale.

Therefore, it’s easy to argue that Zillow and its revenue growth will have a hard time pushing incremental growth now, and like many other tech firms, are facing tough metrics to beat year-over-year in for next earnings’ season.

Cratering interest rates of 2020 was the catalyst that drove the incremental buyer into the market, and I believe that harvest has mostly been collected.

Prospective buyers simply are at the extreme upper limit of affordability, now that the median house for sale in the U.S. is around $400,000.

Growth in Zillow Offers which is direct purchase and sale of homes continued to reaccelerate in Q1.

Zillow reported home segment revenue of $704 million, which exceeded the high-end outlook with 1,965 home sales.

Purchases increased to 1,856 homes in the quarter from 1,789 homes purchased in Q4, but not quite at the rapid pace planned as Zillow continued to work on retooling algorithm models to catch up with the rapid acceleration in home price appreciation.

The flipping game is just becoming too expensive, even for a subsidized tech corporation like Zillow and the algorithms are having a hard time competing with properties selling for $50,000 over the asking price!

Zillow is now competing with Qatar Sheikhs, sovereign wealth funds, and family offices of the elite who are piling into U.S. residential real estate at the same time.

Management has said they “buy homes at the median”, but wait, I thought technology would find the market inefficiencies in the pricing and Zillow would be able to find discounts.

Apparently not and that goes out of the window in an era of ultra-liquidity.

Management also claims they avoid buying houses in “really wealthy or really unique neighborhoods because they’re harder to resell and harder to price.”

The problem I have with Zillow Offers is that this division would be sucker-punched by a devastating blow from a property market pullback and be stuck with the carrying costs of thousands of mortgages and homeowner association fees per month.

That’s most likely the real reason for avoiding pricey areas.

Also, there is the conundrum that in market downdrafts, pricing power in the neighborhoods that Zillow targets fall fastest in terms of velocity of price and quality of buyer.

Even more worrying, Zillow charges the seller a fee of about 7.5% on average, which is notably higher than the traditional 6% commission a seller pays to realtors.

I thought technology was supposed to incite a deflationary effect?

Apparently not.

Mortgages segment revenue increased 169% year-over-year in Q1 to $68 million and was primarily driven by mortgage loan origination volume, which was up more than 8x year-over-year.

Sure, the 8x growth looks great on paper, but this division is still only 5% of total revenue and is a recipient of the law of small numbers looking better than they are.

In Q1, refinance loan origination volume comprised 90% of total origination volume.

There will be no refi boom in 2021.

Zillow really missed a gold mine in the mortgage division last year when they couldn’t even turn a profit in this division.

For the IMT segment, Zillow is forecasting 66% year-over-year revenue growth in Q2.

This is Zillow’s strength and you can expect Premier Agent revenue to be between $342 million to $350 million up 80% year-over-year.

On a sour note, they expect mortgage segment revenue to be down from Q1 and with respect to margins, Zillow’s Q2 IMT margin is expected to be 41% down sequentially from the 47% in Q1.

It’s clear that on the horizon, margins will shrink and nascent businesses will stall, and that’s a poor recipe for short-term price action in shares.

I don’t think investors will pay the current high premium for Zillow at these inflated levels, and yes, it’s a great buy and hold long term company, with a superior ad business that connects agents, but I do not see the case for the next leg up in the next few months.

This year will be remembered as a consolidation year as a few years of revenue were brought forward because of a once-in-a-lifetime interest rate collapse and pandemic tailwind.

Unfortunately, this year might just be too boring to 10X Zillow’s stock.

“It is only when they go wrong that machines remind you how powerful they are.” – Said Australian Journalist Clive James

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

May 10, 2021

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE SUSHI HITS THE FAN),

(SPY), (TLT), (TBT), (V), (UNP), (DAL), (MSFT), (GS), (JPM), (FCX)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.