When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

September 29, 2022

Fiat Lux

Featured Trade:

(THE UNITED STATES OF DEBT),

(TLT), (TBT), ($TNX)

With ten-year US Treasury yields hitting 4.00% yesterday, it’s time to pay the piper for the last 15 years of the borrowing rampage of epic proportions.

This is not a new thing.

We are, in fact, becoming the United States of Debt.

That Washington is taking the lead in this frenzy of borrowing is undeniable. The last administration took the national debt from $23 trillion to $28 trillion during four years of prosperity that was entirely borrowed from the future.

The Biden administration will eventually take that figure up to an eye-popping $38 trillion. That will be the final bill for ending the pandemic, putting 25 million people back to work, and bringing the second Great Depression to a close.

The National Debt exceeded US GDP in 2016, taking the debt to GDP ratio to the highest point since WWII.

Treasury Secretary Janet Yellen recently confided to me that, “It’s the kind of thing that should keep you awake at night.”

It gets worse.

According to the Federal Reserve Bank of New York, total personal debt topped $19 trillion by the end of 2020. An overwhelming share of personal consumption is now funded by credit card borrowing.

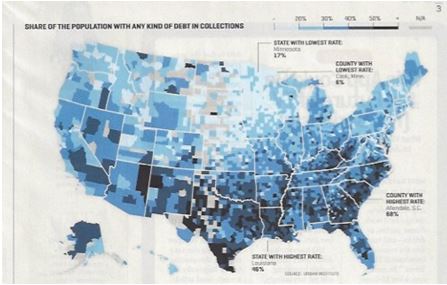

Some 33% of Americans now have debts in some form a collection, and that figure reaches an astonishing 50% in many southern states (see map below). Call it the Confederate States of Debt.

Corporations have also been visiting the money trough with increasing frequency, taking their debt to $6.1 trillion, up by 39% in five years, and by 85% in a decade.

The debt to capital ratio of the top 1,000 companies has ballooned from 35% to 54% and is now the highest in 20 years.

Another foreboding indicator is that corporate debt is rising faster than sales, with debt rising by a breakneck 8.5% annualized compared to 4.6% for sales over the past decade.

Automobile debt now tops $1 trillion and with lax standards has become the new subprime market.

And remember that other 800-pound gorilla in the room?

Student debt now exceeds $1.6 trillion and is rising, as is the default rate. Provisions in the last tax bill eliminate the deductibility of the interest on student debt, making lives increasingly miserable for young borrowers. And you wonder why the US birth rate is so low.

Of course, you can blame the low interest rates that have prevailed for the past decade. Who doesn’t want to borrow when the inflation adjusted long-term cost of money is FREE?

That explains why Apple (AAPL), with $270 billion in cash reserves held overseas, borrowed last year via ultra-low coupon 30-year bond issues, even though it doesn’t need the money. Many other major corporations have done the same.

And while everything looks fine on paper now, what happens if interest rates ever rise and stay high?

The Feds will be in dire straight very quickly. Raise short term rates to the 6% seen at the peak of the last cycle, and the nation’s debt service rockets from 4% to over 10% of the total budget. That’s when the sushi really hits the fan.

You can expect the same kind of vicious math to strike across the entire spectrum of heavily leveraged borrowers going forward, including big borrowers like cruise line, airlines, you, and me.

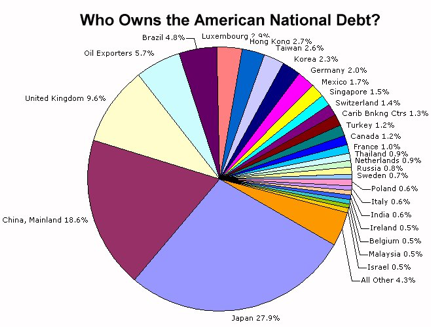

We are also witnessing the withdrawal of the Chinese as major Treasury bond buyers, who along with other sovereign buyers historically took as much as 50% of every issue. Threaten a war on your largest lender and it plays hell with you cash flow.

Rising supply against fewer buyers sounds like a recipe for eventually much higher interest rates to me.

Just watch this space for the next Trade Alert regarding when to get back in for the umpteenth time.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

September 28, 2022

Fiat Lux

Featured Trade:

(CHICKENS COME HOME TO ROOST)

(APPL), (HNHPF), (TSM), (ASML)

I hit the nail on the head – I’ll take another victory lap and you’re welcome.

I’ve been telling all my subscribers.

Apple backing off production of the new iPhone 14s signals that the US consumer is tapped out.

Throw in the towel!

What does that mean?

At the low-end, US consumers don’t have the extra funds to pay for all the streaming services or the extra hardware, gizmos, and gadgets they are used to.

That means the iPhone 14 Pro is next to get squeezed from the budget after an eye-watering $1,500 pretax price tag. At least at that price point, it includes 1 TB of data storage, but no charger.

Personally, I acknowledge that Apple makes a pretty darn good smartphone, but it’s way too overpriced in 2022 and there aren’t enough improvements to justify the lofty prices.

But the killing of new iPhone production goes well beyond just the issue of global sales of smartphones, this is a harbinger of things to come as global economic growth goes from bad to worse.

This is also legit confirmation that inflation is not only transitory, but it’s terrorizing US consumers’ budgets.

Interestingly enough, the most expensive models did still see high demand, confirming what I already have been saying is that high income US consumers are navigating elevated inflation more than superb even if conditions aren’t ideal.

Because they are in good shape – great personal financial balance sheets – hope it stays that way.

Thus, Apple supplier is shifting production capacity from lower-priced iPhones to premium models.

High income households are passing on their costs to the end consumers in the companies they run, and they are jacking up rents in the condos they let out.

They are even hitting up Walmart more than usual and abstaining from pricier options like Whole Foods or Whole paycheck.

Fantastically, high income Americans are ready to spend, spend, spend and that’s great news for employers and employees, but bad news for the bond market.

Apple is cutting the iPhone 14 product family by as many as 6 million units in the second half of this year.

Instead, the company will aim to produce 90 million handsets for the period, roughly the same level as the prior year and in line with Apple’s original forecast this summer.

In Taipei, key chipmaker Taiwan Semiconductor Manufacturing Co. (TSM) fell 2.2% and Apple’s biggest iPhone assembler Hon Hai Precision Industry Co. (HNHPF) was down 2.9%, amid a wide selloff of electronics suppliers.

ASML Holding NV (ASML), maker of advanced chipmaking gear, dropped as much as 3.2% in Amsterdam.

Purchases of the iPhone 14 series over its first three days of availability in China were 11% down on its predecessor the previous year.

Readers must be aware of Apple being the biggest component of the S&P. When Apple goes, so does the market.

Then there is the issue of, maybe the phones just suck now, since each iteration is the trigger for higher expectations which aren’t really met anymore.

Either way, CEO Tim Cook needs to roll up his sleeves, and this report ostensibly means that Apple won’t return to 2022 highs anytime soon.

It also vindicates and confirms that we are still in a sell the rallies mode or buy the dip after deep selloffs mode. This is a short-term traders' world right now and the data backs me up.

Happy trading!

“The thing that we are trying to do at Facebook is just help people connect and communicate more efficiently.” – Said Facebook Co-Founder and CEO Mark Zuckerberg

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.