Any doubts that financial markets are fully discounting a recession were completely smashed last week.

It isn’t just the economic data that are rolling over like the Bismarck. Oil plunged 19%, copper is off 22% from its top, and bond yields have collapsed an astonishing 46 bases points in only two weeks, from 3.48% to 3.02%, a cataclysmic move in the bond market.

Asset classes most sensitive to a recession, like industrial commodities, suffered the biggest falls. That’s because if commodities don’t get used immediately they have to be stored at great expense and a million barrels of oil don’t look very pleasant in your backyard.

How did the stock market respond? It loved it. Stocks delivered the first positive week in June. The Dow Average rallied a healthy 1,900 points off the bottom, some 6.41%.

So what gives? Why is every asset class in the world getting trashed while stocks rocket?

It's really very simple. Stocks love lower interest rates. Cut borrowing costs and equities catch a bid. Lower rates more and stocks should further appreciate.

It's not like we are out of the woods yet. We could get another interest rate spike as we move into the next Fed move on interest rates on July 27. That could take us to new lows in stocks, but not by much. Any declines from here will be limited and are worth buying, as I have been arguing for weeks.

Always focus on what is going to happen next for we are in the “what happens next business.”

While broker reports, research, and the news focus on what happened in the past, or rarely today, it is what happens next that determines the performance of your investment portfolio.

Live in the future and there are never any surprises, only rewards.

Powell Highlights the Fed’s Inflation Commitment, even though the principal drivers, OPEX+ and the Ukraine War, are completely out of his control, in testimony in front of congress. The next two 75 basis point rate rises are a sure thing. Number three won’t happen if a recession kicks in before then.

Oil Dives as Recession Fears Mount, off 20% in a week. Oil is the last thing you want to hold going into a recession, as storage fears are at record highs a few tankers are available for charter. Avoid all energy plays like the plague. Too many other better fish to fry.

American Airlines, United Airlines, and Delta are Cutting Routes, to deal with staff shortages. Small cities where no money is made, like Toledo, Islip, and Dubuque are the main targets. Reno lost much of its airline services in the last recession for the same reason.

A Real Estate Selloff is Going Global, the effect of rising interest rates worldwide. Auckland, New Zealand, Vancouver, Canada, and Sydney, Australia have suddenly seen homes go heavily offered as free money disappears. The US could be next. In Incline Village, NV homes priced under $1 million are seeing aggressive price cuts to sell, while those over $5 million are maintaining prices.

Electric Vehicles Could Reach a 33% Market Share by 2028 and 54% by 2035, says AlixPartners, a research firm. Automakers are going to have to invest $526 billion to meet this demand. EVs are becoming a dominant factor in the US economy. Keep buying (TSLA) on dips, which has a 12-year head start over everyone and has an 80% global EV market share. You just missed a chance to buy the shares at $635 last week.

Existing Home Sales plunge 3.4% in May to 5.41 million units, Dow 8.6% YOY. Inventories fell slightly, with 1.16 million homes for sale. The median home price rose to a new all-time high of $407,600. Home sales priced under $250,000 are down 27% YOY. Mansions are still selling well nationally.

Industrial Production rises by a modest 0.2% in May. Their recession hasn’t hit here yet.

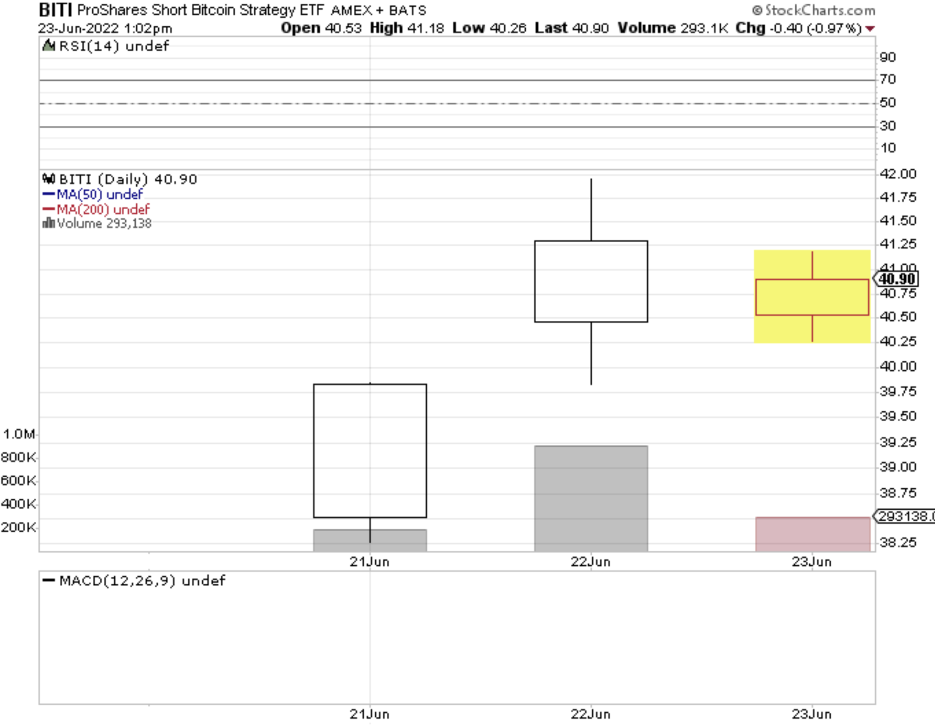

Bitcoin hit a $17,900 low Asian trading. Bitcoin crash is particularly compelling to watch as it has become a great risk indicator for all asset classes. Ignore it at your peril. It turns out that the wonder of 24/7 trading means it can go down a lot faster. I have no idea where the bottom is so don’t ask. This amount of fear is impossible to quantify.

My Ten-Year View

When we come out the other side of pandemic and the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With oil peaking out soon, and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side will be far more efficient and profitable than the old. Dow 240,000 here we come!

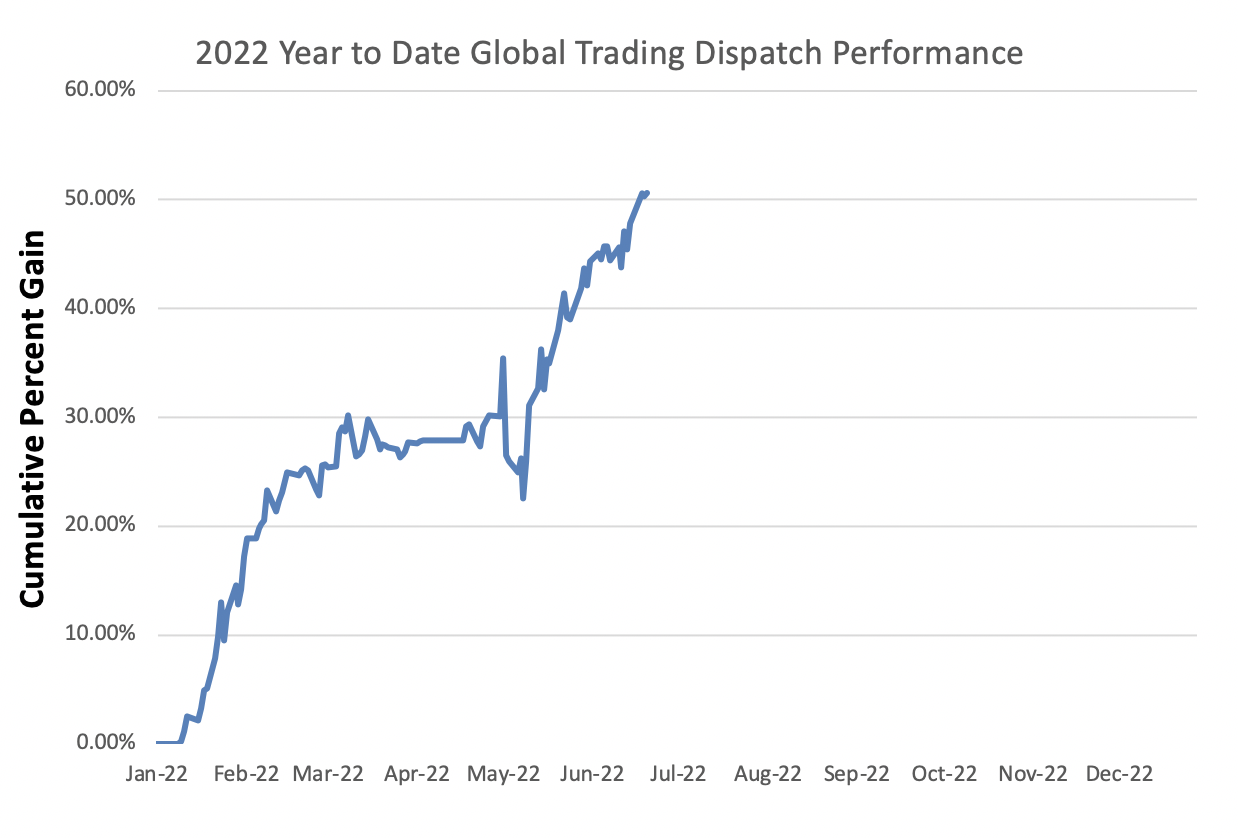

With some of the greatest market volatility in market history, my June month-to-date performance exploded to +9.99%.

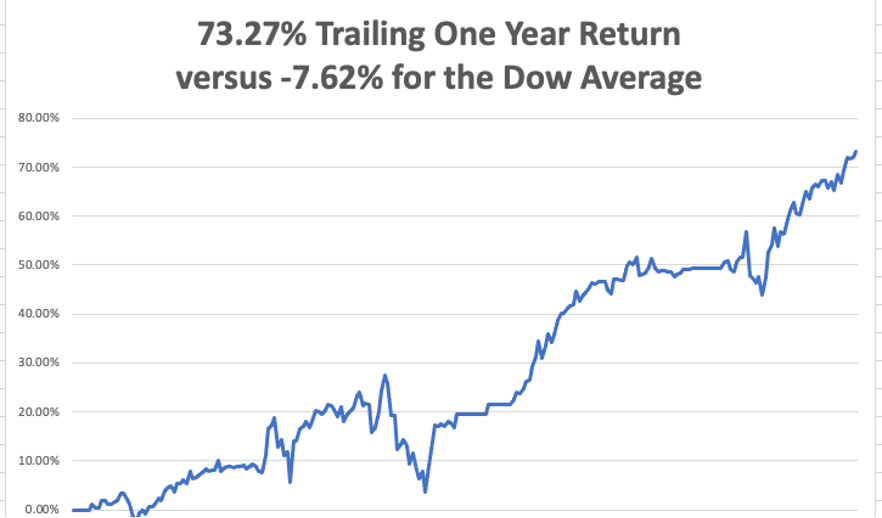

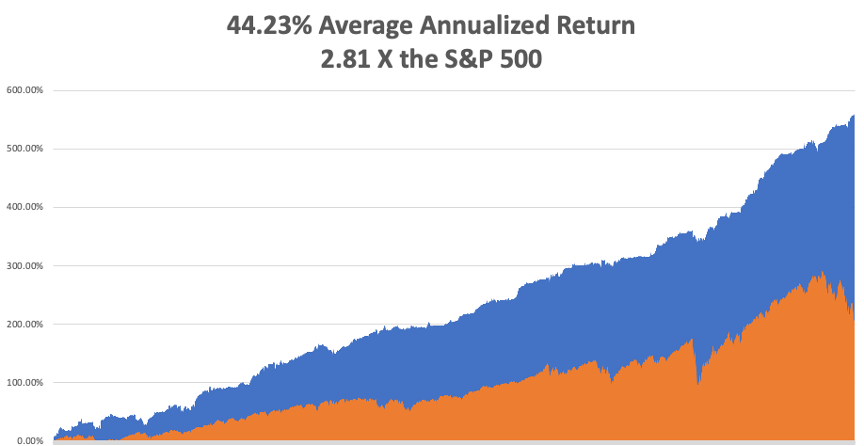

My 2022 year-to-date performance ballooned to 51.86%, a new high. The Dow Average is down -13.22% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high 73.27%.

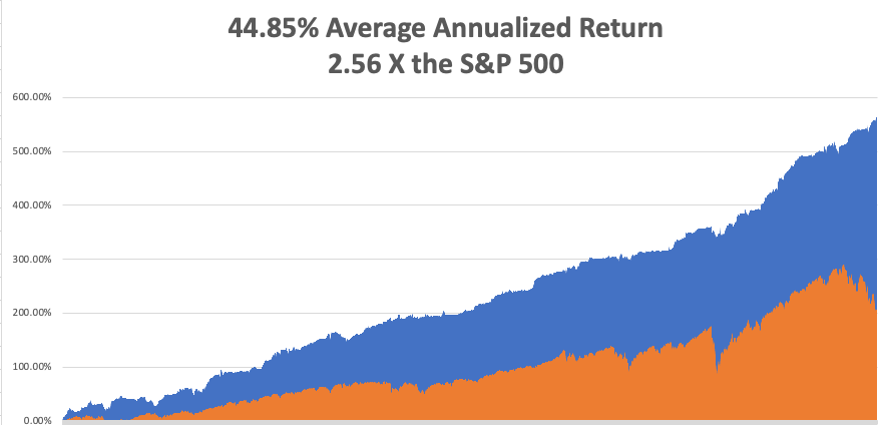

That brings my 14-year total return to 564.42%, some 2.56 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to 44.85%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 87 million, up 300,000 in a week and deaths topping 1,016,000 and have only increased by 2,000 in the past week. You can find the data here.

On Monday, June 27 at 8:30 AM, US Durable Goods for May are released.

On Tuesday, June 28 at 7:00 AM, the S&P Case Shiller National Home Price Index for April is out.

On Wednesday, June 29 at 7:00 AM, the final read of the US Q1 GDP is published.

On Thursday, June 30 at 8:30 AM, Weekly Jobless Claims are announced. We also get US personal Income & Spending.

On Friday, July 1 at 7:00 AM, the ISM Manufacturing PMI for June is disclosed. At 2:00 the Baker Hughes Oil Rig Count is out.

As for me, as this pandemic winds down, I am reminded of a previous one in which I played a role in ending.

After a 30-year effort, the World Health organization was on the verge of wiping out smallpox, a scourge that had been ravaging the human race since its beginning. I have seen Egyptian mummies at the Museum of Cairo that showed the scarring that is the telltale evidence of smallpox, which is fatal in 50% of cases.

By the early 1970s, the dreaded disease was almost gone but still remained in some of the most remote parts of the world. So, they offered a reward to anyone who could find live cases.

To join the American Bicentennial Mt. Everest Expedition in 1976, I took a bus to the eastern edge of Katmandu and started walking. That was the farthest roads went in those days. It was only 150 miles to basecamp and a climb of 14,000 feet.

Some 100 miles in, I was hiking through a remote village, which was a page out of the 14th century, back when families though buckets of sewage into the street. The trail was lined with mud brick two-story homes with wood shingle roofs, with the second story overhanging the first.

As I entered the town, every child ran to their windows to wave, as visitors were so rare. Every smiling face was covered with healing but still bleeding smallpox sores. I was immune, since I received my childhood vaccination, but I kept walking.

Two months later, I returned to Katmandu and wrote to the WHO headquarters in Geneva about the location of the outbreak. A year later I received a letter of thanks at my California address and a check for $100. They told me they had sent in a team to my valley in Nepal and vaccinated the entire population.

Some 15 years later, while on customer calls in Geneva for Morgan Stanley, I stopped by the WHO to visit a scientist I went the school with. It turned out I had become quite famous, as my smallpox cases in Nepal were the last ever discovered.

The WHO certified the world free of smallpox in 1980. The US stopped vaccinating children for smallpox in 1972, as the risks outweighed the reward.

Today, smallpox samples only exist at the CDC in Atlanta frozen in liquid nitrogen at minus 346 degrees Fahrenheit in a high-security level 5 biohazard storage facility. China and Russia probably have the same.

That’s because scientists fear that terrorists might dig up the bodies of some British sailors who were known to have died of smallpox in the 19th century and were buried on the north coast of Greenland, remaining frozen ever since. If you need a new smallpox vaccine, you have to start from somewhere.

As for me, I am now part of the 34% of Americans who remain immune to the disease. I’m glad I could play my own small part in ending it.

Stay healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

On Mt. Everest Smallpox Free in 1976