“Quantitative easing is universal basic income for rich people.” – Said Portfolio Manager Travis Kling

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

October 26, 2021

Fiat Lux

Featured Trade:

(CHINA’S COMING DEMOGRAPHIC NIGHTMARE)

Mad Hedge Technology Letter

October 25, 2021

Fiat Lux

Featured Trade:

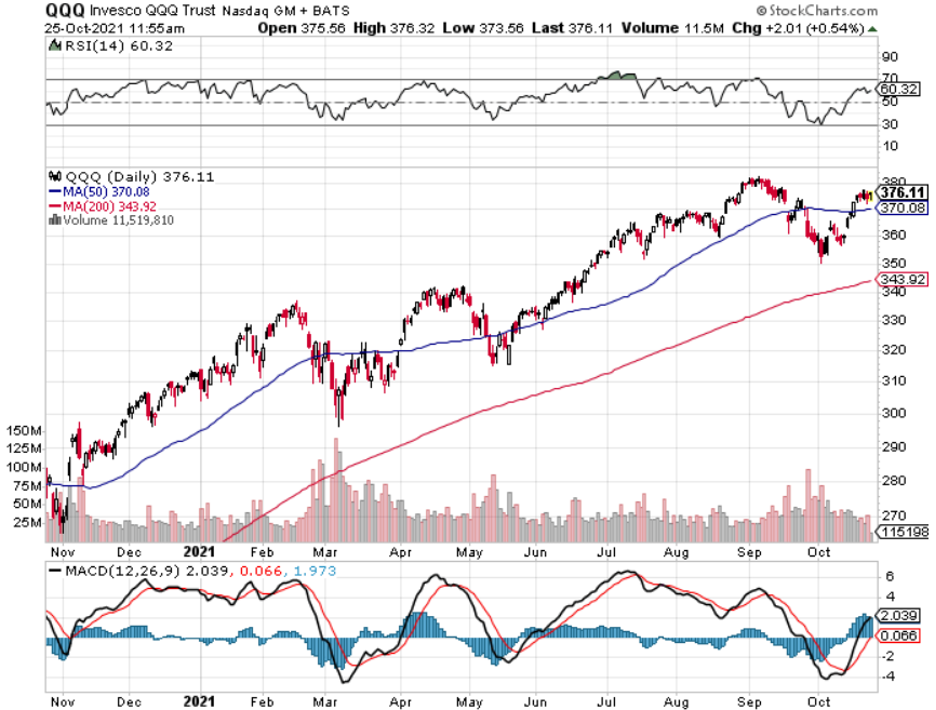

(HOW TO PLAY THE TECH EARNINGS SEASON)

(MSFT), (FB), (GOOGL), (AAPL), (SNAP)

The big guns of tech are coming up to the plate for earnings and they could use a strong showing as big tech’s narrative is on the ropes.

They are still the apex warriors of the stock market, and that position is hardly under threat, but there are whispers of a slowdown.

A recipe of high expectations mixed with cruddy forecasts could give us a dip to buy into.

This is what our portfolio would love to be gifted.

Don’t forget we have already seen some misses from tech companies like Snap (SNAP) which plunged 27% after warning that customers are cutting back on digital advertising spending.

The fallout sent other ad tech companies like Twitter and Google significantly lower.

This never used to happen to these companies and that’s important to point out because we just exited an era where ad tech companies could do no wrong.

Now it almost seems like they can’t do no right.

Readers got spoilt, earnings after earnings, these tech companies used to knock it out of the park and much of that high expectation is still leftover, perhaps a legacy concept from the bull market from 2008 to 2021.

These are the bellwether stocks of the broader market that have single-handedly put the rest of their market on their back and carried it higher.

Everyone wants to know if they can still hack it?

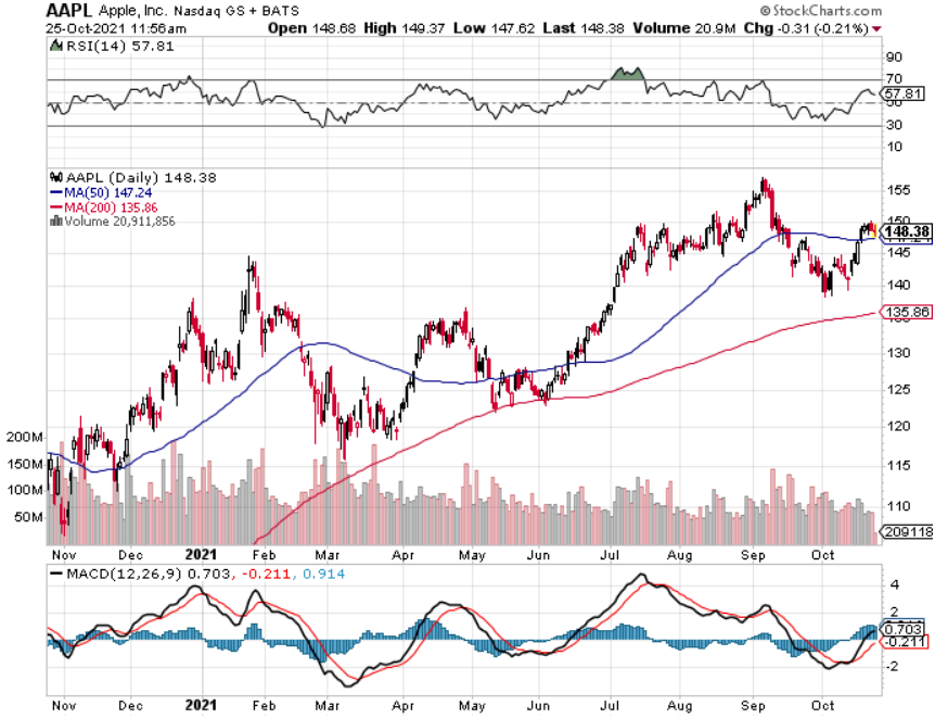

Technology companies in the S&P 500 Index are projected to report revenue growth of roughly 19% for the third quarter such as Alphabet at 38% growth, followed by Facebook at 37% and Apple (AAPL) at 31%.

I do believe that they will achieve these lofty estimates but they won’t overperform to the point where buyers line up in spades.

We aren’t in that type of environment now.

These companies have pricing power, and combined with underlying growth drivers, they generate high returns and reinvest in the business and perpetuate that strength.

The price action backs up my concerns with 85% of tech companies having beaten profit estimates, but the stocks have fallen an average of 2.4% the following day.

The lack of response means we are long in the tooth.

If this does become a “buy the rumor, sell the news” type of event, this will give us plenty of discounts to cherry-pick the next day.

The challenge of justifying their valuations means these companies aren’t getting their “free pass” that they used to pocket and manipulate.

They aren’t the darlings of the business world anymore — that title goes to cryptocurrency and bitcoin.

Facebook will tell us how badly Apple’s privacy changes are affecting its ad revenue model.

Consensus is looking for revenue growth of nearly 40% this quarter in Alphabet which in a normal year wouldn’t be that hard to beat but it’s a new normal now.

Ongoing monetization improvements in search advertising through product/AI-driven updates, along with greater-than-expected contributions from businesses like YouTube and Google Cloud can seem them meet their forecasts.

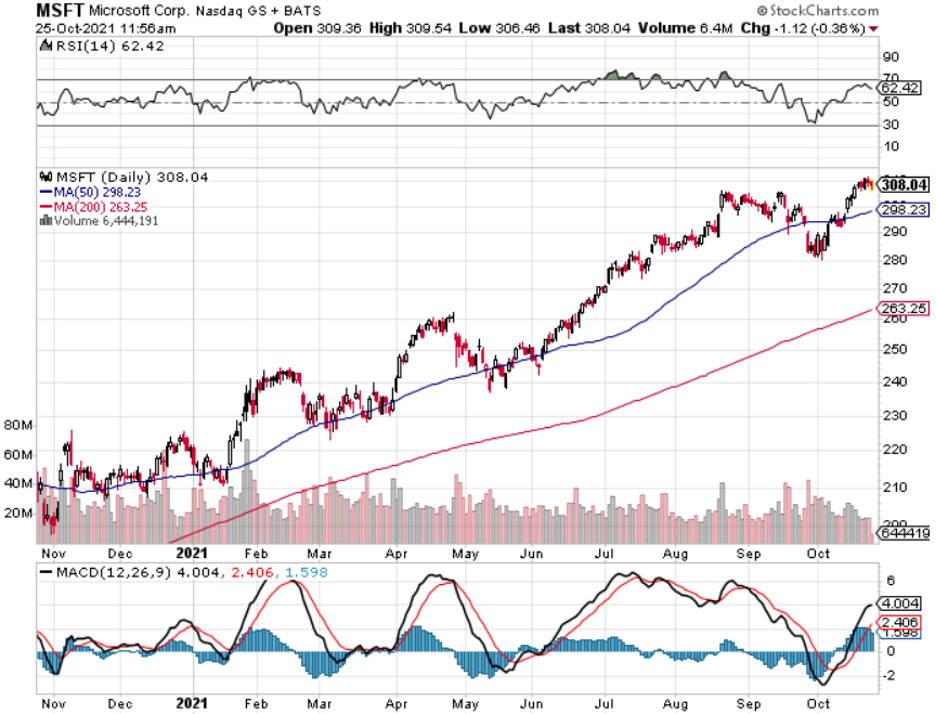

Microsoft (MSFT) expects revenue to grow around 20% in the quarter and we need to look out for if their cloud-computing business maintains strong demand.

Year-over-year comparisons get progressively tougher throughout the year which is an obstacle for MSFT’s durable growth portfolio of Azure/Security/Teams.

Apple could deliver great iPhone sales, but semiconductor shortages are a limiting factor, and the China risk is another big quagmire.

At what point will the Chinese Communist Party stop giving Apple such an easy go of it in China?

Regulatory uncertainty is an overhang — implications of the App Store ruling remain a wild variable.

Amazon is dealing with supply-chain challenges and labor shortages.

Last quarter, revenue missed expectations for the first time since 2018, and the company warned of the reverse of the pandemic-related tailwind for online retail.

Revenue is expected to grow a little more than 16%, the slowest pace since 2015.

The stock has been dead weight this year, which is unlike Amazon.

I do believe we will get a sprinkling of fairy dust that includes margin expansion, but some of these companies will experience a pullback and I will be waiting to aggressively take advantage of these deals.

“It is only when they go wrong that machines remind you how powerful they are.” – Said Australian Writer Clive James

Global Market Comments

October 25, 2021

Fiat Lux

Featured Trade:

(TESTIMONIAL),

(MARKET OUTLOOK FOR THE WEEK AHEAD, or TAKING A BREAK)

(MS), (GS), (BAC), (TLT), (TSLA), (AAPL), (AMZN), (GOOGL), (FB)

When I ran the international equity trading desk at Morgan Stanley during the 1980s, there was always one guy I was trying to recruit and that was David Tepper at Goldman Sachs. Whenever we did a trade with David, we lost money.

If we sold David a stock it usually took off like a rocket. If we bought a stock from him it plummeted like a stone. Eventually, unable to lure David over with a monster salary, I had to ban trading with him as it was such a loser for us.

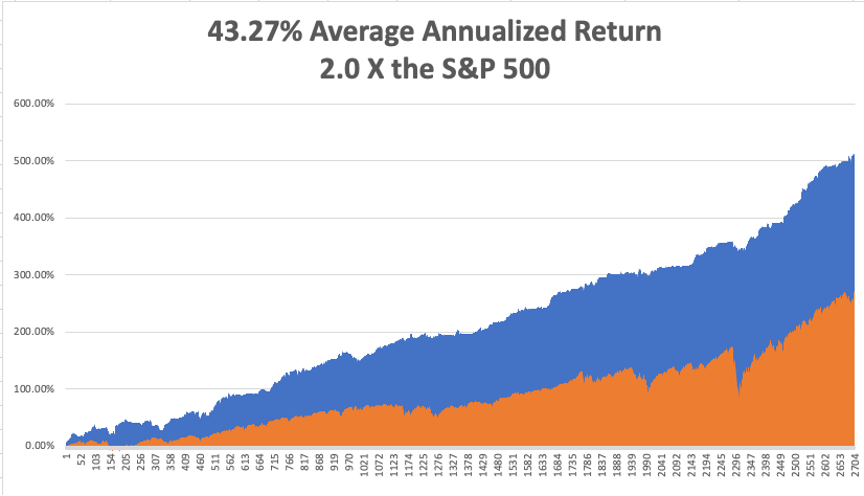

David never did get pried away from Goldman until he left to start his own firm, Appaloosa Management, after he was mistakenly passed over for partner two years in a row. After that, he racked up an annualized return of over 40%, near my own results.

But David was doing it with $20 billion in real money, while I was doing it with newsletters. In 2012, David received a $2.2 billion performance bonus from his fund, one of the largest in history. I bet the partners at Goldman are kicking themselves.

So, I thought it timely to check in with David, now the owner of the Carolina Panthers football team, to see what he thought about the market. The S&P 500, the Dow, Ten-year bond yields, and Bitcoin all simultaneously hit all-time highs last week, and we were long all of them.

David was phlegmatic at best. “There are times to make money and there are times to not lose money, and this is definitely time to make money.” However, nothing is cheap. There are no screaming buys here or screaming shorts. He did expect stocks to keep rising through the end of 2021.

Keep in mind that David is a trader just like me and rarely has a view beyond six months. His last 13F filing on June 30 showed that his five largest positions were T-Mobile (TMUS), Amazon (AMZN), Facebook (FB), Google (GOOG), and Uber (UBER). Uber was the only new buy.

David is not alone in his views.

Up 89.20% so far in 2021, I am sitting here dazed, shocked, and pinching myself. This has been far and away my best year in a 53-year career. I know a lot of you made a lot more. I stared down every correction this year, loaded the boat, and won.

It’s not always like this.

So I think we are in for a few weeks of profit-taking, sideways chop, and minimal action. I call this the “counting your money” time. Traders have visions of Ferraris dancing in their eyes. Then once we form a new base, it will become the springboard for a new yearend rally.

I don’t think stocks will fall enough to justify selling here. And you might miss the next bottom.

Until then, I’m thinking of taking up the banjo.

That brings me to the foremost question in your collective minds. Can I top an astonishing 100% profit this year? Only if we get another great entry point with a 5% correction.

I’m sure that when the financial history of our era is written something in the future, this will be known as the week that Bitcoin went mainstream. That was prompted by the SEC approval of the first futures ETF, the ProShares Bitcoin Futures ETF (BITO).

By giving this approval, which had been sought for years, unlocks $40 trillion worth of assets owned by 100 million shareholders managed under the Investment Company Act of 1940 to go into Bitcoin. The possibilities boggle the mind. The consensus year-end target for Bitcoin is now $100,000, or up 65%.

It’s not too late to subscribe at the founder's rate of $995 a year for the Mad Hedge Bitcoin Letter by clicking here. After that, the price goes up….a lot.

Morgan Stanley (MS) Announces Stellar Earnings, with profits at $3.71 billion, up 36.4%. Morgan Stanley Asset Management sucked in an amazing $300 billion so far in 2021, bringing their total assets to $4.5 trillion.

Goldman Sachs (GS) announces blockbuster earnings, and we are laughing all the way to the bank. Profits soared an eye popping 63% to $5.28 billion.

Existing Home Sales soar by 7% in September to a seasonally adjusted 6.29 million units. First time buyers accounted for only 28%, the lowest since 2015. A brief drop in interest rates is the reason. There are only 1.29 million homes for sale, only a 2.4 month supply.

Housing Starts fall by 1.6% in September. Higher materials and labor costs, rising land expenses, and soaring energy costs are the culprit. A pop in interest rates may mean that the slowdown could last through the winter.

Single Family Rents are surging especially for the top end of the market. Nationally, rents rose 9.3% in August year over year, up from a 2.2% year-over-year increase in August 2020, according to CoreLogic. Buy homebuilders on dips like (KBH), (LEN), and (PHM)

If the Rescue Package passes in whatever size, it will trigger a massive new surge in risk prices, including stocks and Bitcoin. Don’t act surprised when it happens. $3.5 trillion, $1.5 trillion who cares? That’s a ton of money to be dumped into the economy ahead of the 2022 elections.

Tesla profits smash records in Q3, reporting a shocking $1.62 billion profit on $13.76 billion in revenues. A 30.5% profit margin blew people away. Imagine how much they’ll earn when they make 25 million cars a year in ten years. Buy (TSLA) on big dips.

Weekly Jobless Claims dive to 290,000, a new post-pandemic low. Delta is in fast retreat. A pre-pandemic normal level of 225,000 is coming within range.

Rising Interest rates are tagging the Real Estate Market, with the 30-year fixed rate hitting 3.23%. Refis are off 7% on the week. The Fed taper is looming large, especially if the 30-year hits 4.0%, which it should, taking affordability down.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

My Mad Hedge Global Trading Dispatch saw a heroic +9.60% gain so far in October. My 2021 year-to-date performance soared to 89.20%. The Dow Average is up 16.60% so far in 2021.

After the recent ballistic move in the market, I am continuing to run my longs and those include (MS), (GS), (BAC), and a short in the (TLT). All are approaching their maximum profit point and we have nothing left but time decay to capture. So, I am going to run these into the November 19 expiration in 14 trading days. It’s like having a rich uncle write you a check once a day.

That brings my 12-year total return to 512.75%, some 2.00 times the S&P 500 (SPX) over the same period. My 12-year average annualized return now stands at an unbelievable 43.75%, easily the highest in the industry.

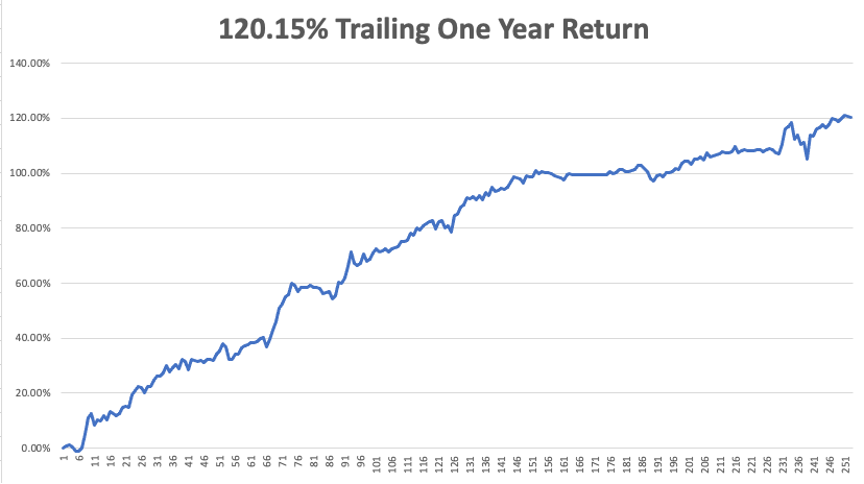

My trailing one-year return popped back to positively eye-popping 120.15%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases approaching 46 million and rising quickly and deaths topping 736,000, which you can find here.

The coming week will be slow on the data front.

On Monday, October 25 at 8:30 AM, the Chicago Fed National Activity Index is out. Facebook (FB) earnings are released.

On Tuesday, October 26 at 10:00 AM, the S&P Case-Shiller National Home Price for August Index is released. Alphabet (GOOGL) and Microsoft (MSFT) earnings are out at 5:00 PM.

On Wednesday, October 27 at 7:30 AM, Durable Goods Orders for September are printed. McDonald’s (MCD) earnings are out.

On Thursday, October 28 at 8:30 AM, Weekly Jobless Claims are announced. The first read on Q3 GDP is announced. Apple (AAPL) and Amazon (AMZN) earnings are out.

On Friday, October 29 at 8:45 AM, the US Personal Income & Spending for September is published. At 2:00 PM, the Baker Hughes Oil Rig Count is disclosed.

As for me, when I went to college in Los Angeles, the local rivalries between universities were intense.

UCLA and USC had a particularly intense rivalry, and I went to both. It was traditional to steal Tommy Trojan’s sword prior to each homecoming game and then paint the statue blue. USC had a mascot, a mixed breed dog called “Old Tire Biter.” Prior to one game, UCLA kidnapped the dog.

At halftime, the kidnappers appeared midfield, tied the dog to a helium-filled weather balloon, and let him waft away somewhere over the city. Enraged USC fans stormed the field only to find that the real dog was hidden in a nearby truck. The dog headed for the stratosphere was actually a stuffed one.

Of course, the greatest prank of all time was carried out by the California Institute of Technology in the 1961 Rose Bowl, which didn’t have a football team, on the Washington Huskies. Washington was famous for its elaborate card tricks, which spelled out team names and various corporate sponsors and images.

On the night before a game, imaginative mathematically-oriented Caltech students snuck into the stadium and changed the instructions on the back of each card packet sitting in the seats. When it came time to spell out an enormous “WASHINGTON”, “CALTECH: displayed instead. The incident was broadcast live on national TV ON NBC.

At Caltech, where I studied math, they are still talking about it today.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Technology Letter

October 22, 2021

Fiat Lux

Featured Trade:

(BOMBSHELL HITS AD TECH)

(SNAP), (FB), (GOOGL), (AAPL)

So, first the good news — SNAP expanded revenue by 57% year-over-year.

It was only a few years ago that this tech company was the backwater of social media, but it’s done its bit to catch up with the crowd.

SNAP targets the 18–29-year-olds and although not minted, there are pathways for a lifetime of revenue generation from this cohort.

In a rough environment battling Google (GOOGL) and Facebook (FB) and despite these challenges, they crossed $1 billion in quarterly revenue for the first time.

That was the good news and now you might want to cover your ears so put on those earmuffs.

The reason SNAP missed guidance by $3 million was because there have been changes to advertising tracking in Apple’s iOS system.

These ongoing changes to digital advertising were introduced as part of iOS 14.5 and were announced ahead of time, and now that move is started to suppress the bottom line for the social media giants.

SNAP anticipated some degree of business disruption, and unfortunately, their provided measurement solution did not scale as expected.

Basically what’s happening is that it’s more difficult for advertising partners to measure and manage ad campaigns for iOS.

Advertisers are no longer able to understand the impact of their unique campaigns based on things like the time between viewing an ad and taking an action or the time spent viewing an ad.

Real-time campaigns and creative management are hindered by extended reporting delays and advertisers are unable to target advertising based on whether or not people have already installed an app.

Without these business analytics, SNAP’s platform is less attractive because sale conversions are a great deal lower.

This impact was compounded by the ongoing macroeconomic effects of the global pandemic with advertising partners facing a variety of supply chain interruptions and labor shortages.

The ongoing magnitude and duration of these global supply and labor disruptions are inherently unpredictable.

Also, businesses do not have the inventory or operational capacity to support incremental demand.

SNAP expect customers to cut marketing budget given the diminished need to drive incremental demand at a time when supply chains are not able to operate at peak capacity.

This in turn that reduces their short-term appetite to generate additional customer demand through advertising at a time when their businesses are already supply-constrained.

The big question is: how bad will the Apple changes impact SNAP in the future?

SNAP is down 25% in today’s trading and that’s just them.

Facebook is down around 6% and Google is also off 3%.

Apple has signaled that they aren’t willing to accommodate the tracking techniques of the social media companies.

Clearly, investors are worried about the magnitude of the drop in shares, and this does a great deal to kill the momentum in the stock.

This isn’t the end of the world because I would like to point out that these changes happened in June and July, yet SNAP was still able to grow revenue by 57% year over year.

But I will say this will crimp the growth elements in the business model and lower the ceiling.

Growth rates of high 50% could start trending towards the lower 40% and investors hate that.

The company is still quite small — less than $90 billion of market cap.

This is exactly what SNAP didn’t want because comparatively speaking, Google and Facebook will be able to absorb this better with their war chest of capital readying itself to plug in the gaps.

The stock essentially gave back a year of performance in one morning, but I do view this as a buying opportunity and readers who have a long-term view will certainly profit once SNAP work itself through this problem, but it will be closer to a crawl up than big gaps up in prices.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.