“Try never to be the smartest person in the room. And if you are, I suggest you invite smarter people…or find a different room.” – Said Founder and CEO of Dell Technologies Michael Dell

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

February 9, 2022

Fiat Lux

Featured Trades:

(WHY TESLA IS TAKING OVER THE WORLD)

(TSLA), (GM), (TM)

(TESTIMONIAL)

It was another typical Elon Musk earnings call.

Tesla is evolving into the world’s preeminent robotics and AI company.

It is building the largest neural network in history, which means all the Tesla’s ever made are talking to each other, some four million by the end of this year.

When the US goes all electric in a decade, the size of the power grid is going to triple (buy copper), or else brownouts and outages will become constant. Every home in the country is going to need solar roofs to meet the demand.

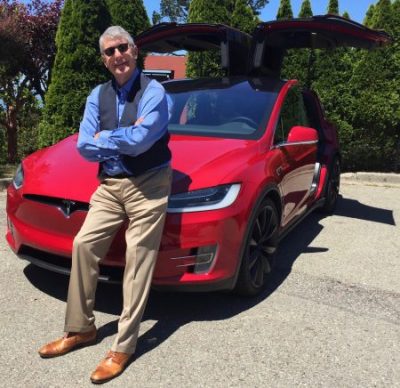

Demand for cars is the greatest Tesla has ever seen, far beyond their ability to produce them, and Q1 is the slow quarter for the auto industry. I just tried to buy a new Model X and the waiting list is one year. In fact, I can sell my existing 2018 Model X on eBay for more than I paid for it….new.

Elon never fails to amaze.

As for the stock, you have to get used to the idea that the world’s greatest company has annual 45% drawdowns. That’s how Tesla has always traded. It's either going to zero or infinity, depending on who you talk to.

My decade target is still $10,000 per share. We just had a $420, 35% pullback, so we may take one more run at the lows before we go to new Highs. But I have only been trading Tesla shares for 11 years. What do I know?

I’ll never forget my first tour of the Fremont factory in 2010, right after they bought it for stock from Toyota (TM) out of the General Motors (GM) bankruptcy (Toyota owned half). Tesla then occupied only a tiny corner of the gigantic 50,000 square foot space.

But you know what? There were virtually no humans on the assembly line, just a long row of red German-made robots. There was just the occasional guy shooting oil into automatic joints.

It was a vision into the future.

I knew I was on the right track when the salesman told me that the customer who just preceded me for a Tesla Model X P100D SUV was the Golden Bay Warriors star basketball player, Steph Currie.

Well, if it’s good enough for Steph, then it’s good enough for me.

So, when I received a call from Elon Musk’s office to test the company’s self-driving technology embedded in their new vehicles for readers of the Diary of a Mad Hedge Fund Trader.

I did, and prepare to have your mind blown!

I was driving at 80 MPH on CA-24, a windy eight-lane freeway that snakes its way through the East San Francisco Bay Area mountains. Suddenly the salesman reached over a flicked a lever twice on the left side of the driving column.

The car took over!

There it was, winding and turning along every curve, perfectly centered in the lane. As much as I hated to admit it, the car drove better than I ever could. It does especially well at night or in fog, a valuable asset for senior citizens whose night vision is fading fast.

All that was required was for me to touch the steering wheel every minute to prove that I was not sleeping.

The cars do especially well in rush hour driving, as it is adept at stop-and-go traffic. You can just sit there and work on your laptop, read a book, call some customers, or watch a movie on the built-in 5G WIFI HD TV.

When we returned to the garage the car really showed off. When we passed a parking space, another button was pushed, and we perfectly backed 90 degrees into a parking space, measuring and calculating all the way.

The range is 300 miles, which I can recharge at home at night from a standard 220-volt socket in my garage in seven hours. When driving to Lake Tahoe, I can stop halfway at get a full charge in 30 minutes at a Tesla supercharging station.

The new chargers operate at a blazing 400 miles per hour. That’s enough time to walk to the subway next door and get a couple of sandwiches.

The chassis can rise as high as eight inches off the ground so it can function as a true SUV.

The “ludicrous mode,” a $12,000 option, take you from 0 to 60

mph in 2.9. However, even a standard Tesla can accelerate so fast that it will make the average passenger carsick.

Here’s the buzzkill.

Tesla absolutely charges through the nose for extras.

The 22-inch wheels, the third row of seats to get you to seven passengers, the premium sound, the leather seats, and the self-driving software can easily run you $30,000-$40,000.

A $750 tow hitch will accommodate a ski or back rack on the back. There is a $1,000 delivery charge, even if you pick it up at the Fremont factory.

It’s easy to see how you can jump from an $84,990 base price to a total cost of $162,500, including taxes, for the ultra-luxury Performance model, as I did.

As for “drop dead’ curb appeal, nothing beats the Model X. When I first started driving Tesla’s I used to get applause at stoplights. It took a while to realize they were cheering the car, not me.

Even after driving one of these for 11 years, I still get notes with phone numbers from young women asking for rides. And they don’t even offer that as an option!

My original split-adjusted cost for my Tesla shares is $3.30.

It’s still true that if you buy the shares, you get the car for free.

I got three.

Thank You, Elon!

Mad Hedge Biotech and Healthcare Letter

February 8, 2022

Fiat Lux

Featured Trade:

(A NEW WAVE OF GENE-EDITING EXPERTS)

(NTLA), (REGN), (VRTX), (CRSP), (TMO), (SGMO), (EDIT), (MRK), (BIIB)

The gene-editing sector quietly achieved historical results in 2021. Last year, human trials of two in vivo CRISPR-centered treatments released promising data.

One study, conducted by Intellia Therapeutics (NTLA) and Regeneron Pharmaceuticals (REGN), worked on targeting the faulty gene responsible for transthyretin amyloidosis.

Using their new CRISPR-based therapy, they were able to record an impressive 96% decline in the transthyretin gene.

This is an impressive accomplishment not only for its high efficacy but also for the mere fact that no other work has managed to record any significant effect on the gene for almost a decade now.

The other study is by Vertex Pharmaceuticals (VRTX) and CRISPR Therapeutics (CRSP). Over the years, the two have been collaborating on coming up with treatments for various rare diseases.

In 2021, they recorded promising results in their clinical trials for sickle cell disease and beta-thalassemia. Aside from the potency of these treatments, there is a possibility that the effects would offer long-lasting improvements in the patients' lives.

While 2021 was clearly a remarkable year for the gene-editing sector, all signs indicate an even better 2022.

If the sector doesn’t deliver, there will be 2023 and the year after. After all, the gene-editing world is the kind of space that gets better with age.

More than that, this sector will keep evolving and attracting new players every year.

Hence, key players like Thermo Fisher Scientific (TMO), Sangamo Therapeutics (SGMO), Editas Medicine (EDIT), Merck (MRK), and Oxford Genetics cannot expect to be the top names in the industry forever.

Recently, some names have been making waves in the gene-editing industry.

One is Excision BioTherapeutics. Founded in 2015, this Philadelphia biotechnology company leverages its CRISPR-based platform to target viral infections.

Basically, they aim to snip the viral DNA out of the host genome.

To date, the company’s most advanced project is its HIV treatment: EBT-101. So far, Excision has managed to functionally cure its test animals of the infection by removing their HIV genomes.

Ultimately, Excision’s goal is to come up with a “one-and-done” therapy for viral diseases.

Apart from working on HIV treatments, the company is also looking into potential cures for herpes simplex, hepatitis B, and a rare brain infection called multifocal leukoencephalopathy.

If these treatments succeed, Excision’s therapies would be available in highly specialized treatment centers.

Another promising biotechnology company is California’s Scribe Therapeutics, which was founded in 2018.

Describing their approach to be guided with an “engineer first” philosophy, Scribe’s plans to use CRISPR-based gene-editing tools to achieve their goals.

Instead of using the conventional CRISPR-Cas9 methods, the company opts for modified versions of the RNA-guided genome editors or CasX enzymes.

Scribe has been developing these CasX enzymes to ensure that they acquire the qualities of the target for enhanced specificity.

That is, the company wants its “editor” to learn as much as possible about the characteristics of the system to deliver intentionally designed solutions.

Simply, Scribe aims to control all elements and eliminate the need to leave anything to chance or even nature.

Since its founding, Scribe has been actively developing solutions for unmet medical needs.

For instance, it has been working with Biogen (BIIB) to develop and eventually market CRISPR-based treatments that target an underlying genetic component of a nervous system disease called amyotrophic lateral sclerosis.

The agreement states that Scribe will get $15 million upfront and receive over $400 million in potential milestone payments.

The company has already started testing its technology in mouse models, focusing on neurological and neurodegenerative conditions.

Given their current trajectory, Scribe expects to release data by the third or fourth quarter of 2022 or early 2023.

All in all, gene-editing tools have evolved so much from the mid-twentieth century. Back in the 1970s and 1980s, the process of gene targeting was only possible in experiments on mice.

Since then, the ever-expanding world of science has pushed the sectors of gene analysis and manipulations to cover all kinds of cells and organisms.

Considering the increasing demand in this sector, it’s no wonder the gene-editing world has been growing at breakneck speed over the past years—a pace that won’t slow down anytime soon.

Mad Hedge Bitcoin Letter

February 8, 2022

Fiat Lux

Featured Trade:

(BITCOIN MOMENTUM PICKS UP)

(BTC), (ETH), (TSLA)

One might pontificate that the recent bullish price action in Bitcoin is because Bitcoin and other cryptocurrencies are finally starting to decouple from equities.

I don’t agree.

For the past few months, Bitcoin has been relegated to a status of just another lousy tech stock as the price movement mimicked the Nasdaq index but in a more exaggerated form.

I would argue that the decoupling moment hasn’t materialized yet and the industry needs to mature to exhibit more idiosyncratic characteristics.

Once they shake off that convenient moniker, it will allow the incremental investor to define it by its merit.

Defining it through the prism of its current strategic position relative to an entirely different industry just doesn’t make a whole lot of sense.

Bitcoin has roared back from the dead and it’s about time.

The bears can’t hold down the secular drivers underpinning the asset forever.

I believe the outperformance of late that has seen Bitcoin elevate into the mid-$40,000s is more of a result of interest rate expectations being pushed to the upper limit in the short-term and investors expecting a small reversion to the mean.

The U.S. 10-year Treasury yield is now a smidge below 2% after a pulsating move from 1.3% in the past 3 months.

The 35% move down had a funny way of distorting pretty much every asset class as consumers rushed into real estate, sold off technology stocks as fast as they could, and triggered a flight to safety.

No doubt that interest rates will most likely blow past the 2% threshold, but the reversal in bitcoin is signaling that the ensuing pace of yield appreciation will be orderly and smoother than what we just witnessed the past few months as the Fed tries to catch up.

If the Fed can wrestle back the narrative and actually do their jobs, Bitcoin is sitting pretty as we move forward.

The Fed has finally indicated they will finally act and that shakeout penalized crypto as the goalposts narrowed.

The sad fact is that in times of panic, high-risk assets are usually the first to be sold to supplement the losers or a cascade of stop-loss orders being dismantled can cause contagion that overflows into other areas.

As Bitcoin stabilizes and marks a short-term floor of $40,000, we could experience another buying wave as calm waters mean it's time to set sail aboard the crypto speed boat.

There are more green shoots occurring beneath the surface as more organizations are embracing bitcoin.

Earlier today, KPMG Canada, the Toronto-based branch of professional services firm KPMG, announced that it had purchased some Bitcoin and Ethereum.

Even more important, automaker Tesla (TSLA) revealed in a recently filed 10-K that it held almost $2 billion in bitcoin at the end of last year.

Tesla’s 10K SEC filing update was released yesterday, reaffirming notions that Tesla held onto their Bitcoin holdings amidst declines in Bitcoin’s price to the lower $30,000.

Combined with the news of KPMG Canada adding Bitcoin onto its balance sheet, encouraged a sharp rise in positive Bitcoin price sentiment.

These events mean that market confidence is coming back quickly, and people are realizing that we have finally arrived at an entry point.

These events are simply the latest sign of progress for cryptocurrencies.

On the legal front, I believe a huge source of momentum comes from Congress, with many members of the U.S. Senate speaking favorably on Bitcoin.

On Friday, Texas Sen. Ted Cruz disclosed that he invested in $50K worth of bitcoin during its dip back last month and spoke positively about Texas being the next bitcoin mining hub.

Sentiment has climbed back from the dead and we could experience short-term rapid upside price action in this highly volatile asset class.

“Stone Age. Bronze Age. Iron Age. We define entire epics of humanity by the technology they use.” – Said Co-Founder and CEO of Netflix Reed Hastings

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.