“There are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know.” – Said Harvard economist John Kenneth Galbraith

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

November 15, 2021

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or PROFITING FROM INFLATION),

($INDU), (TLT), (TBT), (MS), (GS), (BAC), (BRKB), (TSLA)

Worried about inflation?

I’m not. That’s because I know how to trade inflation, which we had in spades during the 1970s when it reached a horrific 18% rate. Those who figured out the game early made fortunes. Those who didn’t got killed.

And what is the best protection against inflation? You own stocks and homes, as much as you can get your hands on.

That’s because in an inflationary environment, companies can raise their prices faster than the inflation rate, which they have been doing since the summer. That’s why we have just seen the best earnings quarter in recent memory and all-time high stock indexes.

Homes do well because there are still 85 million millennials chasing a housing stock that is easily short ten million homes and are given free money to chase prices upward.

I asked a local real estate agent when home prices would slow down and she answered, “it might slow down on Christmas eve and Christmas day, and after that, it will take off again.”

I think home prices will continue to rise for another decade, but not at this year’s ballistic rate.

What about impending rising interest rate, you may ask? They will rise but not enough to hurt either stocks or homes. The pandemic vastly accelerated technology, which we all know is the greatest price destroyer of all time. So, inflation will go up, but from zero to 3%-4%, not the 18% of yore.

And yes, prices are rising for the working classes, those least able to pay them. But the same minimum wage workers are getting the biggest pay hikes in history, up to 100% in some cases, more than offsetting inflation.

And while stocks and homes see rising inflation, bonds don’t. My feeling is that the bond market will stumble across it in the dark some nights and prices will crash. Bonds will keep ignoring inflation until they can’t. The bond vigilantes will then return with a vengeance and are doing their stretching exercises as we speak.

One of the odder things about the past week is that each of the three announcements heralding sharply higher inflation trigger sharp moves up in bonds when they were supposed to go down. That worked until Thursday when the worst 30-year Treasury bond auction since 1990 prompted a $5.00 selloff.

Another bizarre development is that call options are trading at greater premiums than put options, an exceedingly rare event. That means that the consensus for stocks is now almost universally up.

It also means that the at-the-money long-dated LEAPS call option spreads I have been pelting my Concierge members with have become massively profitable. Six months out you can earn eye-popping 100% returns, and 200% in some of the more volatile names, like (ROM) and (MSTR).

The bottom line is that goldilocks is moving in for the long term and might advance to senior citizenship on this watch.

That works for me, so I’m going on a long hike.

The $1.2 Trillion Infrastructure Budget Passes, adding another 6% in GDP growth for the next two years. Construction detours are about to break out all over the country, and the domestic recovery play is on fire. Lost along the way was $550 million in social spending. No increase in corporate taxes sets up a perfect storm for stocks the next several months. Stay fully invested as I begged you to do weeks ago.

The US Reopens, provided you have two Covid shots and a test within the last three days. Got to keep those pesky diseased foreigners out! Hotels, airlines, casinos, and cruise lines took off like a scalded chimp, taking the indexes to new all-time highs. Buy (ALK) and (LUV) on dips.

The Bitcoin Rally Continues, with new all-time highs for both (BITO) and (ETHE). Concerns about the monetary health of the US are rising ahead of a major debt ceiling fight in Congress in December.

Inflation Soars with a Red Hot 6.2% CPI Print in October, the highest in 31 years. Energy, rent, and car costs led the gains. Bitcoin (BITO) and Ethereum (ETHE) jumped to new all-time highs in response. This is only going to get better. You can now count on a Fed interest rate hike in June.

The Disappearing Worker Trend Continues, with a record 4.4 million quitting in September. Workers are taking advantage of the labor shortage to switch jobs for higher wages. This will get worse before it gets better. Good luck trying to hire anyone.

US Consumer Sentiment Hits Ten-Year Low, down from 71.7 to 68.6 in October, according to the University of Michigan. Inflation at a 30-year high 6.2% is starting to hit consumers hard.

Elon Musk Tesla Sales Top $5.1 billion, to pay off Uncle Sam. That must be one hell of a tax bill. At this rate, the market is rapidly running out of the sole seller. Buy (TSLA) on dips.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

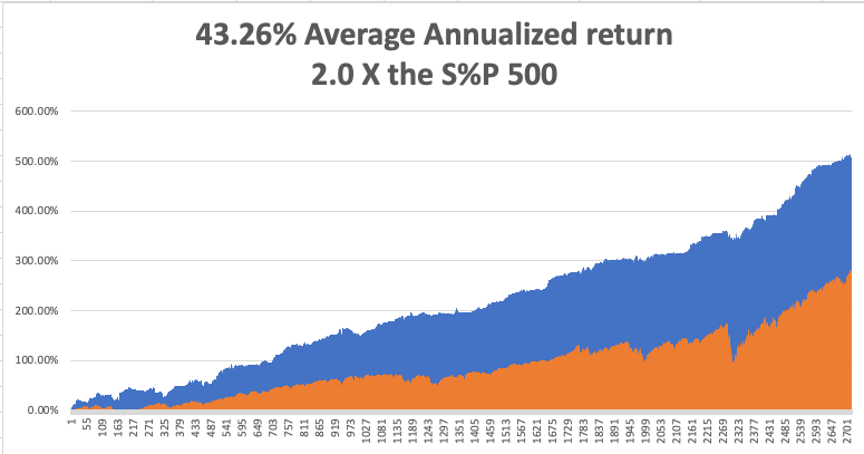

My Mad Hedge Global Trading Dispatch saw a massive +8.95% gain in October, followed by a decent 4.42% so far in November. My 2021 year-to-date performance moved to a new high of 92.97%. The Dow Average is up 18.00% so far in 2021.

After the recent ballistic move in the market, we got a week of consolidation which brought some generalized bitching, moaning, and wining.

I am continuing to run my longs in. Those include (MS), (GS), (BAC), (BRKB), and a short in the (TLT). The (TLT) short brought some hair-raising moments when we got a $3.00 spike up in the wake of the red hot 6.2% CPI release. I knew it was a complete BS move and successfully stared it down, watching it all reverse the next day. I don’t do this very often.

All positions are now approaching their maximum profit point and we have nothing left but time decay to capture. So, I am going to run these into the November 19 expiration in 4 trading days and capture all the accelerated time decay.

That brings my 12-year total return to 515.52%, some 2.00 times the S&P 500 (SPX) over the same period. My 12-year average annualized return has ratcheted up to 43.26%, easily the highest in the industry.

My trailing one-year return popped back to positively eye-popping 112.08%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 47 million and rising quickly and deaths topping 763,000, which you can find here.

The coming week will be all about the inflation numbers.

On Monday, November 15 at 9:00 AM, the New York Empire State Manufacturing Index for November is released. WeWork reports.

On Tuesday, November 16 at 8:30 AM, US Retail Sales for October are printed. Home Depot (HD) and Walmart (WMT) report.

On Wednesday, November 17 at 8:30 AM, the Housing Starts and Building Permits for October are published. NVIDIA (NVDA) and Cisco Systems (CSCO) report.

On Thursday, November 18 at 8:30 AM, Weekly Jobless Claims are announced. The Philadelphia Fed Manufacturing Index is printed. Macy's (M) and Alibaba (BABA) report.

On Friday, November 19 at 2:00 PM, the Baker Hughes Oil Rig Count are disclosed.

As for me, I am sitting in the Centurion Lounge in San Francisco Airport waiting for a United flight to Las Vegas where I have to speak at an investment conference. I have time to kill so I will reach back into the deep dark year of 1968 in Sweden.

My trip to Europe was supposed to limit me to staying with a family friend, Pat, in Brighton, England for the summer. His family lived in impoverished council housing.

I remember that you had to put a ten pence coin into the hot water heater for a shower, which inevitably ran out when you were fully soaped up. The trick was to insert another ten pence without getting soap in your eyes.

After a week there, we decided the gravel beach and the games arcade on Brighton Pier were pretty boring, so we decided to hitchhike to Paris.

Once there, Pat met a beautiful English girl named Sandy, and they both took off for some obscure Greek island, the ultimate destination if you lived in a cold, foggy country.

That left me stranded in Paris.

So, I hitchhiked to Sweden to meet up with a girl I had run into while she was studying English in Brighton. It was a long trip north of Stockholm, but I eventually made it.

When I finally arrived, I was met at the front door by her boyfriend, a 6’6” Swedish weightlifter. That night found me bedding down in a birch forest in my sleeping bag to ward off the mosquitoes which hovered in clouds.

I started hitchhiking to Berlin, Germany the next day. I was picked up by Ronny Carlson in a beat-up white Volkswagen bug to make the all-night drive to Goteborg where I could catch the ferry to Denmark.

1968 was the year that Sweden switched from driving English style on the left to the right. There were signs every few miles with a big letter “H”, which stood for “hurger”, or right. The problem was that after 11:00 PM, everyone in the country was drunk and forgot what side of the road to drive on.

Two guys on a motorcycle driving at least 80 pulled out to pass a semi-truck on a curve and slammed head on to us, then were thrown under the wheels of the semi. The driver was killed instantly, and his passenger had both legs cut off at the knees.

As for me, our front left wheel was sheared off and we shot off the mountain road, rolled a few times, and was stopped by this enormous pine tree.

The motorcycle riders got the two spots in the only ambulance. A police car took me to a hospital in Goteborg and whenever we hit a bump in the road, bolts of pain shot across my chest and neck.

I woke up in the hospital the next day, with a compound fracture of my neck, a dislocated collar bone, and paralyzed from the waist down. The hospital called my mom after booking the call 16 hours in advance and told me I might never walk again. She later told me it was the worst day of her life.

Tall blonde Swedish nurses gave me sponge baths and delighted in teaching me to say Swedish swear words and then laughing uproariously when I made the attempt.

Sweden had a National Healthcare system then called Scandia, so it was all free.

Decades later, a Marine Corp post-traumatic stress psychiatrist told me that this is where I obtained my obsession with tall, blond women with foreign accents.

I thought everyone had that problem.

I ended up spending a month there. The TV was only in Swedish, and after an extensive search, they turned up only one book in English, Madame Bovary. I read it four times but still don’t get the ending.

The only problem was sleeping because I had to share my room with the guy who lost his legs in the accident. He screamed all night because they wouldn’t give him any morphine.

When I was released, Ronny picked me up and I ended up spending another week at his home, sailing off the Swedish west coast. Then I took off for Berlin to get a job since I was broke.

I ended up recovering completely. But to this day whenever I buy a new Brioni suit in Milan, they have to measure me twice because the numbers come out so odd. My bones never returned to their pre-accident position and my right arm is an inch longer than my left. The compound fracture still shows upon X-rays.

And I still have this obsession with tall, blond women with foreign accents.

Go figure.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Brighton 1968

Ronny Carlson in Sweden

“If markets were rational, I would be washing dishes for a living,” said Oracle of Omaha Warren Buffet.

Mad Hedge Technology Letter

November 12, 2021

Fiat Lux

Featured Trade:

(PEAK STREAMING GROWTH ISN’T THE END OF STREAMING)

(DIS), (NFLX), (AMZN)

Peak streaming — that’s what the indicators are telling us.

It’s been a good run — lots of money made so far.

The streaming industry is resting after the pandemic pulled revenue forward a few years.

It won’t be as easy now, as the maturity of the industry means that it becomes a war inside the war, instead of the tide-lifts-all-boats type of growth.

The latter is what everyone hopes, but doesn’t always get.

The world’s largest entertainment company, Disney, posted a significant slowdown in subscriber sign-ups at its flagship streaming service in the most recent quarter.

Disney+ added only two million subscribers last quarter bringing its total to 118.1 million.

Analysts had expected this quarter’s total to come to 125.3 million. During the previous quarter, Disney+ had added more than 12 million new subscribers.

First, the follow-through from consumers just wanting to experience outside and the services attached to them ring true.

The price hikes are also another net negative, as it makes consumers less enthused about signing up.

This had to be expected and many of these streaming companies would honestly admit that they couldn’t continue the pandemic era performance.

A reversion to the mean is not the end of streaming and Disney’s streaming services.

It is still on track to reach previous guidance of between 230 million and 260 million paid Disney+ subscribers globally by the end of fiscal 2024.

Dig deeper into the streaming data and it shows that customers in India didn’t sign up because of a delay of Indian Premier League cricket games that were to air on the service.

Another indicator of the pivot to outside business is the Disney theme park revenue climbing 99%.

The trend towards outdoor activities means a slew of cancellations of the monthly subscriptions.

Netflix was the rare streaming company that bucked the trend.

Netflix streaming service added 4.4 million subscribers—or about a million more than it had forecast—on the strength of new popular shows like “Squid Game.”

Moving forward, the bar rises quite a bit for the quality of content.

Viewers are demanding more or they are riding Space Mountain in Anaheim.

Streaming companies won’t be able to pedal out mediocre shows and movies, and secondly, there is no patience for customers as the number of streaming options has multiplied.

The deeper underbelly shows us that the general trend of linear TV cancellations and streaming signups appears to be continuing even if the rate of signups is slowing.

Disney, WarnerMedia, and AMC Networks all reaffirmed previous full-year and future year forecasts. And while pandemic gains may have slowed, production slowdowns and shutdowns have also ended, which will lead to a surge of new content for all of the streaming services.

Disney investors will be zeroed in to see if the company can pump out some blockbusters, but a glut of content might mean not enough eyeballs to digest these blockbusters.

Coronavirus-related production delays continue to disrupt its pipeline of content delivery.

Disney subscriber growth could ramp back up in the latter half of 2022 when they have better titles coming to market.

Another issue for Disney is if they are willing to produce more adult content and veer away from the younger cohort they are used to entertaining.

I don’t mean X rated, but the 25-44 aged bunch, everyone is sick of the superhero movies.

When it comes to attracting subscribers to Disney+, the company in November and December will be relying on a Beatles documentary, “The Beatles: Get Back,” additional Marvel Studios and Lucasfilm Ltd. shows and films that include a new “Home Alone” feature.

In April, Jeff Bezos said more than 175 million Amazon Prime members had streamed shows and movies in the past year.

Beyond the big three — Netflix, Disney+, and Amazon Prime — things get cloudier.

In July, NBCUniversal’s Peacock reported 54 million net new subscribers and more than 20 million monthly active accounts.

Other players with potentially strong platforms include WarnerMedia’s HBO Max, with a reported 69.4 million global subscribers, and Apple TV+, which is rumored to have about 20 million U.S. subscribers.

The major streaming competitors are also actively expanding their footprint abroad to acquire more growth, but the issue I have there is that the average revenue per user (ARPU) is nothing close to what it is in North America.

Although oversees revenue could provide a little bump to earnings, it won’t recreate their earnings composition.

Which leads me to a broader take on tech, it’s slowing down because we have been in the same cycle which was essentially initiated by the smartphone, the cloud, 3G super apps, and high-speed internet.

Those super levers are showing exhaustion.

It’s not a coincidence that Facebook’s Mark Zuckerberg was desperately trotting out his vision for the Metaverse and Apple removing personal data tracking from its ecosystem.

These are late cycle signs that shouldn’t be missed.

Big tech has become a great deal more mercantilist during the latter half of this bull market, yet we aren’t at the point of cannibalization, but I do envision that moment 5-7 years out from now.

Until then, high quality tech will grind higher while slowly raising their monthly prices, and the low-quality tech products will fall by the wayside because they lack the killer content.

“I know that you must be passionate, unreasonable, and a little bit crazy to follow your own ideas and do things differently.” – Said CEO and Founder of Salesforce Marc Benioff

Global Market Comments

November 12, 2021

Fiat Lux

Featured Trade:

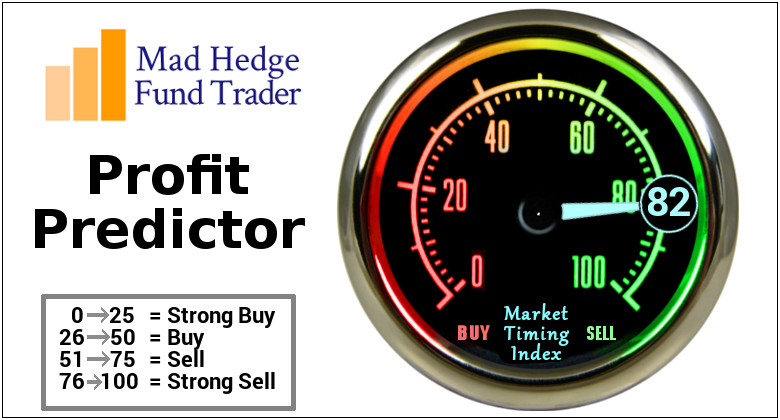

(HOW TO RELIABLY PICK A WINNING OPTIONS TRADE)

Mad Hedge Biotech and Healthcare Letter

November 11, 2021

Fiat Lux

Featured Trade:

(A HIGH-QUALITY DIVIDEND STOCK WITH MORE ROOM TO GROW)

(LLY), (INCY), (GILD), (ABBV), (PFE), (NVO), (BIIB)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.