When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

January 14, 2022

Fiat Lux

Featured Trades:

(LEARNING THE ART OF RISK CONTROL)

Global Market Comments

January 13, 2022

Fiat Lux

Featured Trades:

(WHY A US HOUSING BOOM WILL CONTINUE),

(LEN), (PHM), (KBH),

(WHY SENIORS NEVER CHANGE THEIR PASSWORDS)

Lately, my inbox has been flooded with emails from subscribers asking if the housing market is about to crash as a result of the housing bubble and if they should sell their homes.

They have a lot to protect.

Since prices hit rock bottom in 2011 and foreclosures crested, the national real estate market has risen by 50%.

The hottest markets, like those in Seattle, San Francisco, and Reno, are up by more than 125%, and certain neighborhoods of Oakland, CA have shot up by 500%.

Looking at the recent housing statistics, I can understand their concern. The data are the hottest on record across the board:

* Housing prices are still exploding to the upside with S&P Case Shiller Rising 10.4% in December, the one-month biggest spike in history

*Your Check is in the Mail, with the passage of the $1.9 trillion rescue package. A big chunk of this is going into housing upgrades

* Goldman Sachs is Forecasting a Jobs Boom, which will take the headline Unemployment Rate down to 4.1% by yearend. Employed people buy houses.

*Rising rates haven’t touched the housing market, and won’t for years.

*Workforce at home will double post-pandemic, maintaining demand for large homes

*30-year fixed-rate mortgages still a mere 3.26%, still near a historic low

*$45 billion in rental assistance is now available, thanks to Biden’s Rescue Package.

I have a much better indicator of future housing prices than the depressing numbers above. The way homebuilder stocks like Lennar (LEN), KB Homes (KBH), and Pulte Homes (PHM) are trading I’d say your home will be worth a lot more in a year, and possibly double in another five years. Many of these stocks are up nearly 200% since the March 23 bottom.

What I call “intergenerational arbitrage” will be the principal impetus. The main reason that we are just endured two “lost decades” of economic growth over the last 20 years is that 85 million baby boomers are retiring to be followed by only 65 million “Gen Xers”. When you are losing 20 million consumer economies, don’t grow very fast. For more about millennial investing habits,x please click here.

When the majority of the population is in retirement mode, it means that there are fewer buyers of real estate, home appliances, and “RISK ON” assets like equities, and more buyers of assisted living facilities, healthcare, and “RISK OFF” assets like bonds. That’s what got us to a 0.32% yield in the ten-year.

The net result of this is slower economic growth, higher budget deficits, a weak currency, and registered investment advisors who have distilled their practices down to only municipal bond sales.

Fast forward to the other side of the pandemic and the reverse happens. The baby boomers will be out of the economy, worried about whether their diapers get changed on time or if their favorite flavor of Ensure is in stock at the nursing home.

That is when you have 65 million Gen Xers being chased by 85 million of the “millennial” generation trying to buy their assets!

By then, we will not have built new homes in appreciable numbers for 14 years, and a severe scarcity of housing hits. Even before the pandemic, new home construction was taking place at half the 2008 peak. Residential real estate prices will naturally soar. Labor shortages will force wage hikes.

The middle-class standard of living will then reverse a 40-year decline. Annual GDP growth will return from the subdued 2% rate of the past four years to near the torrid 4% seen during the 1990s. It all leads to my “Return of the Roaring Twenties” scenario which you can learn about by clicking here.

It gets better.

It is certain that the current administration will restore tax deductions for state and local real estate taxes (SALT) lost in the 2017 tax bill. The cap on home mortgage interest rate deductions will also rise.

These two events will trigger an immediate 10% increase in the value of your home on an after-tax basis and more on the coasts.

So, if someone approaches you with a discount offer for your home, I would turn around and run a mile the other way.

You should also pile into the stocks, options, and LEAPS of housing stocks in any future market dip.

Mad Hedge Biotech and Healthcare Letter

January 13, 2022

Fiat Lux

Featured Trade:

(NO REST FOR THIS PANDEMIC SUPERSTAR)

(PFE), (MRK), (RHHBY), (DNAY), (JNJ), (LLY), (BNTX), (EDIT)

Amid the pandemic fatigue hounding everyone these days, one name continues to attack the situation with consistent vigor: Pfizer (PFE).

It’s not a stretch to say that its COVID franchise is the most popular line in Pfizer’s portfolio today.

Needless to say, this is highly lucrative from a shareholder’s point of view. The company’s vaccination business has recorded over 3 billion doses to generate roughly $36 billion in sales from Comirnaty alone in 2021.

Riding the momentum of its successful 2021, the company anticipates an even more successful 2022.

So far, Pfizer is targeting an increase in its Comirnaty production to hit at least 4 billion doses this year.

Aside from being one of the first companies to develop a vaccine, the company has also created a highly effective antiviral COVID treatment that can be taken orally: Paxlovid.

While Merck (MRK) has earlier announced its move to come up with a similar oral treatment, Pfizer’s pill proved to be more effective.

Actually, customers are starting to take note of the difference and are switching brands. France already canceled their agreement with Merck and decided to order Pfizer’s Paxlovid instead.

This once again underscored the dominance of Pfizer’s brilliant R&D segment and the company’s capacity to rapidly come up with highly effective solutions for issues involving COVID.

The way Pfizer has been handling the COVID situation can be compared to Roche’s (RHHBY) approach and eventual blockbuster success with Tamiflu over 20 years ago.

Although the flu is obviously not as deadly as the coronavirus, it still caused widespread economic breakdown and health problems.

When Tamiflu eventually entered the market, the world was finally granted a simple medical answer for what was initially thought to be an unsolvable health problem.

Pfizer’s Paxlovid could very well be the Tamiflu for COVID.

Looking at Paxlovid’s effect in terms of revenue, it’s safe to say that this oral treatment can drive medium-term growth for Pfizer.

To date, Pfizer disclosed that Paxlovid would be sold for roughly $700 for each treatment course.

Let’s use the US numbers as an example to help put things in perspective. So far, the country has recorded approximately 170,000 cases per day.

If we assume that this will be the average for 2022, then there will be about 62 million COVID patients this year.

Let’s say that only 40% of these patients qualify for Pfizer’s treatment; then this would reach 24 million people at $700 each to rake in roughly $17 billion in total revenue in the US alone.

The number would definitely be significantly higher considering that Paxlovid will be offered as a global COVID treatment.

It’s evident that Pfizer’s efforts are paying off, as the sheer earnings power of the company’s COVID-19 pandemic franchise could provide a medium-term boon for its investors.

In 2021, Pfizer recorded a 130% growth in its revenue, with the numbers still climbing.

While its pandemic response has become its primary growth driver, Pfizer’s other key segments also posted promising revenues.

To sustain its climb, the company has continued to invest in R&D heavily.

A notable investment it made recently is an $8 million upfront payment to Codex DNA (DNAY) for the smaller biotechnology company to “produce certain materials of interest to Pfizer.”

According to the deal involving the exclusive product, Codex expects $10 million in technical milestone payments, up to $60 million in clinical development milestones, and $180 million in sales milestones.

Codex DNA is a small biotechnology company with a market capitalization of $267 million. It’s a spinoff from a California company called Synthetic Genomics.

While Pfizer and Codex have yet to share their plans publicly, we can hypothesize that it has something to do with the large biopharma using the small biotech’s technology to accelerate its mRNA vaccine development process.

After all, Codex’s distinct value proposition lies in its rare ability to automate various elements of the entire process. Its push-button, end-to-end solutions promise to build functional grade synthetic mRNA and DNA.

In effect, this will save cost and time for its clients.

Aside from Pfizer, this small biotech has been collaborating with other organizations like Duke University and MIT.

It has also been working with large biopharmas, including Johnson & Johnson (JNJ), Eli Lilly (LLY), BioNTech (BNTX), Merck, and even gene therapy expert Editas (EDIT).

For 2022, Pfizer is anticipated to generate at least $96 billion in sales, showing off a jaw-dropping 17.2% jump from its 2021 revenue and a 229% increase from 2020.

As we slowly accept that COVID will become a staple in our lives in the coming years, I think investors would be wise to add proven “experts” in their portfolio to take advantage of the ever-present and increasing demand.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Bitcoin Letter

January 13, 2022

Fiat Lux

Featured Trade:

(THE TURKISH LIRA AND THE DEATH CROSS COME INTO PLAY)

(BTC), (LIRA), (ETH), (USD)

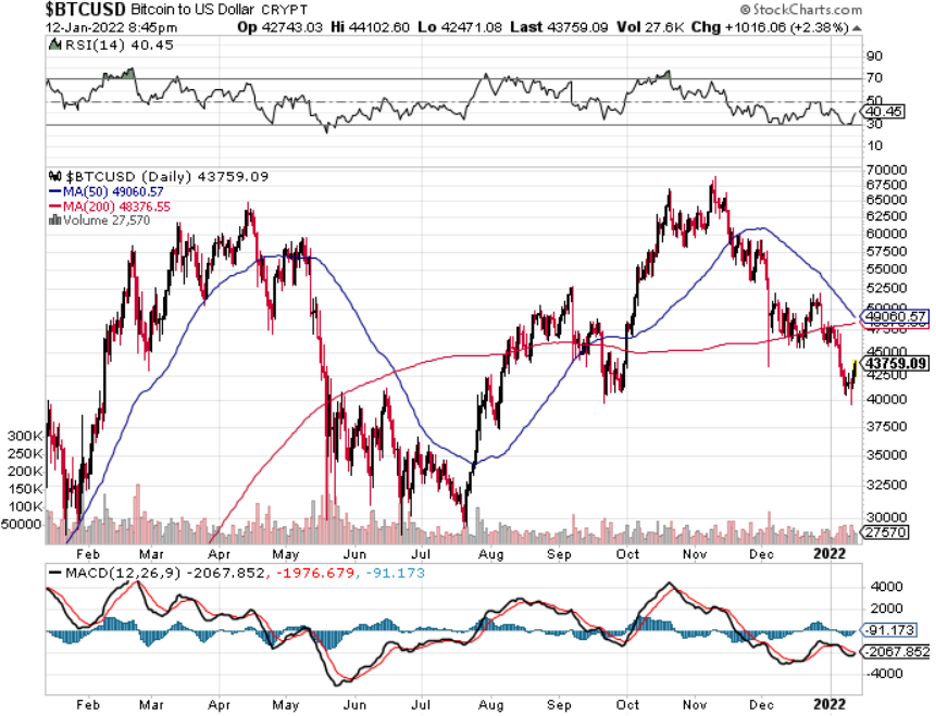

The infamous Death Cross is just around the corner again staring us in the face as another potential liquidity event could drive us lower or higher.

Even if you don’t fancy dealing with this phenomenon, algorithms lap it up and these technical events signal short-term price momentum and the direction of it.

To get even more exact, the death cross is the situation in which an asset's average price over the last 50 days drops below that of its 200-day moving average, an indication that its momentum is toast.

And this event is even more scrutinized after Bitcoin’s disgusting start to the year that has left it languishing in the lower $40,000s.

Not exactly the start we wanted and lots of complaints about the dufus called Fed Chair Jerome Powell and his handling of monetary policy.

Now, we should zone in on the big whales — the ones that hold massive amounts of Bitcoin and by that, I don’t mean 1 BTC or 1.2333 BTC.

All eyes are on them, many have said they will hold until infinity, but that’s easier when you bought BTC 10 years ago and not at $60,000 per unit which is what many retail traders did last year.

As we inch towards the vaunted death cross, will this trigger a 10% escape hatch that deadens the asset?

So far in 2022, Bitcoin has outperformed for just a few days and has been under relentless selling pressure.

To make matters worse, Ethereum appears to be forming a death cross as well.

The macro turning putrid has had a meaningful effect on the drop of Bitcoin prices, and if BTC can get through this death cross quagmire by holding onto the $40,000 level, then that could signal greener pastures ahead in the mid-term.

Speculative investments like Bitcoin are being abandoned under such aggressive tightening. Reports show only 5% of the clients surveyed by JPMorgan Chase expect Bitcoin to reach $100,000 per piece by the end of 2022.

Although the "death cross" is a bearish indicator, Bitcoin's historical record surrounding the indicator remains unclear. When the metric appeared last June, Bitcoin’s performance was dismal. But when the metric appeared last March, Bitcoin’s performance was strong. The emergence of this indicator in November 2019 sent Bitcoin lower.

As the U.S. economy is grappling with rip-roaring inflationary prices searing through the consumer prices to home prices, emerging countries are doing so bad with inflation that some are already completely giving up their own fiat currency.

Sure, El Salvador sucked up all the headlines for nationalizing Bitcoin as the de-facto medium of exchange for their citizens, but Turkey and its massive population of 84 million straddling the European continent have comprehensively pivoted towards Bitcoin as hyperinflation wrecks the purchasing power of the Turkish Lira.

The situation in Turkey is what crypto fanatics want to happen in the United States and it also represents what could unfold if the US Federal Reserve neglect doing their job.

Luckily, we are nowhere near that yet.

The Turkish lira has become so unpredictable that bakeries are closing down by the thousands citing a local currency that has lost most of its value.

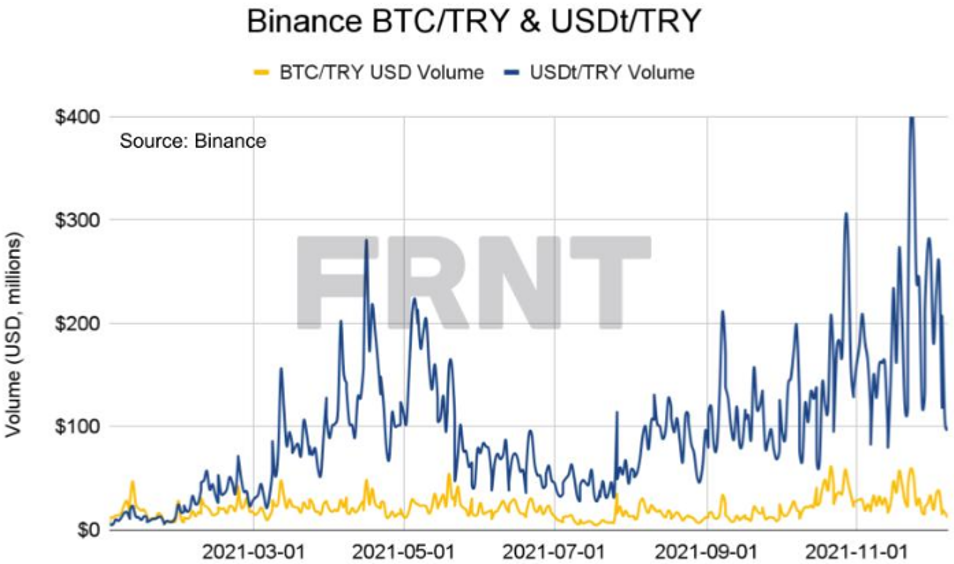

In Turkey, cryptocurrency trading volumes using the lira exploded to an average of $1.8 billion a day across three exchanges, according to blockchain analytics firm Chainalysis.

Turks favor stable coin tether, whose value is pegged to the dollar.

The rise of cryptocurrencies in recent years has presented a unique tool kit in which to store wealth, albeit far more volatile, and the shortage of US dollars circulating has forced the hand of the average Turk.

The Turkish lira has lost 40% of its value against the U.S. dollar in the past 5 months.

In the capital Istanbul, on the ground level, the local bazaars are accepting Bitcoin as standard currency over their own Turkish Lira.

This trend could mirror the future for some of these marginal economies that are run into the ground by renegade dictators.

Although the U.S. Federal Reserve has been irresponsible, the degree of policy mistake in Washington is nowhere near as atrocious as the events in Turkey.

There are numerous countries whose population could resort to crypto as a store of wealth including every ex-Soviet republic, big swaths of the Middle East, and major areas of Central and South America along with all of Africa.

My guess is that over time Bitcoin gets elevated as the de facto third currency behind the U.S. dollar and Euro. At this point, Bitcoin is too big to fail and too big to get rid of.

In a time of desperate need and no access to dollars and euros, Bitcoin is giving hope to large parts of the world as the pandemic and omicron inches closer to their shores.

Wait out this sideways correction then we march higher.

“We've arranged a civilization in which most crucial elements profoundly depend on science and technology.” — Said American Astronomer Carl Sagan

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.